简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

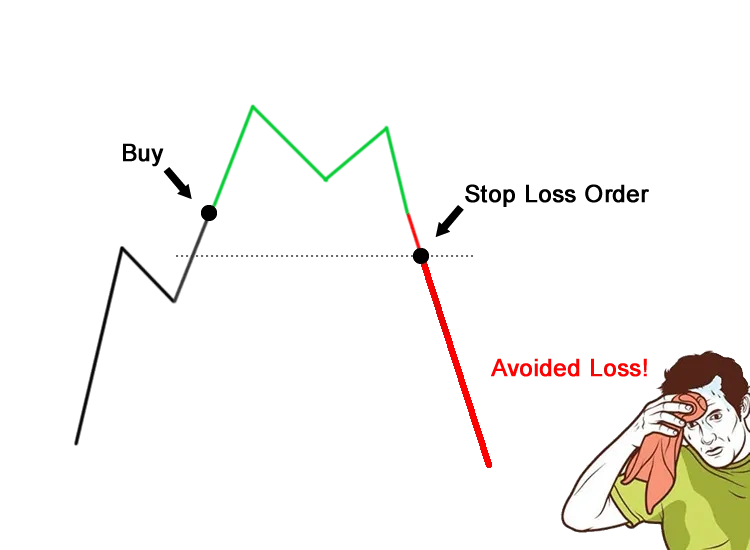

Setting Stops in Context

Abstract:Let's go through all you need to know about stop losses now.

So there you have it, our comprehensive guide on establishing stop losses.

Let's go through all you need to know about stop losses now.

Find a broker who will let you trade position sizes that are appropriate for your funds and risk tolerance.

In this course, we use the phrase “predetermined” a lot since you should ALWAYS know when to exit before you start a position.

If you're already in a losing transaction, you won't be able to make a rational decision to abandon it. That might be disastrous for your bank account!

Set your stops according to the current market conditions, framework, or trading strategy.

Set your exit levels based on how much you're willing to lose, not how much you're willing to gain.

The market has no idea how much money you have or how much money you're ready to risk. To be honest, it doesn't seem to mind.

First, identify the stop levels that reveal your trade is incorrect, and then adjust your position size accordingly.

It's worth reiterating.

To close a deal, use limit orders. Only individuals with a large number of trades in their journal should employ mental stops.

Even so, limit orders are the way to go: they're emotionally agnostic and may be executed automatically while you're relaxing on the beach sipping virgin margaritas.

Your stop should only be moved in the direction of your profit aim. Trailing stops are great, but spreading stops are terrible!

Setting stop losses, like everything else in trading, is both a science and an art.

Markets are dynamic, volatility is, well, volatile, and what works today may not work tomorrow.

You'll be one step closer to being a professional risk manager if you consistently practise the proper technique to establish stops, document, and analyse your thinking processes and trade outcomes in your notebook.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator