Score

GCM

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.gcmasia.com/en/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Malaysia 2.58

Malaysia 2.58Contact

Licenses

Licenses

Licensed Entity:Fortrade Limited

License No. 609970

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed GCM also viewed..

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Malaysia

China

gcm-asia.com

Server Location

United States

Most visited countries/areas

Malaysia

Website Domain Name

gcm-asia.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2012-12-11

Server IP

45.60.35.148

gcmasia.com

Server Location

United States

Most visited countries/areas

China

Website Domain Name

gcmasia.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

0001-01-01

Server IP

199.59.148.140

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Country/Registered Area | United Kingdom |

| Foundation Year | 5-10 years |

| Company Name | GCM Asia |

| Regulation | suspicious regulatory license |

| Minimum Deposit | not specified |

| Maximum Leverage | Up to 200:1 |

| Spreads | From 2.5 pips |

| Trading Platforms | GCMasia pro, metatrader 4 |

| Tradable Assets | Currency Pairs, CFDs on Precious Metals, CFDs on Commodities, CFDs on Shares, CFDs on Indices, Treasuries |

| Account Types | Standard Account, Premium VIP Account, ECN Pro Account, Demo Account |

| Demo Account | Available |

| Islamic Account | not specified |

| Customer Support | Telephone support, email |

| Payment Methods | Credit/Debit Card, WeChat Pay, Alipay, FPX Pay, Online Banking, BitPay, Neteller, Skrill, Bank Transfer |

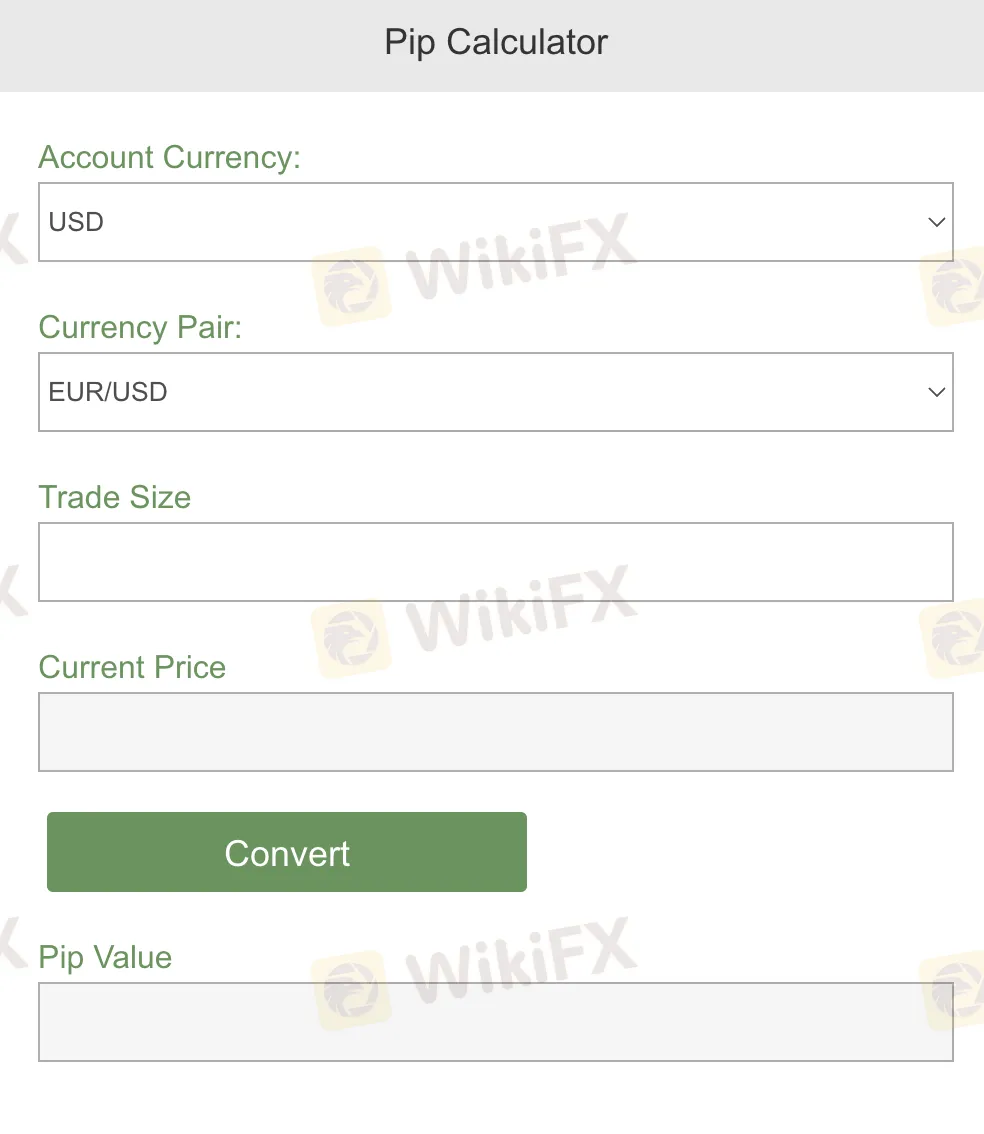

| Educational Tools | Economic Calendar, Forex Calculator, Swap Rate Calculator, Pip Calculator, Margin Calculator, Strategy, Daily Analysis, Weekly Analysis |

General Information

GCMasia is a forex and CFD broker and works in association with fortrade, promoting its services and platforms in the asian region. fortrade is the trading name of fortrade ltd, llc “fort securities blr”, and fort securities australia pty ltd. for trade ltd. is authorized and regulated by the financial conduct authority (fca) with firm reference number (frn) 609970. llc “fort security blr” was registered by the minsk city executive committee on may 8, 2018 under the number 193075810.

Pros and Cons

| Advantages | Disadvantages |

| Wide range of trading instruments | Categorized as a “suspicious clone” by regulators |

| Different account types available | Many merchant complaints |

| Popular trading platforms offered | Reliability and trustworthiness concerns |

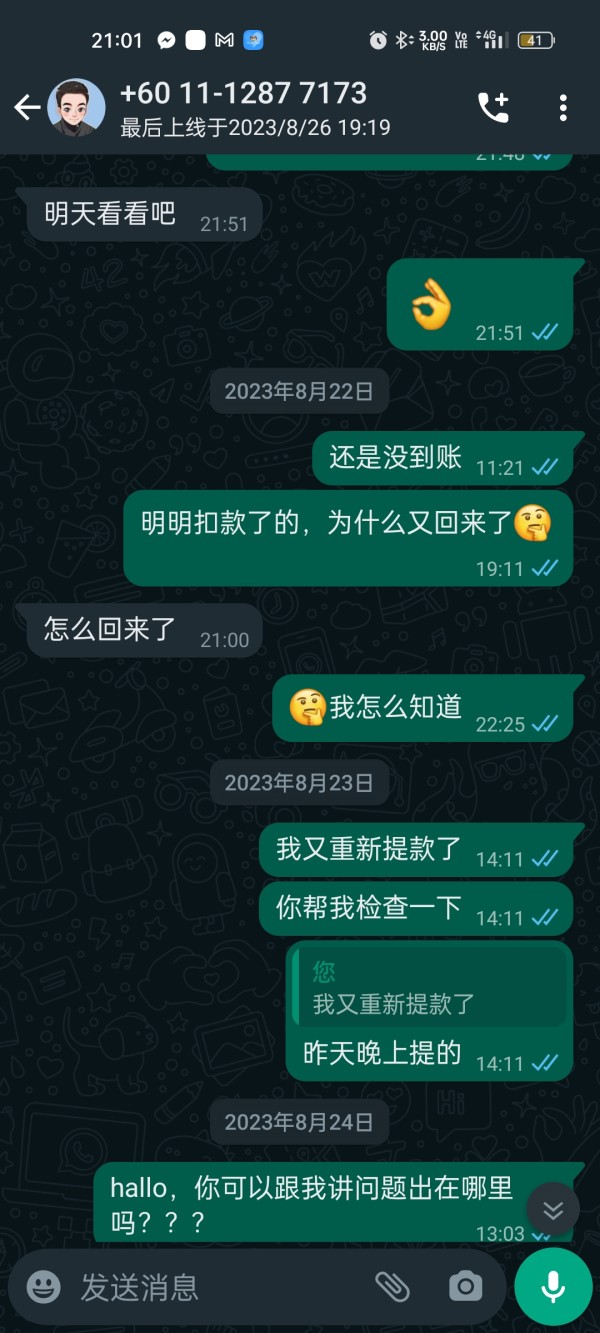

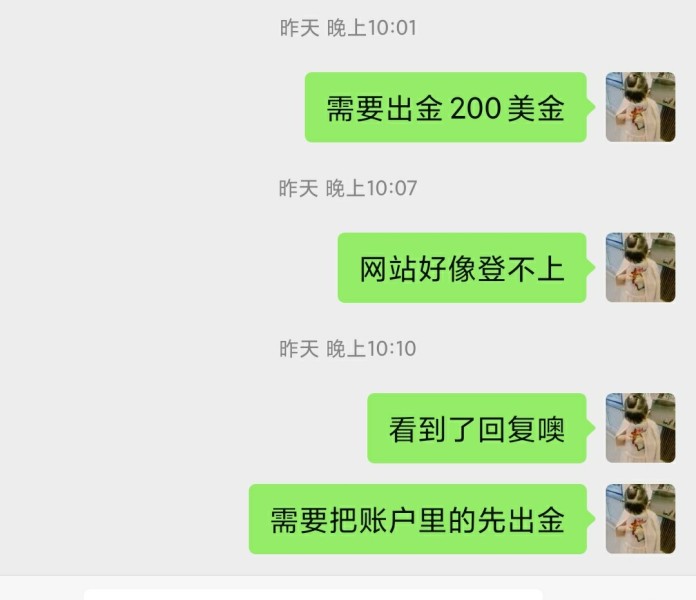

| Market analysis and educational resources provided. | Problems with withdrawals and customer service |

| Multilingual customer service | High minimum deposit requirement |

| Demo account available | |

| Bonuses and promotion offered |

Is GCM legal?

GCM is being described as suspicious and potentially involved in a scam. the text mentions that GCM It claims to be regulated by the Financial Conduct Authority (FCA) in the UK under license number 609970. However, this FCA regulation is claimed to be suspected of being a clone.

Market Instruments

Customers can trade more than 300 products on GCM Asia , including forex, bonds, stocks, indices, precious metals, commodities, etc.

market instruments offered by GCM They include currency pairs, CFDs on precious metals, CFDs on commodities, CFDs on shares, CFDs on indices and Treasury bonds.

Currency pairs:

GCMprovides access to the foreign exchange market, which is known for its high liquidity, with approximately $5 trillion traded daily. Traders can choose from over 50 currency pairs, including popular options such as eur/usd, gbp/usd, aud/usd, and usd/jpy. the advantages of trading currency pairs with GCM they include zero commissions, high leverage, and the ability to trade the forex markets 24 hours a day, five days a week.

CFDs on precious metals:

GCMoffers traders the opportunity to trade precious metals, which are often sought after as safe-haven assets in times of uncertainty and market volatility. Traders can participate in CFDs (contracts for difference) on metals such as gold, silver, platinum, and palladium. the benefits of trading precious metals cfds with GCM they include precise execution with no requotes, zero commissions, and high leverage.

Commodity CFDs:

GCMIt allows traders to diversify their portfolios by trading CFDs on commodities. This includes fixed spreads on commodities such as oil, natural gas, soybeans, corn, and other energy and agriculture related CFDs. traders can speculate on the price movements of these commodities without taking actual ownership. Like other instruments, CFDs on commodities come with zero commissions and high leverage.

CFDs on shares:

for portfolio diversification, GCM offers stock CFDs on a variety of US, Australian and European stocks. Traders can choose from over 200 stocks from popular marketplaces like Facebook, Amazon, Alibaba, and more. With stock CFDs, traders can enjoy zero commissions, high leverage, and accurate execution.

CFD index:

GCMProvides the opportunity to trade indices CFDs, allowing traders to engage in spot indices CFD trading. Traders can choose from more than 20 indices from the US, European and Asian markets. Index CFDs offer zero commissions, high leverage, and fast order execution.

Treasures:

GCMAllows CFD trading on United States Treasury securities issued by the United States Department of the Treasury. Traders can participate in CFDs on 5-, 10-, and 30-year US Treasury securities. the advantages of trading treasury bonds with GCM they include zero commissions, high leverage, and enhanced execution.

Account Types

STANDARD ACCOUNT

The standard account offered by CMAsia is suitable for traders who want to start with a relatively small deposit of $100. This account allows traders to execute trades with a minimum trade size of 0.01 lots. With a maximum leverage of 1:200, traders can expand their trading positions. However, it is important to note that higher leverage also comes with higher risk. The standard account has an average margin of 2.5 pipes, It represents the difference between the buy and sell price of a currency pair.

PREMIUM VIP ACCOUNT

CMAsia provides the Premium VIP account for high-level clients seeking additional benefits and personalized services. VIP clients have the opportunity to participate in professional training courses that can enhance their knowledge and understanding of investment strategies. They also receive access to free forex training materials, allowing them to expand their trading skills. In addition, the Premium VIP account grants exclusive access to expert risk management advice, allowing clients to apply advanced investment techniques and minimize potential risks.

ECN PRO ACCOUNT

The ECN Pro account is designed for high volume traders who require direct access to the interbank market. This type of account offers the advantage of operating with low transaction costs through a commission-based model. By paying a small fee per transaction, merchants can lower their costs and potentially increase their overall profits. ECN Pro account benefits are tied to trading volume, which means that as traders execute more trades, they gain access to additional benefits and features.

DEMO ACCOUNT

CMAsia also offers a Demo account, which serves as a practice platform for traders. This account allows people to get familiar with the trading platform and test various strategies without risking any real money. Traders can simulate real market conditions and assess the effectiveness of their trading strategies without fear of financial loss.

Leverage

leverage in the context of GCM Asia refers to the ability provided to traders to enlarge their trading position size by a specified multiple. GCM Asia offers standard leverage options to its traders, allowing them to increase the size of their trades. the maximum leverage available is 200:1, which means that traders can control a position that is 200 times larger than their trading account balance.

Non-commercial rates

non-commercial fees refer to charges collected by GCM Asia that are not directly associated with commercial activities. an example of such a fee is the inactivity fee. this fee is applicable to accounts that remain inactive for a continuous period of 180 days or more. GCMAsia imposes a monthly fee of $10 or an amount equal to the Inactivity Fee.

Spreads and Commissions

GCMAsia offers spreads starting at 2.5 pipes and it's not impose a minimum deposit requirement for traders. the spreads offered by GCM Asia It can affect trading costs and profitability, so it is crucial for traders to assess the implications of their spread and commission structure.

Business platform

GCMAsia offers two trading platforms: GCMasia pro y metatrader 4.tThese platforms cater to traders who are looking for different features and functionality, giving them options based on their preferences and trading styles. Both platforms are designed to be accessible from a variety of devices, including Apple and Android mobile devices, PCs, and tablets.

