简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

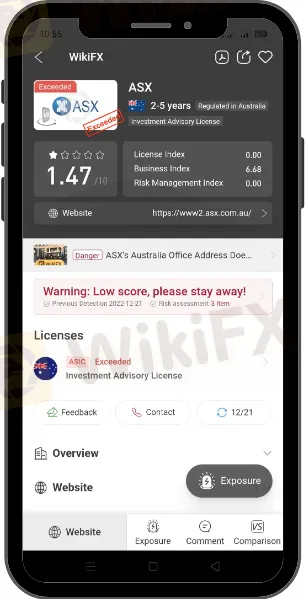

ASIC Seeks Court Order Against "Tyson Scholz" An ASX Influencer

Abstract:The Australian Federal Court ruled that social media 'influencer' Tyson Robert Scholz violated s911A of the Corporations Act by operating a financial services firm without an Australian financial services license between March 2020 and November 2021.

Mr. Scholz was accused of carrying on a financial services business without a license by delivering training courses and seminars about trading in ASX-listed securities, during which he made recommendations about share purchases, according to the Australian Securities and Investments Commission (ASIC). Using the name '@ASXWOLF TS,' I'm promoting those courses and seminars on Twitter and Instagram. Making share purchasing suggestions on private internet forums (which he ran) and on Instagram.

Mr. Scholz's offering to paying subscribers included:

subscription/membership fees of $500, $1,000, or $1,500

offers of various levels of share trading training referred to as ‘Stage 1’, and ‘Stage 3’ packages, which were marketed as introductory or advanced seminars

offers of individual one-off share trading suggestions, or tips for a fee

the Stage 2 package provides one year‘s access to a private chat site, named ’Black Wolf Pit, using the online communications platform Discord.

The case will be scheduled for a case management hearing on January 31, 2023, followed by a subsequent hearing to address any outstanding problems, including any orders prohibiting Mr. Scholz from doing financial services without a license.

ASIC is seeking orders prohibiting Mr. Scholz from:

promoting or carrying on the business of providing recommendations or statements of opinions about the purchase of shares in return for payments of money or other benefits

directly or indirectly carrying on any financial services business in Australia

receiving, soliciting, transferring, or disposing of customer funds received in connection to providing recommendations or opinions about the purchase of shares.

The financial product advice supplied by Mr. Scholz was an intrinsic component of this company,' her Honour Justice Downes noted in her conclusion. His advice was not one-time, but rather part of the ongoing and systematic commercial activities from which Mr. Scholz profited.

Through his Instagram lifestyle and 'life story' postings, Mr. Scholz had created a reputation as a successful share trader with the capacity to discover attractive firms in which to invest. It didn't matter that the pieces made no overt suggestion to buy the shares: it was enough that Mr. Scholz mentioned a firm or its stock in the tales, generally in a manner that suggested that he loved that company.'

ASIC filed proceedings in the Federal Court in December 2021 seeking orders prohibiting Mr. Scholz from advertising or carrying on any financial services activity in Australia. On December 16, 2021, the Federal Court issued cooperation orders prohibiting Mr. Scholz from marketing or carrying on a financial services firm. Those orders were issued until the Court's decision on ASIC's request for a permanent injunction, which was heard in a contentious hearing in October 2022.

Find out more of ASX news here: https://www.wikifx.com/en/dealer/4321685308.html

Stay tuned for more Forex News.

Use the download link below to download and install WikiFX App on your mobile phones to stay updated on the latest news, even on the go.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Dark Side of Trading Gurus: Are You Following a Fraud?

Across social media, YouTube, and countless online forums, self-proclaimed trading ‘gurus’ promise to share their winning strategies for a price. These so-called experts claim to have cracked the code, offering courses, investment tips, and mentorship schemes that guarantee success. However, in reality, many of them are little more than sophisticated scammers, preying on the financial aspirations of their followers.

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

INFINOX has teamed up with Acelerador Racing, sponsoring an Acelerador Racing car in the Porsche Cup Brazil 2025. This partnership shows INFINOX’s strong support for motorsports, adding to its current sponsorship of the BWT Alpine F1 Team.

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

Authorities Alert: MAS Impersonation Scam Hits Singapore

MAS scam alert: Scammers impersonate officials, causing $614K losses in Singapore since March 2025. Learn how to spot and avoid this impersonation scam.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator