Score

JP Markets

South Africa|5-10 years|

South Africa|5-10 years| https://www.jpmarkets.co.za

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

JPMarkets-Live

Influence

C

Influence index NO.1

South Africa 4.24

South Africa 4.24MT4/5 Identification

MT4/5 Identification

Full License

Germany

GermanyInfluence

Influence

C

Influence index NO.1

South Africa 4.24

South Africa 4.24Contact

Licenses

Licenses

Licensed Entity:JP MARKETS SA (PTY) LTD

License No. 46855

- This broker exceeds the business scope regulated by South Africa FSCA(license number: 46855)National Futures Association-UNFX Non-Forex License. Please be aware of the risk!

Basic Information

South Africa

South Africa

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed JP Markets also viewed..

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Company Name | JP Markets |

| Registered Country/Area | South Africa |

| Founded Year | 2017 |

| Regulation | License by the FSCA revoked |

| Market Instruments | Forex, stocks, indices, commodities |

| Account Types | Standard, Premium, VIP, Islamic, Draw Down Bonus, Rescue Bonus, Zero Stop Out |

| Minimum Deposit | Standard: R100, Premium: R1500,VIP: R5000,Islamic: R1500,Draw Down Bonus: R1500,Rescue Bonus: R100,Zero Stop Out: R100 |

| Maximum Leverage | Up to 2000 |

| Spreads | Starting from 0.5 pips |

| Trading Platforms | MT5 |

| Customer Support | Phone at +27 66 401 1374, email at support@jpmarkets.co.za |

| Deposit & Withdrawal | Bank transfers, credit/debit cards, e-wallets |

| Educational Resources | Limited educational resources such as a blog and FAQ section. |

Overview of JP Markets

JP Markets, established in South Africa in 2017, offers a wide range of trading assets, including Forex, stocks, indices, and commodities. The platform provides competitive spreads, multiple account types, and a variety of payment methods.

However, regulatory records indicate that JP Markets' license has been revoked, which could raise risks about its compliance and credibility. Despite this, the platform continues to serve traders with responsive customer support and a wide range of trading opportunities, establishing itself as a notable player in the financial markets.

Is JP Markets legit or a scam?

JP Markets, once regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, has had its license revoked.

This means it no longer holds authorization to operate as a financial service provider. Traders on the platform may experience heightened uncertainty and risks due to the lack of regulatory oversight. Without regulatory supervision, traders may face challenges regarding investor protection, transparency, and recourse in case of disputes. Additionally, the absence of regulation may deter potential traders from engaging with the platform, as they may perceive it as less trustworthy or reliable compared to regulated counterparts.

Pros and Cons

| Pros | Cons |

| Multiple account types | Limited educational resources |

| Competitive spreads starting from 0.5 pips | License revoked |

| Variety of payment methods including bank transfers, credit/debit cards, and e-wallets such as Skrill and NETELLER | High minimum deposit for some account types |

| Responsive customer support | |

| Wide range of markets including forex, stocks, indices, commodities |

Pros:

Multiple account types:

JP Markets offers various account types such as Standard, Premium, VIP, Islamic, Draw Down Bonus, Rescue Bonus, and Zero Stop Out accounts. These account types serve different trading preferences, risk tolerances, and capital levels, providing flexibility for traders to choose the most suitable option for their needs.

Competitive spreads starting from 0.5 pips:

JP Markets offers competitive spreads on a wide range of trading instruments starting from 0.5 pips.

Variety of payment methods:

JP Markets supports multiple payment methods, including bank transfers, credit/debit cards, and e-wallets such as Skrill and NETELLER.

Responsive customer support:

Numerous user testimonials and reviews highlight JP Markets' responsive customer support team, which promptly addresses client inquiries.

Wide range of markets:

While JP Markets offers a wide range of trading instruments across various asset classes, the license revocation may raise risks about the reliability and stability of trading conditions.

Cons:

Limited educational resources:

While JP Markets provides some educational resources such as a blog and FAQ section, user feedback and reviews suggest that the educational offerings may be insufficient for traders seeking comprehensive learning materials.

License revoked:

Regulatory records or official announcements may confirm that JP Markets' license has been revoked by regulatory authorities, indicating potential regulatory risks or compliance issues.

High minimum deposit for some account types:

The minimum deposit requirements for certain JP Markets account types, such as the VIP account, may be relatively high compared to industry standards.