GCMasian professional is a trading platform available as an android/ios app, which allows users to trade a wide range of more than 300 products. The mobile app allows traders to access the platform anytime, anywhere, giving them the freedom to manage their trades on the go. GCM Asia pro offers a user-friendly interface, making it easy for traders to navigate through the platform and execute their trades efficiently. Additionally, the platform incorporates a range of features that enhance the trading experience, providing users with tools and resources to make informed trading decisions.

Metatrader 4, on the other hand, it is a widely recognized and popular trading platform in the industry. It is accessible from Android devices, mobile devices, PCs and tablets, allowing traders to choose their preferred device.

Trading tools

GCMasia offers a range of trading tools designed to assist traders in their decision-making process and enhance their overall trading experience. These tools can be classified into various types, each with a specific purpose.

Economic Calendar: The Economic Calendar is a valuable tool that displays important economic announcements and events. It provides traders with information on key economic indicators such as interest rate decisions, GDP releases and employment data. By staying up to date on these events, traders can anticipate market volatility and adjust their trading strategies accordingly.

Currency calculator: The currency calculator allows traders to quickly convert between different currencies. It helps them assess the value of different currency pairs and make informed trading decisions. This tool eliminates the need for manual calculations and provides accurate currency exchange rates in real time.

Interchange Fee Calculator: The Swap Rate Calculator is designed to help traders calculate overnight swap rates for holding positions overnight. This information is crucial for traders who are engaged in long-term trading strategies and need to take into account any costs or benefits associated with holding positions overnight.

Pipe Calculator: Pip Calculator is a simple tool that allows traders to calculate the value of a pip for various currency pairs. It helps traders determine the potential profit or loss on a trade based on pip movement, allowing for better risk management and position sizing.

Margin Calculator: The Margin Calculator is an essential tool for traders as it helps them calculate the margin required to open or hold positions. It helps traders understand the amount of leverage they can use and the potential risk involved in their trades.

Strategy, daily analysis and weekly analysis: GCMAsia also offers various strategies, daily analysis and weekly analysis to provide traders with valuable information and research. These resources help traders identify potential trading opportunities, analyze market trends, and make informed decisions based on fundamental and technical analysis.

Deposit and Withdrawal

- CHINA (Credit/Debit Card, WeChat Pay, Alipay): in China, GCM Asia offers various deposit options to meet the preferences of Chinese merchants. Customers can use credit/debit cards (china union), wechat pay or alipay to fund their business accounts. these options provide a familiar way for Chinese traders to add funds and start trading.

- MALAYSIA (FPX Payment, Online Banking): for customers in malaysia, GCM Asia offers two deposit options: fpx payment and online banking.

- INTERNATIONAL (Credit/Debit Card, BitPay, Neteller, Skrill, Bank Transfer): International customers have a wider range of deposit options. They can choose to deposit funds via credit/debit card (VISA, MASTER, AMEX), BitPay, Neteller, Skrill or bank transfer.

GCMAsia recommends a minimum initial deposit of €/$/£500, depending on the base currency chosen by the merchant. However, it is also possible to start trading with a smaller amount as low as 100€/$/£.

Educational Resources

In addition to webinars, GCM Asia it also offers educational materials in the form of articles and guides. These resources cover a wide range of trading-related topics, including risk management, trading psychology, trading strategies, and market indicators. The articles are written by experts in the field and aim to provide traders with in-depth knowledge and practical advice.

Customer Support

customer service in GCM Asia involves providing assistance and addressing user queries. They offer various channels such as phone, email, facebook and instagram to make it easy to communicate with their support team. the telephone numbers available for English-speaking users are +1 800-81-9796 and +62 212-7899-369. users can also contact customer support via email at cs@ GCM Asia .com. GCM Asia customer support operates 24/5, allowing users to seek help during most trading hours.

Conclusion

in conclusion, GCM (either GCM Asia ) seems to be a broker with several drawbacks and risks. The broker is labeled as suspicious and potentially involved in scams, and its UK Financial Conduct Authority (FCA) regulatory license is suspected to be a clone. complaints and negative reviews further raise concerns about the credibility of the broker. on the positive side, GCM offers a wide range of market instruments, including currency pairs, CFDs on precious metals, CFDs on commodities, CFDs on shares, CFDs on indices and Treasury bonds. it also provides different types of accounts to suit the preferences of traders and offers two trading platforms, GCM pro and metatrader 4.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 24

Content you want to comment

Please enter...

Comment 24

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

loke2455

Malaysia

When I deposited money, they kept calling to remind me, but when I wanted to withdraw money, they pretended to know nothing. No one can be found now.

Exposure

2023-09-04

yichang

Malaysia

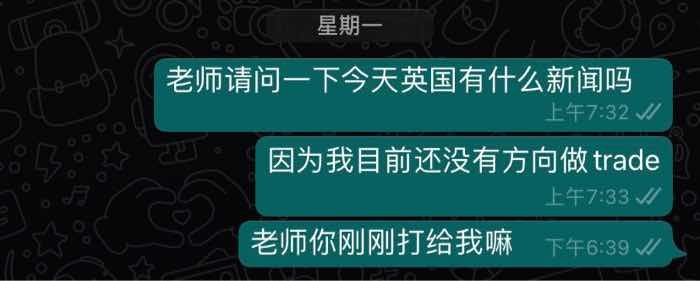

The analyst’s attitude is extremely arrogant, he will ask you to deposit money every day, and then find an analyst on social software when something happens. The analyst ignores it. At the beginning, he called every day to ask you to deposit money. If you don’t have the willingness to deposit money, the analyst will start. Ignoring you, the analyst asked me to lock up the position and invest more.

Exposure

2021-06-17

哄哄37787

Hong Kong

The bank card number was wrong just cuz there were two digitals mistaken. I was told that I should pay 20% of the account balance to modify it

Exposure

2020-12-22

Matt Wu

Hong Kong

After I exposed them, I can’t contact them I hope they can be exposed here And the customer service always push you to deposit funds.

Exposure

2020-12-11

FX2910247995

Hong Kong

Cheat people who have no experience. Let you operate without any instructions and make you forced liquidation. Then shrink the responsibility. Then abet deposits. Their regulator is fake. You can’t withdraw funds.

Exposure

2020-11-27

FX3951950780

Japan

I can't withdraw all my fund.

Exposure

2020-09-17

养乐多zz

Hong Kong

I just wanted to make withdrawal, while the analyst claimed as if the money was his. I was speechless. It is simply a fraud platform!

Exposure

2020-07-21

晴天² ⁰ ² ⁰

Hong Kong

1.I deposited $1000 and another 7468 into private accounts. But there was only $7.05 left in the Huobi net in wake of high exchange rate. 2.Since I was a novia, a so-called analyst told me to buy XAU/USD. The price was plummeting, but he said that it was unnecessary to set the stop-loss, resulting in liquidation on the next day. But the frauds all sent fake profit screenshots. What a phony.

Exposure

2020-06-14

Tan Chin Wei

Malaysia

At first, they told me that as long as I followed the analyst, I would surely make money. Fall disclosure the analyst always delayed to reply to me and asked me to add position. They also didn’t suggest that I close position when making losses. Even my position was liquidated, they continued inducing me to adding position. Stay away.

Exposure

2020-05-23

FX1000130419

Hong Kong

GCM refused my withdrawal with grinding excused.They asked me to use Online bank,Credit card and fill in applications repeatedly.Scam platform.No one will respond to your complaints.I don’t know what to do with this rip-off!

Exposure

2019-11-19

june.jay

Hong Kong

GCM ASIA deliberately made my account liquidated instead of depositing. Later they wanted to compensate me, but I refused. After that they gave me no response. Now it is not a problem of money; it is a matter of financial scam. Currently, I have reported to the police office and related Hong Kong department.

