Score

Biz Trade Pro

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://biztradepro.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomAccount Information

Users who viewed Biz Trade Pro also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

biztradepro.com

Server Location

United States

Website Domain Name

biztradepro.com

Server IP

148.163.122.51

Company Summary

| Aspect | Information |

| Company Name | Biz Trade Pro |

| Registered Country/Area | United Kingdom |

| Founded year | 2021 |

| Regulation | Lack of regulatory information |

| Maximum Leverage | Up to 1:500 |

| Spreads | Variable, starting from 1.0 pips |

| Trading Platforms | MetaTrader 5 |

| Tradable assets | Forex pairs, commodities, indices, cryptocurrencies |

| Account Types | Standard, VIP |

| Customer Support | Limited |

| Deposit & Withdrawal | Multiple payment methods |

Overview of Biz Trade Pro

Biz Trade Pro, a trading platform established in 2021 and headquartered in the United Kingdom, operates in the financial markets without specific regulatory information publicly available. Offering a maximum leverage of up to 1:500, the platform boasts a variable spread structure, initiating from 1.0 pips. Utilizing the MetaTrader 5 platform, Biz Trade Pro allows users to trade a diverse range of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies. The platform caters to different traders with Standard and VIP account types, albeit with limited customer support services. Facilitating transactions, Biz Trade Pro accepts multiple payment methods for deposits and withdrawals.

Is Biz Trade Pro legit or a scam?

Biz Trade Pro operates without regulation, raising concerns about the exchange's transparency and oversight. Unregulated platforms lack the safeguards and oversight provided by regulatory bodies, amplifying risks like fraud, market manipulation, and security breaches. Users may encounter difficulties in dispute resolution or seeking redress due to the absence of regulatory backing. Moreover, the lack of oversight fosters a less transparent trading atmosphere, making it challenging for users to gauge the exchange's credibility and reliability accurately.

Pros and Cons

| Pros | Cons |

| Diverse trading assets available | Limited educational resources |

| Multiple payment methods | Very limited customer support |

| Competitive spreads | Lack of comprehensive tutorials |

| Copy Trading | |

| Easy to use platform |

Pros:

Diverse Trading Assets Available: Biz Trade Pro offers a wide array of trading assets, including Forex pairs, indices, commodities, and more, allowing traders to explore various markets.

Multiple Payment Methods: The platform supports multiple payment methods, providing flexibility for users to deposit and withdraw funds conveniently.

Competitive Spreads: Users benefit from competitive spreads, enhancing the potential for favorable trading conditions.

Copy Trading: Biz Trade Pro offers the option of copy trading, allowing users to replicate the trades of successful traders directly into their accounts.

Easy-to-Use Platform: The platform is designed to be user-friendly, simplifying the trading experience for both novice and experienced traders.

Cons:

Limited Educational Resources: The platform lacks comprehensive educational resources, including tutorials, guides, webinars, or blogs, which can be crucial for new traders to learn the ropes.

Very Limited Customer Support: The availability of customer support is severely limited, potentially causing issues for users seeking assistance or guidance.

Lack of Comprehensive Tutorials: While the platform offers copy trading, there might be a shortage of in-depth tutorials or guidance on utilizing this feature effectively.

Market Instruments

Biz Trade Pro offers a diverse array of trading assets, including share CFDs, enabling users to trade on the price movements of various companies without owning the underlying shares. Moreover, the platform features a range of Forex pairs, providing opportunities to trade currency pairs from major to minor and exotic currencies. Additionally, traders can access indices, allowing them to speculate on the performance of market indexes, and commodities, offering the ability to trade precious metals, energies, and agricultural products. This breadth of assets empowers users to diversify their portfolios and engage in different markets according to their preferences and strategies.

