简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

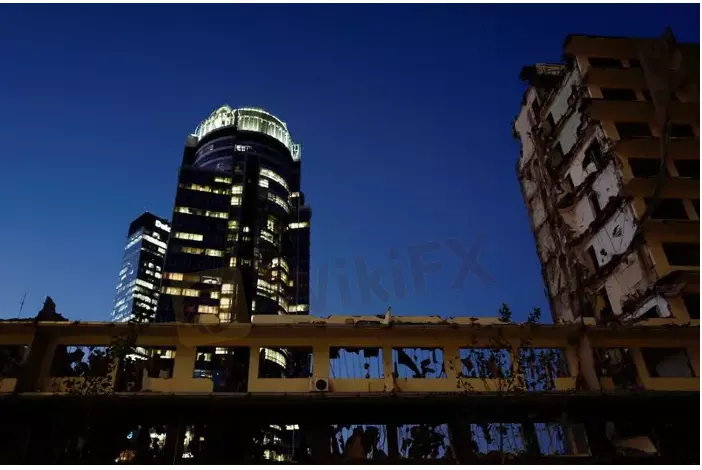

‘Panic’ in Pakistani markets as rupee slides further against U.S. dollar

Abstract:The Pakistan rupee slid further against the U.S. dollar on Wednesday, as the local foreign exchange association warned that panic was spreading through the currency market following the sharp declines this week.

The rupee fell 2% on Monday, and 3% on Tuesday, despite last weeks staff level agreement reached with the International Monetary Fund (IMF) that would pave the way for a disbursement of $1.17 billion under resumed payments of a bailout package.

On Wednesday morning the rupee was trading at 225 per dollar, having ended Tuesday at 221.99 after Fitch ratings agency revised its outlook for Pakistan sovereign debt from stable to negative – though it affirmed Long-Term Foreign-Currency and Issuer Default Rating at “B-”.

“There is panic in the market, I fear it (the rupee)will go down further,” Zafar Paracha, Secretary General of a foreign exchange association, the Exchange Companies of Pakistan, told Reuters.

Paracha said he did not see any reason for the depreciation in the rupee other than a possible IMF pre-conditions. Neither the government or the IMF have said anything about the need for any further depreciation of the currency, though Pakistan recently adopted a market-based exchange rate under advice from the IMF under the economic reforms agenda.

“The recent movement in the rupee is a feature of a market-determined exchange rate system,” the State Bank of Pakistan said in a series of Twitter posts late Tuesday night, adding that rupees depreciation against dollar is in large part a global phenomenon.

Pakistan faces economic turmoil, with fast depleting foreign reserves, a declining currency and widening fiscal and current account deficits, and the rupee has lost 18% of its value since Dec. 21.

Reserves have fallen to as low as $9.8 billion, hardly enough to pay for 45 days of imports.

Pakistan has also passed through another bout of political instability, with the government of Prime Minister Shehbaz Sharif taking over from ousted premier Imran Khan in April.

On Tuesday, sovereign dollar bonds issued by Pakistan suffered sharp losses to record lows after Fitch‘s move, while the Pakistan Stock Exchange’s KSE100 Index .KSE fell 2.36%.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Australian Dollar Surges as Trade Surplus Hits 11-Month High: A Golden Opportunity for Forex Traders

Australia's trade surplus has surged to an 11-month high, reaching $5.62 billion in January 2025. The unexpected boost in trade surplus was primarily driven by a 1.3% month-over-month increase in exports, with non-monetary gold playing a starring role.

ECB Set to Cut Rates, But Future Path Uncertain Amid Global Tensions

- ECB expected to cut interest rates on March 6 - Future rate decisions unclear due to ongoing inflation and global trade issues - Markets expect more cuts, but some ECB officials urge caution

Forex Trading Mastery: The Ultimate Winning Formula

The foreign exchange market is inherently volatile, with its sharp fluctuations driven not only by changes in the global economic landscape but also by large-scale speculative capital and the influence of major market players, further intensifying its instability.

Gold Surge News: Central Banks Expand Gold Reserves—Will Prices Rise?

Central banks have purchased over 1,000 tons of gold annually for three consecutive years, and 2024 is no exception. However, the key question remains: as demand for gold continues to rise, will its price keep increasing?

WikiFX Broker

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FINMA Opens Bankruptcy Proceedings

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Currency Calculator