Exposure

2019-09-17

心勇-王氏宗亲文化研究会

Hong Kong

Complaint against GCM Asia(evidence is required) 1.Money is deposited into the platform by exchanging dollars via an individual account, which is the so-called third party account. That harbors great risks! And the exchange rate is higher than the real-time rate. 2.The customer service personnel don’t provide services after I deposited in the platform. When I asked them for explanations, their ill manners drove crazy; As time goes by, I doubt it is an irregular platform. I advise the relevant department to investigate it carefully. 3.Higher spread. For example: the spread of GBP/USD is 3.5, which made it hard to gain profits. 4.The platform attracted the clients with low deposit. And traps were set for you later: service fee for depositing money, high spread, no service, serious slippages, betting with clients. 5.The relation between clients and the platform is like dating relation, with sweetness first and then bitterness.

Exposure

2019-04-29

FX8889792331

Hong Kong

They have no hardware services. All they do is asking clients to deposit. Stay away from this platform. You can’t log in unless you deposit more.

Exposure

2019-01-10

FX8889792331

Hong Kong

I registered a national exchange in GCM a year ago, and my account became liquidated. Now I want to log in to view the historical trade record. At that time, the leverage was 200 times.I asked for my account and login information and customer service arranged an analyst for me. I Just want to log in to the account.Through WeChat call, the analyst said that the platform is regulated by the FCA in August,2018,and now the leverage is 10 times. The previous account was frozen since I didn’t log in for long time.It’s OK.The analyst said that recharging to trade can activate the account.Such a contradiction. Only by recharging the account can I log in?How to do with my previous deposit?Why I can't I log in?The analyst said that how to trade without money? Recharge the account can also continue trading with high leverage.As far as I am concerned,I won’t trade unless the FCA regulate the low leverage.Low leverage can activate the new account,what about high leverage activate the old account?Why I can’t review the record without recharging?Is it a fraud platform?Why only deposit is allowed instead of viewing the record?

Exposure

2019-01-09

FX8889792331

Hong Kong

I can not log in the the account with the password. The system informed me to retrieve the password. But the password recovery operation always fails, and then the customer service personnel does not reply me.

Exposure

2019-01-07

FX9399234369

Hong Kong

I met a trader on GCM. He promised me their exchange rate would be consistent with the bank. After I earned and tried to withdraw, he said the exchange rate is set by the platform instead of bank. He even told me it is ok since I earned money! Don’t get yourself fooled! They service fee for deposit and withdraw is 25% high. Don’t believe them!

Exposure

2018-10-19

FX1969904143

Hong Kong

During the period of August 15-16th this year, my account was forcibly closed due to the abnormality of the platform's deposit channel! Afterwards,I made feedback to the platform by means of telephone, mail, etc. On September 7th, the platform manager called me,saying that the feedback has been verified.My account could be unfrozen but I needed to pay a service charge of $280.The abnormality of the deposit channel is the fault of the platform. The platform should restore my order unconditionally. After many negotiations, there is no result. The channel abnormal is intentional. Please stay away! The platform is a scam platform. Hope WikiFx help me.

Exposure

2018-09-25

FX1969904143

Hong Kong

My position was liquidated due to GCM’s deposit problem. I received a margin call at that night, August 15th, 2018. I was trying to deposit from 21:00 to 03:00 the next day but failed every time. Their manager was missing. I saw my position liquidated! Back then no matter how I try, their system told me deposit failure. I tried to contact their manager, but he didn’t answer me. I heard from a resigned worker of GCM that this is GCM. I found many people scammed on the Internet. Don’t get yourself scammed!

Exposure

2018-08-23

FX3019221352

Hong Kong

Fraud platform,in which the withdrawal rate is inconsistent with the day.The exchange rate was 6.6,while they gave the withdrawal by 6.5.I suggest you avoiding trading in this broker.

Exposure

2018-07-24

大鲨鱼

Hong Kong

I lost $7000! Now I can’t recover the loss.

Exposure

2018-06-29