Overview of Nations Trading

Nations Trading, based in China, has been operating in the financial markets for 2-5 years. Although unregulated, the company provides a platform for trading various instruments including Indices, Forex, and Commodities.

Clients have the option to choose from different account types, namely the MT4 Standard account, MT4 RAW account, and TN Trader account. Notably, there is no minimum deposit requirement, allowing traders with varying capital levels to participate.

With a maximum leverage of 500:1 and spreads starting from 0.0, Nations Trading offers competitive conditions for its clients. The trading platforms available include MetaTrader 4 (MT4) and TN Trader, providing users with flexibility and familiarity in their trading experience.

For those looking to explore the platform before committing funds, Nations Trading offers a demo account. Additionally, customer support is accessible through email, phone, and live chat for assistance with any queries or concerns.

Deposits and withdrawals can be made using various methods such as VISA, Mastercard, Bitcoin, FPX, Grab Pay, and Ngan Luong Wallet, ensuring convenience and accessibility for clients worldwide.

To support traders in their journey, Nations Trading provides educational resources including Insights Hub, Types of Trading, Analysis, and Trading Times, empowering clients with knowledge to make informed trading decisions.

Regulatory Status

Nations Trading operates as an unregulated trading platform. Unregulated exchanges typically do not provide the same level of investor protection measures as regulated exchanges. This means that users' funds may not be safeguarded in the event of theft, fraud, or the exchange going bankrupt.

Pros and Cons

Pros:

No Minimum Deposit Requirement: Nations Trading's lack of a minimum deposit requirement allows traders to start trading with any capital amount they choose, making it accessible to a wide range of investors.

High Maximum Leverage: The high leverage offered by Nations Trading can amplify potential profits for traders, allowing them to control larger positions with a smaller amount of capital.

Competitive Spreads: With competitive spreads starting from 0.0, Nations Trading offers favourable trading conditions that can potentially reduce trading costs for its clients.

Variety of Trading Instruments: Nations Trading provides a range of trading instruments including Indices, Forex, and Commodities, offering traders numerous opportunities to diversify their portfolios and explore different markets.

Multiple Deposit and Withdrawal Options: The availability of various deposit and withdrawal methods such as VISA, Mastercard, Bitcoin, FPX, Grab Pay, and Ngan Luong Wallet provides flexibility and convenience for clients in managing their funds.

Cons:

Unregulated Operation: Operating in an unregulated environment may expose traders to higher risks such as potential fraud or lack of investor protection measures.

Limited Regulatory Oversight: The lack of regulatory oversight means that Nations Trading may not adhere to the same standards and regulations as regulated brokers, potentially exposing clients to increased risk.

Lack of Trust: The absence of regulation may lead to a lack of trust among potential clients who may prefer to trade with regulated brokers for greater security and transparency.

Limited Customer Support Channels: Nations Trading offers limited customer support channels, which may result in delays or difficulties in resolving issues or inquiries for clients.

Potential Security Concerns: Trading with an unregulated broker like Nations Trading may pose security concerns for clients, as there may be less recourse in the event of disputes or financial losses compared to trading with regulated brokers.

Market Instruments

Nations Trading offers a range of market instruments, including Indices, Forex, and Commodities, providing traders with ample opportunities to engage in various trading strategies and diversify their investment portfolios.

Indices: Indices represent a basket of stocks that are grouped together to track the overall performance of a specific sector, market, or economy. Traders can speculate on the movement of indices such as the S&P 500, NASDAQ, or Dow Jones Industrial Average, allowing them to capitalize on broader market trends and sentiments.

Forex (Foreign Exchange): Forex trading involves the buying and selling of currency pairs, where traders aim to profit from fluctuations in exchange rates. National Trading offers access to a wide range of major, minor, and exotic currency pairs, enabling traders to participate in the world's largest financial market with high liquidity and trading volume.

Commodities: Commodities are physical goods or raw materials that are traded on global markets. Nations Trading allows traders to trade various commodities such as gold, silver, crude oil, and agricultural products. Commodities serve as essential components of the global economy, and trading them provides opportunities to hedge against inflation, diversify investment portfolios, and capitalize on supply and demand dynamics.

Account Types

Nations Trading offers three distinct account types tailored to accommodate varying trading preferences and requirements.

The MT4 Standard Account presents commission-free trading, eliminating additional charges for executing trades. This account type is especially appealing for traders seeking straightforward transactions without commission fees. Moreover, there is no minimum deposit requirement, enabling traders to start trading with any capital amount they choose.

