简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

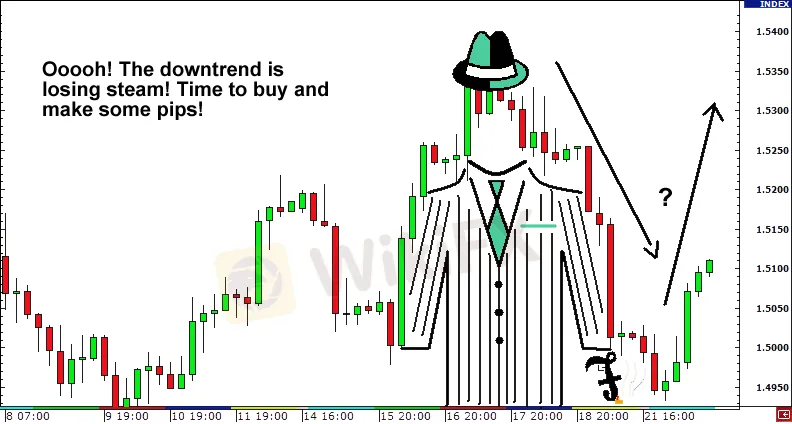

Is this a trend retracement or a trend reversal?

Abstract:Nobody wants to be smacked by the "Smooth Retracement," yet it does happen from time to time.

Consider the following scenario. Price starts to rise. Keeps rising. Then it starts falling.

And falling some more.

And falling some more.

And then it starts going back up!

Have you ever been in a similar situation?

Price activity appears to be rallying, indicating that a buy trade is in order.

WRONG!

The “Smooth Retracement!” has hit you!

Nobody wants to be smacked by the “Smooth Retracement,” yet it does happen from time to time.

The forex trader in the preceding example didn't know the difference between a retracement and a reversal.

Rather than being patient and riding the overall downturn, the trader sensed a reversal was underway and entered the market long. Oh my, he's lost his money!

Check here how one of her AUD/USD deals was tainted by the “Smooth Retracement.”

You will discover the features of retracements and reversals, how to spot them, and how to avoid misleading signals in this session.

What are Trend Retracements and How Do They Work?

A retracement is a price movement that goes against the established trend for a short period of time.

Another way to look at it is as a price movement that deviates from the trend but then returns to it.

Isn't it simple? Let's get this party started.

What are Trend Reversals and How Do They Work?

A price reversal is described as a shift in the general price trend.

· A reversal occurs when an upswing becomes a downtrend.

· A reversal occurs when a downtrend changes to an uptrend.

Here's an example of a reversal using the same example as before.

So, what are your options?

You have three options when faced with a likely retracement or reversal:

· If you were in a position, you could keep it. If the retracement turns out to be a longer-term reversal, this could result in losses.

· If the price starts moving with the overall trend again, you can close your trade and re-enter. Of However, if the price moves sharply in one way, a trade opportunity may be lost. If you decide to re-enter, you will also squander money on spreads.

You have the option of closing permanently.

Depending on the structure of the trade and what happens afterwards, this might result in a loss (if the price went against you) or a significant profit (if you closed at a peak or bottom).

Because reversals might occur at any time, deciding on the best course of action isn't always straightforward.

This is why, while trading with the trend, employing trailing stop loss points can be a superb risk management approach.

You can use it to secure your winnings and ensure that, even if a long-term reverse occurs, you will always walk away with some pips.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator