简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Breakout Hits Resistance - Pullback or Reversal?

Abstract:Gold prices have been aggressively bid after last week's tariff announcement, finally finding a bit of resistance at fresh six-year-highs.

Gold Technical Analysis:

Gold prices have been aggressively bid, US Dollar weakness and a potentially dovish outlay at the Fed in response to heightened trade worries.

Gold remains very near fresh six-year-highs as the bullish breakout continued through this weeks open. Prices have since found resistance but, at this point, there's little to suggest this is anything more than a pullback rather than a full-scale reversal.

DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If youre looking to improve your trading approach, check out Traits of Successful Traders. And if youre looking for an introductory primer to the Forex market, check out our New to FX Guide.

Gold Prices Continue Ascent

The bullish breakout in Gold has continued into a new week as a potent cocktail of risk has gripped global markets. Perhaps not ironically, this has all begun after the FOMC cut rates for the first time since the Financial Collapse. In a move that was initially framed by FOMC Chair Jerome Powell as an insurance rate cut, which brought on a pullback in Gold; it‘s now looking increasingly likely that last week’s cut was the first of more to come. In the accompanying press conference, Powell pointed to trade tensions as one of the reasons for a more cautious outlook, and this topic came to light less than 24 hours later when President Trump announced increased tariffs on China. This took many by surprise but it also perhaps re-defined the Feds outlook discussed less than a day earlier as that potential variable of worry around trade got a little bit louder.

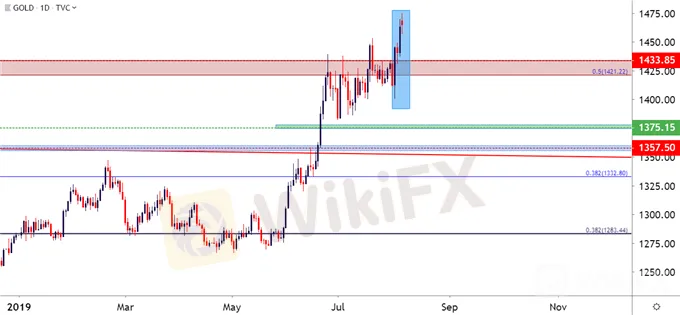

After resistance just shy of the 1450 level last week, Gold prices put in an aggressive topside breakout to begin this week, coming very close to the 1475 marker during last nights trade.

Gold Daily Price Chart

Chart prepared by James Stanley; Gold on Tradingview

Chase an Overbought Breakout, or Wait for Pullback

As looked at coming into this week, bullish breakout potential remained as Gold prices postured so close to those previously established highs. But now that fresh highs are in and prices have begun to pullback, the big question is where support may show up. And given that we‘re in some territory that hasn’t been traversed in more than six years, it can be difficult to grasp onto recent historical examples of where that may show. So, first, taking a shorter-term perspective for traders that want to approach the matter aggressively, higher low-support potential could be sought out in a few different areas of interest.

The prior six-year-high that was set around the 1453 level can be extended down to the 38.2% Fibonacci retracement of the recent breakout, creating a potential support zone to look to for higher-low support. A bit-lower, another similar area of interest exists from the late-July swing-high around 1433.80 down to the 61.8% retracement of the same move, coming-in around 1428.85. If both of these zones are taken-out, near-term continuation potential comes into question.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

Gold Prices Longer-Term

If this recent breakout does end up becoming erased, which given the headline-flow over the past few days, must be considered as a scenario; the longer-term look on Gold prices still remains bullish. This comes from the fact that we‘re probably not going to see any hawkish major Central Banks anytime soon and, likely, pressure will remain on global growth until cessation is seen on a variety of trade issues. And, at this point, it appears as though China’s strategy will be to try to wait out President Trump through the 2020 election, which can keep that pressure on growth for an extended period of time.

This excitement is likely one of the major factors driving the force of the recent breakout in Gold. It‘s context that’s roughly similar to the post-Financial Collapse backdrop when most major Central Banks around the world are harboring some form of dovish policy, or at the very least considering it.

So, if this current phase does end up washing out, similar to what was seen from February-April of this year, longer-term support potential remains at key areas of prior resistance that, as yet, havent been tested for support since prices broke-out in June. These levels show around 1375 and 1357.50, each of which were previous annual highs that showed as follow-through resistance.

Gold Weekly Price Chart

Chart prepared by James Stanley; Gold on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Prices Struggle Even as Markets Convulse Amid Omicron Fears

Gold prices seesawed on Omicron variant news as real rates rose. Testimony from Fed Chair Powell now in focus, may offer support. Technically, prices are testing the mettle of a three-month uptrend

Gold Forecast - Gold Looks to Defend Key 1800 Level as PCE Inflation Data Nears

Gold plunges after Biden renominates Powell to Fed Chair. XAU traders eye US inflation data due out this Wednesday. 1800 level key to direction, will bears break below the level?

Gold Prices Rise Post CPI, But US Dollar Strength Outshines. Will XAU/USD Go Higher?

Gold broke higher after eye popping US inflation last week before pausing. Treasury yields continued higher and USD buying eventually dominated gold. Inflation focus has faded but Fed action lingers. Where to for XAU/USD?

Gold Price Forecast: XAU/USD Eyes US Retail Sales for Direction

Gold Forecast - prices look higher after big gain on inflation worries. US retail sales may provide the key for XAU’s direction. XAU/USD eyes psychological 1900 level as prices gain.

WikiFX Broker

Latest News

How to Avoid Risks from Scam Brokers in Forex Investment

Beware: Forex Investment Fraud Targeting Low Income Earners

Central Bank Policies,Forex Markets and Gold Prices

These 24 Crypto Scams Are Accelerating the Theft of Your Assets

Beware of Fake 'Educational Foundations' Targeting Crypto Investors, Warns North Dakota Regulator

49 Foreigners Arrested in Illegal POGO Raid in Pasay City

We Asked Grok About Illegal FX Brokers—Here’s What It Revealed

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

Online Investment Scams on the Rise: How Two Victims Lost Over RM100K

Vanished Savings: How One Woman Lost RM412,443 to an Online Scam

Currency Calculator