In contrast, the MT4 RAW Account maintains a similar commission-free trading structure but necessitates a minimum deposit of $1,000. However, traders benefit from tighter spreads, starting from 0.0, which can potentially enhance trading profitability. Additionally, both account types offer leverage up to 500:1, amplifying trading opportunities for clients.

Alternatively, the TN Trader Account distinguishes itself with a unique feature—no commissions. Traders utilizing this account type can execute trades without incurring any additional commission fees. Furthermore, this account offers low fixed spreads on non-FX products, ensuring competitive pricing for traders across various markets.

How to Open an Account?

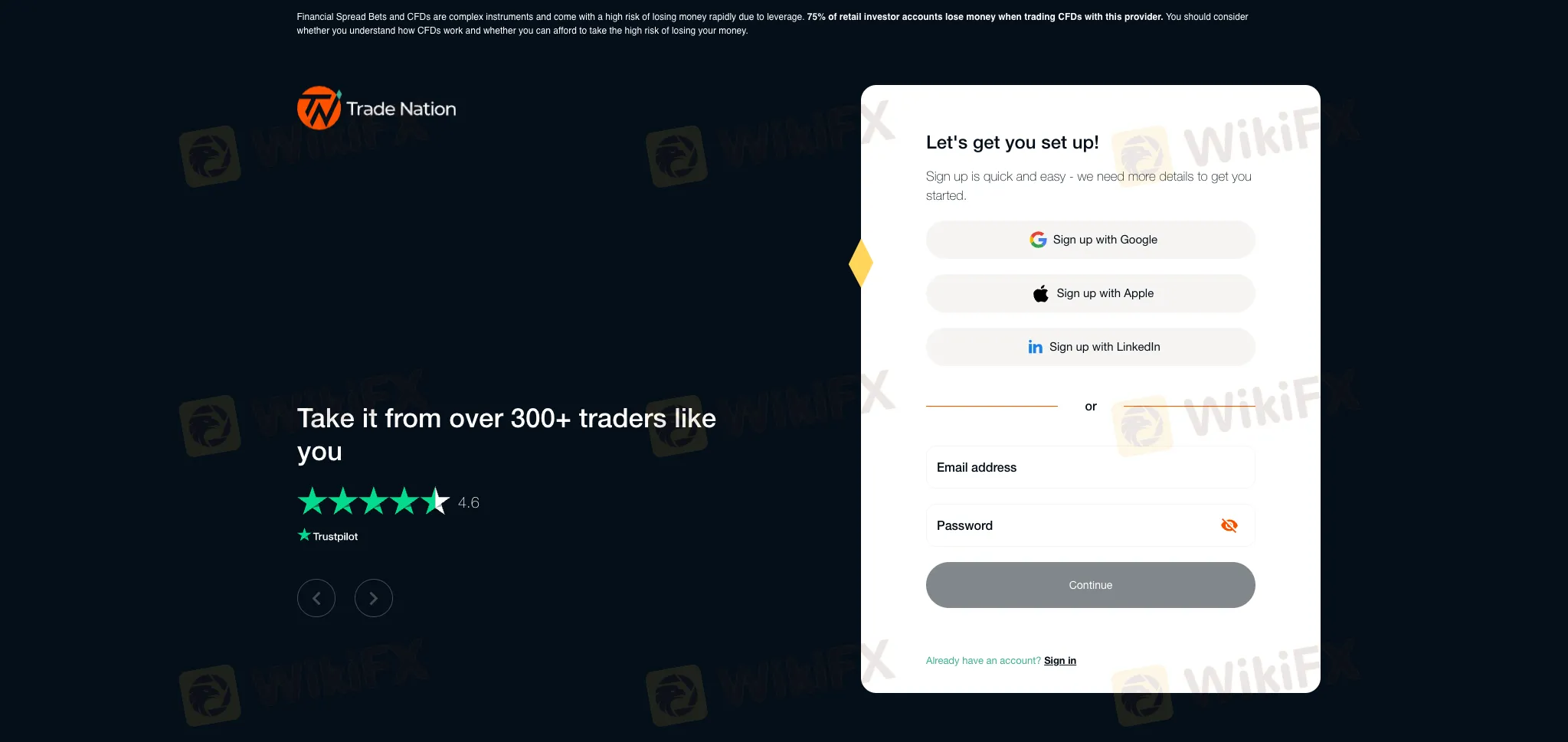

Opening an account with Nations Trading is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the Nations Trading website and click “Trade Now.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: Nations Trading offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the Nations Trading trading platform and start making trades.

Leverage

While Nations Trading offers the advantage of high leverage, allowing traders to control larger positions with a smaller amount of capital, it's crucial to understand the associated risks. Leverage amplifies both potential profits and losses, meaning that while traders can potentially increase their returns, they also face heightened exposure to market volatility.

At a leverage ratio of up to 500:1, even small price movements can result in significant gains or losses. Traders may find themselves in a precarious position where a slight adverse movement in the market can lead to substantial losses exceeding their initial investment.

Trading Platform

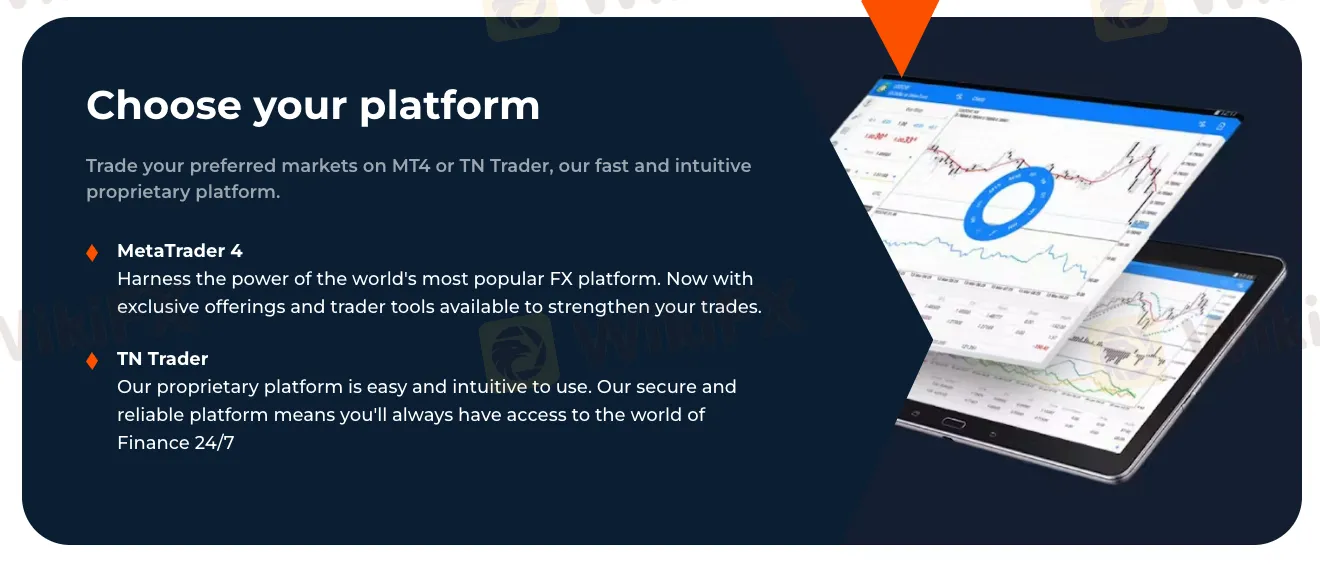

Nations Trading provides clients with access to two robust trading platforms designed to elevate their trading experience: MetaTrader 4 (MT4) and TN Trader.

MetaTrader 4 (MT4): MetaTrader 4 is a renowned trading platform known for its user-friendly interface and advanced analytical capabilities. With MT4, clients can execute trades swiftly and efficiently while accessing a wealth of real-time market data and analysis tools. The platform's customizable interface allows traders to tailor their trading environment to suit their preferences, while the support for automated trading strategies through Expert Advisors (EAs) enables algorithmic trading for enhanced efficiency and precision.

TN Trader: TN Trader is Nations Trading's proprietary trading platform designed to offer traders an intuitive trading experience. With TN Trader, clients can access a comprehensive suite of features and tools tailored to facilitate informed decision-making and efficient trade execution. The platform boasts an intuitive user interface, advanced charting capabilities, and integrated news feeds and economic calendars to keep traders informed about market events and developments.

Deposit & Withdrawal

Nations Trading offers a variety of convenient deposit and withdrawal methods to facilitate transactions for its clients.

VISA and Mastercard: Clients can easily deposit and withdraw funds using their VISA or Mastercard debit or credit cards. This widely accepted payment method provides a quick and secure way to transfer funds to and from trading accounts.

Bitcoin: Nations Trading accepts Bitcoin as a deposit and withdrawal method for clients who prefer cryptocurrency transactions. This decentralized digital currency offers enhanced privacy and security, making it a popular choice among traders.

FPX (Financial Process Exchange): FPX allows clients to make online payments directly from their bank accounts, providing a convenient and efficient way to deposit funds into their trading accounts. With FPX, clients can enjoy instant transactions and fund transfers.

Grab Pay: Nations Trading accepts Grab Pay, a mobile wallet offered by Grab, a leading ride-hailing and financial services platform in Southeast Asia. Clients can use Grab Pay to deposit funds into their trading accounts securely and conveniently.

Ngan Luong Wallet: Ngan Luong Wallet is a digital wallet service that enables clients to make online payments and money transfers. Nations Trading supports Ngan Luong Wallet as a deposit and withdrawal method, offering clients in Vietnam a convenient and reliable payment solution.

Customer Support

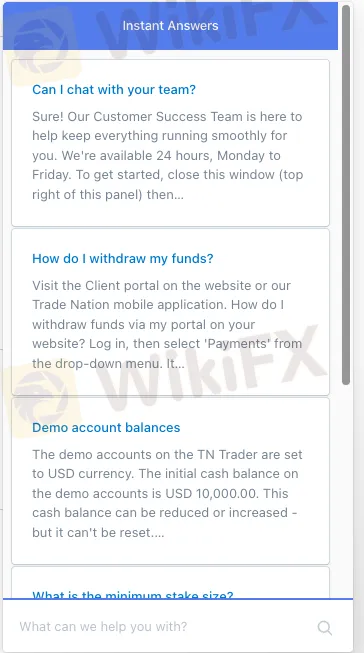

Nations Trading prioritizes customer satisfaction by offering responsive and accessible support channels to assist clients with their inquiries and concerns.

Email Support (support.sc@tradenation.com): Clients can reach out to Nations Trading's support team via email at support.sc@tradenation.com. This allows clients to communicate their queries or issues in writing, providing a convenient and efficient way to seek assistance.

Phone Support (+248 4671996): Nations Trading provides a dedicated phone support line at +248 4671996, enabling clients to speak directly with a customer support representative. This real-time communication channel allows for immediate assistance and resolution of urgent matters.

Live Chat: Nations Trading offers live chat support on its website, allowing clients to engage in instant messaging with a customer support agent. Live chat provides a convenient way to receive real-time assistance, ask questions, and resolve issues efficiently without the need for phone calls or emails.

Educational Resources

Nations Trading offers a range of educational resources designed to empower traders with knowledge and insights to enhance their trading experience.

Insights Hub: The Insights Hub provides traders with valuable market analysis, news updates, and expert commentary to help them stay informed about market trends and developments. By accessing the Insights Hub, traders can gain valuable insights into potential trading opportunities and make more informed decisions.

Types of Trading: Nations Trading offers educational materials on various trading strategies and techniques for traders of all skill levels. Whether traders are interested in day trading, swing trading, or long-term investing, Nations Trading provides resources to help them understand the different types of trading and choose the approach that best suits their goals and risk tolerance.

Analysis: Nations Trading offers educational resources on technical and fundamental analysis, two essential tools for evaluating market trends and making informed trading decisions. Traders can learn how to analyze price charts, identify key support and resistance levels, and interpret economic indicators to anticipate market movements.

Trading Times: Understanding the optimal times to trade can significantly impact trading performance. Nations Trading provides educational materials on trading times, including sessions overlap, market hours, and volatility patterns. By learning about trading times, traders can optimize their trading schedules and capitalize on the most active and liquid periods in the market.

Conclusion

Nations Trading offers enticing perks like no minimum deposit, high leverage, competitive spreads, trading options, and flexible deposit methods.

However, its unregulated status attracts worries about oversight, trust, and security. Limited customer support adds to these worries. Traders should weigh the benefits against risks, stay cautious, and manage risks wisely when considering Nations Trading.

FAQs

Q: Does Nations Trading require a minimum deposit to start trading?

A: No, Nations Trading does not have a minimum deposit requirement, allowing traders to start trading with any amount they choose.

Q: What is the maximum leverage offered by Nations Trading?

A: Nations Trading offers a maximum leverage of up to 500:1, allowing traders to control larger positions with a smaller amount of capital.

Q: What are the available trading instruments on Nations Trading?

A: Nations Trading provides access to a variety of trading instruments, including Indices, Forex, and Commodities, offering traders numerous opportunities to diversify their portfolios.

Q: How can I deposit and withdraw funds on Nations Trading?

A: Nations Trading supports multiple deposit and withdrawal options, including VISA, Mastercard, Bitcoin, FPX, Grab Pay, and Ngan Luong Wallet, providing flexibility and convenience for clients.

Q: Does Nations Trading offer demo accounts for practice?

A: Yes, Nations Trading provides demo accounts for traders to practice their trading strategies and familiarize themselves with the platform before committing real funds.

Q: What customer support channels are available on Nations Trading?

A: Nations Trading offers customer support through email, phone, and live chat, although there may be limitations in the availability of support channels.