Note: UFXs official site - https://www.ufxpartners.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

UFX is a brokerage operational since 2010. Reliantco Investments, the owner of UFX, is a Cyprus Investment Firm authorized and regulated by the Cyprus Securities Exchange Commission (CySEC), under license number 127/10, since December 22nd 2010. It operates under the Financial Instruments Directive 2014/65/EU or MiFID II and the EUs 4th Anti-Money Laundering Directive. The company offers a wide range of trading services in multiple financial markets, including forex currency pairs, commodities, stocks, stock indices, and exchange-traded funds (ETFs). Traders can choose from different account types based on their experience and preferences, and access various trading platforms such as MetaTrader 5 (MT5) and UFX WebTrader, as well as mobile trading apps. While UFX provides regulatory oversight and a user-friendly trading experience, traders should consider factors such as higher spreads, limited educational resources, and the importance of conducting thorough research before engaging in trading activities. UFX has several advantages for traders, including its regulated status under CySEC, a diverse range of market instruments, multiple account types, and convenient trading platforms. However, there are a few drawbacks to consider, such as higher spreads compared to some other brokers and limited educational resources. Traders should carefully weigh these pros and cons to determine if UFX aligns with their trading goals.

UFX is a regulated and legitimate broker under the supervision of CySEC. It is owned by Reliantco Investments Ltd, which holds the license number 127/10. The broker provides access to various market instruments, including forex currency pairs, commodities, stocks, stock indices, and ETFs, offering traders a range of opportunities to participate in global financial markets. Traders should be aware of the risks involved and exercise caution while trading.

In conclusion, UFX presents a range of opportunities for traders looking to access global financial markets. However, traders should carefully evaluate the pros and cons, consider the higher spreads and limited educational resources, and conduct thorough research before deciding to trade with.

Pros and Cons

UFX has its advantages and disadvantages for traders. On the positive side, UFX is a regulated broker under the Cyprus Securities and Exchange Commission (CySEC), providing a sense of security and oversight. They offer a diverse range of market instruments, including forex currency pairs, commodities, stocks, stock indices, and ETFs, allowing traders to access various financial markets. UFX also provides multiple account types to cater to different trader preferences and experience levels. Their trading platforms, including MetaTrader 5 (MT5) and UFX WebTrader, offer convenience and accessibility. Additionally, UFX offers leverage options for traders to amplify their trading positions. However, there are a few drawbacks to consider. UFX's spreads are generally considered higher compared to some other top brokers, which may increase trading costs. The educational resources provided by UFX are limited, lacking comprehensive materials and courses to enhance traders' knowledge and skills. It's essential to carefully weigh these pros and cons to make an informed decision when considering UFX as a trading broker.

Is UFX Legit?

Yes, UFX is regulated by the Cyprus Securities and Exchange Commission (CySEC). It is owned by Reliantco Investments Ltd, which holds the license number 127/10. The regulatory status of UFX indicates that it operates under the oversight of the CySEC and is subject to regulatory requirements and guidelines. The contact information provided for the licensed institution (Reliantco Investments Ltd) includes an email address, phone number, and address in Limassol, Cyprus.

Market Instruments

UFX offers a range of market instruments for trading. Here is a description of the market instruments available on UFX:

1. Forex Currency Pairs: UFX allows trading in a wide variety of currency pairs, including major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs. Forex trading involves buying one currency while selling another, with the aim of profiting from fluctuations in exchange rates.

2. Commodities: UFX provides access to trading in various commodities. Commodities are raw materials or primary agricultural products that can be traded, such as gold, silver, crude oil, natural gas, wheat, corn, and coffee. Trading commodities allows investors to speculate on price movements and potentially profit from changes in supply and demand dynamics.

3. Stocks: UFX allows trading in stocks of various companies listed on global stock exchanges. By trading stocks, investors can take positions on the price movements of individual company shares, potentially benefiting from changes in company performance, market sentiment, and other factors affecting stock prices.

