Overview of Swift Trader

Swift Trader is a recently established trading company based in Comoros. Despite being unregulated, it offers a wide array of market instruments including Foreign Exchange, Cryptocurrency CFDs, Commodity, Stock Indices, and Stock CFDs. Traders can choose from various account types including Standard, Mini, Micro, Pro, and ECN for different trading preferences.

The minimum deposit required is $50, making it accessible to traders with varying capital levels. With a maximum leverage of 1:1000, Swift Trader provides ample trading opportunities. Traders can utilize the MT5 trading platform, known for its advanced features and versatility.

Customer support is offered through live chat and email, ensuring readily accessible assistance. Deposit and withdrawal options include Credit Cards, Bank Transfers, Electronic Wallets, and Encrypted Assets, providing flexibility and convenience to traders.

Regulatory Status

Swift Trader operates as an unregulated trading platform. Unregulated institutions may operate in legal gray areas or without clear regulatory guidelines. This can lead to uncertainty regarding the legality of their operations, making it difficult for investors to seek recourse in case of disputes or malpractice.

Pros and Cons

Pros:

Wide Range of Market Instruments: Swift Trader offers a selection of market instruments including Foreign Exchange, Cryptocurrency CFDs, Commodities, Stock Indices, and Stock CFDs, providing traders with ample opportunities for diversification and profit potential.

Variety of Account Types: With Standard, Mini, Micro, Pro, and ECN account types available, Swift Trader appeals to traders of all experience levels and risk appetites, offering flexibility and choice in trading.

Low Minimum Deposit: The minimum deposit requirement of $50 makes Swift Trader accessible to a wide range of traders, including those with limited capital, enabling them to start trading with a relatively small investment.

High Maximum Leverage: Swift Trader offers maximum leverage of 1:1000, allowing traders to amplify their trading positions and potentially increase their profits, although it also entails higher risk.

Cons:

Unregulated, Potentially Higher Risk: Swift Trader operates without regulation, which may expose traders to higher risks such as a lack of investor protection and potential fraud or misconduct.

Lack of Regulatory Oversight: The absence of regulatory oversight means there's no external authority ensuring compliance with industry standards, potentially leading to issues related to transparency and fairness.

Limited Company History: Being a recently established company within 1 year, Swift Trader may lack a proven track record and transparency regarding its operations, which could be concerning.

Limited Deposit and Withdrawal Methods: Swift Trader offers a limited selection of deposit and withdrawal methods including Credit Cards, Bank Transfers, Electronic Wallets, and Encrypted Assets, which may inconvenience some traders who prefer more options or faster transaction processing.

Market Instruments

Swift Trader offers Foreign Exchange, Cryptocurrency CFDs, Commodity, Stock Indices, and Stock CFDs as market instruments.

Foreign Exchange (Forex): Swift Trader provides access to a wide range of currency pairs in the forex market. Traders can speculate on the exchange rate fluctuations between different currencies, such as EUR/USD, GBP/JPY, or USD/JPY.

Cryptocurrency CFDs: Swift Trader offers Contracts for Difference (CFDs) on various cryptocurrencies, allowing traders to speculate on the price movements of digital assets like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and others without owning the underlying assets.

Commodity Trading: Swift Trader enables trading in commodities such as gold, silver, crude oil, natural gas, and agricultural products like wheat, corn, and soybeans. Traders can take advantage of price fluctuations in these physical commodities through CFD trading.

Stock Indices: Swift Trader provides access to popular stock market indices from around the world, including the S&P 500, Dow Jones Industrial Average, NASDAQ Composite, FTSE 100, DAX 30, and Nikkei 225. Traders can speculate on the overall performance of these indices.

Stock CFDs: Swift Trader offers Contracts for Difference (CFDs) on individual stocks of major companies listed on stock exchanges globally. Traders can trade CFDs on stocks like Apple, Google, Amazon, Microsoft, Tesla, and others, without owning the underlying shares.

Account Types

Fundiza offers multiple account types tailored to suit different trading preferences and needs: Standard, Mini, Micro, Pro, and ECN.