Account Types

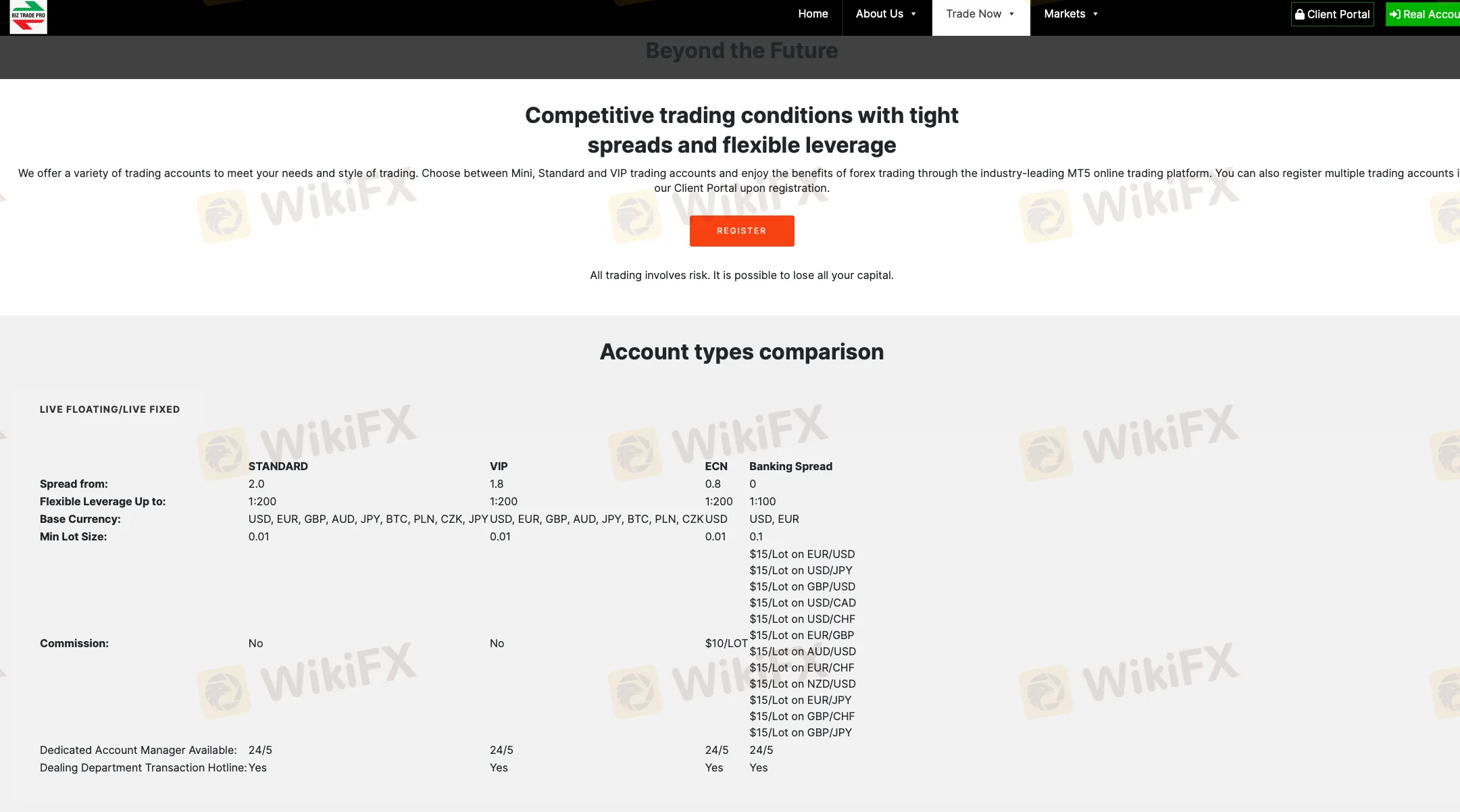

Biz Trade Pro offers four distinct account types—Standard, VIP, ECN, and Banking Spread—each tailored to cater to various trading preferences and needs.

Standard Account:The Standard account offers a spread starting from 2.0 pips and provides flexible leverage up to 1:200. It supports various base currencies like USD, EUR, GBP, AUD, JPY, BTC, PLN, and CZK. Traders can initiate trades with a minimum lot size of 0.01. This account type doesn't involve any commission charges. Users benefit from a dedicated account manager available 24/5 and access to the dealing department's transaction hotline.

VIP Account:The VIP account features a reduced spread starting from 1.8 pips and maintains the same leverage as the Standard account, up to 1:200. Similar to the Standard account, it supports various base currencies. It also allows trading from a minimum lot size of 0.01 and does not entail any commission fees. Traders with a VIP account receive the same 24/5 dedicated account manager support and access to the dealing department's transaction hotline.

ECN Account:The ECN account offers a significantly lower spread, starting from 0.8 pips, and maintains a leverage of up to 1:200. It primarily operates in USD and entails a commission fee of $10 per lot for most currency pairs. However, specific pairs like EUR/USD, USD/JPY, GBP/USD, USD/CAD, USD/CHF, EUR/GBP, AUD/USD, EUR/CHF, NZD/USD, EUR/JPY, GBP/CHF, and GBP/JPY incur a higher commission of $15 per lot. Similar to the other accounts, users have access to dedicated account managers and the dealing department's transaction hotline 24/5.

Banking Spread Account:The Banking Spread account type involves no spread as it operates on a commission-based structure. It provides leverage up to 1:100, supports transactions primarily in USD and EUR, and requires a minimum lot size of 0.1. This account incurs a commission fee of $15 per lot across several specific currency pairs. Similar to other accounts, traders have access to dedicated account managers and the dealing department's transaction hotline 24/5.

How to Open an Account?