Market Instruments

JP Markets offers a wide range of trading assets to its users, providing opportunities for investment across various financial markets.

One of the primary asset classes available for trading is Forex, which encompasses a wide selection of currency pairs. Traders can engage in transactions involving major currency pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs, allowing for diversified trading strategies based on global currency movements.

In addition to Forex, JP Markets facilitates trading in Stocks, enabling users to invest in shares of publicly listed companies across different industries and sectors. Traders can access a comprehensive selection of stocks from both domestic and international markets, allowing for exposure to various stock markets worldwide.

Furthermore, JP Markets offers trading opportunities in Indices, providing access to a range of stock market indices representing the performance of specific sectors or regions. Traders can speculate on the price movements of indices such as the S&P 500, FTSE 100, and Nikkei 225, among others, through derivative instruments such as CFDs (Contracts for Difference).

Lastly, JP Markets accommodates traders interested in Commodities trading, allowing them to invest in a wide array of raw materials and resources. This includes commodities such as gold, silver, crude oil, and agricultural products, providing opportunities for portfolio diversification and exposure to global commodity markets.

Account Types

JP Markets offers a variety of account types as below:

The Standard Account is suitable for novice traders or those with limited trading capital. With a minimum deposit requirement of R100, this account offers competitive trading conditions with leverage of up to 1:2000 and spreads starting from 1.5 pips. However, traders should be aware of the 30% stop-out and 50% margin call levels associated with this account type.

For traders seeking access to a broader range of markets and instruments, the Premium Account may be more appropriate. With a minimum deposit requirement of R1500, this account offers similar trading conditions to the Standard Account but provides access to all instruments available on the platform. Traders can benefit from leverage of up to 1:2000 and spreads starting from 1 pip, with the same stop-out and margin call levels.

The VIP Account is tailored for experienced traders or high-net-worth individuals seeking enhanced trading privileges. With a higher minimum deposit requirement of R5000, this account offers tighter spreads starting from 0.5 pips and the option for a bonus of 3 USD per lot traded. Traders can enjoy the same leverage and trading conditions as the Premium Account but with additional benefits tailored to their trading needs.

The Islamic Account is specifically suitable for traders who adhere to Islamic principles and Sharia law, offering swap-free trading with no interest charges or commissions on overnight positions. With a minimum deposit requirement of R1500, this account provides access to CFDs with leverage of up to 1:500 and spreads starting from 1.5 pips. It also maintains the same stop-out and margin call levels as other account types.

The Draw Down Bonus Account offers traders a bonus of 25% on their deposit, providing additional trading capital to enhance their trading opportunities. With a minimum deposit requirement of R1500 and leverage of up to 1:500, this account offers competitive trading conditions with spreads starting from 2 pips. However, traders should note the higher stop-out level of 15% and margin call level of 100% associated with this account type.

The Rescue Bonus Account is suitable for support traders during drawdown periods by providing a rescue bonus on their deposit. With a minimum deposit requirement of R100 and leverage of up to 1:500, this account offers trading conditions with spreads starting from 3 pips. However, traders should be aware of the 0% stop-out level and the 30% margin call level associated with this account type.

Lastly, the Zero Stop Out Account is ideal for high-risk traders seeking aggressive trading strategies. With a minimum deposit requirement of R100 and leverage of up to 1:500, this account offers competitive trading conditions with spreads starting from 2 pips. However, traders should exercise caution due to the high leverage and the absence of a stop-out level, which could increase the risk of significant losses.

| Account Type | Platform | Range of Markets | Minimum Deposit | Bonus | Leverage | Minimum Trade Size | Spreads from | Commissions | Swap | Stop Out | Margin Call | Account Currency | Order Execution |

| Standard | MT5 | CFDs | R100 | No | Up to 2000 | 0.01 | 1.5 pips | No | Yes | 30% | 50% | USD ZAR | Market |

| Premium | MT5 | All Instruments | R1500 | No | Up to 2000 | 0.01 | 1 pip | No | Yes | 30% | 50% | USD ZAR | Market |

| VIP | MT5 | All Instruments | R5000 | No | Up to 500 | 0.01 | 0.5 pips | Yes 3 USD | Yes | 30% | 50% | USD ZAR | Market |

| Islamic | MT5 | CFDs | R1500 | No | Up to 500 | 0.01 | 1.5 pips | No | No | 30% | 50% | USD ZAR | Market |

| Draw Down Bonus | MT5 | CFDs | R1500 | 25% | Up to 500 | 0.01 | 2 pips | No | Yes | 15% | 100% | USD ZAR | Market |

| Rescue Bonus | MT5 | CFDs | R100 | No | Up to 500 | 0.01 | 3 pips | No | Yes | 0% | 30% | USD ZAR | Market |

| Zero Stop Out | MT5 | CFDs | R100 | 300% | Up to 500 | 0.01 | 2 pips | No | Yes | 30% | 50% | USD ZAR | Market |

How to Open an Account?

