Score

LYCUX

China|2-5 years|

China|2-5 years| https://www.lycux.com/#/home

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

China

ChinaUsers who viewed LYCUX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

lycux.com

Server Location

United States

Website Domain Name

lycux.com

Server IP

104.21.43.71

Company Summary

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 2020 |

| Company Name | LYCUX |

| Regulation | Not regulated |

| Minimum Deposit | 100$ |

| Maximum Leverage | 1:300 |

| Spreads | Varies by asset |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Indices, Cryptocurrencies |

| Account Types | Real Account |

| Demo Account | Unavailble |

| Islamic Account | Unavailble |

| Customer Support | Limited and inadequately responsive |

| Payment Methods | Cryptos only |

| Educational Tools | Absent |

| Website Status | Website reported as down |

Overview

LYCUX, a company reportedly based in China, was founded in 2020 and operates without any regulatory oversight. Traders considering this platform should exercise caution, as the minimum deposit requirement is $100, and the broker offers a maximum leverage of 1:300. Spreads vary across different assets, making cost calculations uncertain. The broker exclusively provides the MetaTrader 4 (MT4) trading platform, offering forex, indices, and cryptocurrency trading options. Unfortunately, LYCUX falls short in terms of customer support, with limited responsiveness. Additionally, traders will find no educational resources on this platform. The website has been reported as down, which further raises concerns. User allegations of scam cast a shadow on the broker's reputation, emphasizing the need for careful consideration before engaging with LYCUX.

Regulation

LYCUX operates as a broker with a notable absence of regulatory oversight. This means that it does not adhere to the stringent guidelines and rules imposed by financial regulatory authorities, such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA) in the United States. While this lack of regulation might offer a certain degree of freedom and flexibility to the firm, it also raises concerns regarding investor protection and transparency. Investors should exercise caution when considering LYCUX as a broker, as the absence of regulatory oversight could potentially expose them to higher risks associated with the financial markets. It is essential for investors to conduct thorough due diligence and consider the potential implications of choosing an unregulated broker like LYCUX before entrusting them with their investments.

Pros and Cons

LYCUX presents a mixed picture of advantages and disadvantages for traders. On the positive side, the broker offers a variety of market instruments, including forex, indices, and cryptocurrencies, along with a high maximum leverage of 1:300. Traders can access the widely-used MetaTrader 4 platform. However, the absence of regulatory oversight raises concerns about investor protection. LYCUX lacks educational resources and offers limited customer support, which can be frustrating. Additionally, issues with cryptocurrency deposit and withdrawal, coupled with numerous user allegations of scam and website downtime, cast significant doubts on the broker's reliability and trustworthiness. Traders should carefully weigh these pros and cons before considering LYCUX for their trading needs.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

Market Instruments

LYCUX offers a range of market instruments across various asset classes, including forex, indices, and cryptocurrencies, providing its clients with diversified trading opportunities:

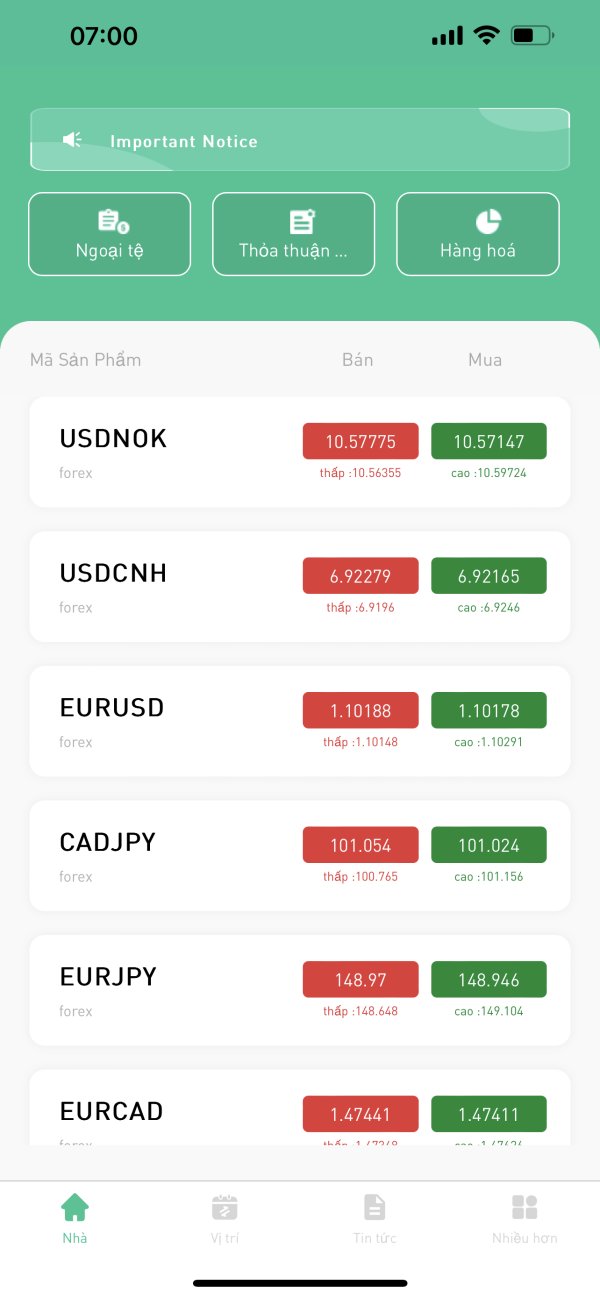

Forex (Foreign Exchange):LYCUX allows traders to participate in the forex market, which involves the trading of currency pairs. Forex trading is one of the largest financial markets globally, where traders speculate on the exchange rate movements between different currencies. Popular currency pairs like EUR/USD, GBP/JPY, and USD/JPY are likely to be available for trading, enabling clients to engage in forex trading strategies.

Indices:LYCUX offers access to a variety of indices, which represent the performance of a group of stocks from a specific market or sector. These indices may include major global indices like the S&P 500, Dow Jones Industrial Average, or the FTSE 100. Trading indices allows investors to gain exposure to the broader market movements without having to trade individual stocks.

Cryptocurrencies:Cryptocurrency trading is a prominent feature of LYCUX's offerings. Traders can buy and sell various cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and other digital assets. Cryptocurrencies have gained popularity as speculative and investment assets, and LYCUX provides a platform for clients to engage in cryptocurrency trading, taking advantage of the price volatility in this emerging asset class.

These market instruments offer diversification and trading opportunities to LYCUX clients, allowing them to tailor their portfolios and strategies based on their risk tolerance and investment goals. However, it is essential for traders to conduct thorough research and risk management when participating in these markets, as they can be highly volatile and carry inherent risks. Additionally, traders should consider the regulatory environment and customer support provided by LYCUX to make informed trading decisions.

Account Types

LYCUX offers only a single type of account - the real account. This limited choice reflects a lack of flexibility on the part of the broker, potentially leaving traders with few options to cater to their specific needs and preferences. While simplicity can be advantageous in some cases, the absence of diverse account types may be seen as a drawback for those seeking more tailored trading experiences or specialized features. Clients may find themselves constrained by this one-size-fits-all approach, limiting their ability to optimize their trading strategies or manage their accounts in a manner that suits their unique requirements. It is advisable for prospective clients to carefully consider whether LYCUX's restrictive account offering aligns with their individual expectations and trading goals before committing to the platform.

Leverage

This broker offers an exceptionally high maximum trading leverage of 1:300. Leverage is a tool that allows traders to control a more substantial position size in the market with a relatively smaller amount of capital. A leverage of 1:300 means that for every $1 of the trader's capital, they can control a position worth up to $300 in the market. While high leverage can magnify potential profits, it also significantly amplifies potential losses. Traders should exercise caution when using such high leverage, as it can increase the level of risk and potentially lead to substantial financial losses if not managed carefully. It is crucial for traders to have a solid risk management strategy in place when trading with such high leverage to protect their investments.

Spreads and Commissions

LYCUX offers a diverse range of trading instruments with varying spreads and commission structures to accommodate different trading preferences. In the forex market, the broker provides competitive spreads, such as a 2-pip spread for the EUR/USD currency pair, which is a popular choice among traders. The GBP/JPY pair comes with a slightly wider spread of 3 pips, while the USD/JPY pair offers a more favorable spread of 1.5 pips. Additionally, traders using the forex market should take note of the $5 commission per lot traded, which is a standard fee applied to each transaction. These spreads and commissions can impact the overall cost of trading in the forex market and should be considered when devising trading strategies.

Moving on to indices, LYCUX offers favorable spreads for major indices like the S&P 500, Dow Jones Industrial Average, and FTSE 100. The S&P 500 Index, for instance, has a narrow spread of 1.5 points, while the Dow Jones Industrial Average carries a 2-point spread. The FTSE 100 Index comes with a slightly wider spread of 2.5 points. Notably, there are no commissions associated with trading indices on this platform, which can be advantageous for investors seeking to diversify their portfolios through index trading.

For cryptocurrency enthusiasts, LYCUX offers trading options in digital assets like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). Bitcoin, being one of the most popular cryptocurrencies, has a spread of $40, indicating the cost difference between the buying and selling prices. Ethereum, another prominent cryptocurrency, boasts a competitive $3 spread, while Ripple, with a spread of $0.02, offers cost-effective trading. Traders should be aware of the 0.5% commission applied to the trade value when dealing with cryptocurrencies, which is an important consideration when evaluating the potential costs associated with cryptocurrency trading.

In conclusion, LYCUX provides a variety of trading options across forex, indices, and cryptocurrencies, each with its own spread and commission structure. Traders should carefully assess these factors in conjunction with their trading strategies and risk tolerance to make informed decisions and optimize their trading experience on the platform.

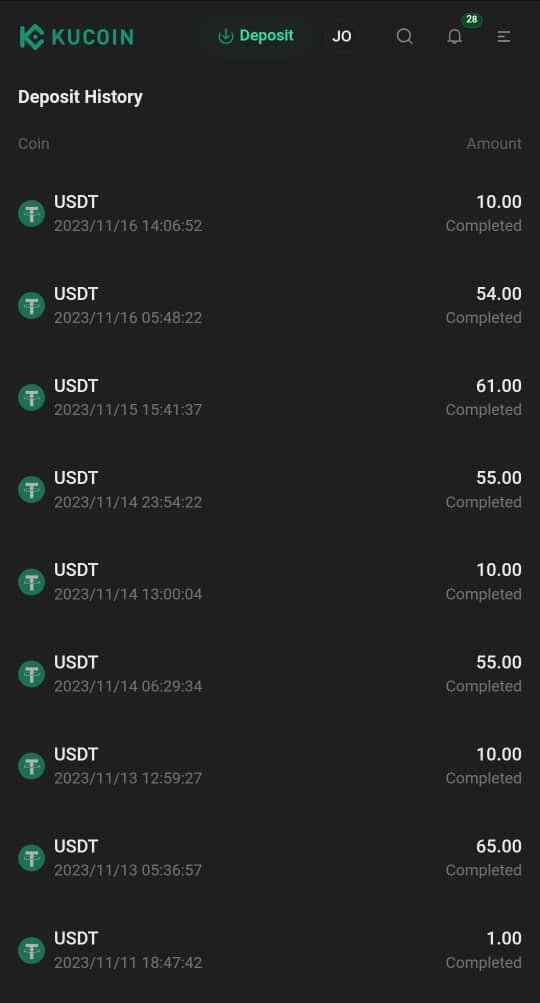

Deposit & Withdrawal

LYCUX's cryptocurrency deposit and withdrawal procedures are fraught with problems. Users often face delays and inconsistencies when depositing funds, and the withdrawal process is equally frustrating, marked by extended processing times and a lack of clear communication. Security is a concern, with reports of breaches and unauthorized access. Hidden fees and high withdrawal charges further compound the issues, eroding trust and making users question the platform's integrity. Overall, LYCUX's cryptocurrency handling falls short in terms of user-friendliness, security, and transparency, casting doubts on its suitability for cryptocurrency traders.

Trading Platforms

LYCUX provides its clients with access to the popular MetaTrader 4 (MT4) trading platform, a widely acclaimed and industry-standard platform known for its robust features and user-friendly interface. This offering allows traders to benefit from the extensive range of tools, technical indicators, and automated trading capabilities that MT4 offers. With MT4, LYCUX users can execute trades across various asset classes, conduct in-depth technical analysis, and implement trading strategies efficiently. The platform's stability and reliability make it a preferred choice for both novice and experienced traders, enhancing their trading experience with LYCUX and offering a familiar environment for optimizing their investment decisions.

Customer Support

LYCUX's approach to customer support leaves much to be desired, as the absence of adequate assistance can be frustrating for traders. The lack of dedicated customer support services or channels, such as live chat, phone support, or timely email responses, significantly hampers clients' ability to seek help or address issues promptly. Traders may find themselves stranded when facing technical glitches, account-related inquiries, or urgent matters, with no reliable means of communication or assistance from the broker. This lack of customer support not only undermines the user experience but also raises concerns about the broker's commitment to resolving client concerns and ensuring a smooth trading environment. As a result, traders should exercise caution and consider their support needs carefully when choosing LYCUX as their trading platform.

Educational Resources

LYCUX's absence of educational resources is a notable drawback for traders seeking to enhance their knowledge and skills in the financial markets. The lack of educational materials, including tutorials, webinars, articles, or trading guides, means that clients are left without valuable resources to improve their understanding of trading strategies, market analysis, or risk management techniques. This deficiency can be particularly detrimental for novice traders who rely on educational content to build their expertise. Without access to educational resources, clients may struggle to make informed decisions, potentially leading to increased risks and losses while trading with LYCUX. Consequently, traders should consider their need for educational support when evaluating the suitability of LYCUX as their broker.

Summary

LYCUX, an unregulated broker, operates without oversight from financial regulatory authorities, raising concerns about investor protection and transparency. The absence of educational resources and limited customer support further hampers traders' ability to navigate the complex financial markets. Traders face frustrations with the cryptocurrency deposit and withdrawal processes, plagued by delays, security issues, and hidden fees. The broker's website being down, coupled with numerous scam allegations from users, underscores the potential risks associated with LYCUX. Caution and thorough due diligence are essential for anyone considering this broker for their trading activities.

FAQs

Q1: Is LYCUX regulated by any financial authorities?

A1: No, LYCUX operates without regulatory oversight.

Q2: What trading instruments does LYCUX offer?

A2: LYCUX provides forex, indices, and cryptocurrency trading options.

Q3: What is the maximum leverage offered by LYCUX?

A3: LYCUX offers an exceptionally high maximum leverage of 1:300.

Q4: Are there educational resources available for traders on LYCUX?

A4: No, LYCUX lacks educational materials for traders.

Q5: Is LYCUX's customer support responsive?

A5: No, LYCUX's customer support is reported to be inadequate, with limited channels and delays in assistance.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 4

Content you want to comment

Please enter...

Comment 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

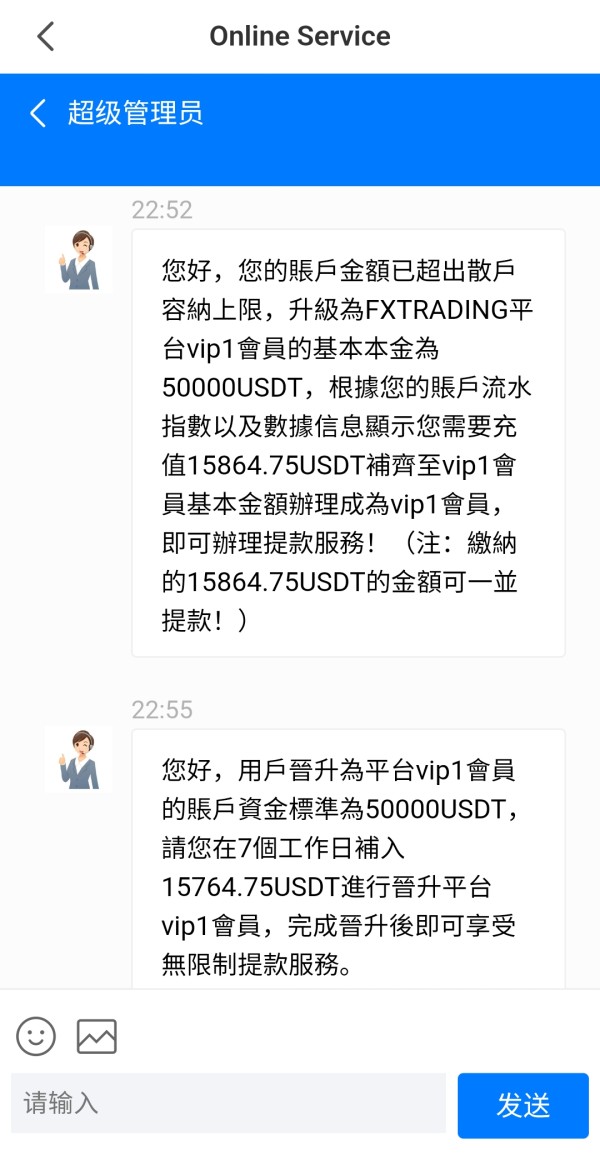

MIKI3714

Singapore

Anyone who uses this company through an acquaintance recommendation needs to be careful. You need to upgrade your VIP to 50,000 before you can withdraw money. What’s wrong with this? If the account funds do not exceed 50,000, you are not allowed to withdraw money and the money will be deducted. It is a fraud. Please don't be deceived.

Exposure

2024-01-08

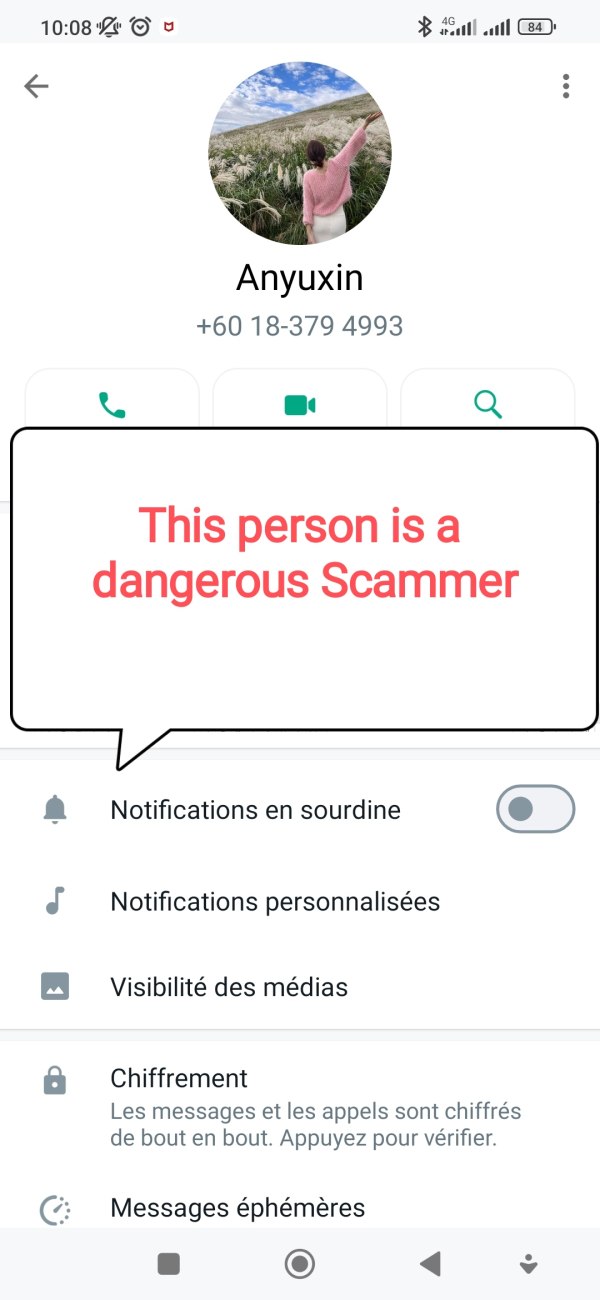

Carin Klaus

Australia

This company made me loose all my money I managed to get help from my profile , stay away , they lured me to download WhatsApp, from their they ripped me off

Exposure

2024-01-04

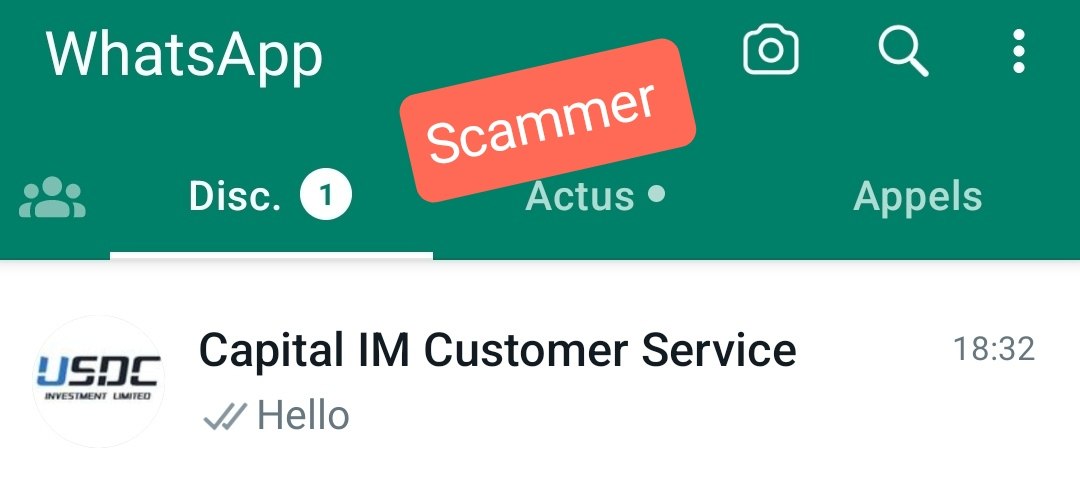

Paco7810

Morocco

I was scammed by a person using this appk sit de and phone number: lycux appk MTC5 appk USDC appk www.capitalimlilited.com this took the money after people's investment then they pend them. Nobody can transfer or get back his money