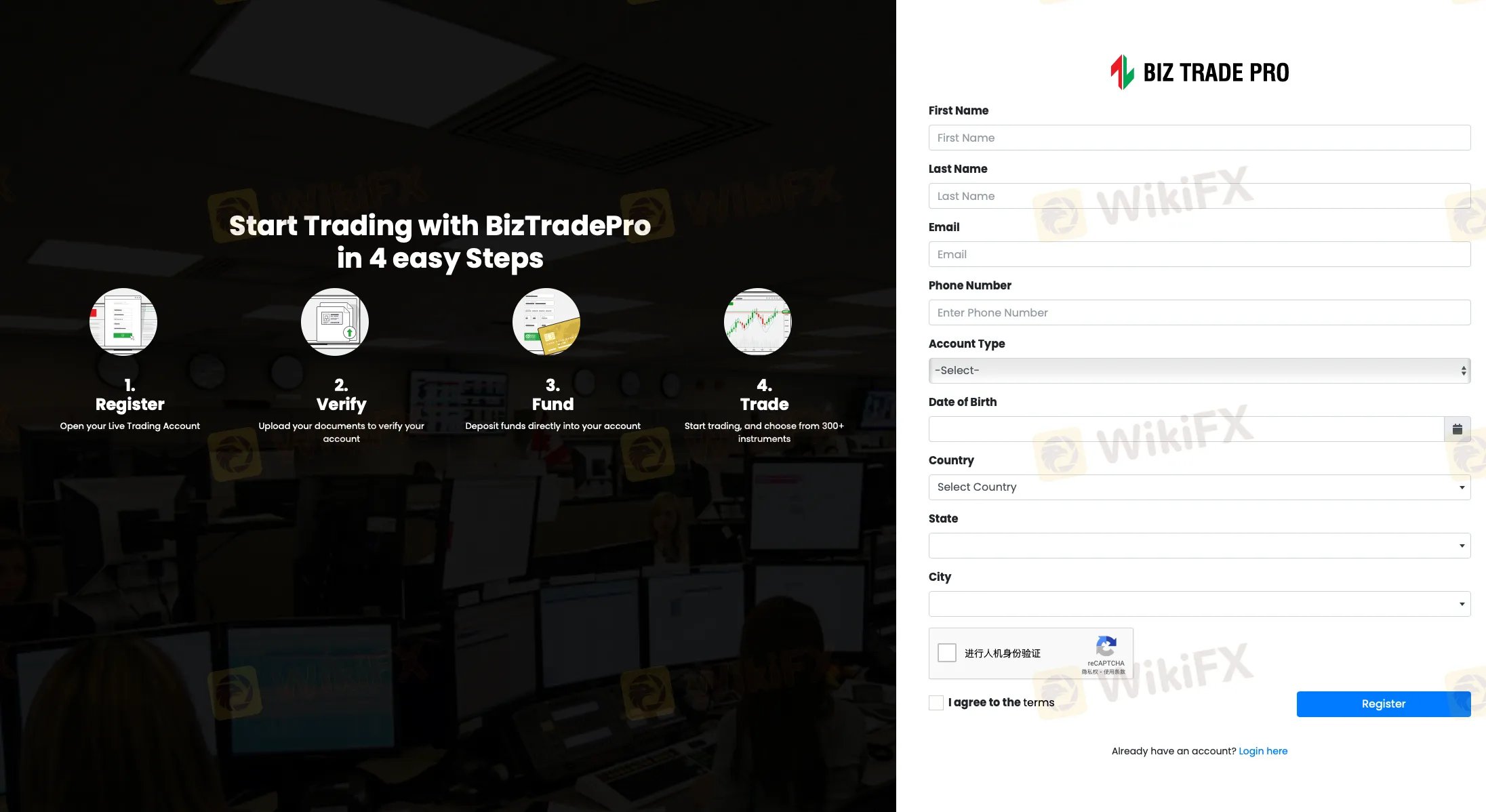

Here's a step-by-step guide to open an account with Biz Trade Pro:

Registration:

Begin by registering on the Biz Trade Pro platform. This involves providing your personal details to create your live trading account.

2. Verification:

Once registered, proceed to upload the necessary verification documents. This often includes identification and proof of address to authenticate your account.

3. Funding Your Account:

Deposit funds into your newly created account using the available payment methods provided by Biz Trade Pro. This step ensures you have the necessary capital to start trading.

4. Initiating Trades:

With your account funded, you can now start trading. Explore the extensive array of over 300 instruments available on the platform and begin your trading journey.

Leverage

The maximum leverage offered by Biz Trade Pro varies based on the account type selected. For the Standard, VIP, and ECN accounts, the maximum leverage reaches up to 1:200. However, for the Banking Spread account, the maximum leverage is slightly lower, capped at 1:100. These leverage ratios indicate the amount a trader can borrow relative to their invested capital, amplifying potential gains or losses in trading positions.

Spreads & Commissions

The spreads and commissions at Biz Trade Pro differ across account types. For the LIVE FLOATING account, the spreads start from 2.0 pips, while for the LIVE FIXED account, they start from 1.8 pips. Meanwhile, the ECN account offers spreads as low as 0.8 pips, and the Banking Spread account has fixed spreads of 0.

Additionally, while the LIVE FLOATING and LIVE FIXED accounts don't incur commission charges, the ECN account applies a $10 commission per lot traded, and the Banking Spread account charges $15 per lot for select currency pairs like EUR/USD, USD/JPY, GBP/USD, USD/CAD, USD/CHF, EUR/GBP, AUD/USD, EUR/CHF, NZD/USD, EUR/JPY, GBP/CHF, and GBP/JPY. These figures may vary based on the currency pair and account type, impacting the overall cost of trading for each user.

Trading Platform

MetaTrader 5 (MT5) is a robust and versatile trading platform offered by Biz Trade Pro. It's designed to cater to the diverse needs of traders, providing an array of features and tools for comprehensive trading experiences. MT5 supports multiple asset classes, including forex, commodities, stocks, and indices. Its user-friendly interface allows for seamless navigation and quick access to various markets.

The platform incorporates advanced charting tools, allowing traders to conduct in-depth technical analysis with a range of indicators and graphical objects. Additionally, MT5 facilitates algorithmic trading through its automated trading capabilities, supporting expert advisors (EAs) and allowing users to implement and test automated strategies.

MT5 also offers an economic calendar and real-time news updates, empowering traders to make informed decisions based on market events and trends. The platform's customization options enable users to tailor their trading environment, from chart layouts to trading preferences, enhancing their overall trading experience. With its stability, speed, and comprehensive tools, MetaTrader 5 stands as a favored choice among traders seeking a sophisticated yet user-friendly platform.

Deposit & Withdrawal

Biz Trade Pro offers multiple payment methods for depositing funds, providing convenience and flexibility to its users, including bitcoin, mastercard, Visa, Skrill, Paypal,etc. The minimum deposit required to start trading varies based on the account type selected, typically starting from a reasonable amount. The processing time for deposits often depends on the chosen payment method, with some methods offering instant transactions while others may take a bit longer.

Withdrawals from Biz Trade Pro are usually processed within a reasonable timeframe, often within a few business days, although the exact processing time can vary based on factors like the withdrawal method used and any additional verification requirements. The platform strives to ensure efficient and secure transactions, maintaining a balance between prompt processing and stringent security measures to safeguard users' funds and financial information. Overall, while specific processing times and minimum deposits can differ, Biz Trade Pro aims to provide a seamless and secure payment experience for its traders

Customer Support

The customer support provided by Biz Trade Pro is notably limited in its scope and accessibility. Users may encounter challenges due to the constrained availability of support channels or the absence of comprehensive assistance options. This limitation in customer support could potentially hinder users' ability to swiftly resolve queries or seek immediate assistance for trading-related issues or platform navigation.

Educational Resources

Biz Trade Pro falls short in terms of educational resources, potentially posing challenges for new users aiming to grasp the platform functionalities and cryptocurrency trading dynamics. Crucial resources like a comprehensive user guide, video tutorials, live webinars, and insightful blogs are notably absent. This deficiency in educational tools may hinder newcomers from understanding the platform nuances and effectively navigating the complexities of cryptocurrency trading. As a consequence, it might lead to missteps and financial losses, ultimately discouraging inexperienced traders from engaging actively in trading activities.

Conclusion

Biz Trade Pro offers a diverse range of trading assets and competitive spreads, providing a platform that caters to various market preferences. Its provision of multiple payment methods and user-friendly interface makes it accessible to traders.

However, the platform faces significant drawbacks with its limited educational resources and notably restricted customer support. The absence of comprehensive tutorials and insufficient support might pose challenges for new users, hindering their ability to navigate the platform effectively and potentially leading to missed opportunities or errors in trading decisions.

FAQs

Q: Can I trade cryptocurrencies on Biz Trade Pro?

A: Yes, Biz Trade Pro facilitates cryptocurrency trading along with a wide range of other assets like forex, indices, and commodities.

Q: Are there any fees for opening an account?

A: Opening an account on Biz Trade Pro is free of charge; however, there might be associated costs with certain transactions or services.

Q: How can I reach customer support on Biz Trade Pro?

A: Biz Trade Pro offers limited customer support through live chat and email.

Q: Does Biz Trade Pro offer educational resources?

A: Unfortunately, Biz Trade Pro lacks comprehensive educational materials, which might pose challenges for new traders.

Q: Can I copy trades from successful traders on Biz Trade Pro?

A: Yes, Biz Trade Pro supports copy trading, enabling users to replicate successful trades from experienced traders.

Q: What payment methods are accepted for deposits on Biz Trade Pro?

A: Biz Trade Pro accepts multiple payment methods for deposits, providing users with flexibility in funding their accounts.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now