General Information

CapitalBear is allegedly a forex broker registered in Saint Vincent and the Grenadines that claims to provide its clients with various tradable financial instruments on web-based and mobile app trading platforms. Here is the home page of this brokers official site:

Capital Bear is a trading platform that operates under the jurisdiction of Saint Vincent and the Grenadines. With a history of 2-5 years, it provides a variety of market instruments including forex, stocks, cryptocurrencies, commodities, and ETFs. Traders can access the platform through web trading or the Capital Bear mobile application. One of the notable features of Capital Bear is its low minimum deposit requirement of $10, making it accessible to traders with different budgets. The platform offers both demo and live accounts, allowing users to practice their trading strategies before risking real money. Fees on the platform include commission fees, inactivity fees, and withdrawal fees. Capital Bear accepts verified, MasterCard, and VISA as deposit and withdrawal methods. Customer support is available through phone, email, and various social media channels such as Facebook, Telegram, Instagram, and Twitter. However, there is no specific information available regarding educational resources, FAQs, or maximum leverage offered by the platform.

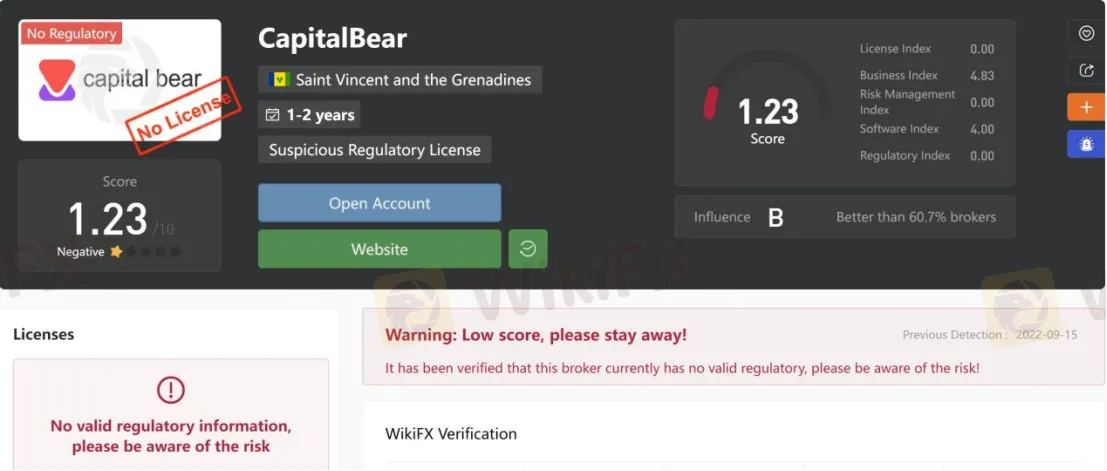

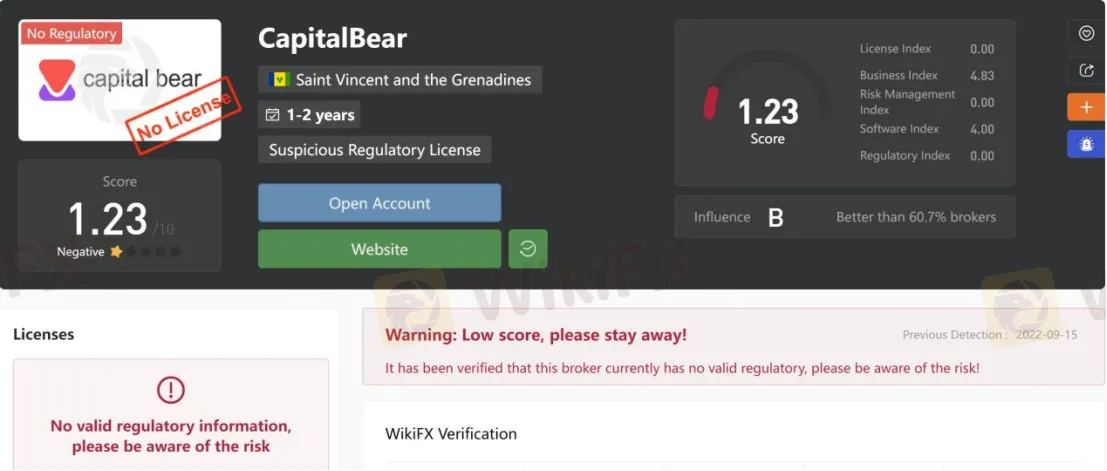

Is Capital Bear legit or a scam?

Regarding regulatory status, it is important to note that Capital Bear does not currently operate under any recognized regulatory authority. As per verification, the platform has not obtained a valid license or regulation. Consequently, Capital Bear's regulatory status on WikiFX is categorized as “No License.” This information highlights the absence of oversight and supervision from established financial regulatory bodies. It is crucial for users to consider this factor when making decisions about trading on the platform.

Pros & Cons

Capital Bear is a trading platform that offers a wide range of trading instruments and diverse payment methods for convenient transactions for users. The platform ensures fast order execution, allowing users to capitalize on market opportunities quickly. It also provides quick withdrawals, ensuring efficient access to funds. Furthermore, Capital Bear has low minimum deposits of only $10, making it accessible to a wide range of traders. The platform offers a demo account, allowing users to practice trading strategies without risking real money.

However, there are some drawbacks to consider. Capital Bear does not offer MT4 or MT5, which may be preferred by some traders. It lacks specific regulation, which could raise concerns about the platform's transparency and accountability. There is no information available regarding spreads, which could make it challenging for users to evaluate trading costs accurately. The platform also lacks a comprehensive FAQ section, potentially leaving users with unanswered questions or uncertainties.

Market Instruments

CapitalBear advertises that it offers access to a wide range of trading instruments in financial markets, including stocks, forex, cryptocurrencies, commodities and ETFs.

Stocks

Traders can find the stocks of the leading companies on this trading platform. So, traders can enjoy trading the stocks of their favorite companies. It features 200 stocks for trading on the platform.

Forex

Forex is another asset that traders can trade very easily on Capital Bear. Traders can find the leading forex with this broker. It includes USD, JPY, etc. Traders can also trade their favorite forex pairs on Capital Bear. It offers as many as 23 forexes for trading.

Cryptocurrencies

Cryptocurrency is very famous among traders because of its possibility to make traders earn high profits. Capital Bear offers the leading crypto. Traders can buy, hold, and sell the top cryptocurrency such as Bitcoin, Litecoin, etc. It offers almost 39 cryptocurrencies for trading.

Commodities

The broker offers 4 commodities to traders for trading. These include silver, gold, crude oil Brent, and WTI. Traders can place their bets on such commodities using the online trading platform.

ETFs

Capital Bear stands out from other brokers because it offers a high ETF offering for traders. Traders can access almost 25 ETFs for trading online.

How to Open an Account?

To open an account with Capital Bear, you can follow these general steps:

1. Visit the Capital Bear website: Go to the official website of Capital Bear using a web browser, and look for a “Open free account” button on the website. Click on it to initiate the registration process.

2.Fill out the registration form: Provide the required information such as your full name, email address, phone number, and create a password.

3. Verify your email: After submitting the registration form, you will receive an email from Capital Bear with a verification link. Click on the link to verify your email address.

4. Complete the KYC process: Capital Bear follows a Know Your Customer (KYC) process, which requires you to provide additional personal information and documentation. This may include uploading a copy of your identification document (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement).

5. Fund your account: Once your account is verified, you can proceed to fund it. Capital Bear typically offers a range of deposit methods, which may include credit/debit cards, bank transfers, or electronic payment systems. Choose the method that suits you best and follow the instructions provided.

6. Start trading: Once your account is funded, you can access the trading platform and start trading. Familiarize yourself with the platform's features, select the desired trading instruments, and execute trades based on your trading strategy.

Trading fees

Capital Bear charges the following fees from traders:

Spreads: Traders who trade forex have to bear spreads on Capital Bear. The broker has competitive spreads that range according to the market condition. Underlying liquidity and volatility are some factors that Capital Bear considers while determining the spreads.

Swap fees: Some traders keep their position on the trading platform open overnight. In such cases, Capital Bear charges a swap fee. It is also known as an overnight fee. Traders have to pay a swap fee ranging from 0.1%-0.5%.

Inactivity fees: For trading accounts that stay dormant for 90 days, the broker charges an inactivity fee. Capital Bear charges an inactivity fee of 10 Euros. If traders wish to avoid such fees while trading on Capital Bear, they must make a trade continuously.

Account Types

CapitalBear claims to offer demo and live accounts, however, it says nothing about the minimum initial deposit requirement.

