Score

GTTC TRADE

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.gt-tc.trade/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed GTTC TRADE also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

gt-tc.trade

Server Location

Luxembourg

Website Domain Name

gt-tc.trade

Server IP

212.117.189.4

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Registered in | St. Vincent and the Grenadines |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Forex, Crypto, Metals, European Stocks, USA Stocks Feedstock, Commodities, Futures Indices, Indices |

| Minimum Initial Deposit | $1,000 |

| Maximum Leverage | 1:400 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4 and webtrader |

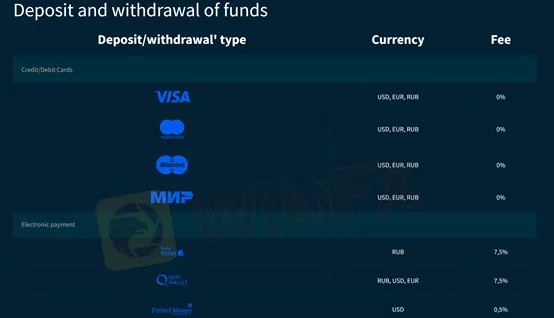

| Deposit and withdrawal method | credit/debit cards, electronic payment and cryptocurrencies |

| Customer Service | Email/phone number/address |

| Fraud Complaints Exposure | No for now |

General information and regulations of GTTC TRADE

GTTC TRADE was founded several years ago in St. Vincent and the Grenadines, and currently it does not have any regulations.

The company doesn't provide services to the citizens and the residents of the United States, Canada, Israel, New Zealand, Australia, North Korea, Puerto Rico, Bangladesh, Yemen, Singapore, Sudan, Iran, Japan.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on.

At the end of the article, we will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Market instruments

Forex, Crypto, Metals, European Stocks, USA Stocks Feedstock, Commodities, Futures Indices, Indices .....GTTC TRADE allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on GTTC TRADE.

Spreads and commissions for trading with GTTC TRADE

There are two types of spread in GTTC TRADE: fixed spread for platinum and exclusive account; floating spread from 0.01 pips for the other 3 types of accounts.

The commission of different accounts varies from 0 USD to 25 USD per lot.

Account Types for GTTC TRADE

Demo Account: GTTC TRADE provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: GTTC TRADE offers a total of 5 account types: bronze, silver, gold, platinum and exclusive. the minimum deposit to open an account is $1,000, $5,000, $10,000, $25,000 and $100,000 respectively. If you are still a beginner and don't want to invest too much money in Forex trading, a bronze account will be the most suitable option for you. However, we should also realize that too little capital not only reduces losses, but also reduces profitability. Therefore, you may find it “unexciting” or unprofitable. In addition, accounts with smaller initial deposits tend to have poorer trading conditions.

Trading platforms offered by GTTC TRADE

Although a long time has passed since the launch of MT4, it is still a major player in the market and is loved by traders all over the world. Accessing it from different devices also makes it easier for users to trade. This company also provides webtrader that permits trading without installing a software.

Leverage offered by GTTC TRADE

GTTC TRADE offers a maximum leverage of up to 1:400, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Deposit and withdrawal methods and fees

GTTC TRADE offers a series of deposit and withdrawal methods such as credit/debit cards, electronic payment and cryptocurrencies. In the correspondent page are the methods, currency and possible fees.

Educational resources

A series of educational resources is available at GTTC TRADE, such as glossary, technical analysis, fundamental analysis, trading psychology, graphical analysis and trading strategies.

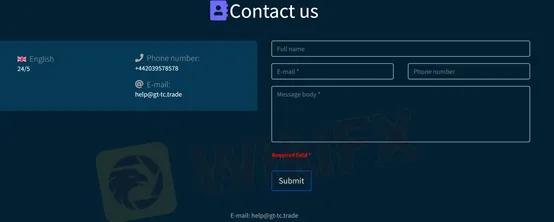

Customer support of GTTC TRADE

Below are the details about the customer service.

Language(s): English, German, Russian, Arabic

Service Hours: 24/5

Email: help@gt-tc.trade

Phone Number: +442039578578

Address: Suite 305, Griffith Corporate Centre Р.О. Box 1510, Beachmont, Kingstown, St. Vincent and the Grenadines

Users exposures on WikiFX

We have not received any reports of fraudulent activity at this time.

Advantages and disadvantages of GTTC TRADE

Advantages:

High leverage

MT4

Sufficient information

Educational resources

Many instruments available

Demo account

Disadvantages:

No effective regulation

No MT5

Frequent asked questions about GTTC TRADE

Is this broker well regulated?

No, it is currently not effectively regulated and you are advised to be aware of its potential risks.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 2

Content you want to comment

Please enter...

Comment 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now