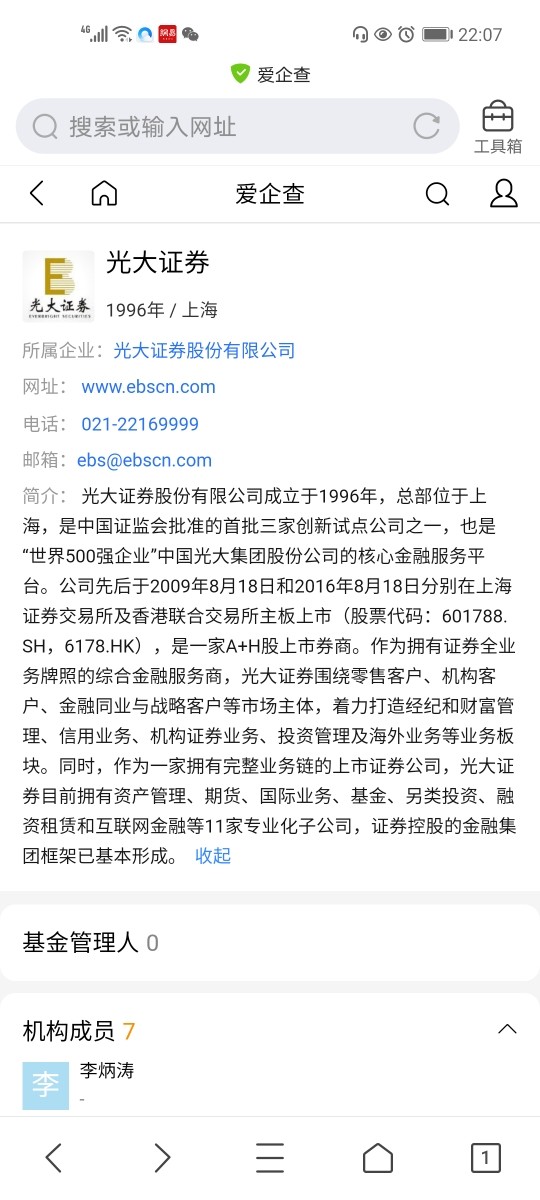

Overview of Everbright Securities

Everbright Securities is a financial services institution headquartered in Hong Kong with over 15 years of industry experience. Everbright Securities operates under the regulation of the Securities and Futures Commission of Hong Kong. Their services encompass wealth management, corporate finance, capital markets, institutional business, asset management, and investment and financing.

They offer direct market access (DMA) to interbank FX pricing, facilitating low spreads starting from 1.1 pips on major currency pairs. Everbright Securities provide traders with access to trading platforms, including MetaTrader 4 and FXTrader Pro, which offer a comprehensive suite of tools and features for market analysis and trade execution.

Regulation

Everbright Securities is regulated by the Securities and Futures Commission of Hong Kong. This regulatory oversight helps to provide a framework of investor protection, market integrity, and operational standards for the company's operations in the financial industry.

License for Dealing in Futures Contracts & Leveraged Forex Trading (SFC License No. AEX690):

Everbright Securities holds a license issued by the Securities and Futures Commission of Hong Kong, allowing them to engage in dealing with futures contracts and leveraged forex trading. This license signifies that Everbright Securities has met the regulatory requirements established by the SFC in Hong Kong for conducting these specific financial activities. The current status of this license is “Regulated”, meaning the company must adhere to the regulatory requirements and standards set by the commission, which aim to foster transparency, safeguard investor interests, and maintain the integrity of the securities and futures industry. The SFC's regulatory framework encompasses licensing, business conduct, risk management, client asset protection, disclosure obligations, and compliance with anti-money laundering regulations. This regulatory oversight ensures that the company operates within the defined parameters and complies with the established regulations enforced by the SFC.

Exceeded License for Dealing in Securities (SFC License No. AAW536):

Everbright Securities also holds a license granted by the Securities and Futures Commission of Hong Kong for dealing in securities. However, the current status of this license is mentioned as “Exceeded.” This indicates that Everbright Securities has surpassed the permissible limits or conditions associated with this license, rendering it void. It is important to note that exceeding a license may have implications for compliance with regulatory standards and operating within the authorized scope of securities trading.

Pros and Cons

Everbright Securities offers a range of financial services, including wealth management, corporate finance, capital markets, institutional business, asset management, and investment and financing. With their extensive experience and a strong presence in the industry, they cater to individuals, corporations, and institutions. The company operates under the regulation of the Securities and Futures Commission of Hong Kong, ensuring compliance with regulatory standards with futures and forex. They provide superfast execution and direct market access (DMA) to interbank FX pricing, enabling traders to benefit from efficient trading with competitive spreads. Everbright Securities prioritizes the security of client funds through proper fund segregation and partnerships with credible liquidity providers. They also offer advanced trading platforms, including MetaTrader 4 and FXTrader Pro, along with various customer support options.

One of the disadvantages of Everbright Securities is the exceeded license for dealing in securities, which renders the license void. This may raise concerns regarding compliance with regulatory standards and the company's ability to engage in securities trading activities. Additionally, the lack of detailed information about educational content, bonus offerings, and the current status of certain licenses may pose challenges for traders seeking comprehensive information.

Market Instruments

Everbright Securities offers a specific market instrument, which is leveraged foreign exchange trading. Leveraged foreign exchange trading allows traders to speculate on the price movements of various currency pairs by utilizing leverage to amplify their trading positions. Everbright Securities provides access to a wide range of currency pairs, enabling traders to participate in the global forex market.

The following is a table that displays that available market instruments by Everbright Securities in copmarison to competitors:

How to make an account?

Visit the Brokerage Website: Go to the official website of Everbright(https://www.ebshkforex.com/)

Locate the Account Opening Section: Look for a section or tab on the website specifically dedicated to account opening or registration. It is usually labeled as “Open an Account” or similar.

3. Download the Account Opening Form: In the account opening section, you should find a link or button to download the account opening form. Click on it to download the form to your computer or device.

4. Review the Form: Open the downloaded form and carefully read through all the instructions and fields provided. Make sure you understand the requirements and information needed to complete the form accurately.

5. Fill in the Form: Using a pen or typing directly into the digital form (if applicable), fill in all the required information. This may include personal details, contact information, financial information, and any additional information as requested by the brokerage.

6. Attach Required Documents: Some brokerage firms may require you to submit supporting documents along with the account opening form. These documents may include identification documents (such as passport or driver's license), proof of address (utility bills or bank statements), and any other documents specified by the brokerage.

7. Review and Verify: Double-check all the details filled in the form for accuracy and completeness. Ensure that all required fields are properly filled and that you have attached any necessary documents.

8. Submit the Form: Once you are satisfied with the completed form, follow the instructions provided by the brokerage to submit it. This may involve uploading the form and supporting documents through their online portal or sending it via email or postal mail, depending on the brokerage's requirements.

9. Wait for Confirmation: After submitting the account opening form, you will typically receive a confirmation from the brokerage. This confirmation may include further instructions or requests for additional information, if needed.

Minimum Deposit

Based on the provided information, the minimum deposit required to open an account with Everbright Securities is $5,000 USD or its equivalent in other currencies. This minimum deposit amount allows clients to access their low-cost trading solutions, tailored for various types of traders, including high-volume traders and those using EA strategies. It is important to note that currency exchange rates may apply when making the equivalent deposit in other currencies.

Leverage

Everbright Securities offers a maximum leverage of 1:20. Leverage of 1:20 means that traders can potentially trade with an amount up to 20 times their invested capital. This level of leverage allows traders to have increased exposure to the market while using a smaller amount of capital.

Spreads

Everbright Securities offers spreads as low as 1.1 pips on EUR/USD and 1.6 pips on GBP/USD for all account types and trade sizes. They also provide spreads ranging from 1.6 to 2.4 pips on major currencies through their FX Trader Pro platform. The spread represents the difference between the bid price and the sell price for a currency pair, and lower spreads can potentially reduce trading costs for clients. It is important to note that specific spread rates may vary across different currency pairs and trading platforms offered by Everbright Securities.

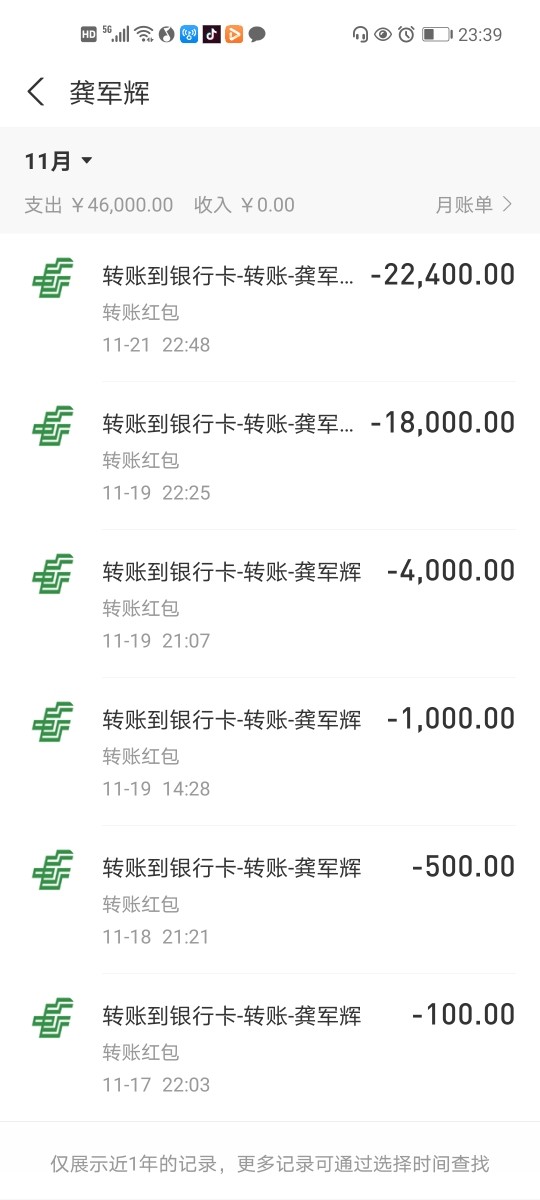

Deposits & Withdrawals

Everbright Securities accepts bank transfers as the deposit/withdrawal method. Bank transfers involve the direct transfer of funds between a client's bank account and the brokerage account. This method typically requires clients to initiate the transfer through their bank by providing the necessary account details provided by Everbright Securities.

Trading Platforms

Everbright Securities offers the following trading platforms:

MetaTrader 4 (MT4): MetaTrader 4 is a popular and widely used trading platform known for its comprehensive features. It provides advanced charting tools, technical analysis indicators, and the ability to automate trading strategies with the use of expert advisors (EAs). MT4 is a reliable and versatile platform suitable for both beginner and experienced traders.

FXTrader Pro: FXTrader Pro is a downloadable trading platform offered by Everbright Securities. While specific details about the features and functionalities of FXTrader Pro are not provided, it is likely designed to provide a robust and efficient trading experience. Traders can expect features such as live pricing from major investment banks, instant execution, and interactive charting tools.

