Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

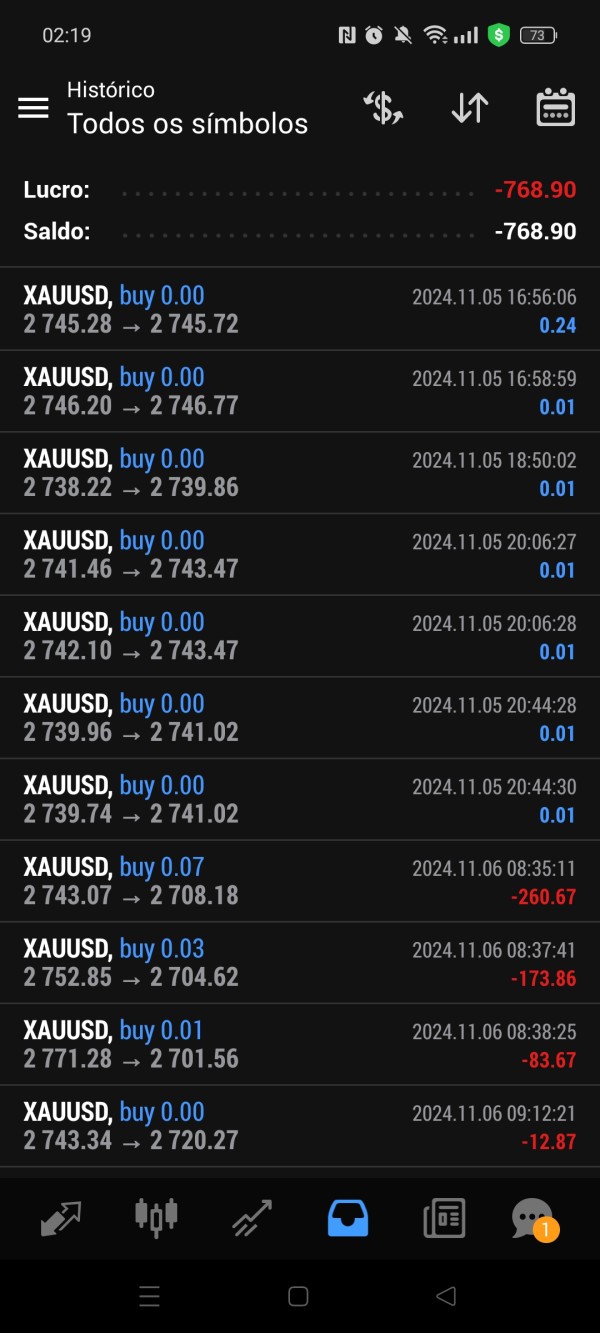

ga270

Brazil

Be very careful with this trader called "Filipe". He is a Portuguese who lives in Cyprus, where he creates his ads for the South American public. He promises to make high profits using his copy. At first, everything seems wonderful, but after a few months of using the copy, he zeroes out your account and steals your money. Then he deletes your social networks and disappears. One thing I think about: He operates by percentage, that is, if he makes 1% on ours, he also makes 1% on his. And his account, as shown, had more than 2 million dollars. So how can he break our accounts and not his? He operates on T4 late. Be very careful with him, he is a scammer. Some Instagram accounts he has used: @bot.forex_ and @profxtrad3r