Trading Platform Available

Platforms available for trading at CapitalBear are web-based and mobile apps. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

CapitalBear says to accept deposits and withdrawals via over 20 local and international payment methods, consisting of MasterCard, Visa and others. The minimum initial deposit requirement is said to be only $10, while there is no mention of what the minimum withdrawal amount is.

Depositing Procedure

1. To make a deposit, the Client shall make an inquiry from their personal profile. To complete the inquiry, the Client shall choose any of the payment methods from the list, fill in all the required details and proceed to the payment page.

2. The processing time of the inquiry depends on the selected payment method and may vary from one method to another. In the case of using electronic payment methods, the transaction time can vary from seconds to days.

In case of using direct bank wire, the transaction time can be up to 45 business days. The Client has the right to withdraw funds only to thee payment system that was used to deposit funds to his/her account. In cases where it is technically impossible to withdraw funds to the payment system that was used to deposit funds, an alternative payment method shall be chosen and the payment details shall meet the conditions specified by the Client in his/her personal info.

Customer Support

CapitalBears customer support can be reached by telephone: +442036565402, email: support@capitalbear.com. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and Telegram. Company address: First Floor, First St. Vincent Bank Ltd Building, James Street, P.O. Box 1574, Kingstown VC0100, St. Vincent and the Grenadines.

Conclusion

In summary, Capital Bear offers a wide range of trading instruments, a user-friendly trading platform, and generous leverage. The platform provides fast order execution, quick withdrawals, low minimum deposits, and a demo account. However, the absence of MT4/MT5 platforms, specific regulation, 24/7 customer support, comprehensive spread information, and educational resources are notable disadvantages that traders should consider before choosing Capital Bear.

FAQs

Q: What is Capital Bear?

A: Capital Bear is an online investment platform that offers various financial services, including trading and investment opportunities in cryptocurrencies, stocks, commodities, and forex markets.

Q: How can I create an account with Capital Bear?

A: To create an account with Capital Bear, you can visit their website (https://Capital Bear.com/) and click on the “Open free account” button. Follow the registration process, which typically involves providing your personal information and completing any required verification steps.

Q: What financial instruments can I trade on Capital Bear?

A: Capital Bear provides access to a wide range of financial instruments, including cryptocurrencies (such as Bitcoin and Ethereum), stocks, commodities (like gold and oil), and forex currency pairs.

Q: What are the deposit and withdrawal options available on Capital Bear?

A: Capital Bear supports various deposit and withdrawal options, including bank wire transfers, credit/debit cards, and electronic payment methods.

Q: What security measures does Capital Bear have in place to protect my funds?

A: Capital Bear prioritizes the security of client funds and employs various measures to ensure their safety. This includes advanced encryption technology, segregated client accounts, and strict adherence to regulatory guidelines to maintain a secure trading environment.

Q: Does Capital Bear offer customer support?

A: Yes, Capital Bear provides customer support to assist clients with their inquiries and concerns. You can typically reach their support team through various channels, such as live chat, email, or phone, during their business hours.

Juan G.

Mexico

Services offered by the Capital Bear has helped me to escape from constants fears of being unsuccessful in life. You know, people tend to put such goals like "dreaming of being financially independent" and stuff like that. So I also dreamt of being successful in the financial sphere, and due to this company I'm gradually crawling up to the top to reach significant goals.

Positive

2023-06-20

Luiz Goncalves

Brazil

A practice account is a great idea. After registering on this platform I started to practice. I trade in the account for practice so that I do not have any mistakes when trading in real. I hope that I can minimize my losses thanks to this feature.

Positive

2023-05-29

Desiderio

Brazil

I was impressed with their dedication to providing a personalized and different approach to trading. Unlike other brokers I had used in the past, CapitalBear took the time to understand the importance of a personalized experience. With my specific goals and preferences and I developed a customized trading plan that was designed to meet my needs. I also admire the customer support here. They work closely with me and provide me with the guidance and support I need to succeed.

Positive

2023-05-29

Renan Goncalves

Brazil

Just started with this broker and so far so good. The platform works without any complaints. The abundance of technical tools is awesome and seems to improve my analytical abilities dramatically. There are no indices though, it’s a pity.

Positive

2023-04-29

小莲子

Malaysia

If you are someone with an interest in investing, Kindly use CapitalBear, as it's one the fastest & secure platforms out there! Thanks, CapitalBear, Keep up the good work.

Positive

2023-02-21

FAINT33913

Nigeria

Great and easy service. Only a couple of days of using the CapitalBear and I am already in profit! And this wouldn't happen without my account manager.

Positive

2022-12-16