The following is a table that displays that available trading platforms by Everbright Securities in copmarison to competitors:

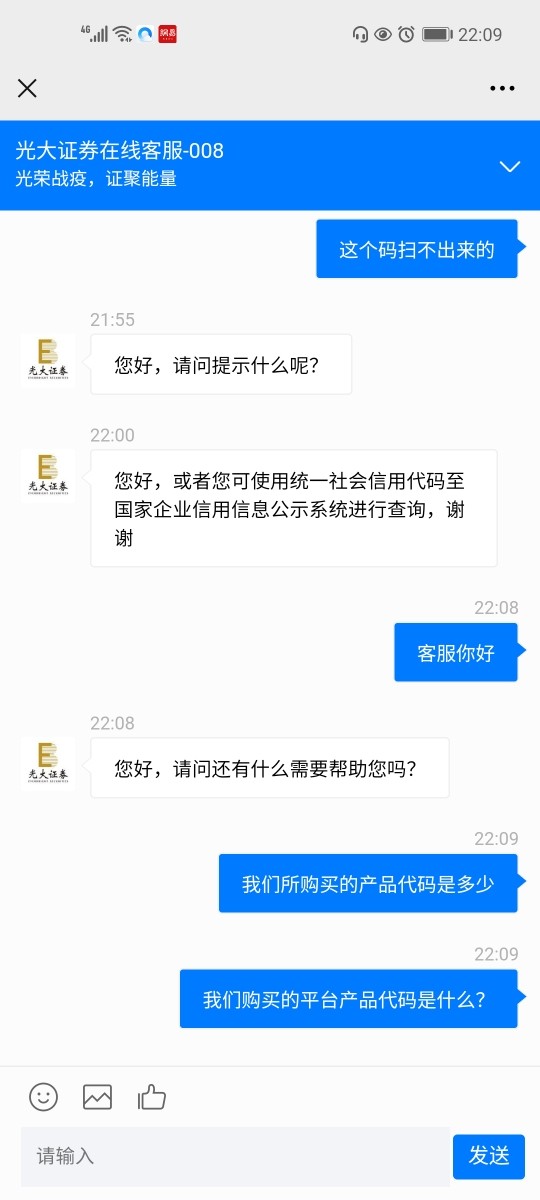

Customer Support

Everbright Securities offers the following customer support options:

Customers can contact Everbright Securities' customer support through their dedicated FX hotline at +852 3920 2720. The hotline operates from market open on Monday morning at 6am HKT to market close on Saturday morning at 5am HKT. This option allows customers to directly communicate with the support team regarding FX-related inquiries or concerns.

Customers can reach out to Everbright Securities' customer support team for general inquiries by sending an email to enquiry@ebshkforex.com.

For specific inquiries related to margin FX trading, customers can send an email to enquiry@ebshkforex.com.

Customers requiring assistance or information about global payments can contact the customer support team viagp@ebshkforex.com.

Conclusion

Everbright Securities is a financial services institution headquartered in Hong Kong, offering comprehensive services to individuals, corporations, and institutions. As the international business platform of Everbright Securities Company Limited, it operates under the brand name “Everbright Securities International” and provides financial products and services in wealth management, corporate finance, capital markets, institutional business, asset management, and investment and financing. The company is regulated by the Securities and Futures Commission of Hong Kong, ensuring adherence to regulatory standards.

Everbright Securities offers leveraged foreign exchange trading and a diverse range of currency pairs for trading, although specific details about leverage and spreads are not provided in the available information. The company provides customer support through a dedicated hotline and email channels, allowing clients to seek assistance during trading hours. Educational resources and trading tools are available to empower investors with market knowledge.

FAQs

Q: What types of services does Everbright Securities provide?

A: Everbright Securities offers a wide range of financial services, including wealth management, corporate finance, capital markets, institutional business, asset management, and investment and financing.

Q: Where is Everbright Securities headquartered?

A: Everbright Securities is headquartered in Hong Kong.

Q: Is Everbright Securities a regulated company?

A: Yes, Everbright Securities is regulated by the Securities and Futures Commission of Hong Kong.

Q: What trading platforms does Everbright Securities offer?

A: Everbright Securities provides trading platforms such as MetaTrader 4 and FXTrader Pro.

Q: What are the available customer support options?

A: Customers can reach Everbright Securities' support team through a dedicated hotline and email support.

Q: What is the minimum deposit requirement for opening an account?

A: The minimum deposit requirement is US$5,000 or its equivalent.