简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Broker Updates During July 12-18

Abstract:Cyprus Securities and Exchange Commission announced on Friday that it is suspending the entire CIF license of investment company Depaho Ltd...

Vietnam

Revenue Growth

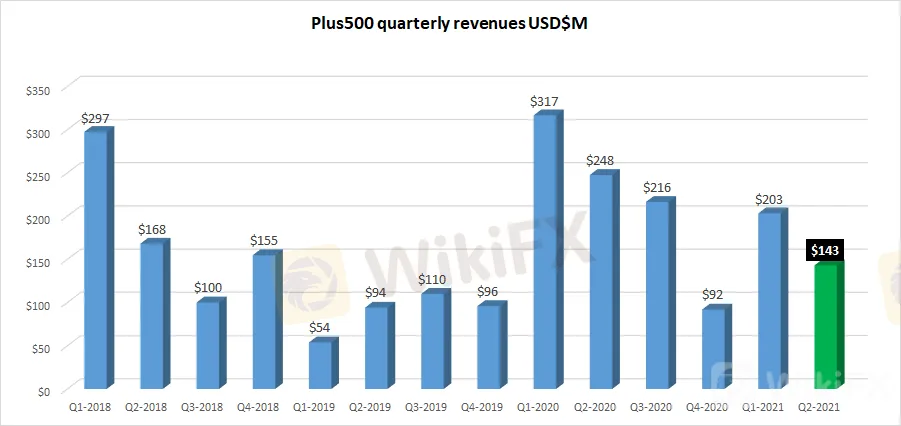

1. According to Monday's update, global CFD group Plus500's revenue in the first six months of the year reached $346.2 million, down $564.2 million compared to the same period in 2020. However, this number is considered to increase 156% compared to the first half of 2019. Additionally, Plus500 revealed that it generated $379.2 million in customer income.

CIF License

2. Cyprus Securities and Exchange Commission (CySEC) announced on Friday that it is suspending the entire CIF license of investment company Depaho Ltd. CySEC said the investment company violated article 5 of the Act on Investment and Investment Services – Regulated Markets of 2017.

AFS License

3. The Australian Securities and Investments Commission (ASIC) announced today the cancellation of the Australian financial services (AFS) licenses of two companies: Jels Financial Group Pty Ltd and Selectinvest Pty Ltd. According to the regulator, Jels has failed to show it has the capacity and capital to provide financial services.

Indonesia

Forex Investment

4. The Indonesian Ministry of Trade (Kemendag) through the Commodity Futures Trading Supervisory Agency (CoFTRA) blocked 137 domains consisting of 117 websites, 12 Instagram accounts, and 8 Facebook accounts of entities in the commodity futures trading sector (PBK) that did not have a permit from BAPPEBTI.

Among the 117 blocked website domains, there are 33 website domains that offer forex investment through the sale of Smartxbot or Smartx Net89 forex trading software.

These sites offer passive income and promise no-loss profits in forex trading.

Thailand

License Renounced

5. The Cyprus Securities and Exchange Commission (CySEC) announced on Tuesday that it has decided to withdraw the CIF license of Globia Wealth Ltd. A meeting took place on May 17 this year where the watchdog addressed the matter, clarifying that the firm was the one who decided ‘expressly’ to renounce the license.

The financial supervisor issued the following statement: “The Cyprus Securities and Exchange Commission announces that, on its meeting of 17 May 2021, has decided, pursuant to section 8(1)(a) of the Investment Services and Activities and Regulated Markets Law of 2017 and section 4(7) of Directive DI87-05, to withdraw the Cyprus Investment Firm authorization with Number 318/17 of Globia Wealth Ltd (‘the Company’), due to the Companys decision to expressly renounce it.”

ICF Membership

6. The Cyprus Securities and Exchange Commission (CySEC) announced on Tuesday that Coverdeal Holdings Ltd., which terminated services last year, is no longer a member of the Investors Compensation Fund (ICF).

The Cypriot regulator offers up to 20,000 euros protection to the deposits of all traders under any locally regulated financial services company. This ensures the safety of client deposits in case of the broker going bankrupt.

Japan

Crypto Scam

7. Four operators of an investment business have been arrested by the Aichi prefectural police for swindling peoples investing crypto. They promised such as “2.5 times profit in 4 months”.

The police are investigating how they collected at least 6 billion yen from more than 10,000 people across Japan.

Four people were arrested, including Shoji Ishida, a corporate officer who ran the investment business named “OZ Project”.

Commonwealth of Independent States (CIS)

FX Promotion

8. RoboForex announced a new $ 1,100,000 promotion in honor of the 11th anniversary of the company! From July 2021 to April 2022, draws of cash prizes will be held every month among traders with prime accounts, partners and CopyFX traders on prime accounts.

FX Course

9. FINAM invites traders to take a new advanced 5-day course “Marketscop (VSA): Intraday Trading”, which starts on 26.07.21! The author of the course is the popular financial expert Alexander Bizyuk.

NewService

10. FINAM has launched a service that allows new clients to replenish a brokerage account before its actual opening in accounting systems. The service allows an investor to speed up the process of starting trading on the exchange without wasting time on replenishment after opening an account.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Hantec Markets Partners with Fortaleza EC

In a landmark move, global trading broker Hantec Markets has become the official trading partner of Fortaleza EC—one of Brazil’s most beloved and historic football clubs. This partnership underscores Hantec Markets’ commitment to aligning with premier sports organizations that share the company’s values of ambition, determination, and excellence.

Best Binary Options Indicators: Enhance Your Trading Strategy

Binary options trading involves predicting whether an asset's price will rise or fall within a specific timeframe. Unlike traditional investing, more specifically, binary options demand rapid decisions due to fixed expiry times (e.g., 60 seconds to 1 hour). For instance, speculating if EUR/USD will be above 1.0800 in the next five minutes. Success yields a fixed payout, while failure results in the loss of invested capital. Binary indicators distill complex market data—price action, volume, volatility—into actionable signals tailored for short-term trades. Indicators act as a compass, guiding traders to trends, reversals, and optimal entry points, thus enabling traders to detect market shifts for higher-probability decisions.

Baazex Review: Is it safe to invest in it?

Baazex is a relatively new broker registered in the United Arab Emirates, with an operating history of between 2 to 5 years. Despite its claims of offering over 1500 trading instruments—from foreign exchange pairs like EUR/USD, GBP/USD, and AUD/JPY, to major stocks including Apple, Meta, Disney, LVMH, and Tesla; as well as commodities (oil, gold, silver, coffee), indices, cryptocurrencies, and futures—investors should be aware of some critical risks.

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

WikiFX Broker

Latest News

How to Avoid Risks from Scam Brokers in Forex Investment

Beware: Forex Investment Fraud Targeting Low Income Earners

Central Bank Policies,Forex Markets and Gold Prices

These 24 Crypto Scams Are Accelerating the Theft of Your Assets

Beware of Fake 'Educational Foundations' Targeting Crypto Investors, Warns North Dakota Regulator

49 Foreigners Arrested in Illegal POGO Raid in Pasay City

We Asked Grok About Illegal FX Brokers—Here’s What It Revealed

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

Online Investment Scams on the Rise: How Two Victims Lost Over RM100K

Vanished Savings: How One Woman Lost RM412,443 to an Online Scam

Currency Calculator