4. Stock Indices: UFX offers trading in stock indices, which are measures of the performance of a group of stocks representing a particular market or sector. Examples of stock indices include the S&P 500, Dow Jones Industrial Average, FTSE 100, and DAX. Trading stock indices allows investors to gain exposure to broad market trends and make predictions about the overall direction of a particular market or sector.

5. Exchange-Traded Funds (ETFs): UFX provides access to trading exchange-traded funds (ETFs). ETFs are investment funds that are traded on stock exchanges, representing a basket of assets such as stocks, bonds, or commodities. Trading ETFs allows investors to diversify their portfolios and gain exposure to various asset classes or sectors.

These market instruments offer traders a diverse range of opportunities to participate in different financial markets and potentially profit from price movements. It's important to note that trading in these instruments involves risks, and investors should carefully consider their investment goals, risk tolerance, and seek professional advice if needed.

Pros and Cons

Account Types

UFX offers six distinct account types to cater to the varying needs and preferences of traders. Here is an overview of the different account types available:

1. Micro Account:

The Micro Account is designed for beginners or traders who prefer to start with smaller investments. It requires a minimum deposit of $100 and offers fixed spreads, daily market reviews, 24/5 customer support, and access to the UFX trading platform.

2. Mini Account:

The Mini Account is suitable for traders looking for more advanced features. It requires a minimum deposit of $500 and provides fixed spreads, daily market reviews, 24/5 customer support, access to the UFX trading platform, and access to Trading Central research.

3. Standard Account:

The Standard Account is ideal for experienced traders who want competitive trading conditions. It requires a minimum deposit of $1,000 and offers floating spreads, daily market reviews, 24/5 customer support, access to the UFX trading platform, and access to Trading Central research.

4. Gold Account:

The Gold Account is designed for traders who want additional features and benefits. It requires a minimum deposit of $5,000 and provides floating spreads, daily market reviews, 24/5 customer support, access to the UFX trading platform, access to Trading Central research, VIP trading support, exclusive updates, and special promotions.

5. Platinum Account:

The Platinum Account is tailored for high-volume traders and professionals. It requires a minimum deposit of $10,000 and offers floating spreads, daily market reviews, 24/5 customer support, access to the UFX trading platform, access to Trading Central research, VIP trading support, exclusive updates, special promotions, and personalized trading support.

6. Islamic Account:

UFX also offers an Islamic Account that complies with Islamic Sharia law, providing interest-free trading for Muslim traders. The Islamic Account follows the principles of Islamic finance and offers the same features as the Mini, Standard, Gold, and Platinum accounts.

How to Open an Account?

To open an account with UFX, you can follow these steps:

1. Visit the UFX website: Go to the UFX website using a web browser.

2. Locate the account opening section: Look for the “Open Account” or similar button/link on the website. It is usually prominently displayed on the homepage or in the main navigation menu.

3. Fill out the online application: Click on the “Open Account” button/link, and you will be directed to an online application form. Fill in the required information accurately and completely. This information typically includes your name, email address, phone number, and country of residence.

4. Submit identification documents: As a regulated brokerage, UFX adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. After completing the online application, you will need to provide verification documents. This usually includes a copy of your identification document (such as a passport or driver's license) and one proof of residency document (such as a utility bill or bank statement). Follow the instructions provided by UFX to submit these documents securely.

5. Wait for verification: Once you have submitted your application and the required documents, UFX will review and verify your information. This process may take some time, typically a few business days.

6. Account activation: After successful verification, your account will be activated. You will receive an email notification with your account details, including login credentials.

7. Fund your account: To start trading, you need to deposit funds into your UFX account. Follow the instructions provided by UFX to fund your account using the available payment methods.

8. Start trading: Once your account is funded, you can log in to the UFX platform using your credentials. Explore the trading platform, access the available markets and instruments, and execute trades according to your trading strategy.

It's important to note that the account opening process may vary slightly depending on the specific requirements and procedures of UFX at the time of application. It's always recommended to carefully follow the instructions provided by UFX and reach out to their customer support if you have any questions or need assistance during the account opening process.

Leverage

UFX, as a Cyprus-regulated broker, offers different trading leverage for retail and professional traders. For retail traders, the maximum leverage for forex instruments is capped at 1:30. While for professionals, the maximum leverage for major forex trading is up to 1: 400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

The exact spreads offered by UFX may vary depending on the account type, market conditions, and the specific instrument being traded. The spreads are typically displayed in pips, which is the smallest unit of measurement in the forex market. The UFX Mini Account offers the spread of 5 pips on USDJPY, 10 pips on AUDCAD, 210 pips on Gold, 750 pips on Silver, 550 pips on German DAX30, and 142 pips on Alibaba share.

For the Standard Account, the spread is 4 pips for USDJPY, 9 pips for AUDCAD, 195 pips for Gold, 700 pips for Silver, 500 pips for DAX30, and 138 pips for Alibaba. The USDJPY spread is 3 pips, the AUDJPY spread at 7 pips, the Gold spread at 165 pips, the Silver spread at 600 pips, the German DAX30 spread is 300 pips, and the Alibaba stock spread is 134 pips. For the platinum account, the spread is 3 pips for USDJPY, 7 pips for AUDCAD, 150 pips for Gold, 550 pips for Silver, 300 pips for German DAX30, and 130 pips for Alibaba stock.

Trading Platform

UFX offers several trading platforms to cater to the diverse needs of its traders. Here is a brief description of the trading platforms provided by UFX:

1. MetaTrader 5 (MT5): MT5 is a widely recognized and popular trading platform in the industry. It offers a range of advanced features and tools for traders, including multiple charting options, technical indicators, expert advisors (EAs), and the ability to execute trades across various financial markets.

2. UFX WebTrader: UFX WebTrader is a web-based trading platform that allows traders to access their accounts and trade directly from their web browsers. It offers a user-friendly interface, real-time market quotes, interactive charts, and a variety of order types to facilitate trading activities.

3. Mobile Trading Apps: UFX provides mobile trading apps for both iOS and Android devices, allowing traders to access their accounts and trade on the go. The mobile apps offer similar features to the web-based platform, including real-time market data, charting tools, and the ability to execute trades conveniently from mobile devices.

These trading platforms aim to provide traders with a seamless trading experience and access to various financial instruments, such as currencies, commodities, stocks, and indices. Each platform has its own set of features and functionalities, allowing traders to choose the one that best suits their preferences and trading style.

Deposit & Withdrawal

UFX provides traders with a variety of options for both deposits and withdrawals. Traders can choose from various payment methods, including bank wires, credit/debit cards, e-wallets such as Skrill and Neteller, and other online payment processors like SOFORT, ELV, giropay, iDEAL, Neosurf, China UnionPay, CashU, Qiwi, WebMoney, POLi, and paysafecard. This range of options allows traders to select the most convenient and preferred method for their transactions.

When it comes to deposits, UFX accepts funds in multiple currencies, including USD, EUR, GBP, AUD, and more. It's important to note that UFX follows strict Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, requiring traders to provide identification documents and proof of residency.

For withdrawals, traders can request to withdraw their funds through the same methods used for deposits. The withdrawal process usually involves submitting a withdrawal request through the UFX platform, which is then reviewed and processed by the broker. Processing times for withdrawals may vary depending on the chosen payment method and the broker's internal procedures. Traders should also be aware that UFX may require additional verification steps for security purposes before approving a withdrawal.

Traders have access to UFX customer support on 24/5. The UFX customer support can only be reached via telephone: +357 25030314.

Educational Resources

UFX offers research and educational resources to its traders, although the offerings are somewhat limited. The research is provided in partnership with Trading Central, a renowned independent third-party research provider. However, access to this research is only available to traders who have made a minimum deposit of $1,000 or more. The Daily Market Review provides daily trading recommendations based on the research conducted by Trading Central. Additionally, UFX provides an economic calendar to keep traders informed about important market events.

On the other hand, UFX falls short when it comes to educational resources. The broker does not offer comprehensive educational materials or courses to help traders enhance their knowledge and skills. This lack of educational support is seen as a significant oversight, especially for a broker targeting the retail sector.

It's worth noting that UFX does provide limited free research on a daily basis, but it seems to be more focused on marketing needs rather than providing in-depth educational content.

