Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

xtradingx

Turkey

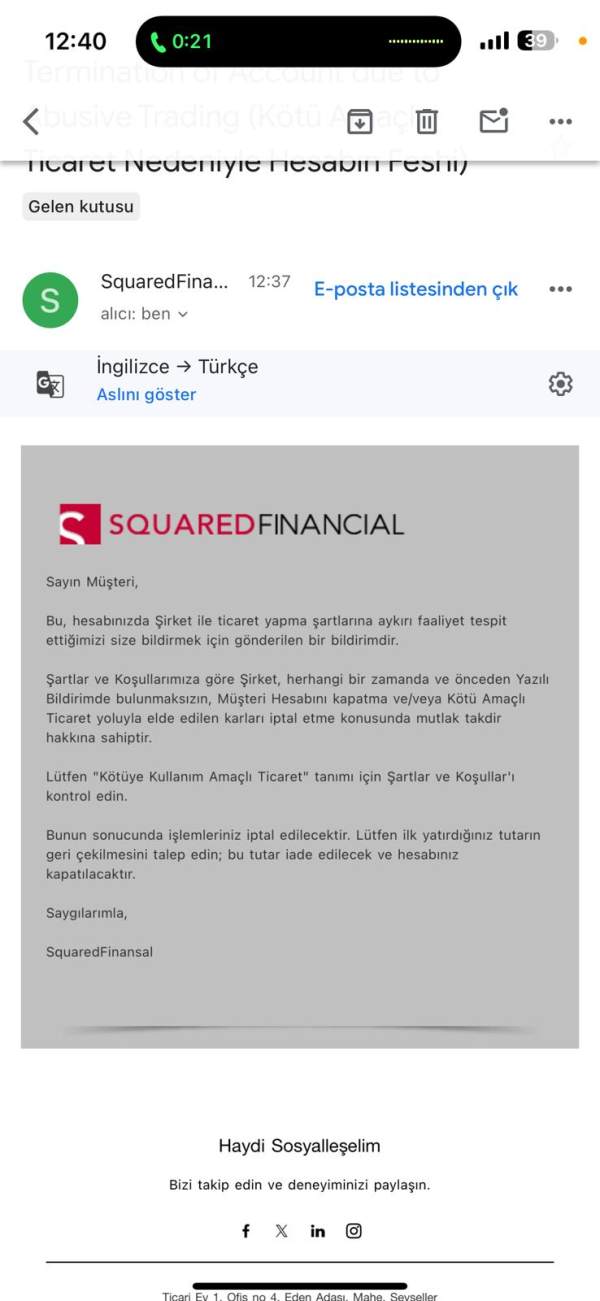

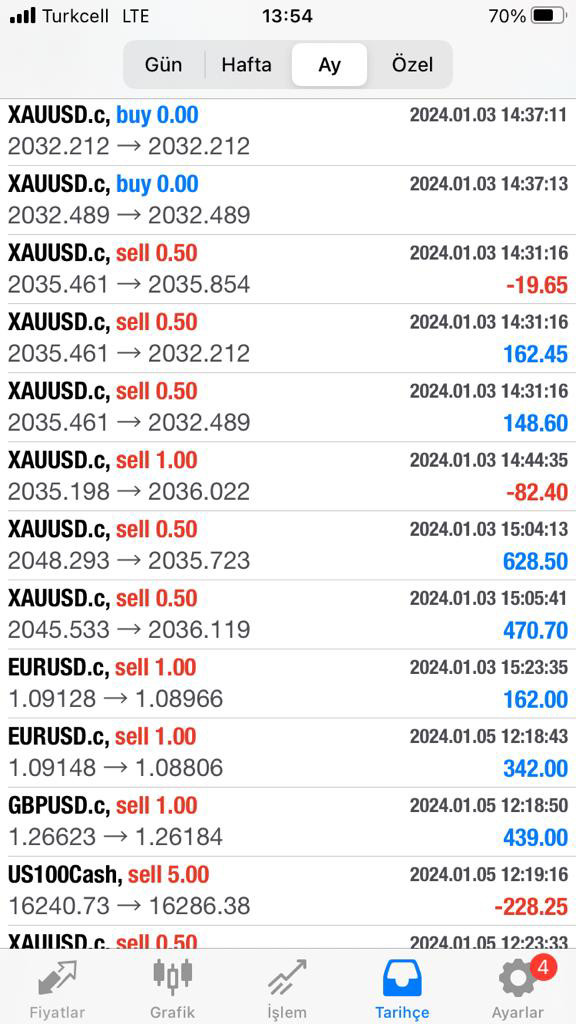

The company called Squared has seized my money and is not paying me. I started trading on Tuesday-Wednesday and I was at a loss on the gold chart and I was making a loss, then there was no problem, then I was always at a loss until Friday, and on Friday at 15:30 or 16:30 there was US data, I was not aware of it, and suddenly there was a profit on the screen, so I closed the transactions, and then they accused me of situations that I did not understand nonsense, cut off communication and confiscated my money. They do not help in any way, they are officially scammers! If this situation continues, my complaints to the relevant licenses and meta system will continue non-stop

Exposure

2024-04-26

FX9602513612

Kazakhstan

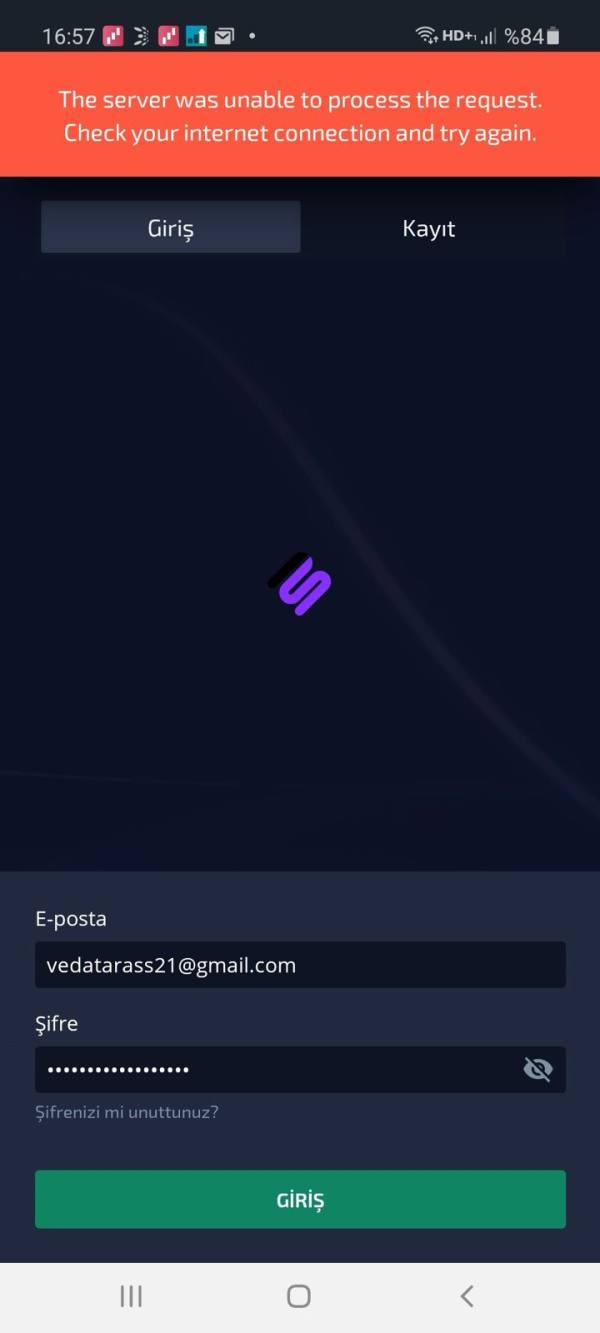

There is a problem with my llan account at this institution. I can neither log in properly nor withdraw money regularly. Someone please help us, we are suffering from this situation now.

Exposure

2024-03-20

FX9602513612

Kazakhstan

I had investments in Squared Financial, but I could not withdraw them. I have money left inside, and I'm not even sure if my account is still valid or not. In short, my money was spent. That's why I wanted to disclose these so that others don't get burned. If you don't work properly, what are you doing to distract people, buddy?

Exposure

2024-03-19

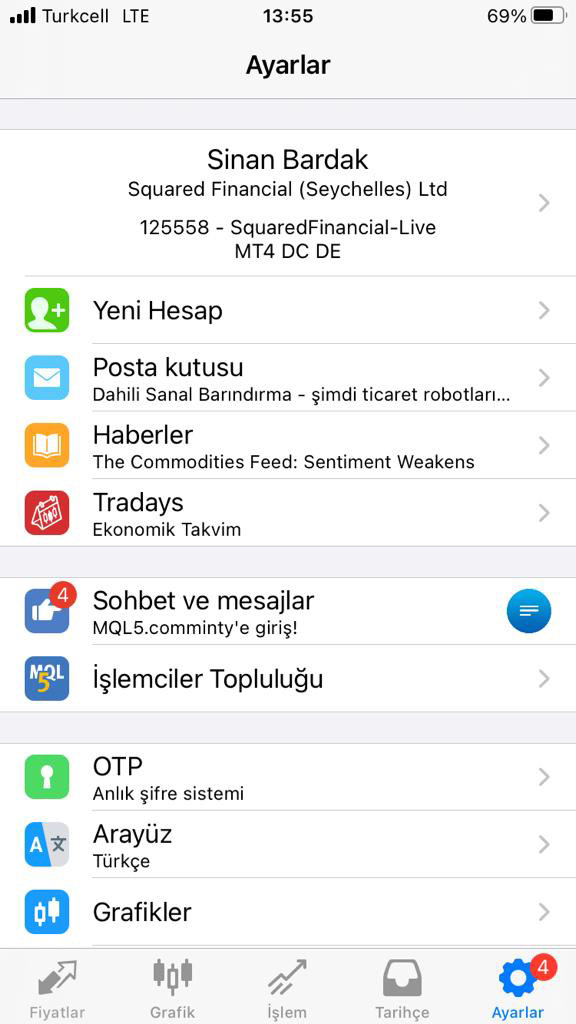

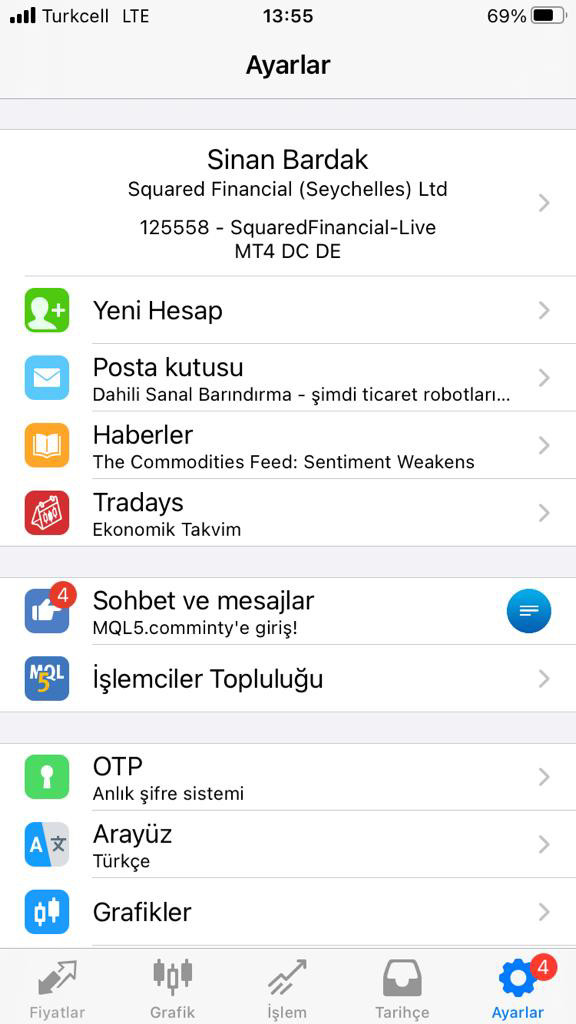

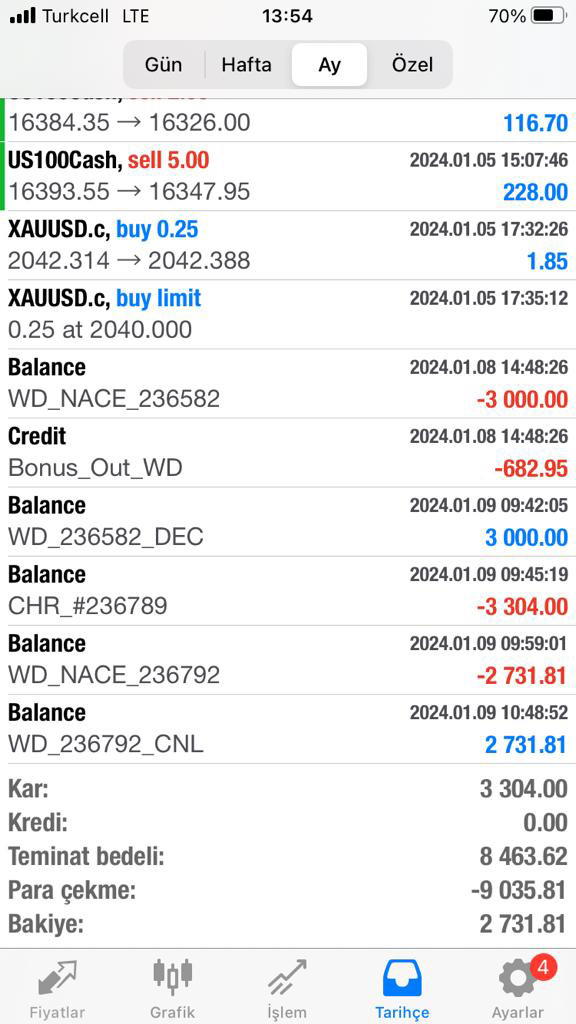

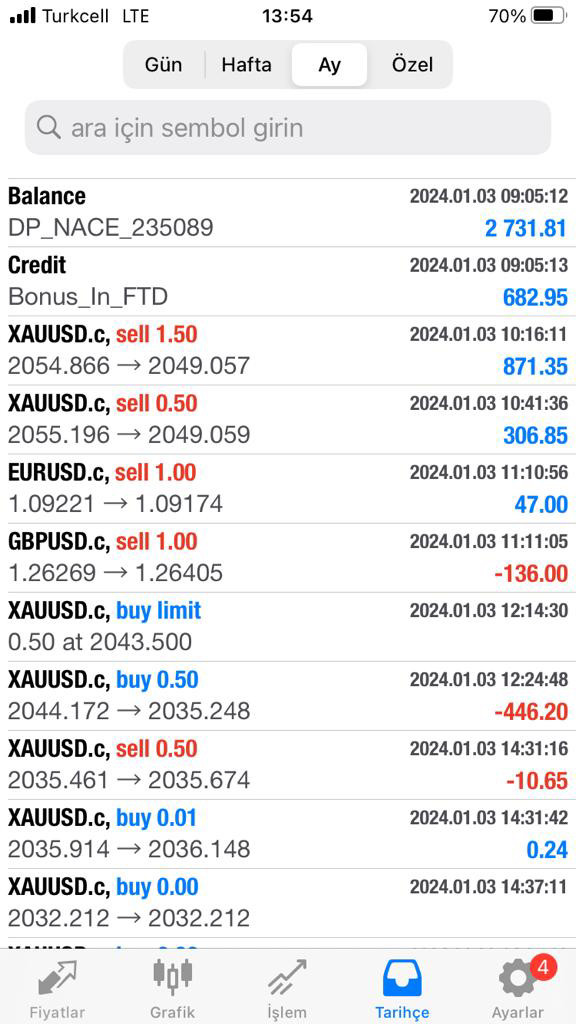

SB7344

Turkey

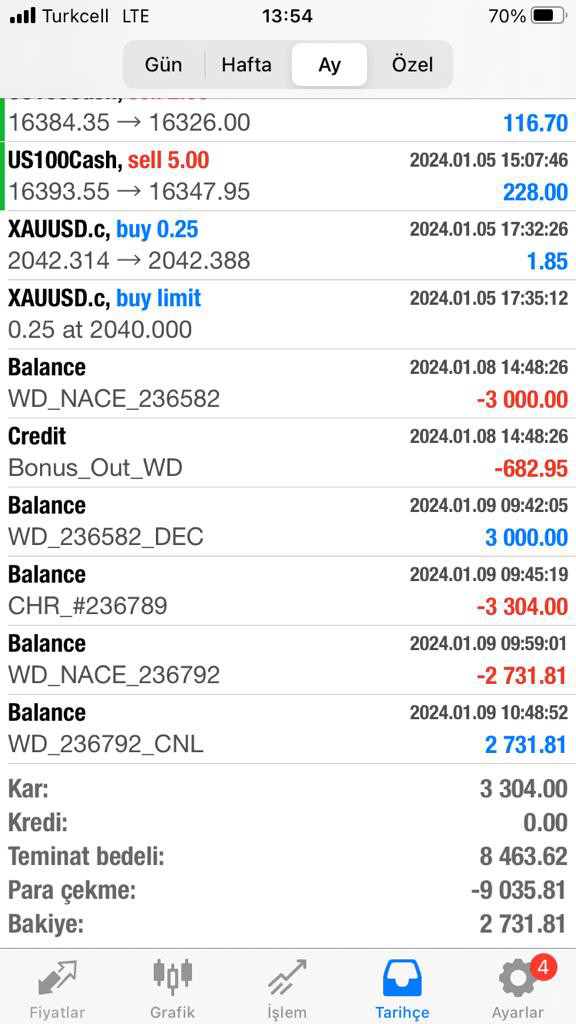

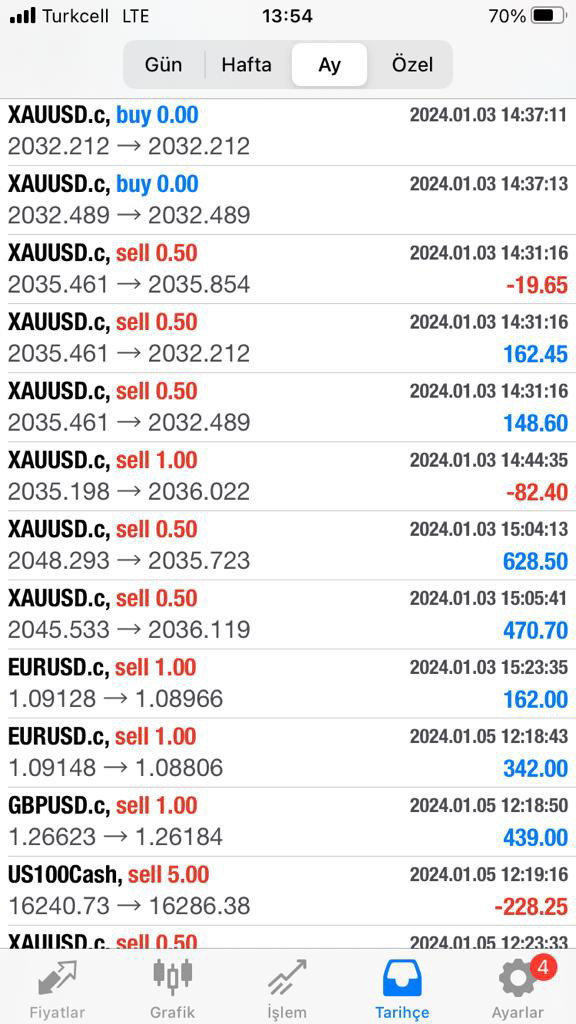

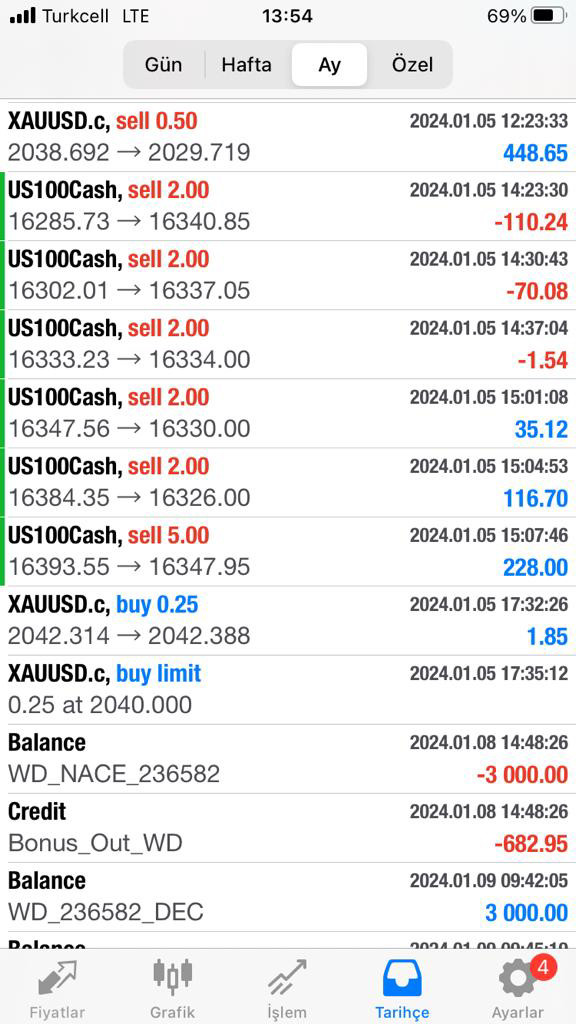

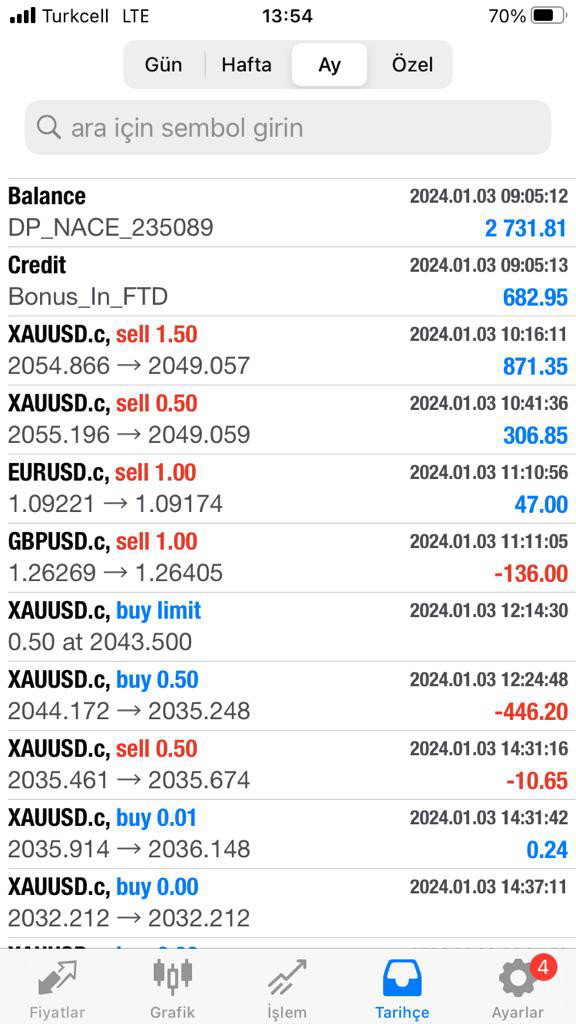

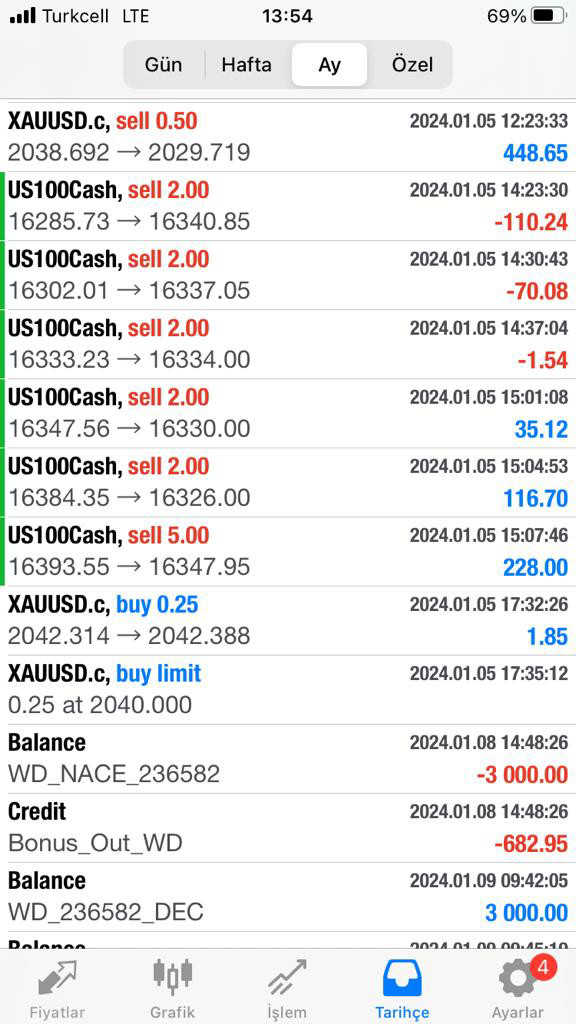

I am the owner of account number 125558 at Squar ed Financial. I invested 2731.81 dollars in the compa ny on 01.03.2024. Then I started trading and my tra ding style was quite normal. By the end of my third day of trading, I had made a total profit of $3304. 0 n 08.01.2024, I requested a withdrawal of 3000 doll ars. On 09.01.2024, a total of 3304 USD profit was deleted from my account due to trading abuse and I was notified that I had to withdraw my principal mo ney. I absolutely deny this. Trading in my acce IS completely consistent with normal market. ts. These are attached with proof.

Exposure

2024-01-14

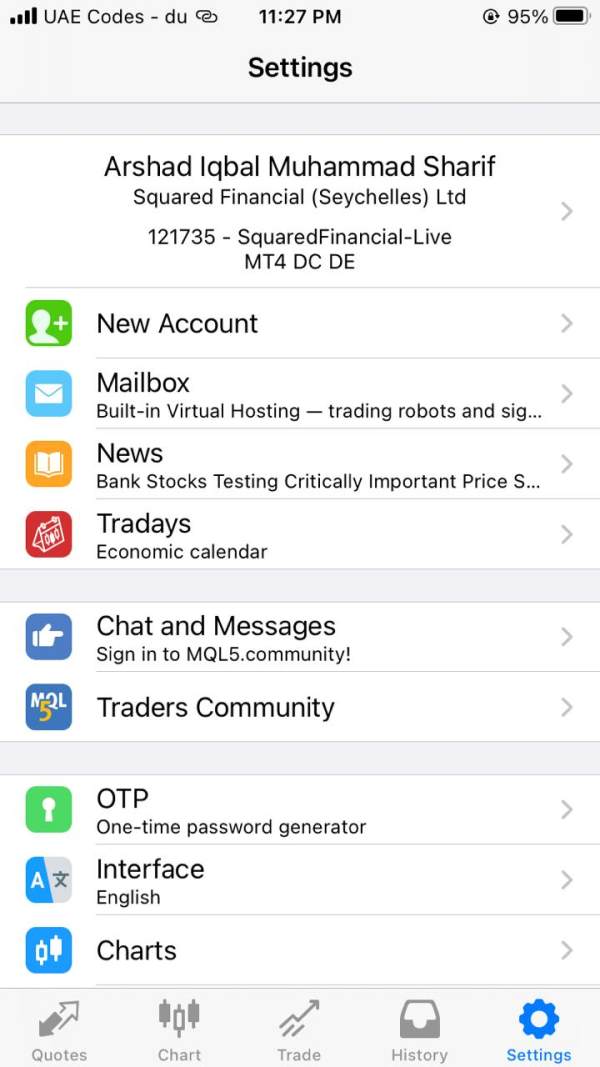

Arshad3622

United Arab Emirates

They deleted my profit which I made doing trade on their platform, I sent them email also regarding this profit deletion, but they just ignore my emails. stay away from this broker.

Exposure

2024-01-12

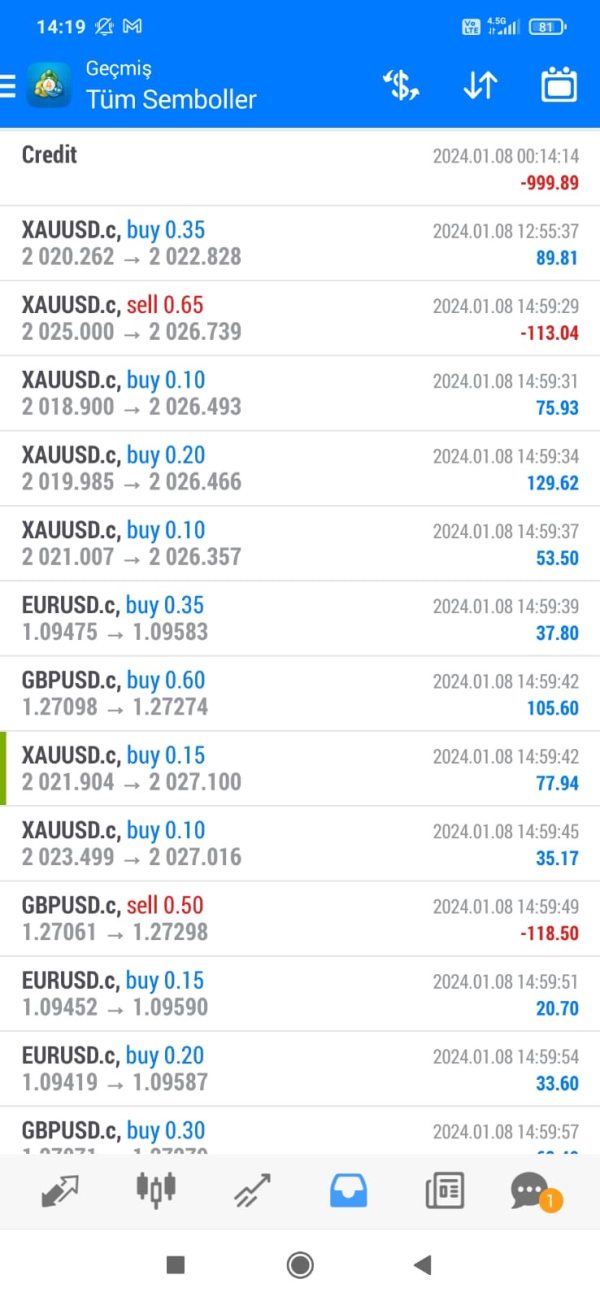

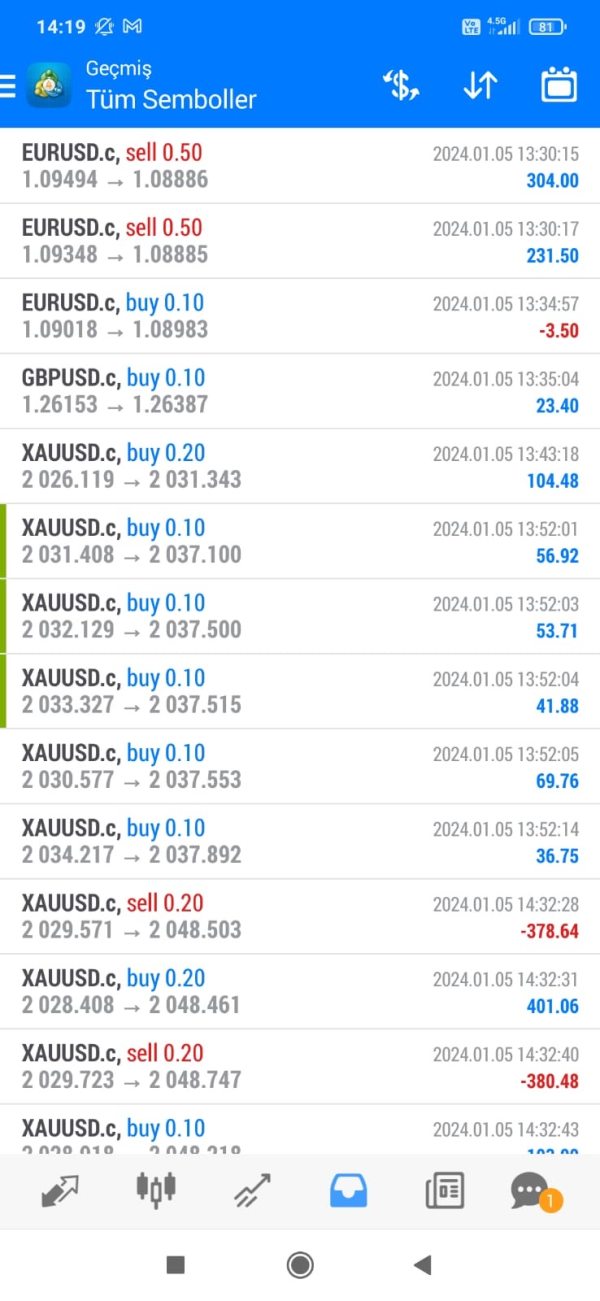

xtradingx

Turkey

Hello, I was making a transaction with a company called Squared, and then they sent me an irrelevant e-mail and deleted my money. They unfairly canceled my entire profit portion by giving a ridiculous reason and mentioning prohibited transactions. And I do not accept this. There was important data in America on 05.01.2024 and I made a profit in this way, then I continued my transactions, but they did the deletion on 09.01.2024, I want the necessary action to be taken, I am experiencing unfair victimization...

Exposure

2024-01-10

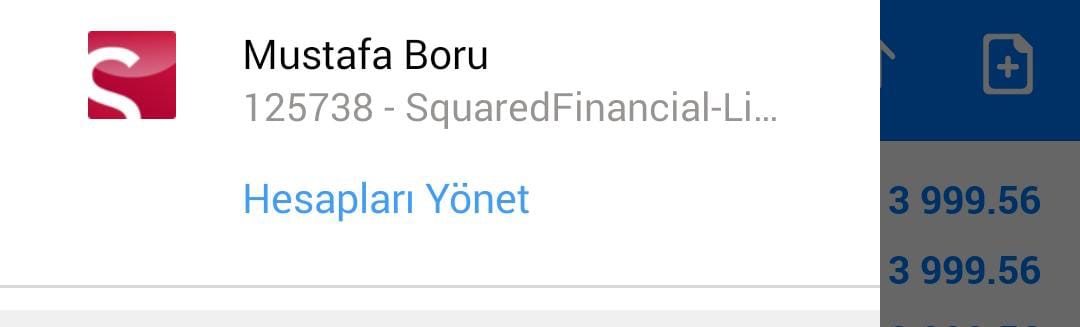

SB7344

Turkey

I am the owner of account number 125558 at Squared Financial. I invested 2731.81 dollars in the company on 01.03.2024. Then I started trading and my trading style was quite normal. By the end of my third day of trading, I had made a total profit of $3304. On 08.01.2024, I requested a withdrawal of 3000 dollars. On 09.01.2024, a total of 3304 USD profit was deleted from my account due to trading abuse and I was notified that I had to withdraw my principal money. I absolutely deny this. Trading in my account is completely consistent with normal market movements. These are attached with proof. Please help me. I have a complaint about this company!!

Exposure

2024-01-09

AbdulBN

United Arab Emirates

I am a regular user of Squared Financial from this year September, everything going fine, then suddenly they delete my $4406.74 profit. I contacted them several time, but they didn't revert it. I want my money back...

Exposure

2023-12-23

Naeem4129

United Arab Emirates

On 26-10-23, $4902 in profit vanished from my trading account without explanation. Despite my compliant trading history, this deletion lacks justification. I urge immediate action and reinstatement of the funds. Your swift resolution is crucial.

Exposure

2023-12-21

Naz4852

United States

Hope you are doing well, my name is Waqas Khan marketing director Drforexofficial and we have also some sites like www.topbrokersreview.com. I used to work for forex as sales Team leader till 2020 in Cyprus . I am writing as I personally experienced unethical activity from Squared Financial. Below I will try to share exact details and I have all evidence , including linkedin conversation with BDM, CEO, CFO and also I called on their support but so far I am not able to get answer showing proof of any illegal activities but just Whatsapp communication from BDM that I will get email from compliance. We opened CPA(cost per account) with them in September as I was approached by M Aysraful BDM through LinkedIn . Aysraful offered CPA and we reached to an agreement , through Whatsapp communication we continued our partnership and we were able to send 5 ftds which were qualifed as per agreement . October 15th once It was time for payment Aysraful mentioned that I missed point and I need to send at least 10 ftds to get paid as per agreement . I checked agreement once again and agreed for same , following month I was able to send 11 Ftds out of 10 were qualified . November 15 came but again I didn't get paid , once I follow up with Aysraful he start telling me that your clients used same IP so your clients are abusers. I request to send me proof for same , but instead providing proof I am keep only getting message that compliance will send me an email . It's been 20 days I didn't get any email showing illegal activities from clients and I didn't get paid for no reason . Meanwhile they send me email end of November that my partner account got deactivated. I sent 3 emails to support , compliance , complaint and adding CFO but no answer yet . I have shared articles on different sites and shared same on my LinkedIn , got to know with different sources that they didn't pay many partners also recently few clients approach me and mentioned that their withdrawals stuck with Squared.

Exposure

2023-12-06

Syed Salman Shah

Pakistan

Dear Traders,I am here to expose this scam broker, squaredfinancial, I register with them in Sept and made a deposit, screenshot has been attached, made profit of 1000, and wanted to withdraw, made the withdrawal request and company declined the request, they terminated my account, both the proofs are attached to this post, I am going to take legal action against their company,

Exposure

2023-11-01

Majid Abdul Malak

United Arab Emirates

Hello,I am here to expose the scam by squaredfinancial, I made adeposit of 1200, screenshot attached to the post, made profit of 1105, and wanted to withdraw, i made the withdrawal and they terminated my account, not giving back my profit and deposit.My account number is MT4: 122007They scammed me for 2305, proofs are attached,

Exposure

2023-10-30

Muhammad Sherazz

Pakistan

Hello Everyone, Scam Alert Squared Financial is a new Scammer broker in the market they are holding withdrawal of many traders as you can see in the screenshot below. So please Be aware everyone don't deposit with this Scammer broker.

Exposure

2023-10-25

FX3091374099

Argentina

The agent told me through a phone call that the information provided was true, and that is why I had to invest 18 soles of which I never saw results, and so far nothing yet

Exposure

2022-03-01

DouZ

Singapore

SquaredFinancial broker offers a sea of trading instruments, charging low fees, and customer support can be available 24/7. I highly recommend you to open a SquaredPro account first to give it a shot, and it won’t disappoint you.

Neutral

2023-02-20

A大大324

Malaysia

This is a super broker and I will continue to trade here

Positive

2023-10-17

David352

Cyprus

I have traded with SquaredFinancial for 2 years now and can honestly say I have never traded with a better broker. They are available every time I need them. The execution and spread is great, they're very friendly on livechat. My account manager is always keeping me up to date. I highly recommend the broker.

Positive

2023-06-19

ゞ→唯ㄨ﹎

South Africa

Sure enough, Forex trading has to be with these brokers who have many years of trading experience! Their customer service team is super professional, and they really have helped me a lot, AWESOME!!!

Positive

2023-02-07

Xingo

Japan

SQUAREDFINANCIAL This company looks great, it has several regulatory licenses, which means that its safety factor is very high... The most important thing I value when trading foreign exchange is safety. I am now going to open a demo account to see how its trading conditions are.

Positive

2022-12-14