Exposure

2024-11-14

FX1801757003

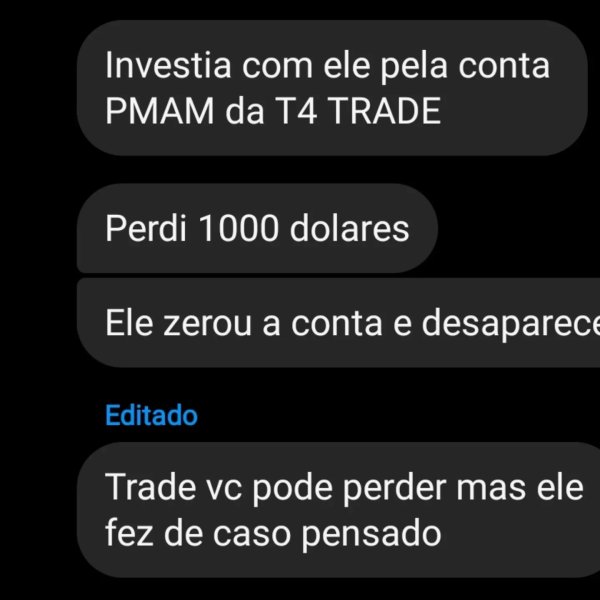

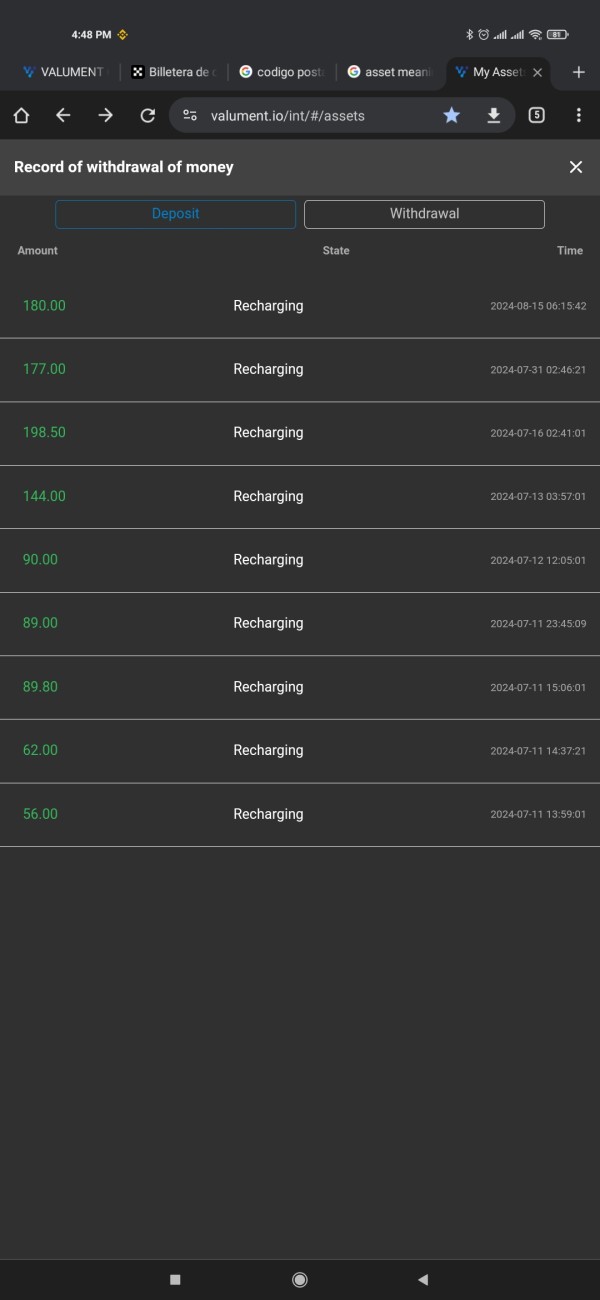

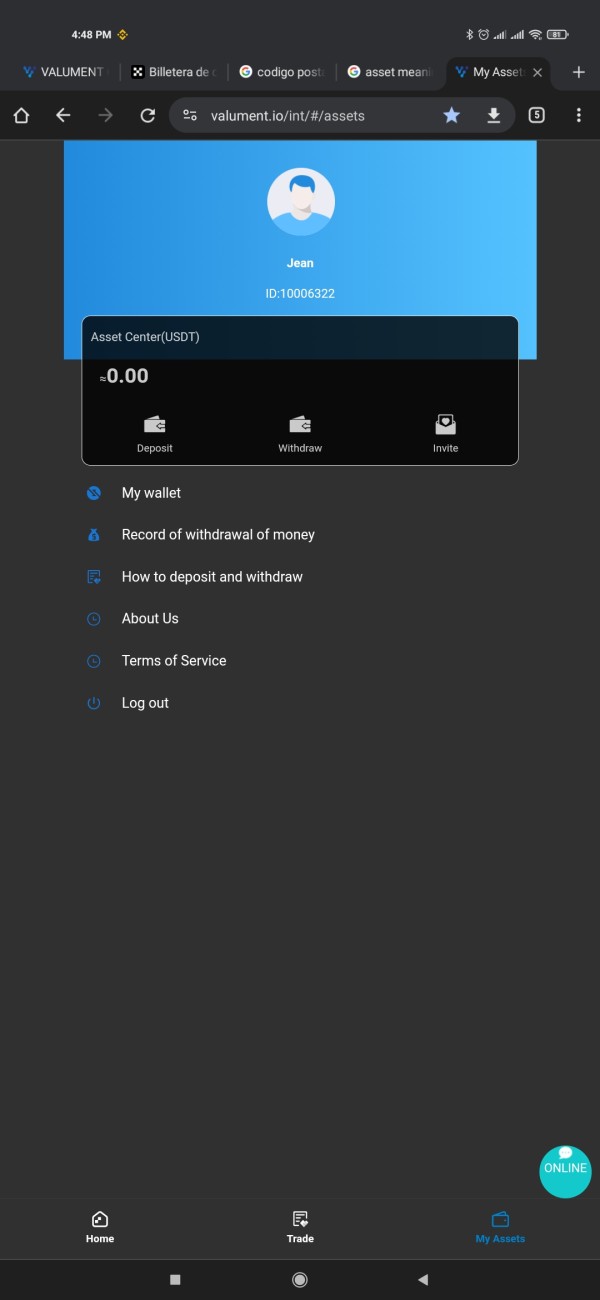

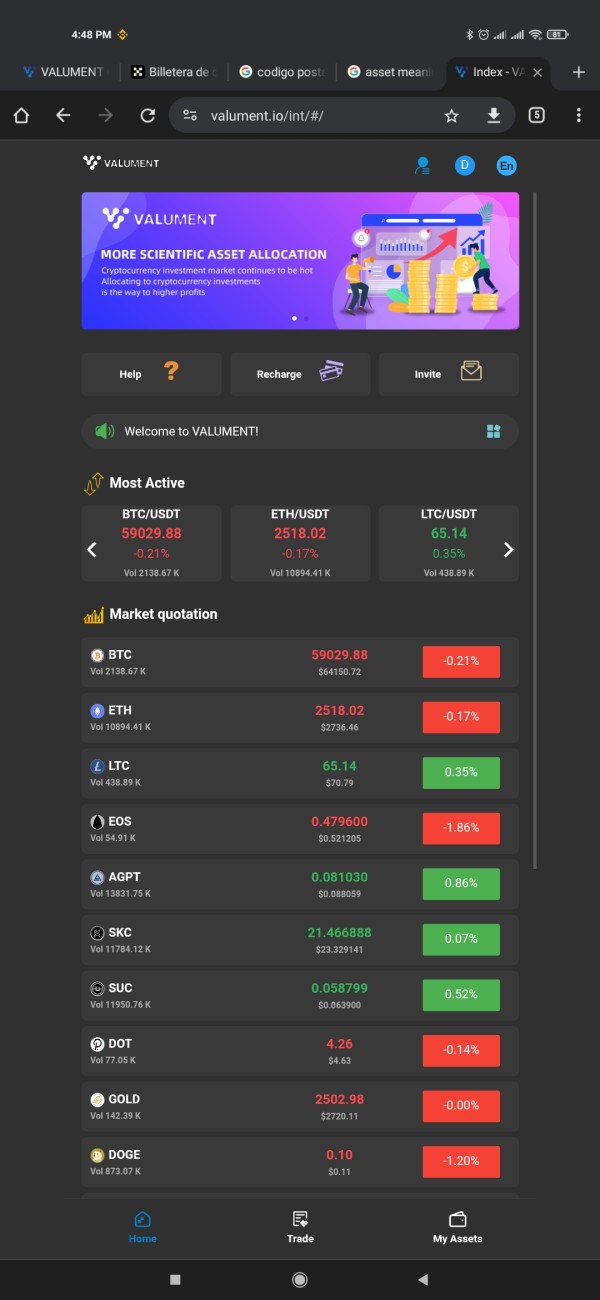

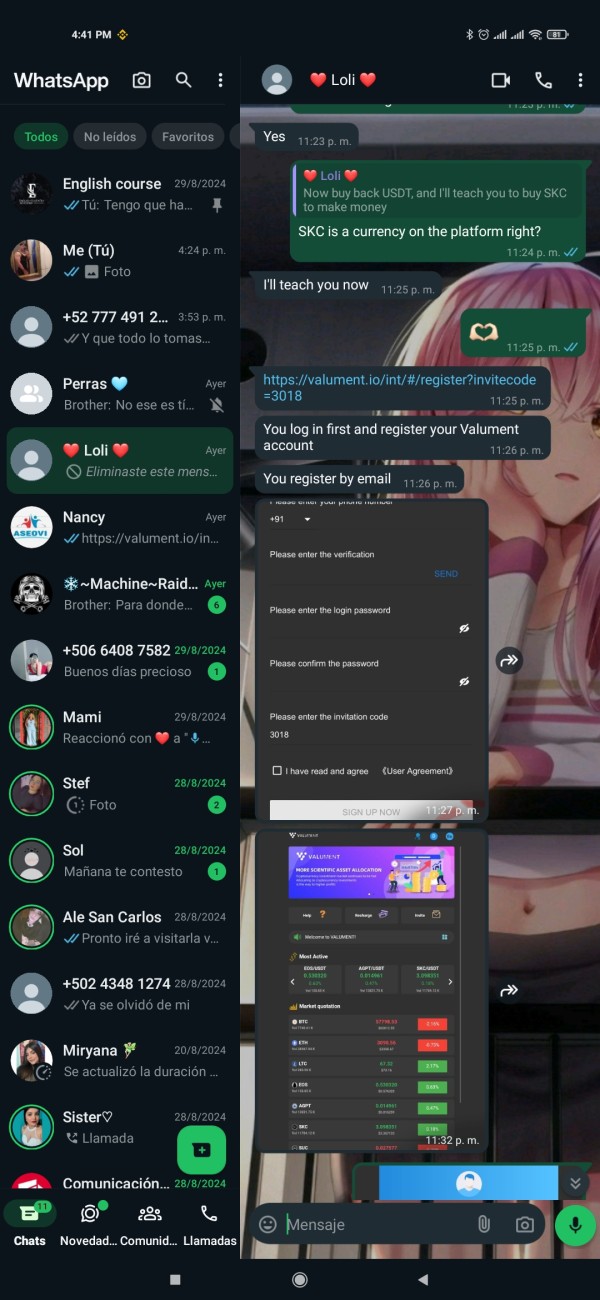

Costa Rica

They made me deposit 1,086 dollars into a wallet called valument and now I can't transfer the money back because they are clearly scammers. Please help, it's all my savings and it's very hard for me to earn money :(

Exposure

2024-09-02

FX2369960581

Hong Kong

I was trading normally on t4. After I made a profit, t4 deleted my profits on the grounds of illegal operations. My profitable orders were held for more than 24 hours, and there were no hedging, order brushing or other illegal operations. Please verify carefully. You deleted my order for 1 minute holding. That’s it. Please return my profits. Is it okay for your platform to make losses, but making profits through normal transactions is a violation?

Exposure

2024-01-18

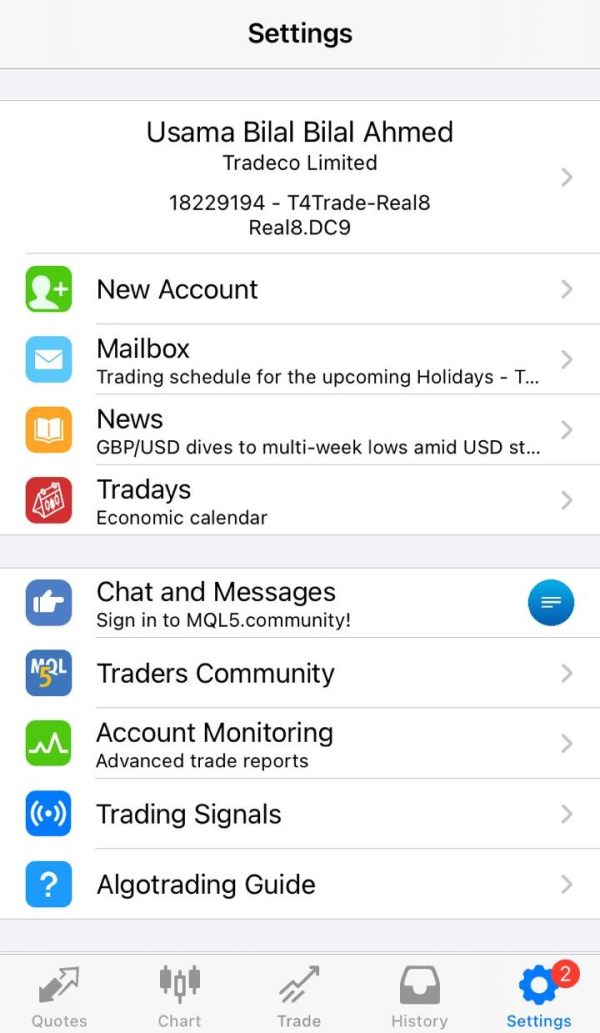

Usama4353

United Arab Emirates

I have a issue of profit deletion and I am contacting them to give it back, but there is no positive response from them. I just my money back.

Exposure

2023-12-20

Jinna3418

Hong Kong

After being introduced by a friend, I opened an account to trade on t4trade, and then the nightmare came. Don’t use this crappy and black platform. They don’t give out money on profit-making accounts. They will find various reasons to make things difficult for you. All my transaction orders have no trace. The problem is that they are all my own trading profits. The platform has been unable to give clear evidence and reasons from beginning to end, and it cannot prove that my transactions are illegal. Where are the violations in my transactions? Can you post my account transaction records? I will reserve the right to further protect my own rights and interests. If you still want to survive in this market, please treat every customer who trusts you carefully. You can terminate cooperation with me, but trading profits are all obtained through technical analysis. Profit, please pay off all the principal and profit before you can terminate the cooperation.

Exposure

2023-11-17

风雨人

Hong Kong

The platform is too bad. It's okay to lose money on your account, but it's not okay to make a profit. I made some money, but I was told that the transaction was illegal and I could not withdraw the profits. There are no problems with all the orders in my account. They are all regular transactions. I can only say that this platform is terrible.

Exposure

2023-10-17

风雨人

Hong Kong

Choose this platform carefully. It’s no problem if your account loses money. If your account makes a profit, find a reason not to make a withdrawal.

Exposure

2023-09-18

Omar 2723

Turkey

Hello, I have opened an account with this company, t4, and my money has been stolen, 25 thousand US dollars. I advise everyone not to deal with this company.

Exposure

2023-08-28

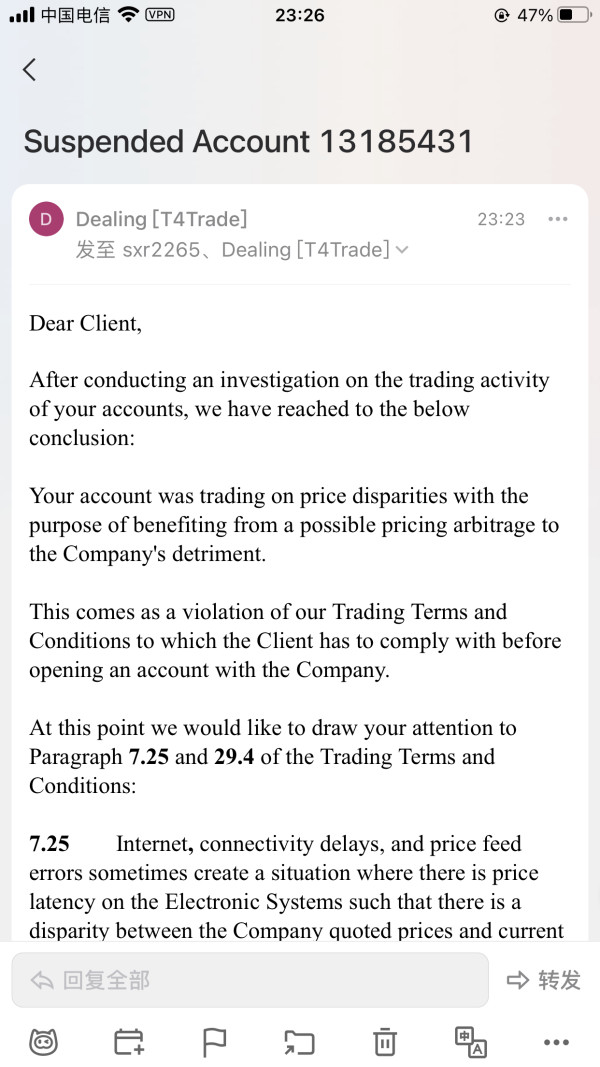

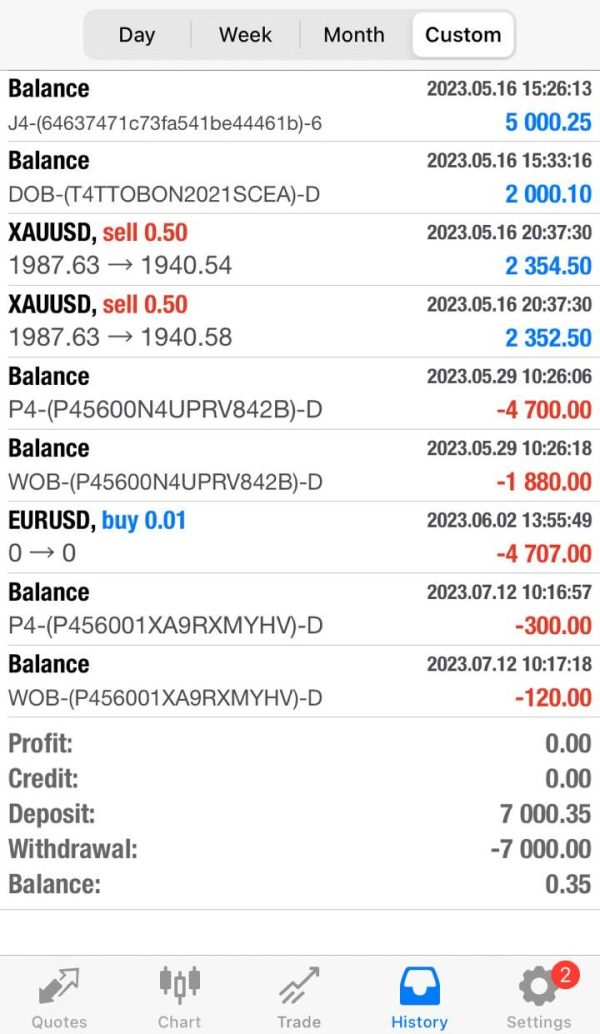

杰杰2841

Hong Kong

Garbage platforms deduct money directly and unable to withdrawal, everyone be careful, see the picture for evidence.

Exposure

2023-07-14

杰杰2841

Hong Kong

An email said I violated the regulations, and my money was deducted directly, and I was not allowed to withdraw money. Is there such a black platform?

Exposure

2023-06-22

杰杰2841

Hong Kong

An email said I violated the regulations, and my money was deducted directly, and I was not allowed to withdraw money. Is there such a black platform?

Exposure

2023-06-22

尼古拉斯24495

Hong Kong

Unable to withdraw money, the account has been failed to log in, and the profit will be deducted. Can't get in touch with the platform now.

Exposure

2023-06-15

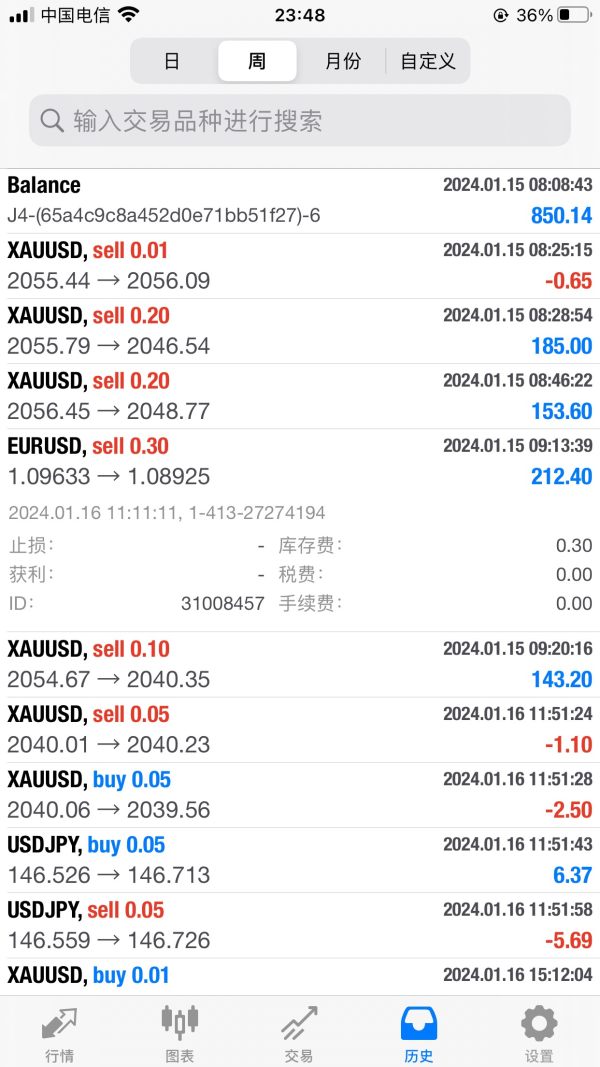

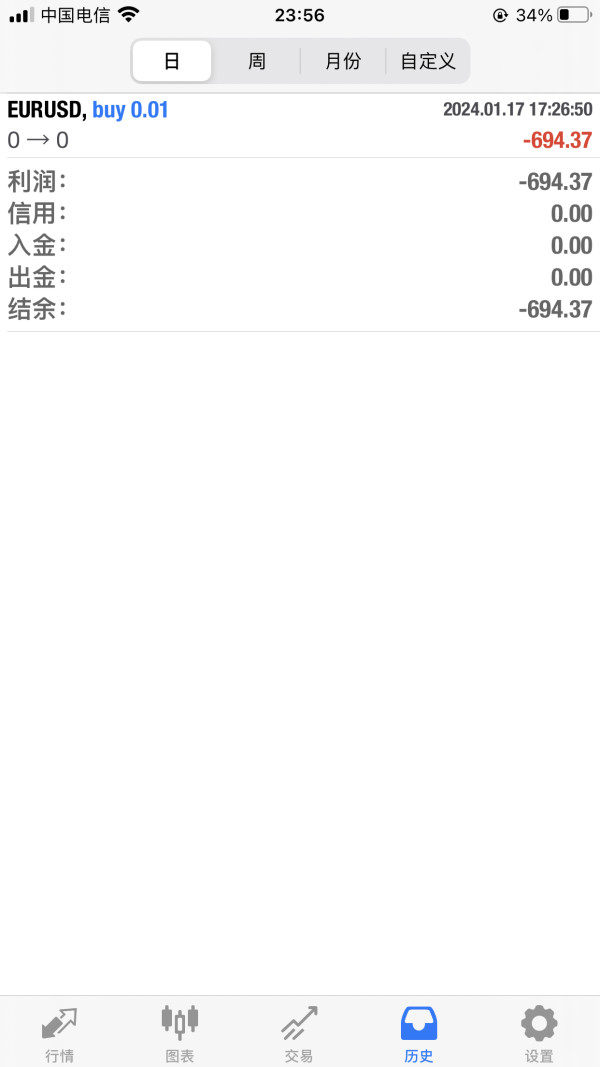

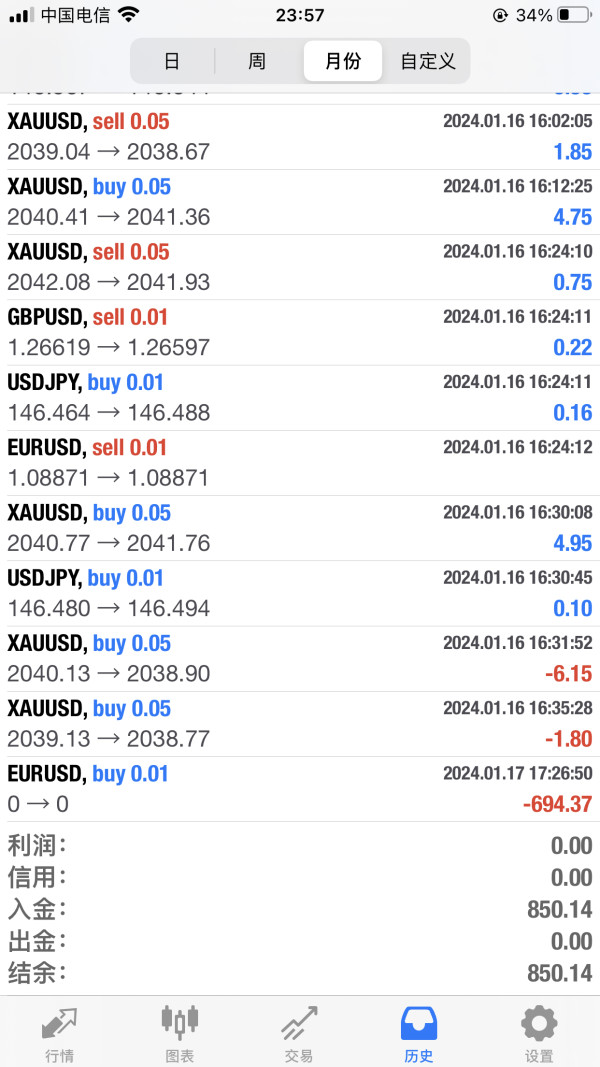

刘灿

Hong Kong

I made a deposit of 1,000 US dollars and made a profit of 1,979 US dollars. The platform deducted the profit and said that I was trading illegally. I posted my order for you to check if there was any violation. Then the sales blocked me.

Exposure

2023-06-07

尼古拉斯24495

Hong Kong

The platform refused to withdraw the funds many times, and kept looking for various reasons, and no one responded to the contact with the T4 staff. I have applied for withdrawals three times, but have always refused.

Exposure

2023-05-29

Bōmëoκ

Hong Kong

My principal has a loss, but the withdrawal is still not proceeding for a long time. No reply to the email. The customer service always delays it. It has been two weeks and the withdrawal still not proceed

Exposure

2023-05-13

FX2256562854

Hong Kong

I made a deposit to make gold, and I made two waves a few days ago. The platform said that I violated the rules and refused to withdraw the gold. There was no order and no hedging. Black platform! Now the opening and closing of the account is delayed for three or four seconds, deliberately chucking the card to prevent me from trading normally!

Exposure

2023-04-12

一小点

Hong Kong

I normally trade in the swing, and the result is that the profit is not given, and the loss can only be recognized! After a week of negotiation, all kinds of prevarications and malicious definitions! Change Order! No money is given!

Exposure

2023-03-28

Breeze54375

Hong Kong

The money has been deducted and passed review,but the payment is not made yet. It's been a while but they still haven't made payment. they claim payment will arrive after a few minutes, but it has been several days,still not arrived.

Exposure

2022-10-04

FX3622982718

Turkey

I made an investment and then I wanted to make a withdrawal they confiscated my money they do not send money stay away from this company and do not deposit money

Exposure

2022-08-24

Atahan03

Turkey

Yesterday I became a member for the first time and invested 2000 usd. I made a profit of 2000 usd and gave a withdrawal request. They said that there was a problem with my transactions and confiscated my profit on the same day. stay away from this company. I know the market very well and I can say that this company is a scammer. They said they could delete my profit from the commodity and send the rest of my money as if nothing had happened.

Exposure

2022-08-23