简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How To Set A Stop Loss Based On Support And Resistance From Charts

Abstract:A smarter way to determine stops is based on what the chart says. We trade markets, so we may stop based on what the market is showing us.

A smarter way to determine stops is based on what the chart says.

We trade markets, so we may stop based on what the market is showing us. Does that make sense?

One of the things we can observe in price action is that there are times when it seems that the price cannot rise above a certain level or break through.

Often times, if these areas of support or resistance are retested, there is a chance that the market will not burst again

Setting stops past these levels of support and resistance appears to be making sense, since, supposing that the market trade past these areas, then, at that point, it is sensible to feel that a break of that area will acquire more traders to play the break and further push your positioning against you.

Or on the other hand, on the off chance that these levels DO break, there might be powers that you know nothing about out of nowhere pushing the market somehow.

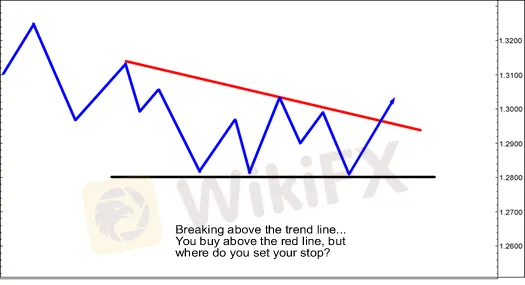

We should look at the method for setting your stops in view of support and resistance:

On the graph above, we can see that the pair is currently trading over the falling pattern line.

You conclude that this is an incredible breakout trade arrangement and you choose to go long.

Yet, before you enter your trade, pose yourself the accompanying inquiries:

Where would you be able to perhaps set your stop?

What conditions would agree to you when your unique trade thought is invalidated?

For this situation, it checks out to set your stops beneath the trend lines and support regions.

Assuming the market moves into these areas, that implies the trend lines drew no help from buyers and presently sellers are in charge.

Your trading thought was invalidated and now is the right time for you to suck it up, leave the trade, and acknowledge the loss.

Example: Short EUR/USD

In the chart underneath, the EUR/USD has been moving down. Price has hit the falling trendline a few times which makes for a pleasant resistance level.

You could submit a short order right at the downtrend line (1.3690).

Presently, where might you put your stop loss?

Your stop loss would be put at 1.3800.

Notice how this is over the resistance region: the downtrend trendline.

We should set profit targets at 1.3530 and 1.3450.

The trade is set off. The trendline holds as resistance and price falls.

Your first target profit is hit.

The subsequent profit target is missed by a solitary pip however at that point, you had moved your stop loss to breakeven (where you entered short) so you didn't lose anything.

This is an instance of resistance as an aide on where to put your stop rather than just utilizing a decent number.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator