Score

FinFX-Pro

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://finfxpro.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed FinFX-Pro also viewed..

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Website

finfxpro.com

Server Location

United States

Website Domain Name

finfxpro.com

Server IP

31.170.166.120

Company Summary

Note: Regrettably, the official website of FinFX-Pro, namely https://finfxpro.com/, is currently experiencing functionality issues.

| FinFX-Pro Review Summary | |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex currency pairs, gold, silver, oil, cryptocurrencies, and index CFDs |

| Leverage | 1:400 (Std) |

| EUR/ USD Spread | 0.7 pips (Std) |

| Trading Platforms | MT4 and MT5 |

| Minimum Deposit | $5 |

| Customer Support | Phone and email |

What is FinFX-Pro?

FinFX-Pro is a trading platform that offers services in Forex and CFD trading, with a range of market instruments. The broker operates with registration in the United Kingdom but is unregulated. They offer trading on MT4 and MT5 platforms and provide customer support via phone and email. Please note that there have been reports of scams associated with FinFX-Pro.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros of FinFX-Pro:

- Range of trading instruments: FinFX-Pro offers a variety of trading instruments including forex currency pairs, gold, silver, oil, cryptocurrencies, and index CFDs, providing traders with diverse investment opportunities.

- Support for MT4 and MT5: The availability of popular trading platforms like MT4 and MT5 can offer traders a familiar and feature-rich trading experience with access to a wide range of tools and resources.

- Flexible leverage: FinFX-Pro provides flexible leverage options for their different accounts, allowing traders to potentially amplify their trading positions and increase their profit potential, albeit with increased risk.

Cons of FinFX-Pro:

- Reports of scam: There have been reports of scams associated with FinFX-Pro, indicating a potential lack of trustworthiness and reliability in their operations.

- Inaccessible website: The unavailability of FinFX-Pro's official website raises concerns about the platform's reliability, maintenance, and overall operational stability, potentially impacting traders' ability to access essential information and services.

- No legitimate forex license: The fact that FinFX-Pro operates without a legitimate forex license means that it is unregulated and not subject to the oversight and investor protection measures typically provided by regulatory authorities.

- Limited trust and transparency: The combination of being unregulated, reports of scams, and an inaccessible website can contribute to a lack of trust and transparency surrounding FinFX-Pro, potentially deterring traders from engaging with the platform due to uncertainties about the safety of their investments and the legitimacy of the services offered.

Is FinFX-Pro Safe or Scam?

As FinFX-Pro currently lacks valid regulation, it means that there is no government or financial authority overseeing and supervising their operations. This absence of regulatory oversight poses significant risks for investors, as there are no established mechanisms in place to ensure transparency, financial stability, and investor protection within the broker's operations. Without regulatory scrutiny, there is a heightened potential for misconduct, fraudulent practices, and mismanagement of funds by the platform.

Furthermore, the unavailability of FinFX-Pro's official website raises serious concerns about the reliability and stability of their trading platform. The inaccessibility of the website can signify technical issues, lack of maintenance, or even potential operational problems within the company. This lack of transparency and communication from the broker can erode trust and confidence among investors, further exacerbating the uncertainty and risks associated with investing in FinFX-Pro.

These combined factors significantly contribute to an elevated level of risk when considering investing with FinFX-Pro. Investors should exercise caution and thorough due diligence before engaging with an unregulated and potentially unreliable broker like FinFX-Pro.

Market Instruments

FinFX-Pro offers a diverse range of trading instruments, including:

- Forex Currency Pairs: These are pairs of currencies that can be traded against each other in the foreign exchange market, such as EUR/USD, GBP/JPY, or AUD/CAD.

- Gold and Silver: Precious metals like gold and silver are also available for trading on FinFX-Pro's platform. These commodities are often seen as safe-haven assets and are traded by investors and traders alike.

- Oil: Crude oil is a popular commodity for trading due to its significant impact on the global economy. Traders can speculate on the price movements of oil through instruments offered by FinFX-Pro.

- Cryptocurrencies: FinFX-Pro allows traders to access the volatile yet potentially lucrative cryptocurrency market, with popular options like Bitcoin, Ethereum, and Litecoin available for trading.

- Index CFDs: These are contracts for difference based on the performance of stock market indices such as the S&P 500, NASDAQ, or FTSE 100. Traders can invest in the overall performance of a specific market index without owning the underlying assets.

Account Types

FinFX-Pro offers a range of account types to cater to different trading preferences and needs.

Micro Account:

- Minimum Deposit: $5

- This account type is designed for traders who are new to the market or prefer to start with a smaller investment.

- It allows traders to access the financial markets with a low initial deposit, making it an accessible option for beginner traders.

Standard STP Account:

- Minimum Deposit: $100

- This account type provides traders with access to Straight Through Processing (STP) execution, offering competitive spreads and fast trade execution.

- It is suitable for traders looking for standard trading conditions with a moderate initial investment requirement.

Pure ECN Account:

- Minimum Deposit: $200

- The Pure ECN account offers traders access to Electronic Communication Network (ECN) trading, providing direct access to liquidity providers.

- This account type is ideal for traders who require deep liquidity, market transparency, and low latency in their trades.

VIP Account:

- Minimum Deposit: $25,000

- The VIP account is tailored for high-net-worth individuals and experienced traders who demand premium trading conditions and personalized services.

- It offers exclusive benefits, such as lower spreads, dedicated account managers, and priority customer support.

Islamic Account:

- Minimum Deposit: $200

- The Islamic account complies with Sharia law principles by offering swap-free trading for Muslim traders who cannot earn or pay interest.

- It provides access to the same trading conditions as other account types but without swap charges.

| Account Type | Minimum Deposit |

| Micro | $5 |

| Standard STP | $100 |

| Pure ECN | $200 |

| VIP | $25,000 |

| Islamic | $200 |

Leverage

FinFX-Pro offers varying leverage options for different types of accounts.

| Account Type | Maximum Leverage |

| VIP Account | 1:100 |

| Islamic Account | 1:200 |

| Micro Account | 1:400 |

| Standard STP Account | |

| Pure ECN Account |

While high leverage can magnify profits, it also significantly increases the level of risk involved in trading. Traders should exercise caution and carefully consider their risk tolerance and trading strategies when selecting leverage levels. Proper risk management practices, such as using stop-loss orders and appropriate position sizing, are crucial in mitigating the risks associated with high leverage trading.

Spreads & Commissions

FinFX-Pro offers a range of spreads and commissions tailored to different types of accounts to accommodate the diverse needs of traders.

For Standard STP accounts, spreads start from 0.7 pips with no commissions, providing a straightforward cost structure for traders seeking competitive pricing. Micro accounts feature spreads starting at 0.2 pips alongside commissions of $4 per standard lot, offering a balance between tight spreads and low transaction costs for traders with smaller trading volumes.

Pure ECN and VIP accounts at FinFX-Pro boast spreads starting at 0 pips, with Pure ECN accounts charging $4 per standard lot in commissions and VIP accounts levying a commission of $2 per standard lot. This pricing model caters to traders looking for direct market access and institutional-grade trading conditions while maintaining cost-effective trading.

Islamic accounts at FinFX-Pro offer spreads starting from 1 pip without any commissions, ensuring compliance with Sharia law and providing swap-free trading options for Muslim traders. FinFX-Pros transparent fee structure allows traders to select an account type that aligns with their trading preferences and requirements, empowering them to make informed decisions to optimize their trading strategies and performance.

| Account Type | Spreads | Commissions per Standard Lot |

| Standard STP | Starting from 0.7 pips | No commissions |

| Micro | Starting from 0.2 pips | $4 |

| Pure ECN | Starting from 0 pips | $4 |

| VIP | Starting from 0 pips | $2 |

| Islamic | Starting from 1 pip | No commissions |

Trading Platforms

FinFX-Pro provides its clients with access to the widely popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, offering traders a robust and user-friendly trading experience.

MT4

The MT4 platform is known for its intuitive interface, advanced charting tools, and customizable trading capabilities, making it a preferred choice for traders of all skill levels. With features such as automated trading through Expert Advisors (EAs) and a vast library of technical indicators, MT4 allows traders to implement and test various trading strategies efficiently.

MT5

On the other hand, the MT5 platform offered by FinFX-Pro builds upon the foundation of MT4 with enhanced features and capabilities tailored for more sophisticated trading needs. MT5 provides additional timeframes, more technical indicators, and an economic calendar integrated directly into the platform, enabling traders to access a broader range of market analysis tools. Moreover, MT5 supports more order types and asset classes, making it suitable for traders looking to diversify their portfolios and engage in more comprehensive trading activities.

Deposits & Withdrawals

FinFX-Pro provides a convenient and flexible system for both depositing and withdrawing funds to and from trading accounts. Traders can easily make deposits using a variety of methods, including credit cards like VISA and MasterCard, popular e-wallets such as Neteller and Skrill, traditional bank transfers, and even cryptocurrencies like Bitcoin. This diverse range of payment options allows traders to choose the method that best suits their preferences and needs.

When making a deposit, traders can simply log in to their FinFX-Pro account, navigate to the deposit section, and select their preferred payment method. They can then follow the on-screen instructions to complete the deposit process, with funds usually reflecting in their trading account shortly thereafter.

Similarly, withdrawing funds from a FinFX-Pro account is a straightforward process. Traders can initiate withdrawal requests via the platform, selecting their desired withdrawal method from the available options.

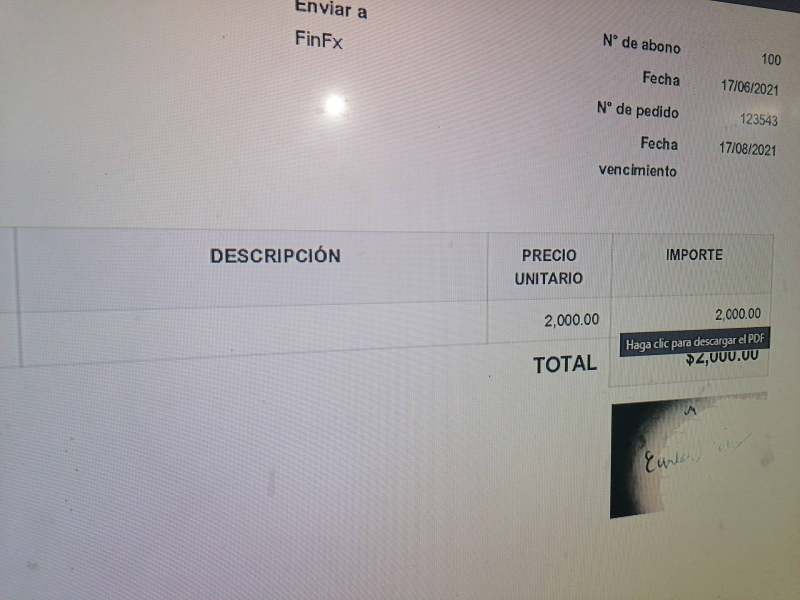

User Exposure on WikiFX

On our website, you can see a report of scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can get in touch with customer service line using the information provided below:

Telephone: +44 7452240979

Email: support@finfxpro.com

Conclusion

In summary, while FinFX-Pro offers a range of trading instruments, supports popular trading platforms, and provides flexible leverage options, potential drawbacks such as reports of scams, an inaccessible website, lack of legitimate forex license, and limited trust and transparency may pose significant risks and concerns for traders considering investing with the platform. Traders should carefully weigh these pros and cons before deciding whether to engage with FinFX-Pro for their trading activities.

Frequently Asked Questions (FAQs)

| Q 1: | Is FinFX-Pro regulated by any financial authority? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at FinFX-Pro? |

| A 2: | You can contact via telephone: +44 7452240979 and email: support@finfxpro.com. |

| Q 3: | What is the minimum deposit for FinFX-Pro? |

| A 3: | The minimum initial deposit to open an account is $5. |

| Q 4: | What platform does FinFX-Pro offer? |

| A 4: | It offers MT4 and MT5. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 3

Content you want to comment

Please enter...

Comment 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now