简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

When Using Stop Loss Orders, There Are 3 Rules To Follow

Abstract:After you've done your study and crafted an outstanding trading strategy with a stop-out level, you must now ensure that you execute those stops if the market moves against you.

After you've done your study and crafted an outstanding trading strategy with a stop-out level, you must now ensure that you execute those stops if the market moves against you.

There are two options for doing so. One method is to use an automatic halt, while the other is to use a mental stop.

A brief suspension of trading in a certain security is known as an automatic halt.

When a share or an index's price moves quickly enough to trigger an exchange-mandated halt, trading may be suspended in preparation of a news announcement, to correct an order imbalance, to address regulatory concerns, or for any of the reasons listed above.

All open orders and option contracts can be terminated during an indefinite trading stop.

Mental stops occur when an investor sets an exit price for a transaction in their mind before entering the market. In a trading system, there is no such thing as an order.

A soft stop refers to using a range of values to quit a trade rather than relying on a specific price to leave the trade.

Short-term traders, such as day traders, frequently rely on mental and soft stops.

So here comes the question: which one is the most appropriate for you?

This is where the tricky part begins, because the answer to this question is determined by your level of discipline.

It takes a lot of self-control to be successful at forex trading. Keep your eye on the prize at all times by following strict trade rules, but you must also be able to keep your eye on the prize. Self-discipline is what experienced traders call it.

What typically differentiates the long-term victors from the losers in the midst of battle is their ability plans to objectively pursue their set path.

When the agony of losing kicks in and brings in negative thoughts such, “Maybe the market will flip right here,” traders, especially the less experienced ones, sometimes question themselves and lose objectivity. I'll just hold on a little longer and it'll go my way.

Wrong!

When the market reaches your stop, your rationale for trading is no longer legitimate, and it's time to exit. There were no questions asked!

This is why limit orders were created by the all-powerful forex gods.

Limit orders should be used by new forex traders to automatically shut off lost trades at predefined levels.

For example, you might want to exchange British pounds (GBP) into US dollars (USD).

Let's say the current market rate for GBP/USD is 1.26 (GBP1,000 buys USD1,260), but you think it may increase. You could place a GBP/USD limit order of 1.3 (GBP1,000 buys USD1,300). If the rate became available, the order would be placed automatically.

This way, you won't have the opportunity to second-guess your strategy and make a mistake.

Isn't that amazing?!

Of course, the more trades and experience you have, the more your grasp of market behaviour, your strategies, and how disciplined you are would presumably improve.

Only then would mental stops be acceptable, but limit orders should still be used to exit the majority of your trades.

Don't expose your trade to needless danger by using a limit order to protect yourself!

Because stops are never fixed in stone and may be moved, we'll wrap off this session with three guidelines to remember while utilising stop loss orders.

3 Rules of Setting Stop Losses

Rule #1: Dont let emotions be the reason you move your stop.

Your stop adjustments, like your original stop loss, should be planned out before you start trading. You must learn to control your emotions as a trader. When making decisions, logic should take precedence over emotion.

Rule #2: Do trail your stop.

Trailing your stop means moving it in the direction of a winning trade. This locks in profits and manages your risk if you add more units to your open position.

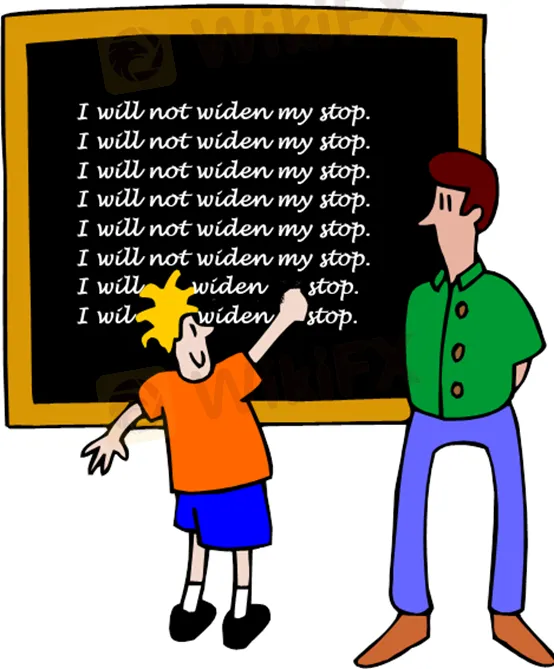

Rule #3: Dont widen your stop.

Do you remember how many times you were right about the direction of a market, but your trade signal was correct? Frustrating to the core. Because your stop loss is set too wide, this keeps happening to you.

Increasing your stop will just increase your danger and your loss. If the market reaches your predetermined stop, your transaction is complete. Accept the blow and move on to the next chance.

These principles are simple to comprehend and should be followed to the letter, especially rule number three!

DO NOT WIDEN YOUR STOP!

Always remember to plan ahead of time and figure out what to do in each case so you don't panic and make a mistake you'll likely regret later.

FX trading is not for the faint of heart! For this, you need patience, expertise, and a strong will. Many people who try it end up losing money, however the strategy and rules discussed above may help you develop a strategy that could be profitable.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator