简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Saxo Bank Achieves Remarkable Growth, Surpassing $100 Billion in Client Assets

Abstract:Saxo Bank, a Danish brokerage firm, has reached $100 billion in client assets, despite a challenging economic climate. While 2022 saw decreased revenues and net profit, the bank's client base grew significantly. The firm attributes its success to trusted client relationships and robust financial services.

In a landmark achievement, Saxo Bank, a leading brokerage firm headquartered in Copenhagen, announced it has amassed over $100 billion in client assets. This significant milestone is a testament to the steady expansion and growth of the Danish financial firm, a journey that has been marked by resilience, robust strategies, and a persistent commitment to client-centric services.

Twenty-five years saw Saxo Bank accumulate $20 billion in assets under management. However, the recent five-year period witnessed an exponential surge, resulting in an additional $80 billion. This rapid ascent to the $100 billion benchmark not only underscores the financial institution's enduring growth in client numbers and deposits but also cements its standing as a significant force in the financial world. The feat is all the more noteworthy given the current, uncertain macroeconomic climate.

Saxo Bank's CEO and founder, Kim Fournais, expressed gratitude for the trust shown by their clients, which has played a pivotal role in reaching this historic benchmark. He noted that the accomplishment is a clear indicator of Saxo Bank's competence in serving its expanding client base, even in volatile market conditions. Fournais highlighted that Saxo Bank continues to earn an increasing share of its clients' wealth, thanks to its competitive deposit interest rates, comprehensive asset management solutions, and robust trading platforms offering access to global markets across various asset classes.

Despite this significant achievement, the brokerage firm did encounter a few bumps in its financial performance in the fiscal year 2022. Reports indicated that revenues and net income witnessed a slight downturn due to a decrease in customer trading activity compared to the previous year.

The financial year 2022 saw the bank's annual revenues dip by 1.6%, amounting to DKK 4.45 billion ($635 million), from DKK 4.52 billion the previous year. The net profit also shrunk by 6% to DKK 711 million ($101.3 million) from DKK 755 million in 2021. Saxo Bank attributes this drop to a decrease in trading activity, influenced by the turbulent macroeconomic scenario, which led to a reluctance among clients to trade. However, a silver lining was seen in the rise in net interest income, buoyed by higher interest rates, which offset some of the loss from the reduced trading activity.

The bank's active accounts swelled to an unprecedented 876,000, largely fuelled by its institutional business. Despite a remarkable onboarding of over 56,000 clients from 2021, total clients' assets under custody saw a minor dip to DKK 584 billion from DKK 595 billion in the preceding year. The bank attributed this decline primarily to a downturn in the equity market, though some of the loss was mitigated by positive net funding from clients.

Despite the aforementioned challenges, Saxo Bank was able to maintain its cost level with minimal fluctuations. This was largely due to the postponed completion of the BinckBank migration, which has inadvertently increased costs and added complexity by running two infrastructures simultaneously. Saxo Bank also managed to improve its cost/income ratio, thanks to cuts in staff costs, reductions in administrative expenses, and a decrease in marketing expenditure.

Overall, despite a mixed bag of financial results, Saxo Bank's significant milestone in client asset accumulation signals its continued growth trajectory and resilience in a volatile market environment.

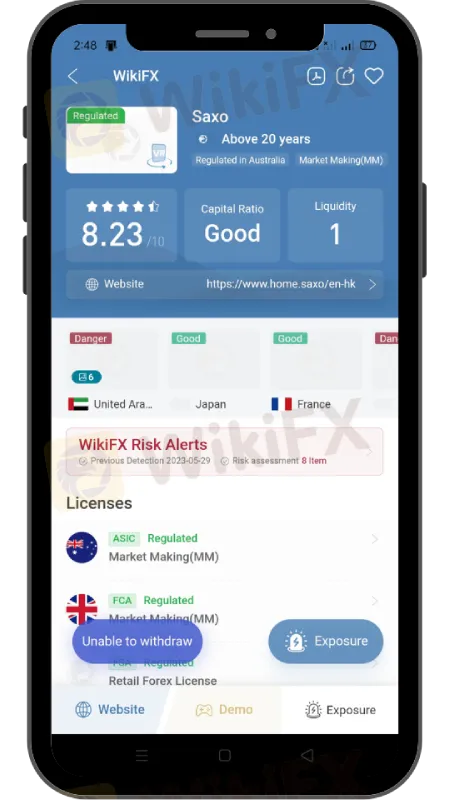

To keep abreast of the latest updates, get the WikiFX App on your mobile device. You can download the app using this link: https://social1.onelink.me/QgET/px2b7i8n

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator