简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

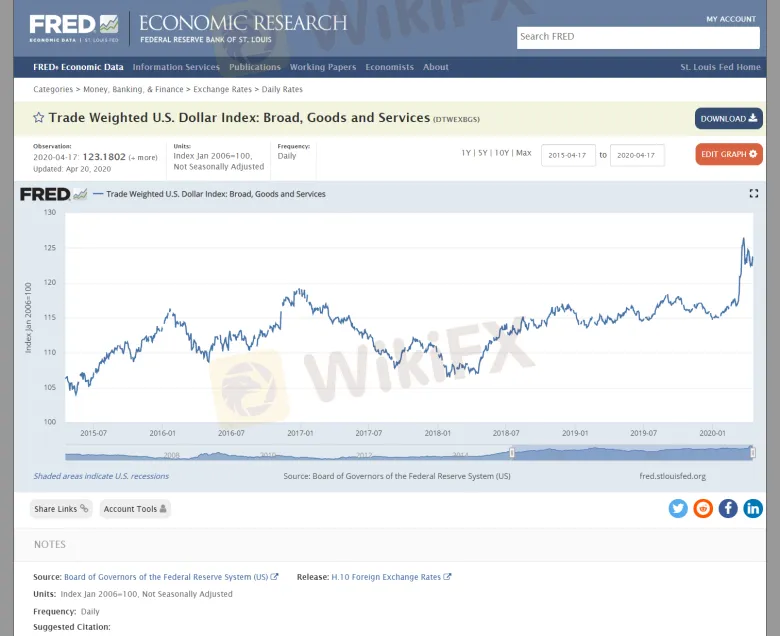

The Trade-Weighted Dollar Index (TWDI)

Abstract:Another type of US dollar index exists. The Federal Reserve invented it, and it's now often used by glamorous people like economists and currency examiners. The "Trade Weighted US Dollar Index" is what it's named.

Another type of US dollar index exists.

The Federal Reserve invented it, and it's now often used by glamorous people like economists and currency examiners.

The “Trade Weighted US Dollar Index” is what it's named.

Here is a link to the Federal Reserve Economic Data (FRED) website where you can find it.

Their website is undoubtedly one of the most gorgeous ever created.

Just joking. It's a website run by the government.

Beautiful? It's like putting lipstick on a pig.

Useful? Yes, definitely.

The wide index, also known as trade-weighted US dollar index, is an evaluation of the worth of the US dollar in relation to several foreign currencies.

It's a trade-weighted index that aims to outperform the ICE U.S. Dollar Index (USDX) by incorporating more currencies and changing the weights on annual basis.

The Fed sought to create an index that would more correctly reflect the dollar's value against other currencies based on how competitive American goods are in comparison to goods from other countries.

It was founded in 1998 to stay up with trade in the United States.

The Trade-Weighted US Dollar Index is a measure of the worth of the dollar relative to other currencies.

“Weighted averages of the foreign exchange value of the US dollar against the currencies of a broad set of important trading partners,” according to the Federal Reserve Bank of St. Louis.

The current weighting (in percentage) of the index is as follows, from strongest to weakest:

| COUNTRY | WEIGHT(%) |

| Eurozone | 18.947 |

| China | 15.835 |

| Canada | 13.384 |

| Mexico | 13.524 |

| Japan | 6.272 |

| United Kingdom | 5.306 |

| Korea | 3.322 |

| Taiwan | 1.95 |

| Singapore | 1.848 |

| Brazil | 1.979 |

| Malaysia | 1.246 |

| Hong Kong | 1.41 |

| India | 2.874 |

| Switzerland | 2.554 |

| Thailand | 1.096 |

| Australia | 1.395 |

| Russia | 0.526 |

| Israel | 1.053 |

| Sweden | 0.52 |

| Indonesia | 0.675 |

| Saudi Arabia | 0.499 |

| Chile | 0.625 |

| Philippines | 0.687 |

| Colombia | 0.604 |

| Argentina | 0.507 |

| Total | 100 |

*Weights as of December 16, 2019

The basket of currencies used and their proportional weights are the key differences between the USDX and the trade-weighted US dollar index.

Countries from all across the world, including several developing countries, are included in the trade-weighted index.

Given the condition of global trade, this index may be expected to provide a more accurate picture of the US dollar's worth around the world.

The weights are based on trade data from last year.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator