简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Traders Look for Reason Behind Bitcoin Rally - Heres 1 Possible Answer

Abstract:It was the best day of the year for cryptocurrency markets, and Bitcoins best day since December 26, 2017.

Talking Points:

- It was the best day of the year for cryptocurrency markets, and Bitcoins best day since December 26, 2017.

- Rumors swirl about potential reasons, but one hasnt been mentioned – price action in the Turkish Lira.

- The correlation between USDTRY and BTCUSD since the first day of September 2018 is a significant 0.77.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

Cryptocurrency markets just produced their best trading day of 2018, with gains widespread across instruments. Bitcoin added nearly 15%, Ether added around 13%, and Litecoin gained near 20%.

Rumors Abound, but No One Knows the Real Reason

Rumors have swirled about the cause of the rally, with reasons spanning from ridiculous (a fake news story on April Fools Day), to improbable (the SEC giving stealth approval to a new ETF without alerting the broader public), to unlikely (Warren Buffet diversifying into crypto), and to simplistic and plausible (stop losses orders kicking in). The truth is, no one really knows.

While all of these reasons may be deemed valid by some and invalid by others, there‘s a conspicuous absence of discussion about one of the ’theories‘ that drove Bitcoin’s meteoric rise in 2017: that investors were using cryptocurrency as a vehicle to diversify away from emerging market currencies experiencing excessive volatility (e.g. the South Korean Won during North Korea's missile tests).

Recent News Out of Turkey Hasnt Helped

Emerging markets haven‘t been in the news much of late, thanks to the intense focus on the latest Brexit negotiations and the US-China trade war talks. But over the weekend, Turkey held local elections, and Turkish President Recep Erdoğan’s ruling party lost control of constituencies in Ankara and Instabul, the countrys two largest industrial cities.

Moreover, with Turkey moving forward with a Russian military contract, the United States has threatened to implement sanctions and to pull parts of its F-35 supply chain out of the country. While any event in isolation may not be cause for concern, “many drops can fill a bucket,” as the saying goes; several minor obstacles appearing at the same time can prove a formidable obstacle.

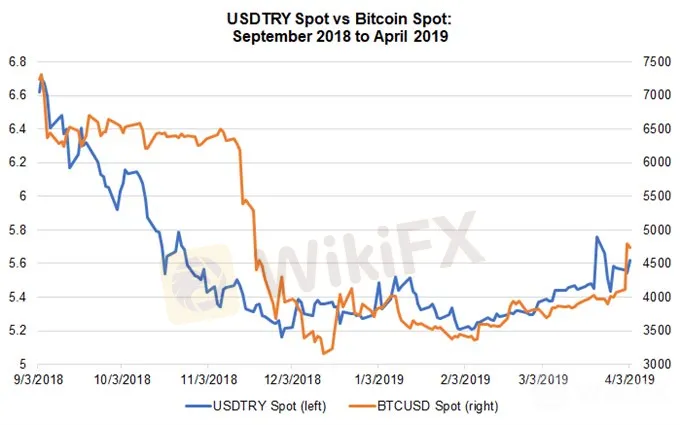

USDTRY vs Bitcoin (BTCUSD) Price Chart: Daily Timeframe (September 2018 to April 2019)

While acknowledging that correlation doesnt equal causation, it must be pointed out that the recent Bitcoin rally has come on the heels of weakness in the Turkish Lira. But this is not a new phenomenon. In fact, over the past six-months, the correlation between USDTRY and Bitcoin (BTCUSD) spot prices is 0.71. In other words, when the Lira has rallied, Bitcoin has weakened (September to December 2018); when the Lira has depreciated, Bitcoin has strengthened (January to present).

If Bitcoin and the cryptocurrency market is to see a significant boost moving forward, the best hope may be for more weakness in not only the Turkish Lira, but emerging market currencies in general.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Today's analysis: USDJPY Set to Rise Amid Bank of Japan Policy Shift

USD/JPY (USD/JPY), an increase is expected as the Bank of Japan may reduce bond purchases and lay the groundwork for future rate hikes. Technical indicators show an ongoing uptrend with resistance around 157.8 to 160.

Bold Prime Review

Bold Prime is an online financial services provider that offers a good selection of CFD instruments for trading online including forex, stocks and cryptocurrencies. They provide traders with the popular MT4 and MT5 trading platforms, which are easy to use and available in desktop, web, and mobile versions.

Using Stop Loss Orders in Forex Trading

highlighting the importance of stop losses in forex trading

INTERACTIVE BROKERS LAUNCHES TOOL TO ASSESS UNDERVALUED STOCKS

Interactive Brokers has launched a new tool for investors

WikiFX Broker

Latest News

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator