简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 FX Events: March German CPI & EUR/JPY Price Outlook

Abstract:Inflation rates in the Eurozones largest economy appear to have stabilized in the near-term.

Talking Points:

谈话要点:

{1}

- According to Bloomberg News, consensus forecasts are calling for German inflation to come it at 0.6% m/m and 1.5% y/y.

- 据彭博新闻社报道,市场普遍预期德国通胀率将维持在0.6%m / m和1.5%y / y。

- Retail traders are net-short EURJPY and recent changes in positioning suggest a bearish bias.

- 零售交易商是净空头欧元兑日元,最近的定位变化暗示看跌偏见。

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

周一美国东部时间7:30 /格林威治标准时间11:30 30分参加FX周前网络研讨会,我们将讨论未来几天的顶级事件风险以及围绕下列事件进行外汇市场交易的策略。

03/28 THURSDAY | 13:00 GMT | EUR GERMAN CONSUMER PRICE INDEX (MAR P)

03/28周四|格林尼治标准时间13:00 |欧元德国消费者物价指数(MAR P)

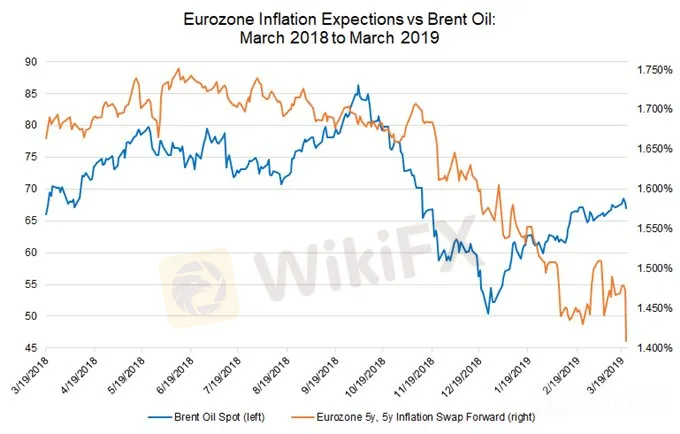

As continents largest economy, as the Germany economy goes, so too does the Eurozone. That rule of thumb extends beyond topline growth rates to inflation readings as well. Energy prices have been stable for the past month (Brent Oil -0.1% past month), and the trade-weighted Euro (-4.2% since March 22, 2018) has proved soft.

作为大陆最大的经济体,随着德国经济的发展,欧元区也是如此。该经验法则也超出了一线增长率,也超出了通胀数据。能源价格在过去一个月保持稳定(布伦特原油价格 - 上个月为0.1%),贸易加权欧元(自2018年3月22日以来的-4.2%)已证明是疲软的。

Coupled with the fact that the European Central Bank has recently announced that it will renew its TLTRO program later this year, there may be the near-term conditions for the decline in inflation readings to level off. The upcoming preliminary German Consumer Price Index on Thursdaymay confirm this theory, where headline CPI is due in at 0.6% from 0.4% (m/m), and 1.5% (y/y) (unchanged from the final February reading).

再加上欧洲央行最近宣布将在今年晚些时候更新其TLTRO计划这一事实,通胀数据下降的近期条件可能会趋于平稳。即将于周四公布的德国初步消费者价格指数可能证实了这一理论,其中整体消费物价指数从0.4%(月比)和1.5%(同比)下降0.6%(与2月份的最终读数相同)。 p>

Pairs to Watch: EURGBP, EURJPY, EURUSD

值得关注:EURGBP,EURJPY,EURUSD

EURJPY Price Chart: Daily Timeframe (July 2018 to March 2019)

EURJPY价格走势图:每日时间表(2018年7月至2019年3月)

EURJPY has been trading on a slight incline since the Yen flash-crash at the start of the year, but some technical developments in recent weeks may be hinting at what has yet to come. The 61.8% retracement at 127.67, of the 2018 high to the 2019 low range, was never retaken during the rebound since the Yen flash-crash. Technicians often use the 61.8% retracement as the delineating factor between describing price action as a “rebound” or as that of a “new trend.”

自今年年初日元暴跌以来,欧元兑日元一直在小幅上涨,但最近几周的一些技术发展可能暗示未来的情况。 2018年高位至2019年低位震荡的回调位于127.67的61.8%,自日元大跌以来的反弹期间从未重新回撤。技术人员经常使用61.8%的回撤作为描述价格行为作为“反弹”或“新趋势”之间的界定因素。

Considering that 127.67 was never retaken during early-March, price action since then has been suggesting that a new bull trend has not formed. Instead, with EURJPY closing back below the 38.2% retracement (124.29) this week at 124.21, it would appear that the probability of more downside has increased materially.

考虑到127.67从未重新开始从3月初开始,价格走势一直表明新的牛市趋势尚未形成。相反,随着欧元兑日元本周回落至38.2%的回撤位(124.29)至124.21下方,看来更多下行的可能性大幅增加。

IG Client Sentiment Index: EURJPY (March 22, 2019)

IG客户情绪指数: EURJPY(2019年3月22日)

Retail trader data shows 66.7% of traders are net-long with the ratio of traders long to short at 2.0 to 1. The number of traders net-long is 67.2% higher than yesterday and 47.0% higher from last week, while the number of traders net-short is 49.5% lower than yesterday and 50.0% lower from last week.

零售交易者数据显示,66.7%的交易者是净多头,交易者的多头比例为2.0比1。交易商净多头比昨天增加67.2%,比上周增加47.0%,而交易商净空头数比昨天减少49.5%,比上周减少50.0%。

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURJPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURJPY-bearish contrarian trading bias.

我们通常采取逆向观点来看待市场情绪,而且交易商持续净多头表明欧元兑日元价格可能继续下跌。交易商进一步净多头昨天和上周,当前情绪和最近的变化相结合,使我们对欧元兑日元看跌的逆势交易产生了偏见。

Read more: Top 5 FX Events: Final Q418 US GDP & USDJPY Price Outlook

了解更多:前5大外汇事件:最终Q418美国GDP和USDJPY价格展望

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

---由高级货币策略师CFA Christopher Vecchio撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Euro Forecast: Risks Remain Lower for EUR/USD, Covid Surge Adds to Weakness

Risks Remain Lower for EUR/USD. Sharp Increase in Covid Cases Adds Another Concern for the Euro.

Japanese Yen Technical Analysis: EUR/JPY, CAD/JPY. What Happened to Momentum?

JAPANESE YEN, EUR/JPY, CAD/JPY - TALKING POINTS AND ANALYSIS

EUR/USD Testing Support Ahead of the Latest US Jobs Report (NFP)

EUR/USD Price, Chart, and Analysis

Crude Oil Prices at Risk if US Economic Data Cool Fed Rate Cut Bets

Crude oil prices may fall if upbeat US retail sales and consumer confidence data cool Fed rate cut bets and sour risk appetite across financial markets.

WikiFX Broker

Latest News

Beware: Forex Investment Fraud Targeting Low Income Earners

Central Bank Policies,Forex Markets and Gold Prices

These 24 Crypto Scams Are Accelerating the Theft of Your Assets

Beware of Fake 'Educational Foundations' Targeting Crypto Investors, Warns North Dakota Regulator

49 Foreigners Arrested in Illegal POGO Raid in Pasay City

We Asked Grok About Illegal FX Brokers—Here’s What It Revealed

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

Online Investment Scams on the Rise: How Two Victims Lost Over RM100K

Vanished Savings: How One Woman Lost RM412,443 to an Online Scam

Investor Alert: FCA Exposes 9 Unregistered Financial Companies

Currency Calculator