Standard Account: This account type offers bonuses and enables traders to trade all available products. It provides a leverage of 1000 and allows for swaps. There's no specific commission associated with this account. Traders can trade with a contract size of 100,000 and a minimum transfer of 10USD. The minimum trade size is 0.01 lots, with a maximum trade size of 100 lots. Margin call and stop out levels are set at 80% and 20%, respectively. Traders can place a maximum of 200 pending orders.

Mini Account: Similar to the Standard account, the Mini account also offers bonuses but limits trading pairs to FX and Metals only. It maintains the same leverage, swap, commission, contract size, minimum transfer, minimum trade size, maximum trade size, margin call, stop out, and maximum pending orders as the Standard account.

Micro Account: The Micro account follows the same pattern as the Mini account but further restricts trading pairs to FX and Metals only. It also maintains the same leverage, swap, commission, contract size, minimum transfer, minimum trade size, maximum trade size, margin call, stop out, and maximum pending orders.

Pro Account: The Pro account is similar to the Standard account, offering bonuses and allowing traders to trade all products. It provides a leverage of 1000 and enables swaps. There's no specific commission associated with this account. Traders can trade with a contract size of 100,000 and a minimum transfer of 10USD. The minimum trade size is 0.01 lots, with a maximum trade size of 100 lots. Margin call and stop out levels are set at 80% and 20%, respectively. Traders can place a maximum of 200 pending orders.

ECN Account: Unlike the other accounts, the ECN account doesn't offer bonuses and allows traders to trade all available products. It provides a leverage of 1000 and enables swaps. There's no specific commission associated with this account. Traders can trade with a contract size of 100,000 and a minimum transfer of 10USD. The minimum trade size is 0.01 lots, with a maximum trade size of 100 lots. Margin call and stop out levels are set at 80% and 20%, respectively. Traders can place a maximum of 200 pending orders.

How to Open an Account?

Opening an account with Swift Trader is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the Swift Trader website and click “Open Account.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: Swift Trader offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the Swift Trader trading platform and start making trades.

Leverage

With a leverage of 1:1000, traders have the potential to control positions that are 1000 times the size of their initial investment, which exposes them to higher levels of market volatility and increases the likelihood of margin calls or account liquidation in case of adverse price movements.

Trading Platform

MT5, or MetaTrader 5, is a powerful and versatile trading platform offered by Swift Trader. It provides traders with a wide range of features and tools to facilitate efficient and effective trading across various financial markets. Here are some key features of MT5:

MT5 offers advanced charting capabilities, allowing traders to conduct in-depth technical analysis. It includes various chart types, timeframes, and drawing tools to analyze price movements and identify trading opportunities.

With MT5, traders can access a range of financial instruments, including foreign exchange (Forex), cryptocurrency CFDs, commodities, stock indices, and stock CFDs. This provides traders with ample opportunities to diversify their portfolios and explore different markets.

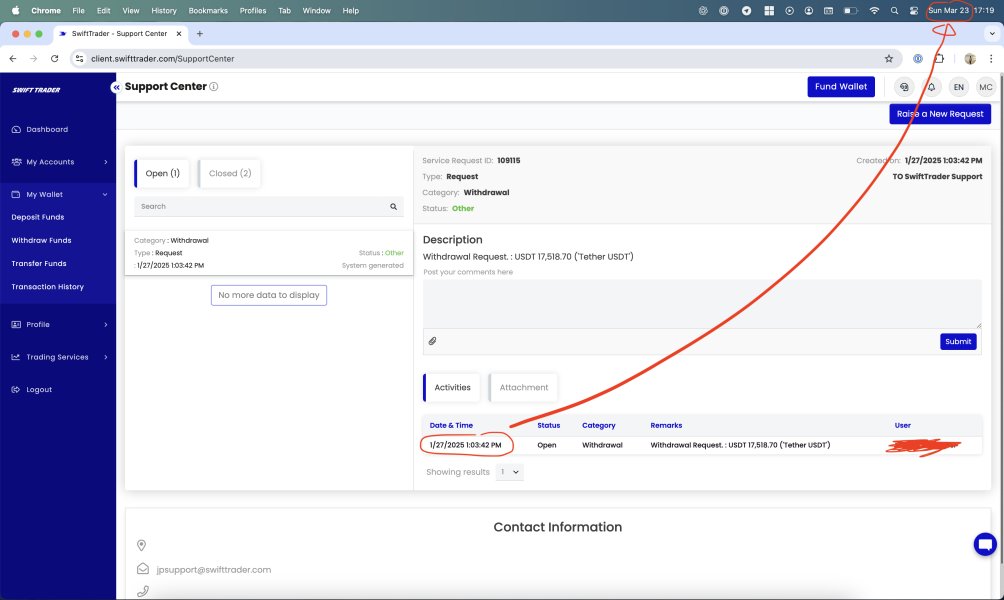

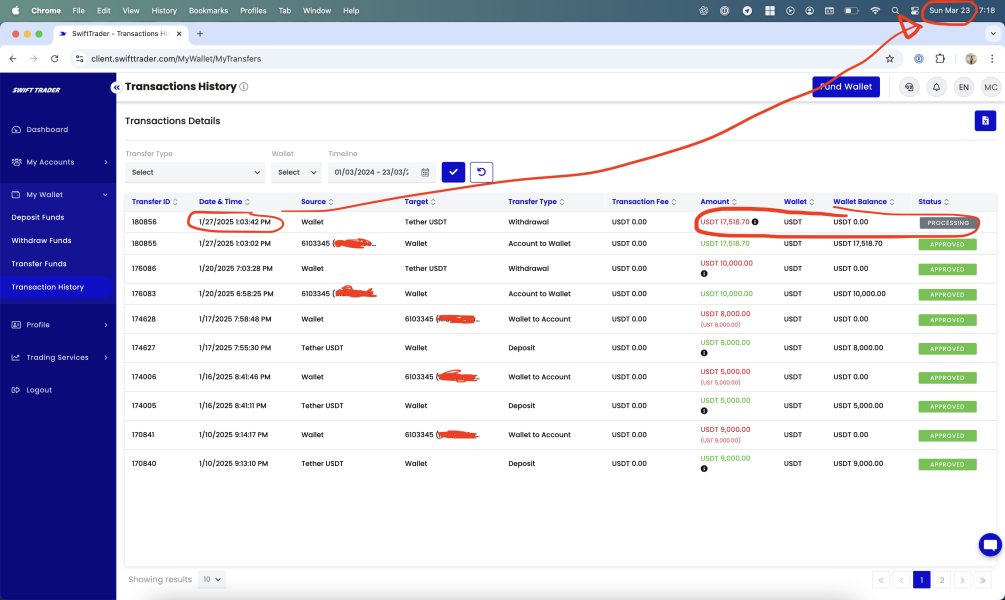

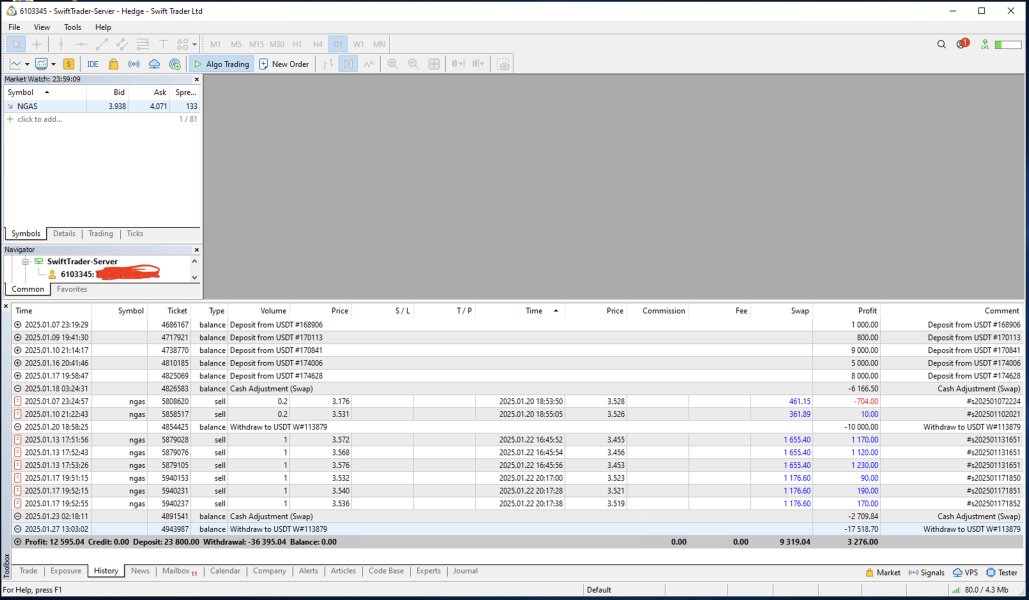

Deposit & Withdrawal

Swift Trader offers a variety of deposit and withdrawal methods, including international bank wires, local bank transfers, Tether, and STICPAY, catering to a global clientele. The platform supports multiple currencies such as USD, JPY, and USDT, with processing times ranging from immediate to a few days.

Importantly, Swift Trader ensures that most transactions are free of charge, enhancing accessibility and convenience for traders managing their funds. Both deposit and withdrawal processes are designed to be swift and secure, with specific minimum and maximum limits set for each method to accommodate different trading needs.

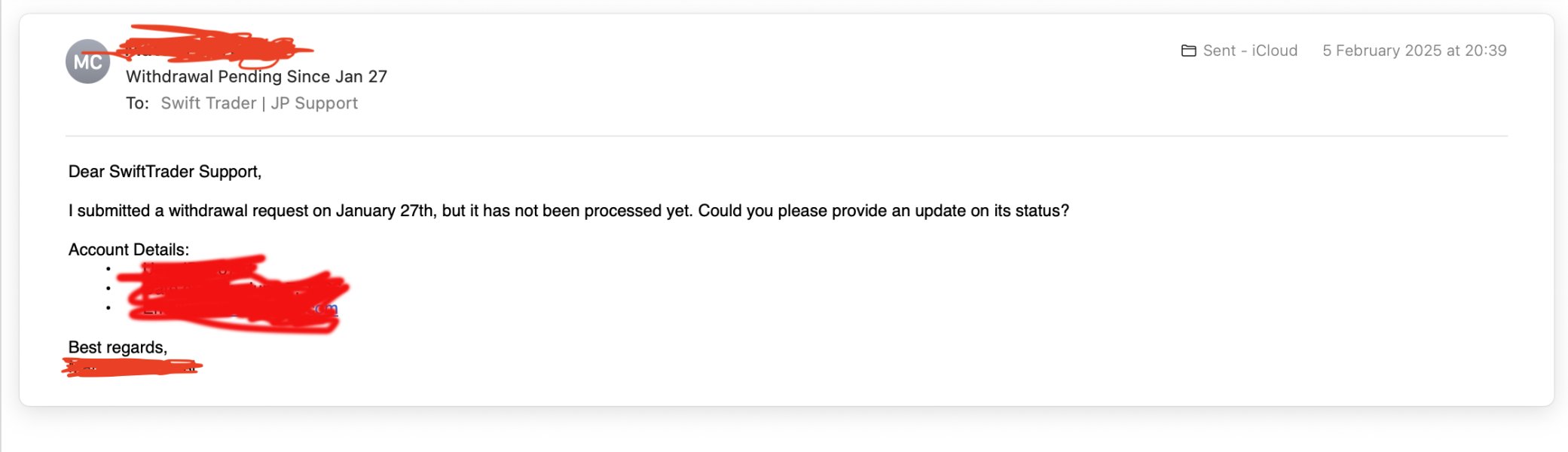

Customer Support

Swift Trader provides efficient and responsive customer support through two main channels: live chat and email.

Live Chat: Swift Trader offers live chat support directly on its platform, allowing traders to communicate with customer support representatives in real-time. The live chat feature enables traders to receive immediate assistance with account-related inquiries, technical issues, trading questions, and other concerns. Traders can initiate a live chat session with a support agent directly from the Swift Trader website or trading platform, making it convenient and easily accessible.

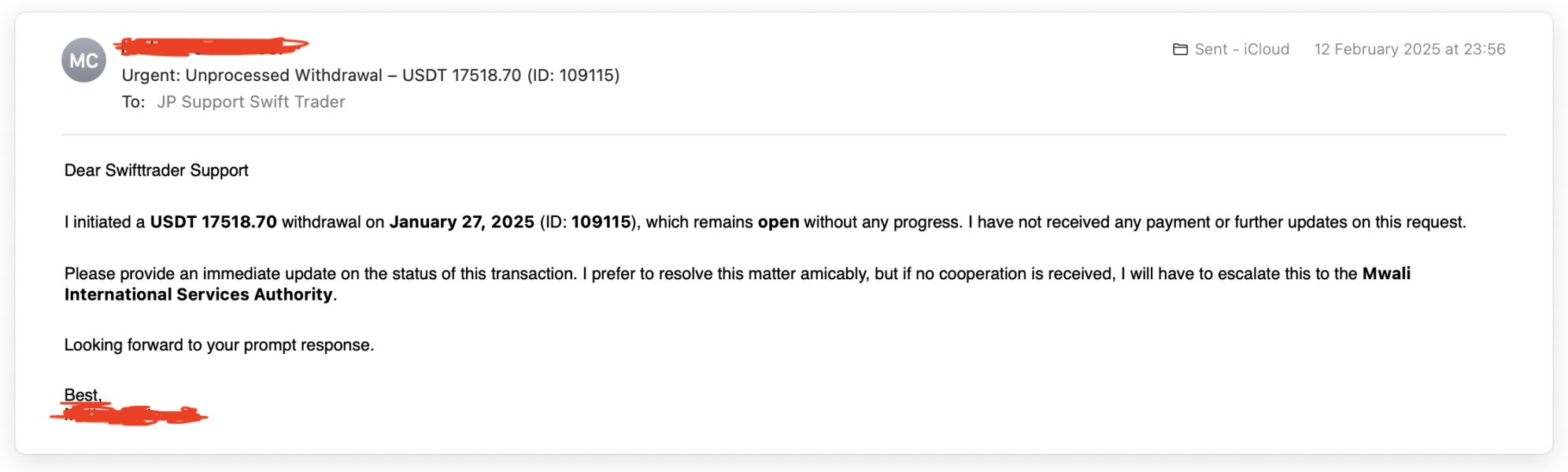

Email Support: Traders can also reach out to Swift Trader's customer support team via email at jpsupport@swifttrader.com. Email support provides traders with a convenient way to seek assistance, submit queries, or report issues at their own pace. Traders can expect prompt responses from the support team during regular business hours, and emails are typically addressed in a timely manner. Email support is suitable for non-urgent inquiries or complex issues that may require detailed explanations or documentation.

Conclusion

Swift Trader provides a wide range of market instruments and account types, making it accessible to traders with different preferences. However, the platform operates without regulatory oversight, which may pose higher risks for users.

Additionally, its limited company history and restricted deposit/withdrawal methods could be potential drawbacks for some traders.

FAQs

Q: What are the available trading platforms?

A: Swift Trader provides MetaTrader 5 (MT5) and also supports Expert Advisors (EA).

Q: How long does it take to open an account?

A: Opening a Swift Trader account takes only a few minutes. After registration, youll receive an authorization link to your provided email address to verify your account.

Q: Is there an age limit for opening an account?

A: You must be at least 18 years old to open a Swift Trader account.

Q: Is it possible to update personal information?

A: You can change the phone number etc. on the client portal. For changes in your email address, please contact the customer experience. The ID card cannot be changed after approval.

Q: Is it possible to lose more money than the amount paid?

A: Swift Trader has a zero cut system in all account types and does not lose more than the deposit amount.