Here are the steps to open an account with JP Markets:

Visit the JP Markets website: Go to the official JP Markets website and navigate to the account opening section.

Complete the online application: Fill out the required information accurately in the online application form. You will need to provide personal details such as your name, contact information, and identification documents.

Verify your identity: Upload clear copies of your identification documents, such as your passport or ID card, and any other requested documents for verification purposes.

Fund your account: Once your account is approved and verified, proceed to fund your account using the available deposit methods. Follow the instructions provided to transfer funds into your trading account.

Leverage

JP Markets offers varying maximum leverage options depending on the account type chosen by the trader.

For the Standard and Premium accounts, the maximum leverage provided is up to 1:2000, allowing traders to amplify their positions significantly relative to their initial margin.

The VIP, Islamic, Draw Down Bonus, Rescue Bonus, Zero Stop Out account offers a slightly lower maximum leverage of up to 1:500, reflecting a more conservative approach to leverage for high-net-worth individuals or experienced traders.

While leverage can magnify profits, traders should exercise caution as it also increases the potential for losses, particularly in volatile markets.

Spreads & Commissions

JP Markets offers a range of account types with varying spreads and commissions to suit the needs of different traders.

The Standard Account, requiring a minimum deposit of R100, offers spreads starting from 1.5 pips with no commissions charged on trades. It is suitable for entry-level traders or those with limited capital who prioritize low-cost trading.

In contrast, the Premium Account, with a minimum deposit of R1500, features tighter spreads starting from 1 pip, while maintaining the commission-free trading model. This account type is ideal for traders seeking access to a wider range of markets and instruments without incurring additional trading costs.

For traders with higher capital or those who value competitive pricing and enhanced trading privileges, the VIP Account may be more suitable. With a minimum deposit of R5000, this account offers even tighter spreads starting from 0.5 pips and provides the option for a commission of 3 USD per lot traded. It is tailored for experienced traders or high-net-worth individuals who prioritize competitive pricing and additional benefits.

Trading Platform

JP Markets utilizes the MetaTrader 5 (MT5) trading platform, which is a widely recognized and popular platform among traders worldwide.

MT5 offers a comprehensive range of features and tools facilitating efficient and user-friendly trading experiences. With MT5, traders have access to advanced charting capabilities, technical analysis tools, and customizable indicators to analyze market trends and make informed trading decisions.

Additionally, MT5 provides access to a wide range of financial instruments, including Forex, stocks, indices, commodities, and cryptocurrencies, allowing traders to diversify their portfolios and explore various investment opportunities. The platform also supports multiple order types, enabling traders to execute trades according to their preferred strategies, whether it be market orders, limit orders, or stop orders.

Furthermore, MT5 is known for its user-friendly interface and intuitive navigation, making it suitable for traders of all experience levels. Whether you are a beginner or a seasoned trader, MT5 offers a friendly trading experience with fast execution speeds and reliable performance.

Deposit & Withdrawal

JP Markets provides a range of payment methods to accommodate the various needs of its clients. Among its payment partners are Peach Payments, OZOW, Kora, STICPAY, NETELLER, Paystack, Skrill, and Praxis. These partners offer various payment solutions, including bank transfers, credit/debit card payments, and e-wallet services.

Bank transfers are a common method accepted by JP Markets, allowing clients to transfer funds directly from their bank accounts to their trading accounts. This method offers security and reliability, although it may take some time for the funds to be processed. Credit and debit card payments provide clients with instant deposit processing, enabling them to fund their accounts quickly and conveniently using their cards.

E-wallet services like Skrill, NETELLER, and STICPAY offer clients an alternative payment option that provides added security and convenience. Clients can fund their trading accounts using their digital wallets without exposing sensitive banking details. These e-wallet solutions are particularly popular among clients who value privacy and seek a easy deposit experience.

The minimum deposit requirement varies depending on the chosen account type. For the Standard Account, the minimum deposit is R100, making it accessible to traders with smaller budgets. The Premium Account requires a minimum deposit of R1500, providing access to a wider range of instruments. The VIP Account, with a minimum deposit of R5000, offers enhanced privileges and benefits for high-volume traders. The Islamic Account, Draw Down Bonus Account, Rescue Bonus Account, and Zero Stop Out Account also have minimum deposit requirements tailored to their specific features and benefits.

Customer Support

JP Markets offers customer support through multiple channels for clients' convenience.

Clients can reach their English-speaking support team via phone at +27 66 401 1374. Additionally, clients can contact support via email at support@jpmarkets.co.za for assistance with inquiries or issues.

These contact options provide clients with direct access to JP Markets' support staff, allowing them to receive prompt assistance and resolve any questions they may have regarding their trading experience. By offering multiple contact methods, JP Markets ensures that clients can easily reach out for support whenever needed.

Educational Resources

JP Markets offers educational resources to assist traders in enhancing their knowledge and skills. These resources primarily include a blog and a FAQ section.

The blog covers various topics related to trading, including market analysis, trading strategies, and educational articles. Traders can access valuable insights and stay updated on market trends through the blog posts.

Additionally, the FAQ section provides answers to common questions about trading, platform features, account management, and more.

Conclusion

JP Markets offers a range of trading opportunities with competitive spreads and various account type. However, its regulatory status, with a revoked license, poses a potential risk and uncertainty for traders regarding compliance and oversight. The platform provides responsive customer support and a variety of payment methods, enhancing user experience.

Despite its advantages, such as multiple account options and competitive spreads, JP Markets faces challenges with limited educational resources and a high minimum deposit requirement for some accounts.

FAQs

Q: What account types does JP Markets offer?

A: JP Markets offers Standard, Premium, VIP, Islamic, Draw Down Bonus, Rescue Bonus, and Zero Stop Out accounts.

Q: What is the minimum deposit required to open an account?

A: Minimum deposits vary depending on the account type, ranging from R100 to R5000.

Q: What trading instruments are available on JP Markets?

A: JP Markets offers trading in Forex, stocks, indices, and commodities.

Q: What trading platform does JP Markets use?

A: JP Markets utilizes the MT5 trading platform for trading activities.

Q: Is JP Markets regulated?

A: No, JP Markets' license has been revoked, indicating a lack of regulatory oversight.

Keywords

- 5-10 years

- Regulated in South Africa

- Financial Service Corporate

- MT5 Full License

- Global Business

- Suspicious Overrun

- Medium potential risk

News

News JP Markets in the South African Forex Economy: The Outcome of the Case and How WikiFX Can Help

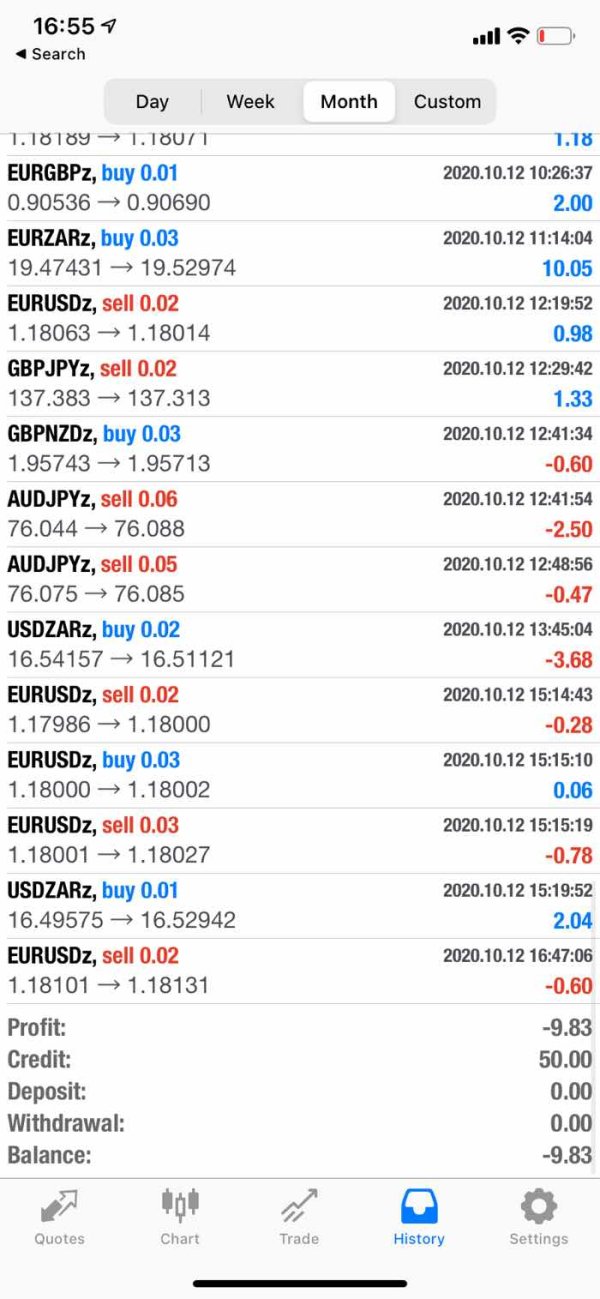

JP Markets was one of the largest forex brokers in South Africa, with a reputation for offering high leverage trading and competitive spreads. However, in 2020, the company found itself at the center of a scandal that rocked the South African forex economy.

2023-04-22 08:30

Exposure JP Market Scam Outcome

The JP Market scam was a major financial fraud that took place in South Africa in 2018. This scam involved a forex trading company that promised its clients huge returns on their investments. Unfortunately, the company was nothing but a Ponzi scheme, and many people ended up losing their life savings.

2023-03-03 17:39

News WikiFX report: JP MARKETS OPERATED IN ‘ABSOLUTE CONFLICT’ WITH ITS CLIENTS

An investigation into JP Markets has uncovered how the South African-based online forex broker has allegedly been trading against its clients and tampering with trading circumstances in order to drive down high earners' profitability while increasing the firm's.

2022-04-22 11:31

News WikiFX report: JP markets liquidated

The Financial Sector Conduct Authority (FSCA) previously reported that it filed an urgent application with the High Court to liquidate JP Markets (Pty) Limited and that the bank accounts of JP Markets had been frozen.

2022-04-22 11:23

News WikiFX report: SOUTH AFRICA’S IBS CAN BREATHE EASY AS JP MARKETS FINALLY BITES THE DUST

JP Markets, which was unlicensed and had a poor reputation among introducing brokers in South Africa, has been forced into administration by the authorities, and had its bank accounts frozen.

2022-04-21 14:57

News WikiFX report: A (temporary) positive ‘spread’ for JP Markets as SCA dismisses liquidation order

The Supreme Court of Appeal (SCA) judgment of JP Markets v FSCA [2021] ZASCA 148 is the latest precedent dealing with state institutions’ attempts to wind-up private companies on just and equitable grounds.

2022-04-21 14:54

Comment 7

Content you want to comment

Please enter...

Comment 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX2179475288

South Africa

I am unable to withdraw my funds since the licensed is revoked and no one gets back to us is been over a year now MY I.D NUMBER is 9505125575083 name is Sizwe Ntsondwa. Sizwe

Exposure

2021-04-22

Haffner

United States

Do not invest in this company. If you do you are guaranteed to lose all your money. I invested with them a few months ago. At the time there were many reviews on YouTube from happy customers who had made nice profits and have no issues withdrawing. However, I spent over a month trying to withdraw and I didn't receive a penny. After much unsuccessful trials, an old experienced trader friend referred me to a litigation firm called Forensic Pro, you can search for them on google, they got my money back, every penny from JP markets.

Exposure

2020-12-06

FX3607541145

South Africa

No willing to complain. They wil never pay out your money they have

Exposure

2020-10-13

Olamide Gordon-Wuraola

United Kingdom

Been told story’s that their international payment is offline and also been told different things in their department

Exposure

2020-02-20

媛乐

Hong Kong

JP Markets’ trading platform sucks, I just cannot open it and log into my personal account. I asked their customer support staff to fix this, but they didn’t give me any response at all. **** it!!!

Neutral

2023-02-15

王川岷

South Africa

JP Markets does not leave you alone, because they will systematically manage to persuade you to invest more money. It is just a trap! Don’t believe their sweet words!

Neutral

2022-12-19

Yurona

South Africa

I've had a positive experience with JP Markets. The customer service was prompt and helpful, especially when setting up my account. Trading on MT5 has been smooth with fast executions and no issues with withdrawals so far. Overall, I think it’s a good platform for trading.

Positive

2024-06-17