Score

Node Capital Group

United Kingdom|2-5 years|

United Kingdom|2-5 years| http://www.ncgforex.com/zh-hk/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Entity:NODE CAPITAL GROUP LIMITED

License No. 0543789

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomAccount Information

Users who viewed Node Capital Group also viewed..

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

ncgforex.com

Server Location

Hong Kong

Website Domain Name

ncgforex.com

Server IP

143.92.58.5

Company Summary

Note: Node Capital Group's official website: http://www.ncgforex.com/zh-hk/ is normally inaccessible.

Node Capital Group Information

Node Capital Group is a brokerage company registered in the United Kingdom engaged in various investments including stocks, currencies, precious metals, commodities, cryptocurrencies, and indices. The minimum spread is from 0 and the commission is free. While the broker's official website has been closed, so traders cannot obtain more security information.

Is Node Capital Group Legit?

| National Futures Association (NFA) |

| Current Status | Suspicious Clone |

| Regulated by | United States |

| License Type | Common Financial Service License |

| License No. | 0543789 |

| Licensed Institution | NODE CAPITAL GROUP LIMITED |

Node Capital Group is authorized and regulated by the National Futures Association (NFA), and its current status is Suspicious Clone, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with Node Capital Group.

Downsides of Node Capital Group

- Unavailable Website

Node Capital Group's website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

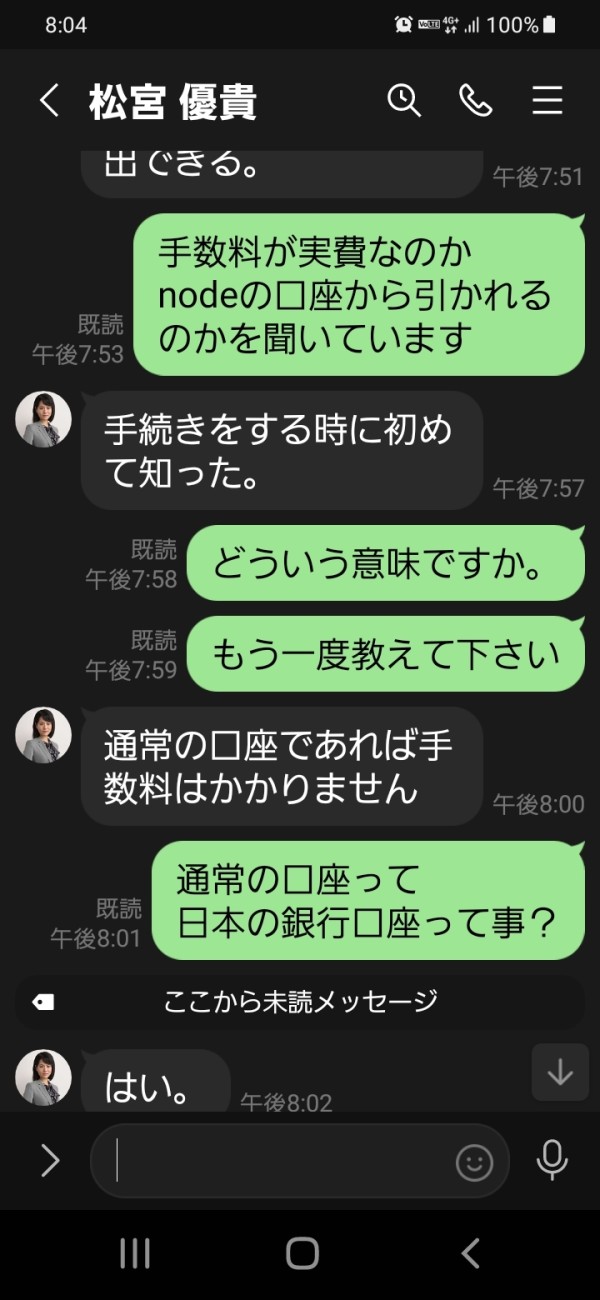

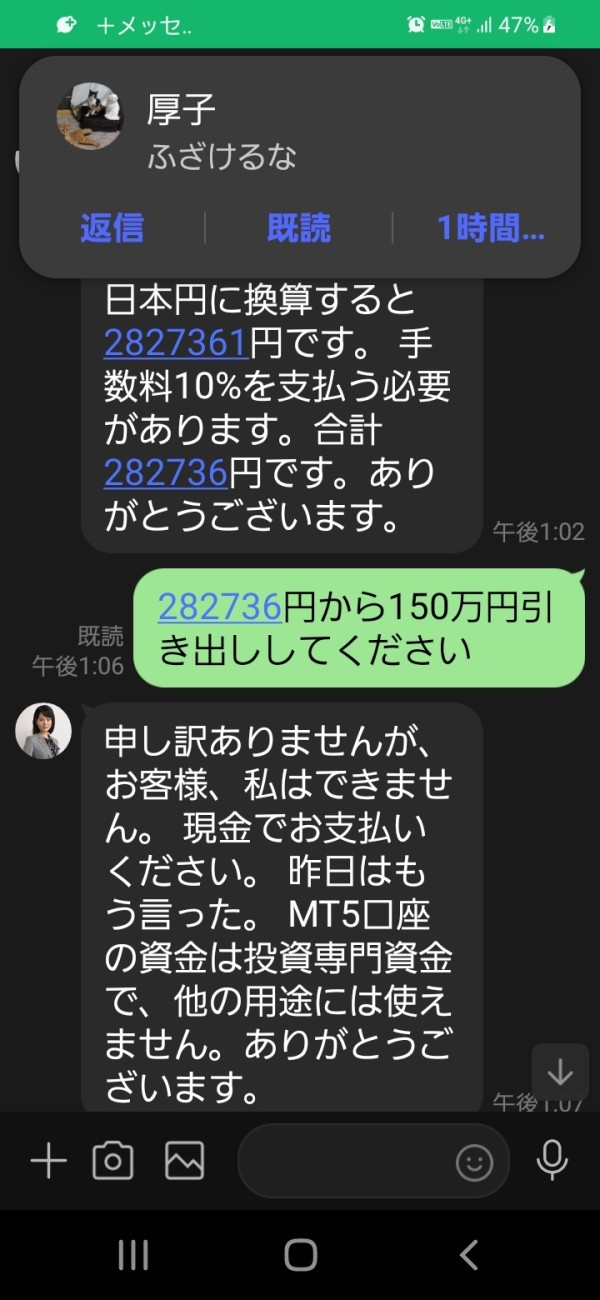

Since Node Capital Group does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

The NFA regulates Node Capital Group. However, the Suspicious Clone status is less safe than a regulated one.