Customer Support

UFX provides customer support to traders on a 24/5 basis. Traders can contact the UFX customer support team through various channels, including telephone, email, and live chat. The telephone number for customer support is +357 25030314. The support team is available during regular market hours, Monday to Friday.

The UFX European customer support center is regulated by the German Financial Supervisory Authority (BaFin) under license number 80164620. This regulatory oversight ensures that the customer support operations meet certain standards and guidelines.

To reach customer support, traders have the option to use a webform on the UFX website, call the provided telephone number, or utilize the live chat feature. These channels allow traders to seek assistance, ask questions, and address any concerns they may have regarding their trading experience with UFX.

Conclusion:

In conclusion, UFX provides traders with a diverse range of market instruments, regulated services, and various account types to suit different trading needs. The availability of popular trading platforms and mobile apps enhances convenience and accessibility. However, it is important to consider the higher spreads compared to some other brokers and the limited educational resources provided. Traders should carefully assess their individual requirements and preferences, weighing the advantages and disadvantages, to make an informed decision about whether UFX aligns with their trading goals.

FAQs

Q: Is UFX a regulated broker?

A: Yes, UFX is regulated by the Cyprus Securities and Exchange Commission (CySEC). It operates under the oversight of the CySEC and follows regulatory requirements and guidelines.

Q: What market instruments can I trade on UFX?

A: UFX offers a variety of market instruments, including forex currency pairs, commodities, stocks, stock indices, and exchange-traded funds (ETFs).

Q: What are the different account types offered by UFX?

A: UFX provides six different account types: Micro Account, Mini Account, Standard Account, Gold Account, Platinum Account, and Islamic Account.

Q: How can I open an account with UFX?

A: To open an account with UFX, visit their website, locate the account opening section, fill out the online application with accurate information, submit identification documents for verification, wait for verification, activate your account, fund it, and start trading.

Q: Does UFX offer leverage?

A: Yes, UFX offers leverage to traders, with a maximum leverage of up to 1:400. Leverage allows traders to amplify their trading positions, but it also increases risk.

Q: What are the spreads and fees on UFX?

A: The spreads on UFX vary depending on the account type, market conditions, and the specific instrument being traded. The spreads are generally considered higher compared to some other brokers in the industry. UFX also applies fees, such as an inactivity fee and a hedging fee.

Q: How can I deposit and withdraw funds from my UFX account?

A: UFX provides various options for deposits and withdrawals, including bank wires, credit/debit cards, e-wallets, and other online payment processors. Traders can choose the most convenient method for their transactions.

Q: What trading platforms does UFX offer?

A: UFX offers MetaTrader 5 (MT5), UFX WebTrader (a web-based platform), and mobile trading apps for iOS and Android devices.

Q: Does UFX provide educational resources?

A: UFX offers limited research and educational resources. Daily Market Reviews based on research from Trading Central are available for traders who have made a minimum deposit of $1,000 or more. However, comprehensive educational materials or courses are not provided.

Q: How can I contact UFX customer support?

A: UFX provides customer support through telephone, email, and live chat. The customer support team is available 24/5 during regular market hours.

FX9220879122

Nigeria

On 15.JUL.2015 I was trading EUR/ CAD pair at UFX and I made 7571.36 USD profits. The same day I get email from their employee (VikyG@ufx.com), they deleted my profit (7571.36 USD), in connection to section 9.6 terms and conditions. So they claim there was "NO QOUTE" on the market in the time of my trading. NO QUOTE means I couldnt open deal, but I did, so they are wrong!!"

Exposure

2021-09-07

FX1694550972

Philippines

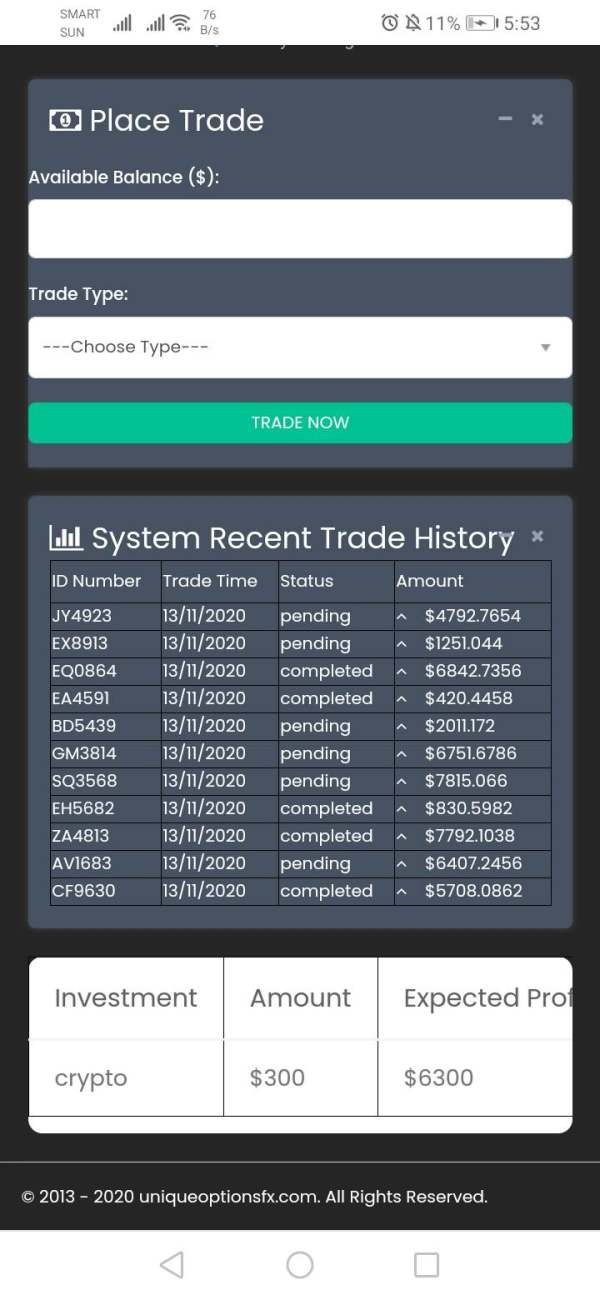

unable to withdraw about this site. ive deposited $300

Exposure

2020-11-14

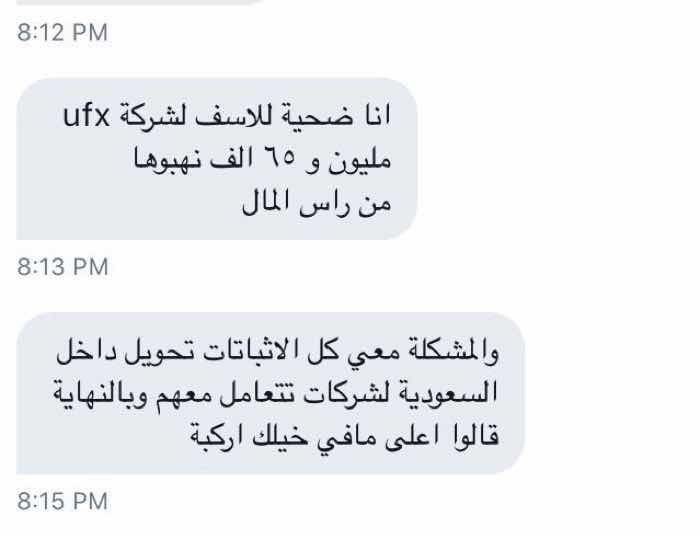

胡丹

Saudi Arabia

الشركة تنهب ٦٥ ألف من رأس المال و ترفض ردهم رغم وجود كل الأوراق التى تثبت ذلك

Exposure

2019-11-18

FX1280925788

India

Suddenly, I cannot open its official website?! What the hell? I just registered an account for two days! While my account manager comforted me that the official website was temporarily down…

Neutral

2023-02-23

FX1047636992

Mexico

My aunt told me that this broker is excellent, but after reading it, I thought that the trading conditions were mediocre. I wondered if he was brainwashed, but when I checked again today, his website couldn't be opened! Did he run off with the money?

Neutral

2022-11-25