Exposure

2024-01-03

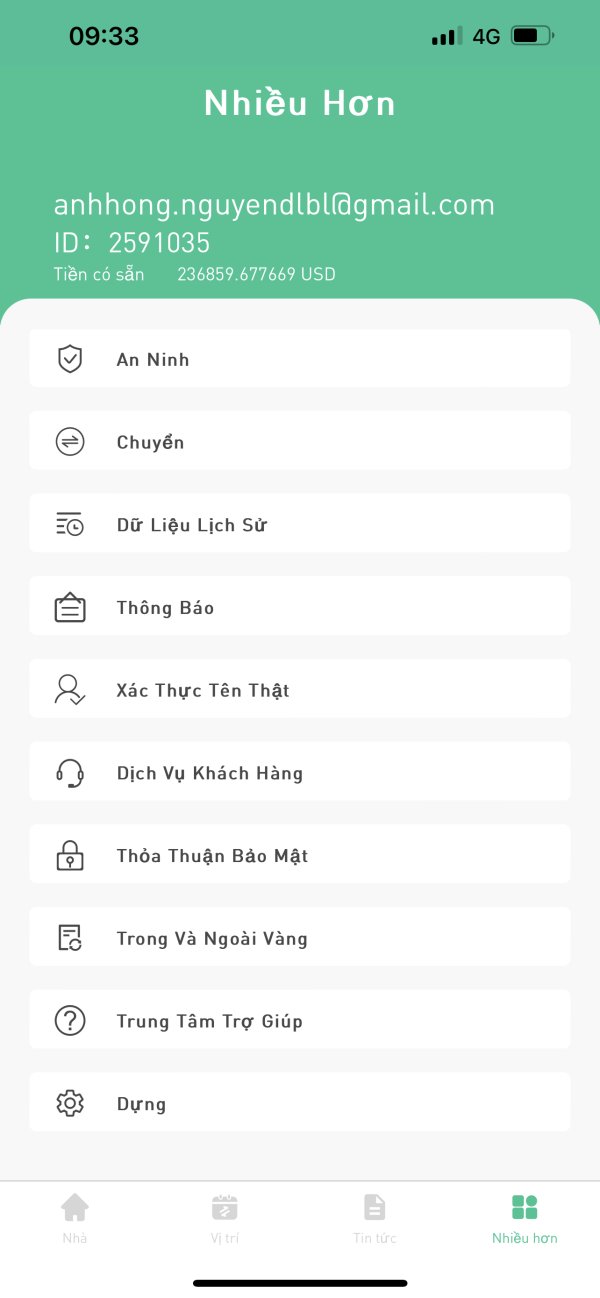

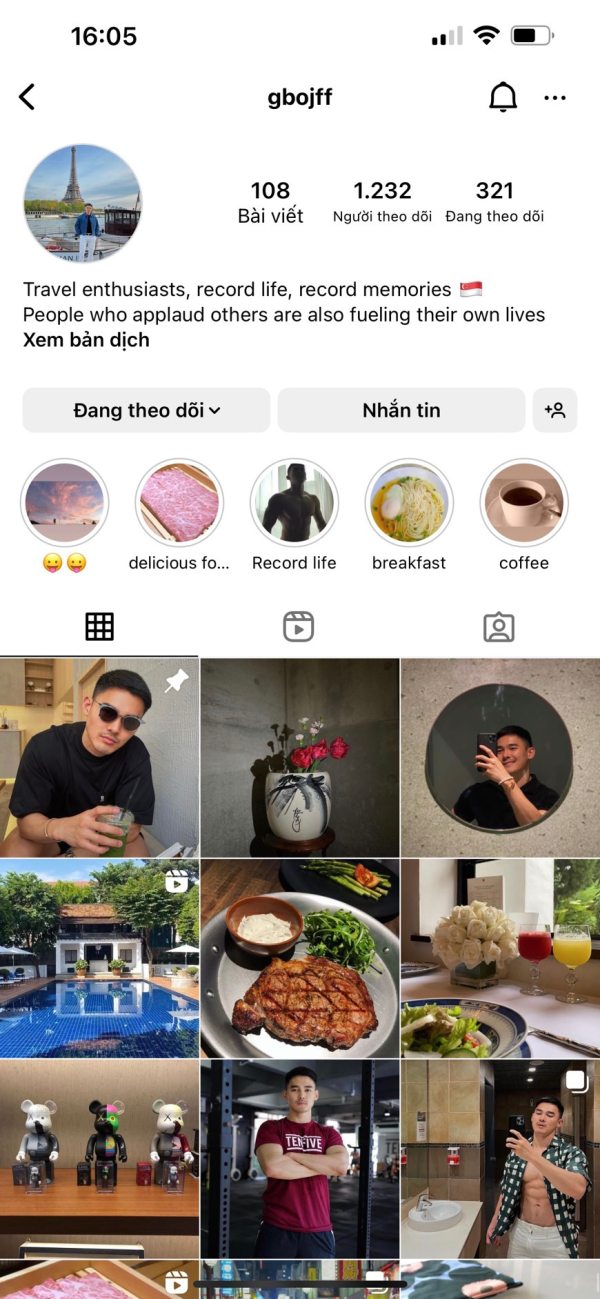

FX3584354274

Vietnam

I participate in forex investment through an acquaintance on the IG network. And there are instructions for me to play Lycux floor. They lured me to borrow on the Lycux system. Now the system requires me to pay the loan to unlock my account. I borrowed $58,100 while my account has more than $20,000. The system requires only depositing, not withdrawing. There are photos with the instructor I participated in and the Instagram account.

Exposure

2023-05-12