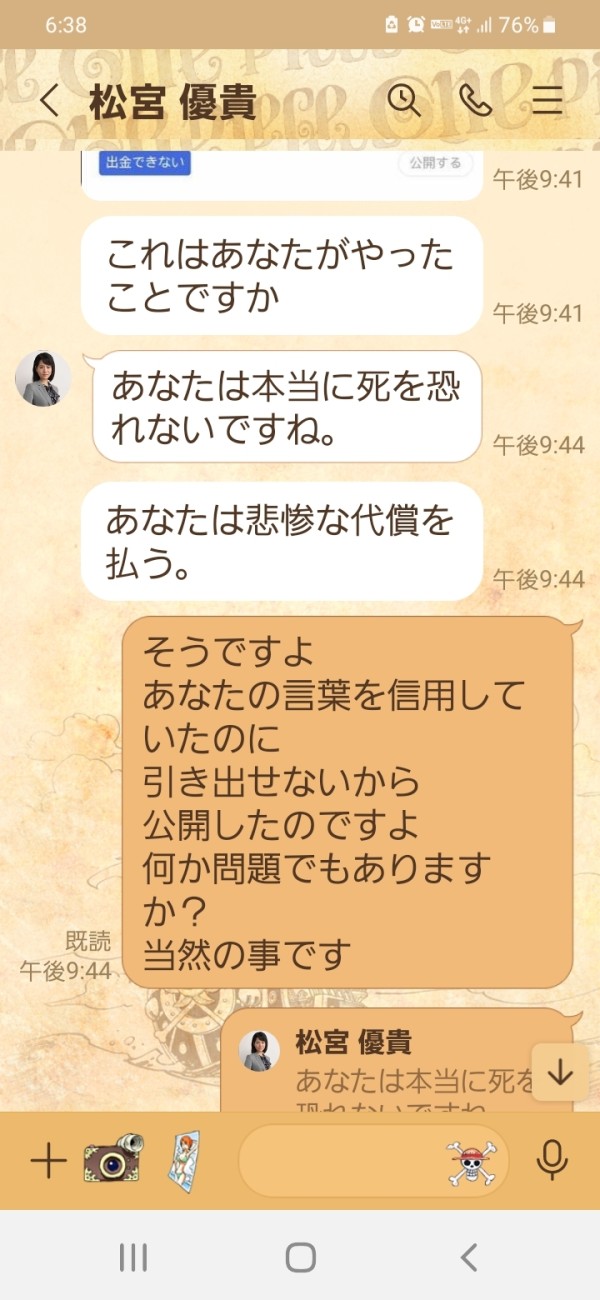

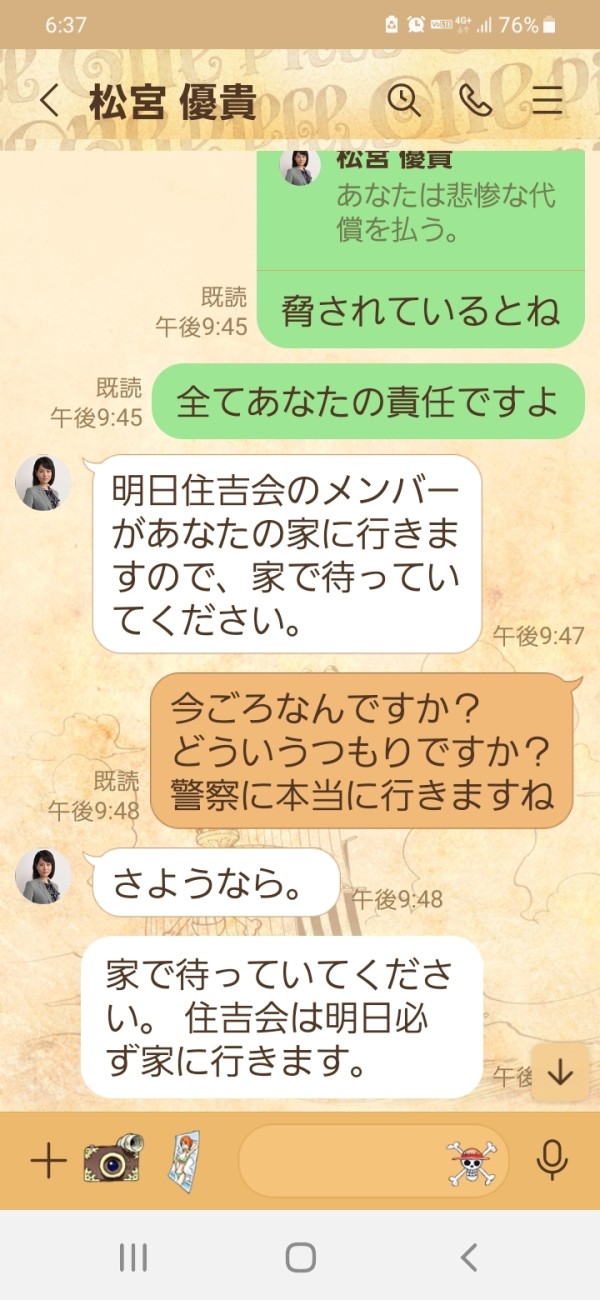

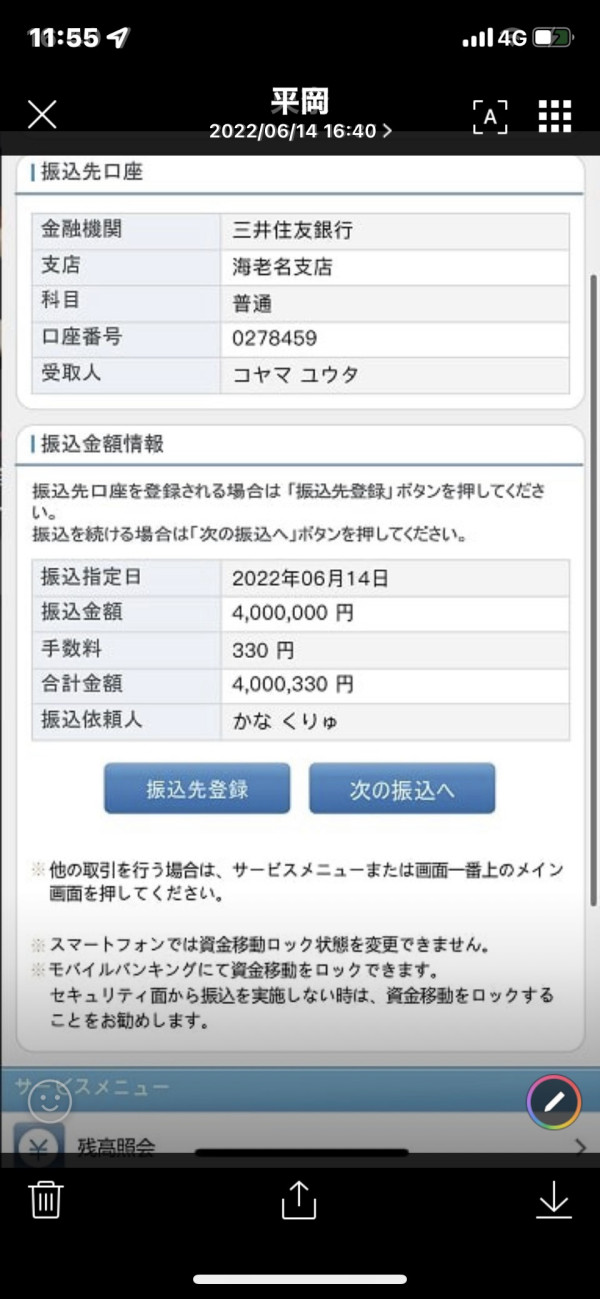

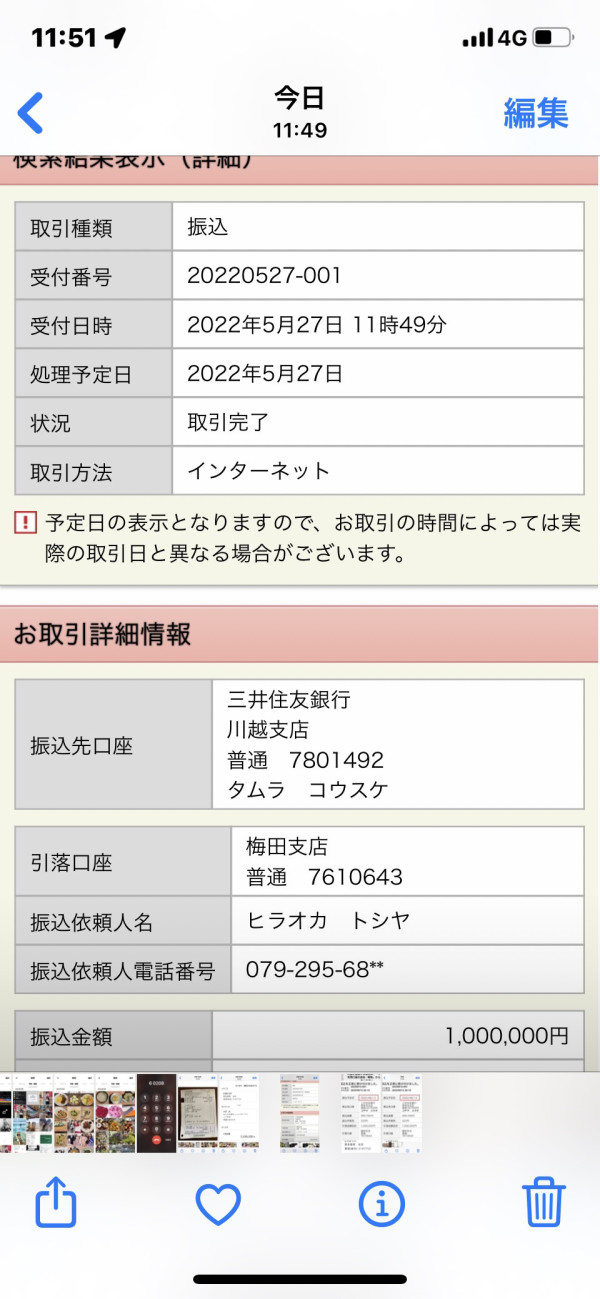

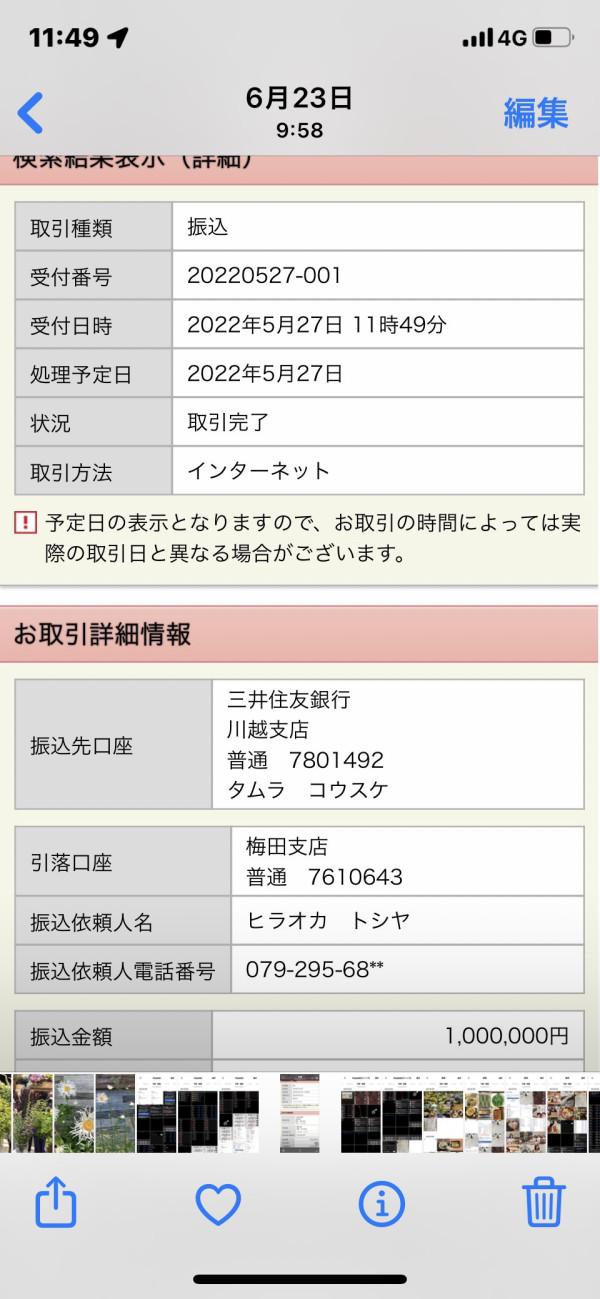

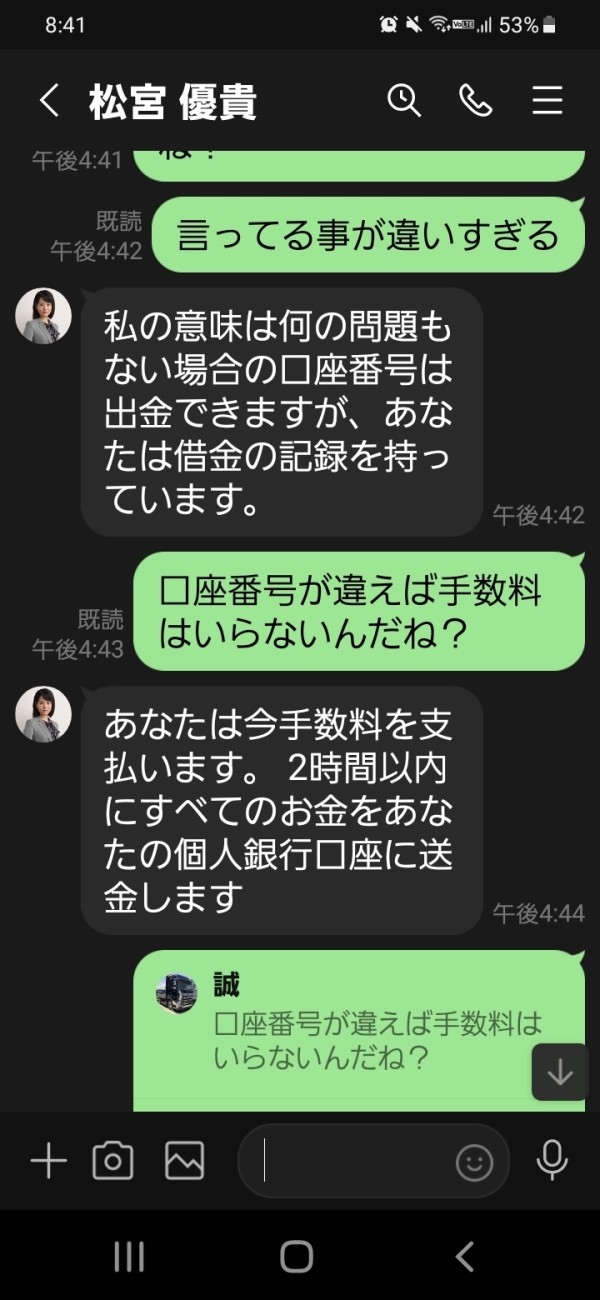

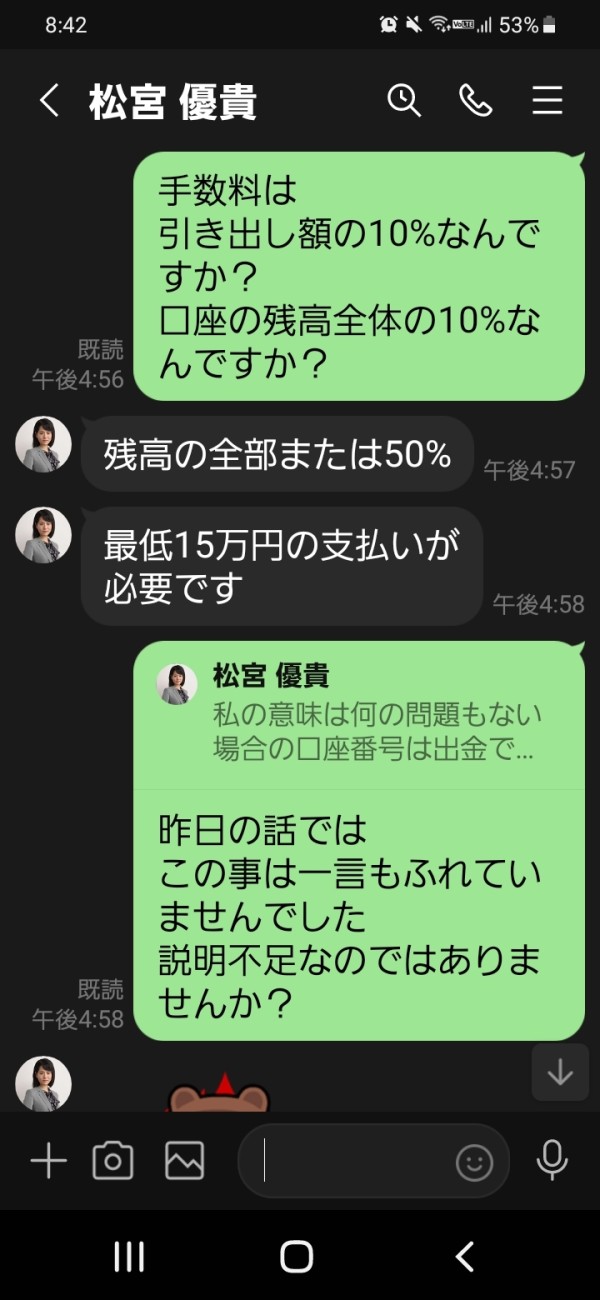

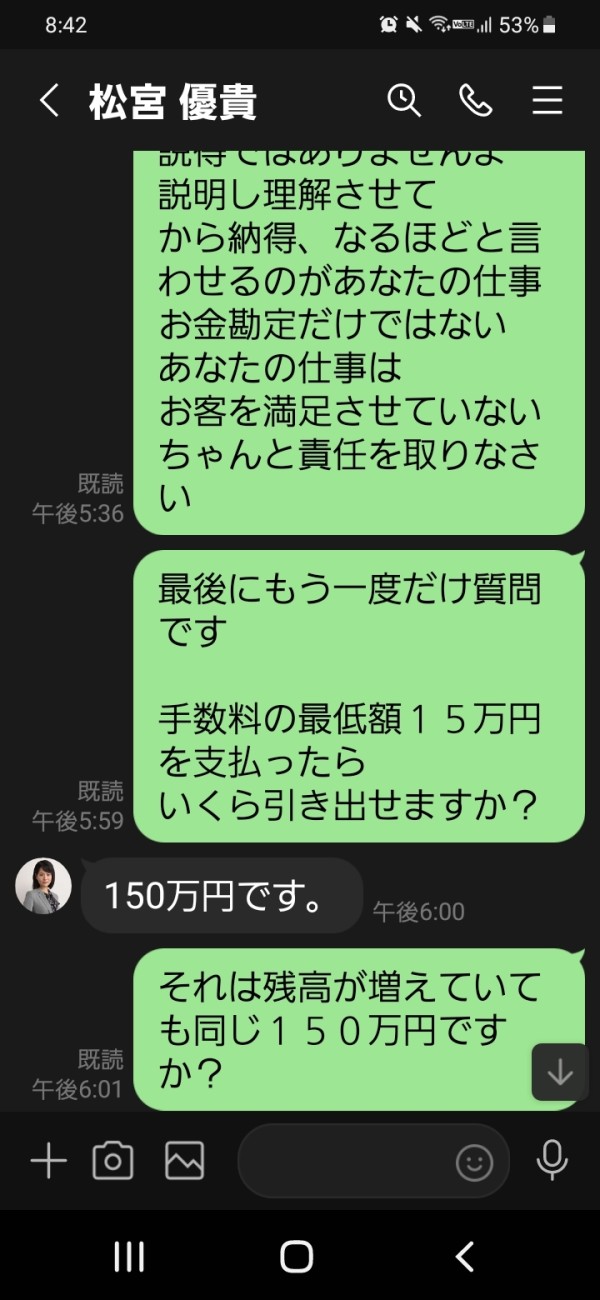

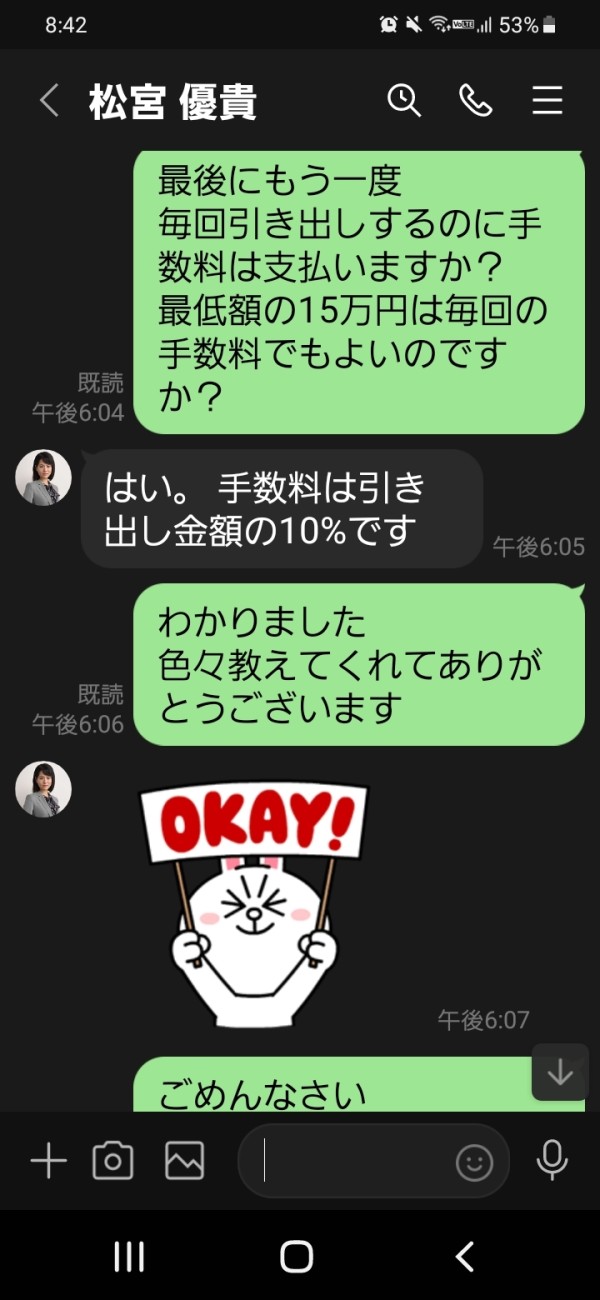

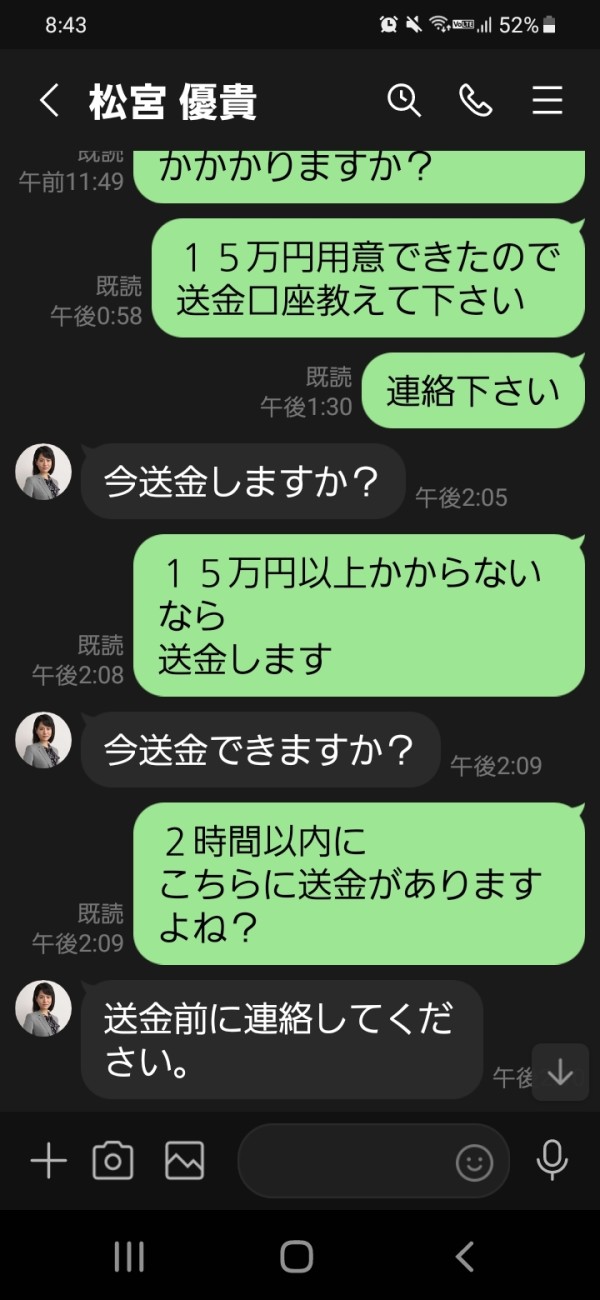

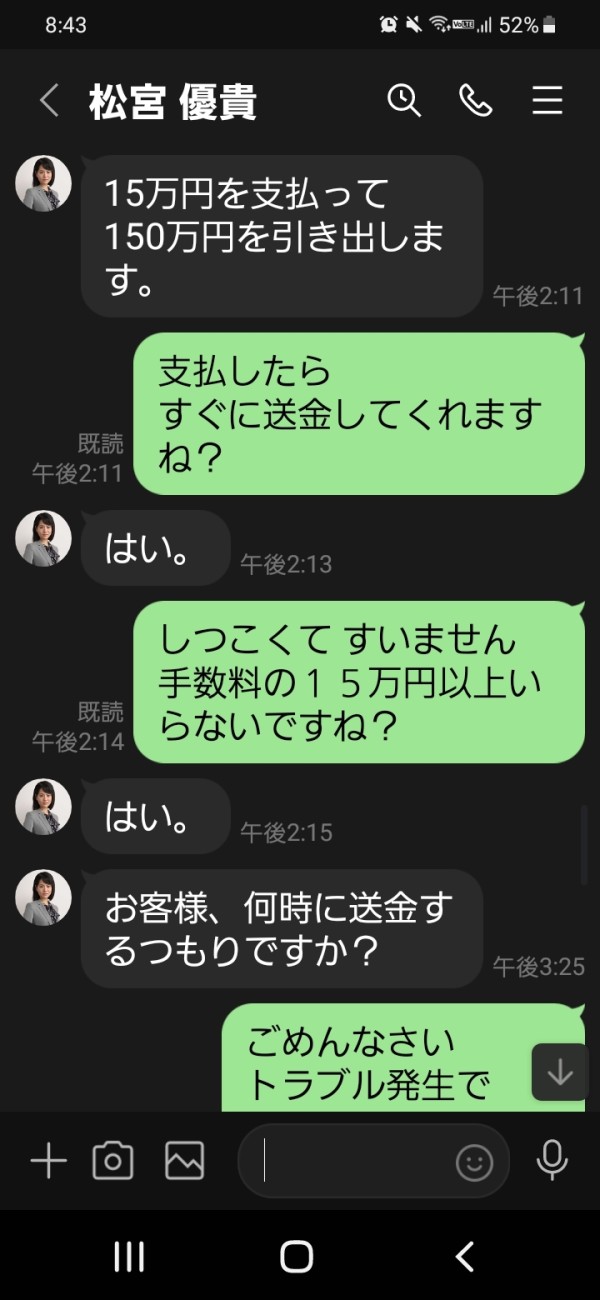

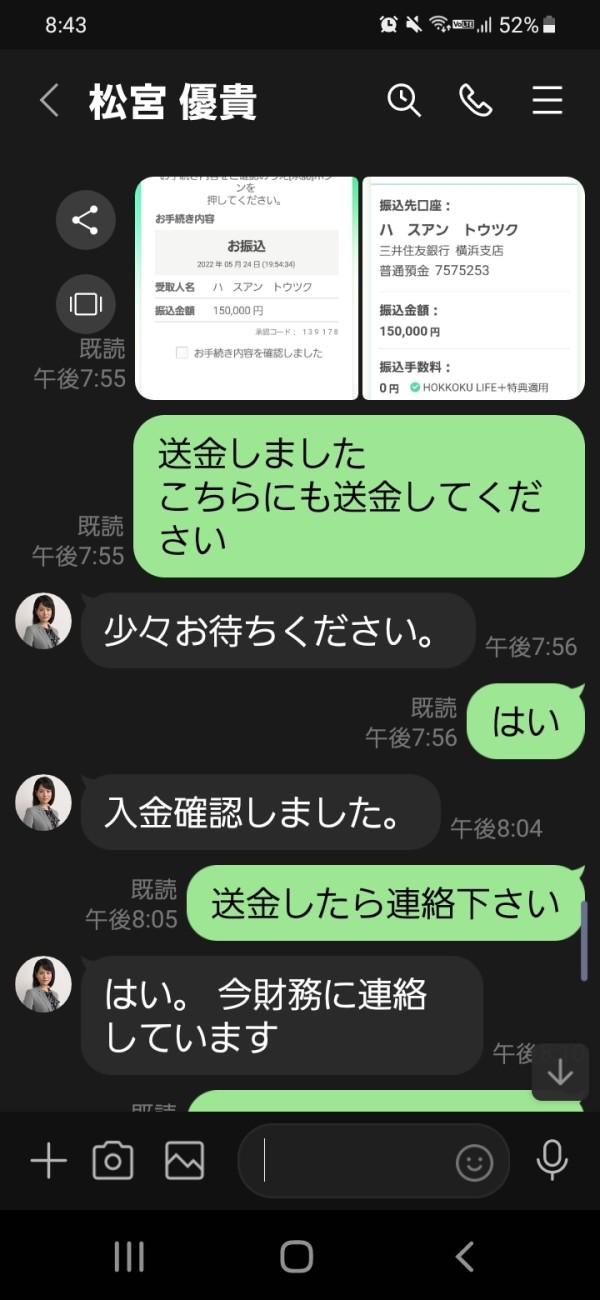

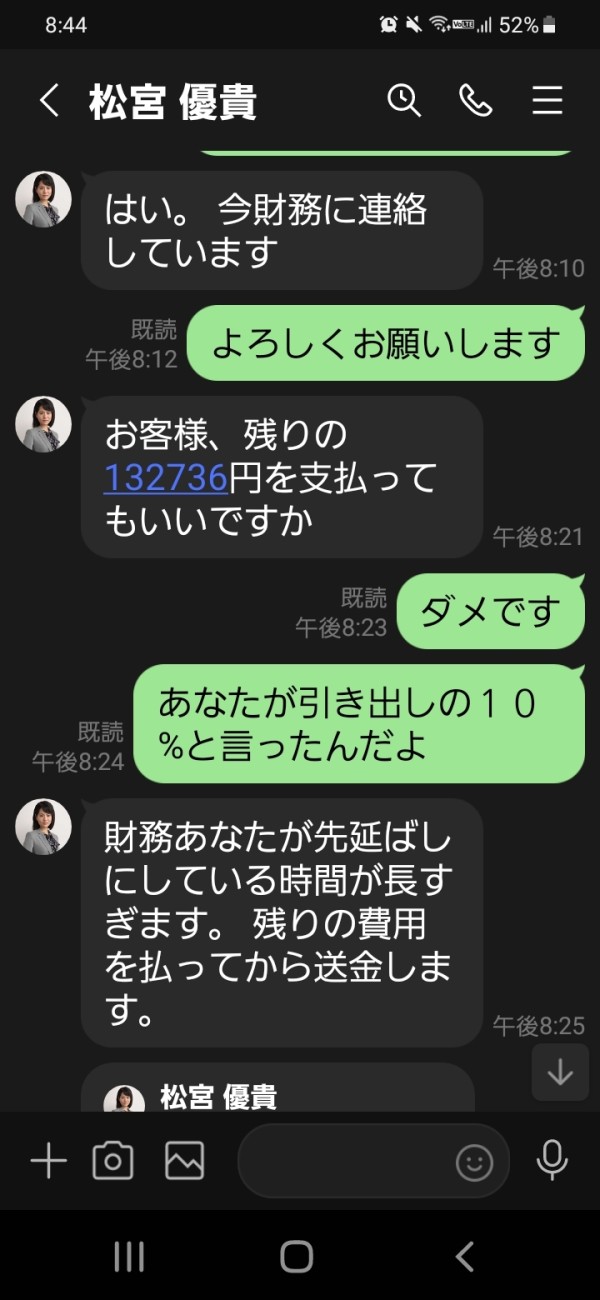

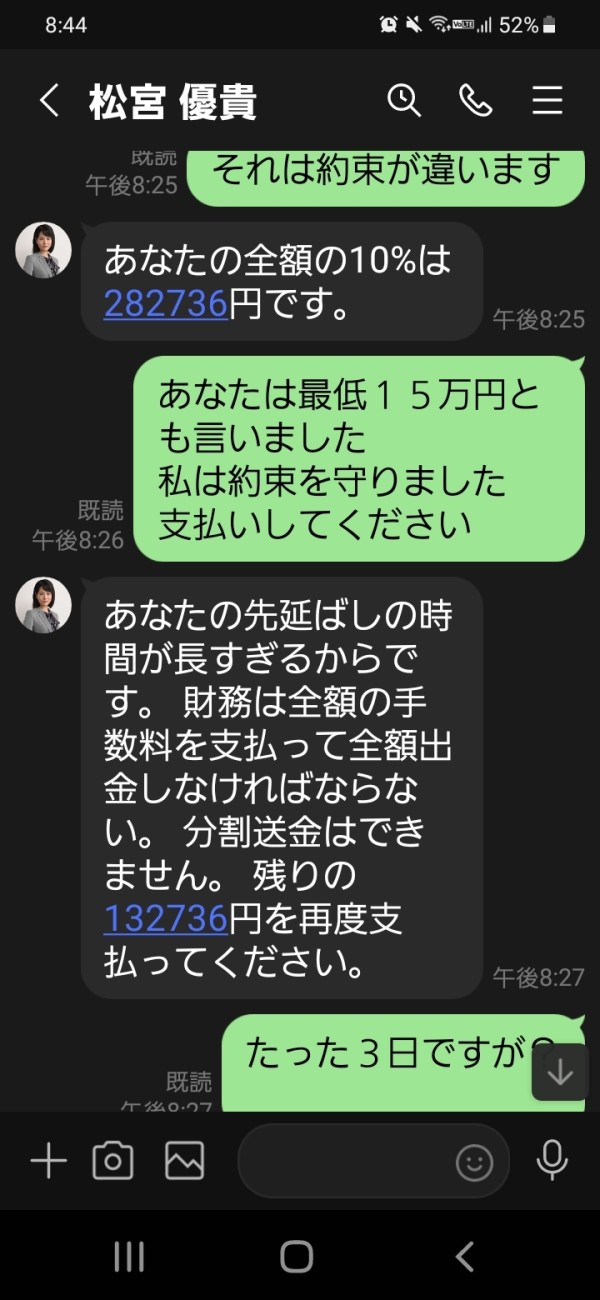

- Withdrawal Difficulty &Scams

According to a report on WikiFX, a user encountered significant difficulties with fund withdrawals and suspicious scams. The issue remained unresolved despite the request being pending for a long time.

Negative Node Capital Group Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there are more than 10 pieces of Node Capital Group Reviews exposure in total.

Exposure. Cannot withdraw & Scams & Others

| Classification | Unable to Withdraw/Scams/Others |

| Date | 2022 |

| Post Country | Hong Kong, China/Japan |

The user said that he was xx, and it was still pending after a long time. You may visit: https://www.wikifx.com/en/comments/detail/202205152442469615.html https://www.wikifx.com/en/comments/detail/202205135972998232.html https://www.wikifx.com/en/comments/detail/202208262562812609.html.

Conclusion

Node Capital Group Since the official website cannot be opened, traders cannot get more information about security services. In addition, the Suspicious Clone status indicates that this brokers trading risks are high. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Suspicious Overrun

- High potential risk

Comment 14

Content you want to comment

Please enter...

Comment 14

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

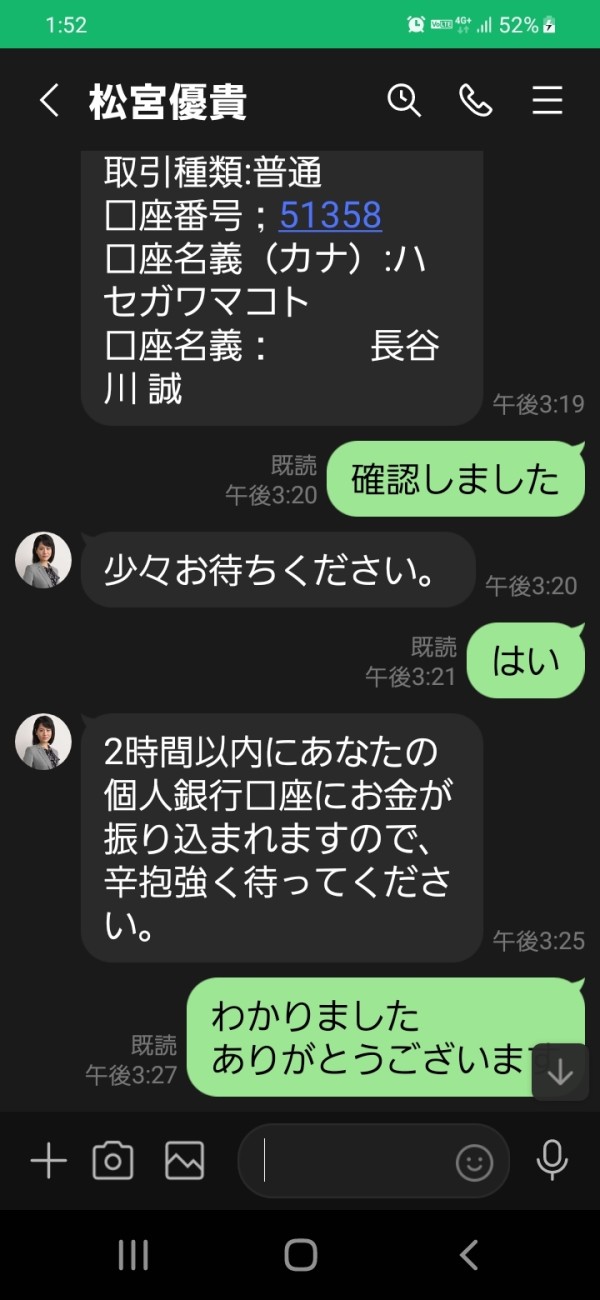

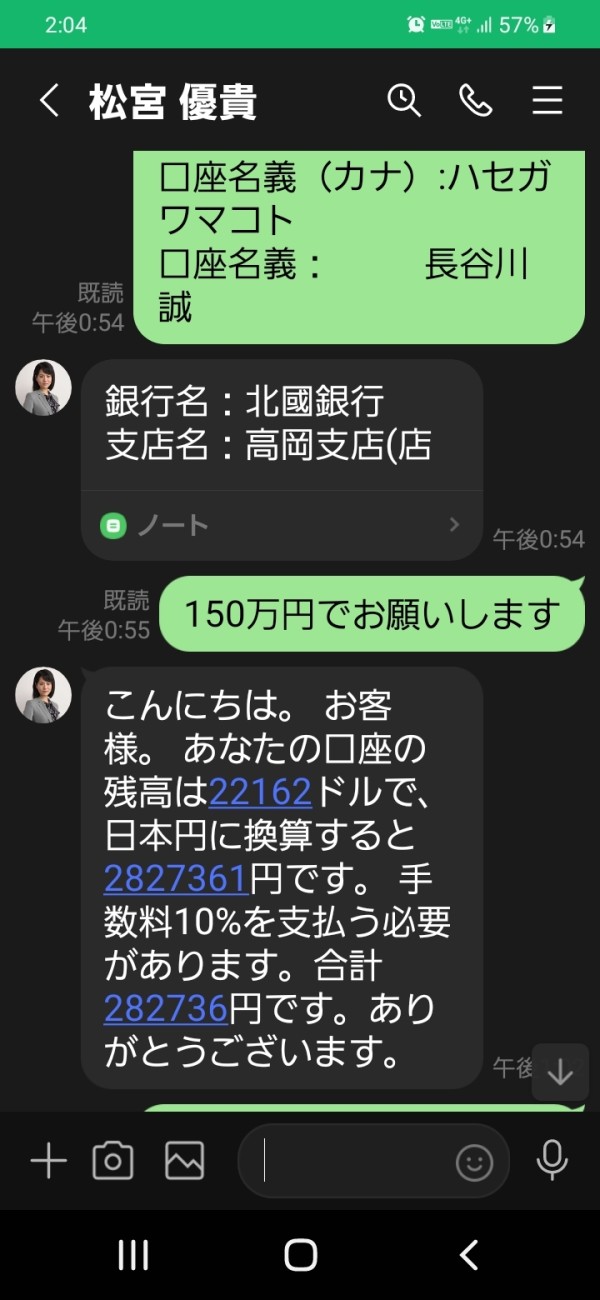

誠15395

Japan

I can't sleep because I'm too scared at night.

Exposure

2022-08-26

FX2425586008

Japan

First, it is 100,000 yen, then 1 million yen will be transferred to your personal name account with 5 times in total

Exposure

2022-07-04

清水英紀

Japan

2022.05.30 Monday Withdrawal amount: 5 million yen in Japanese yen Thank you. 18:37 Linda NODE charge Please wait a moment. Calculating the procedure fee 18:39 Linda NODE charge According to the withdrawal amount calculation, you need to pay 20.315% of the procedure fee, and you need to pay about 1015750 yen. After payment is complete, submit your withdrawal application. Withdrawal will be completed within 24 hours 18:42 Linda NODE Charge When will you pay the procedure fee? 18:46 UK Is that amount a fee? 18:46 Linda NODE charge 1015750 yen 18:46 Linda NODE charge Yes, this is the amount you should pay 18:47 UK When you deposit that amount, 5 million yen will be transferred to you? 18:47 Linda NODE Responsible Yes, after paying the procedure completion fee, submit the withdrawal application. If the submission is successful, the withdrawal of 5 million yen will be completed within 24 hours. 21:25 It seems that it will take time to correct the English transfer limit, so I would like to ask you again tomorrow. Thank you m (_ _) m 21:26 Linda NODE charge Now, I will cancel this remittance application and contact you when you remit tomorrow By the way, please tell me the specific remittance time tomorrow New deposit account 21:34 I'm sorry I couldn't deposit the English margin. I said tomorrow, but I would like to contact you again when withdrawing. 21:35 Linda Mieko Sakamura NODE Yes 2022.06.01 Wednesday 19:09 Linda NODE If the transfer is completed by the end of the day, your credit loss record will be cleared. Can you tell me where and how much to send? 22:46 It's confirmed in English, but if you send money, you can get a transfer of 5 million yen, right? 22:52 Linda NODE charge Apply for you now, and after the remittance is completed, confirm the success and process the withdrawal 22:52 How long will the British 5 million yen be deposited? 22:53 Linda NODE charge Confirmation of the remittance amount was successful. The withdrawal procedure will be completed within 24 hours 22:54 Please tell me the remittance amount just in case. 22:54 Linda NODE charge 1015750 yen 22:55 English If you transfer that amount, 5 million yen will be credited to my bank account within 24 hours, right? 22:55 Linda NODE charge Yes 23:32 Linda NODE charge Hello, I was able to confirm the remittance amount 2022.06.02 Thursday 12:36 How many hours will it take to deposit? 15:59 Linda NODE charge Inquiring 17:05 Linda NODE Respected NODE: UK According to the verification of the wind copy department of our securities company, you submitted a withdrawal of 5 million yen in the background of the withdrawal registration official website and the application failed. According to Article 102 of the Forex Control Treaty, sharing an account is strictly prohibited. Your MT5 account is suspected of being deposited by multiple people and is suspected of being shared by multiple people. This act is suspected of being a crime. Currently, the brokerage firm's wind holding department can freeze your trading account, suspect that you are not the person, and after the account has recovered normally, you can withdraw and trade normally. To resume normal use of your account, complete two requirements: 1) Provide one proof photo that you have (you need to show your face clearly). 2) Pay a deposit of 20% of your account balance. 67706.32 * 20% = $ 13541.264 $ 1758845 payment required 3) Deposit $ 13541.264 (¥ 1758845) will be returned to your Bank of Japan account in 2 business days. Please complete the above two requests and unzip your account by June 2nd. Once completed, you can withdraw all funds from your account. Please complete the process as soon as possible and complete the withdrawal procedure

Exposure

2022-06-03

誠15395

Japan

On May 24th, I sent a fee of 150,000 yen. I have confirmed that I can withdraw money many times, but I am in trouble because I was told that I cannot send money.

Exposure

2022-05-24

誠15395

Japan

At the beginning, I was able to withdraw a small amount of 30,000 yen without any fees, but as soon as the amount became large, I was asked for a fee.

Exposure

2022-05-20

FX3464047817

Hong Kong

I have been used my account for more than a year, and I have been unable to withdraw money. Every time there are various reasons, I have to pay them a high fee every time. In the end, I still can't get my money back. Don't be deceived! !

Exposure

2022-05-16

FX3464047817

Hong Kong

They ake me to pay high fees for various reaons and induce me to invite others to invest. I think that the friend introduced by me will have same experiences. The fund will not be returned.

Exposure

2022-05-13

FX3464047817

Hong Kong

My account limit is $7000, and I have paid $3500tax, and $2000 deposit, $1000 fine, and $2000 handling fee as required by them when I withdraw money, and then I was told that my account is a bit difficult to withdraw. , I need to re-pay the tax of 3500$, the deposit of 2000$, and the handling fee of 1700$, please help, how can I get my money back

Exposure

2022-05-13

FX3464047817

Hong Kong

Easy to deposit, but hard to withdraw. Fraud platform. Hope investors wont be deceived anymore.

Exposure

2022-05-13

FX3464047817

Hong Kong

During the withdrawal, I paid tax, margin, fines and handling fees for many times.Finally, I was informed that I cannot withdraw.

Exposure

2022-05-13

FX3702431509

Japan

LINE] Talk history with Alisa Saved date: 2022/4/11 12:28 2022/2/27 (Sun) 12:13 kiyoyuki nakakita Lina introduced me, is Japanese okay? 12:14 Alisa Hello, customers. I'm Alisa, Customer Support Manager. 12:14 Alisa Would you like to open a true foreign currency trading account in your name? 12:15 kiyoyuki nakakita Yes 12:15 Alisa In order to apply for an account, you need to provide the following information. 12:15 Alisa 1. Name 2. Mobile phone number 3. Email address 4. Passport or ID card or photo of driver's license 12:15 Alisa Enter the information in Articles 1 to 3 in text please. Please take a picture of the information in Article 4 12:18 kiyoyuki nakakita 1. Kiyoyuki Nakakita 2.09020148141 3. kiyoyuki32@gmail.com 4 Please tell me the company name before sending. Customer support manager? I haven't asked which company it is, so thank you. 12:36 Alisa Node Capital Group 13:24 kiyoyuki nakakita [photo] 13:24 kiyoyuki nakakita [photo] 13:24 kiyoyuki nakakita 4. I sent you a photo of your driver's license. 15:07 Alisa Please wait 15:48 Alisa Did your email address receive the information? Please take a screenshot of the information that arrived at your email address. 16:26 kiyoyuki nakakita [photo] 16:26 kiyoyuki nakakita [photo] 16:26 kiyoyuki nakakita [photo] 18:30 kiyoyuki nakakita I don't know how to log in to MT5. Thank you. 18:33 Alisa [Photo] 18:34 Alisa 30100371 VAek699718: 35 Alisa This is your account and password. Now you can ask your friends to log in and tell you the flow of transactions. I hope your foreign currency transactions will be more profitable. Thank you very much. 18:35 Note the difference between uppercase and lowercase letters in the Alisa password 18:44 kiyoyuki nakakita Login alphanumericals 30100371 Password VAek6997 I entered this but was not authenticated. 18:52 kiyoyuki nakakita Get in touch with your friends. Please wait. 19:02 Alisa [Stamp] 19:06 kiyoyuki nakakita Contact [Alisa] to get a bank account of a securities company and send money directly 19:09 Alisa Bank name: Sumitomo Mitsui Banking Corporation Branch name: Omiya branch (store number) 514) Transaction type: Ordinary bank number: 8519953 Account name (Kana): Nguyen Teikiyun Lien 19:09 Alisa If the remittance is completed within 30 minutes, please send us a photo of the transfer details. Choose to deposit on the day 20:30 Alisa Your 50,000 yen has been deposited, so please accept it. 2022/2/28 (Monday) I made a deposit of 50,000 yen yesterday, but please apply for withdrawal how to register a withdrawal account. 16:25 Alisa 233204.31 $ 272311 11:06 Alisa Please deposit as soon as possible after contacting your bank card. 12:51 Alisa Bank name: Sumitomo Mitsui Banking Corporation Branch name: Kawagoe branch (store number 507) Transaction type: Ordinary 囗 ZA number; 7996178 Account name (Kana): Negishi Tact Account name: Takuto Negishi 12:51 Alisa Immediate deposit Please finish and take a picture. Thank you 2022/3/23 (Wednesday) Can I withdraw money by paying the analyst fee? Do you have any other payments required? The other point is that the analyst fee will be transferred from 2 accounts, is that okay?

Exposure

2022-04-11

FX3371055357

Japan

A woman I met on Instagram told me that if I did what I said on Forex, I would definitely make a profit, and I was introduced to the area manager of a designated contractor and opened an account. For some reason, the deposit destination is not the account of the trader but the account of a domestic individual. I was able to log in to my MT5 account with the contents of a normal account opening guide email, and the remittance was reflected normally. In fact, she made too much profit from the amount she normally sent at the time, currency pair, direction, and timing of payment. However, MT5 had a completely different chart movement only during that time from MT4 of the other two companies. As I was told, I added a small amount of money. Profit swelled as it was. The Ukrainian conflict is a great opportunity, but if you don't have $ 10,000, you won't be able to participate in the market and it's dangerous, so if you want to participate, you've been prompted to increase your capital He said he would lend me because I didn't have one, and he lent me 1.05 million yen. However, it was suddenly reflected in MT5, not via my own bank. Final $ 52288.66 I was told to withdraw the full amount once in preparation for the next time, and when I asked the introduced area manager, I was told that I could not withdraw unless I paid 20% tax first, and I would not pay further And the account will be frozen. Isn't it strange that the deposit is taxed? In the first place, the tax is paid to the tax office after filing a tax return, and when you ask where you intend to pay the tax, when do you pay the tax?

Exposure

2022-03-21

诺馨

Australia

I'm disappointed to see yet another forex company go under. It's not just about the money I might have lost, but also the time and effort I put into researching and choosing a company to invest with. It's hard to trust anyone in this industry now. I feel desperate and not having any interest to restart my trading.

Neutral

2023-03-20

半月武$ ~明

Cambodia

Stay away from this these clowns! They deleted my profits, and arbitrary widen the spreads even when the market was not volatile. My only advice is that don’t open accounts here, or you will be so regretful.

Neutral

2023-03-07