简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

No Regulation: VRN Capitals' Equivocation does not Hide the Truth of Illegitimacy

Abstract:In recent years, thanks to public warnings from regulators and increased awareness among general investors, fraudulent brokers are not as easy to get away with as they once were.

A few scammers will steal regulatory information from legitimate brokers and falsely claim to be regulated. But many more scammers, like VRN Capitals, try to obfuscate when asked regulatory-related questions.

No regulatory information found

VRN Capitals shows very attractive trading conditions on its webpage - low spreads, high leverage, and a minimum deposit of even $10. The company also claims that clients' funds are protected by “Solid Regulatory Protection”. But in this dazzling pile of information, only the most important regulatory information for investors can not be found, neither the regulatory number nor the regulator.

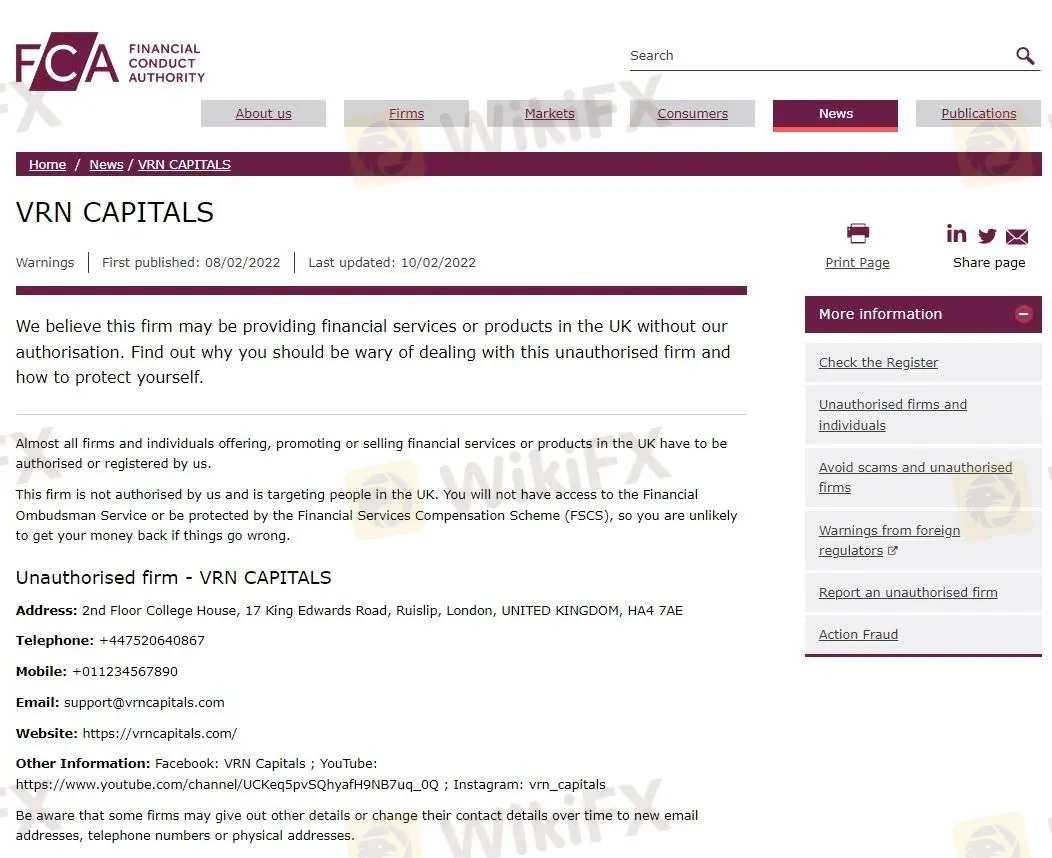

We had no choice but to trace the regulation of the broker through its contact information. The website shows that the company's address is in the UK, and the contact number is also a UK phone number. So we tried to find the license of this company in the FCA. Unfortunately, all we could find was a warning against the company, stating that it provided financial products and financial services to UK citizens without authorization. Obviously, this is not legal.

There are more and more scammers on the market like VRN Capitals, with the attitude of trying to muddle through and never mentioning anything related to regulation. For professionals, this is an obvious red flag, and it is often possible to find the appropriate regulator for a license search through the country where the company is based.

But for the newbies who are distracted from regulation by such a scammer, and, at the same time, are caught by the attractive trading conditions, there is a high risk of falling for it.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

SEC Ends Crypto.com Probe, No Action Taken by Regulator

The SEC has closed its investigation into Crypto.com with no action taken. Crypto.com celebrates regulatory clarity and renewed momentum for the crypto industry.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator