Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

瑞创

South Korea

This platform has been a scam platform since its foundation, using various methods to induce customers to trade and then, after about half a year, various malicious slippages and malicious refusal to withdraw funds were occured. They always find various excuses.

Exposure

01-18

FX3239945048

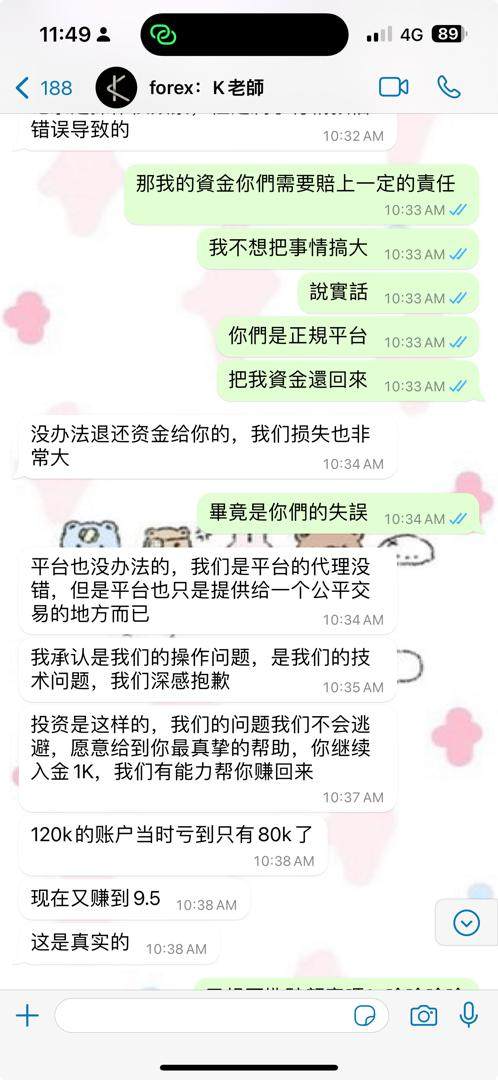

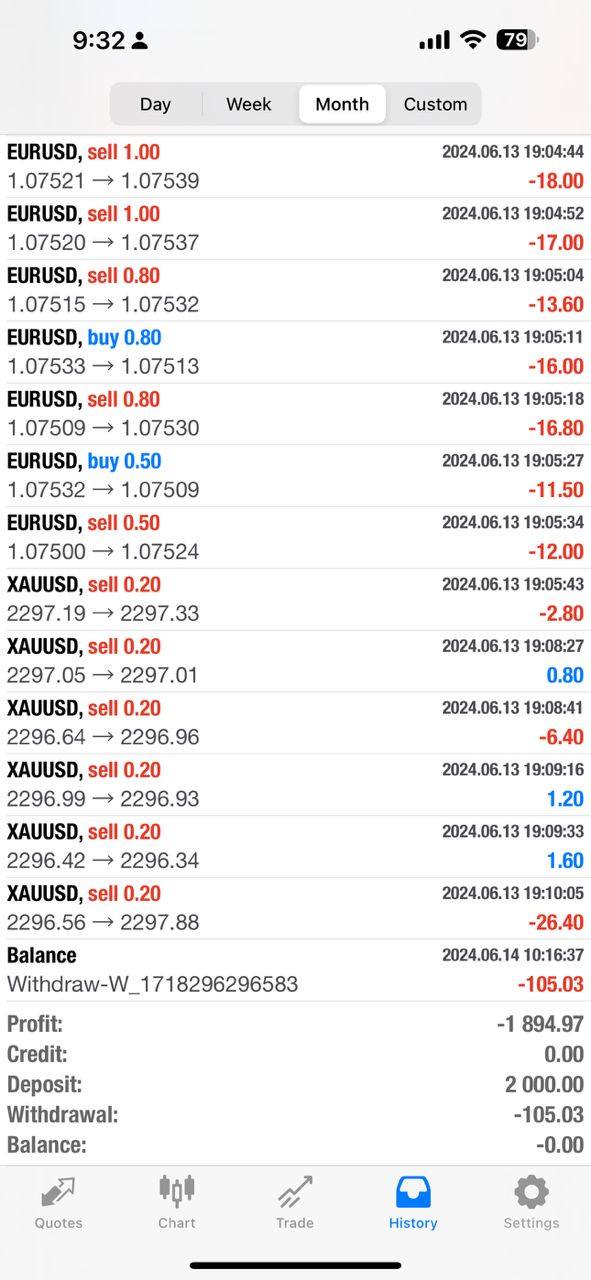

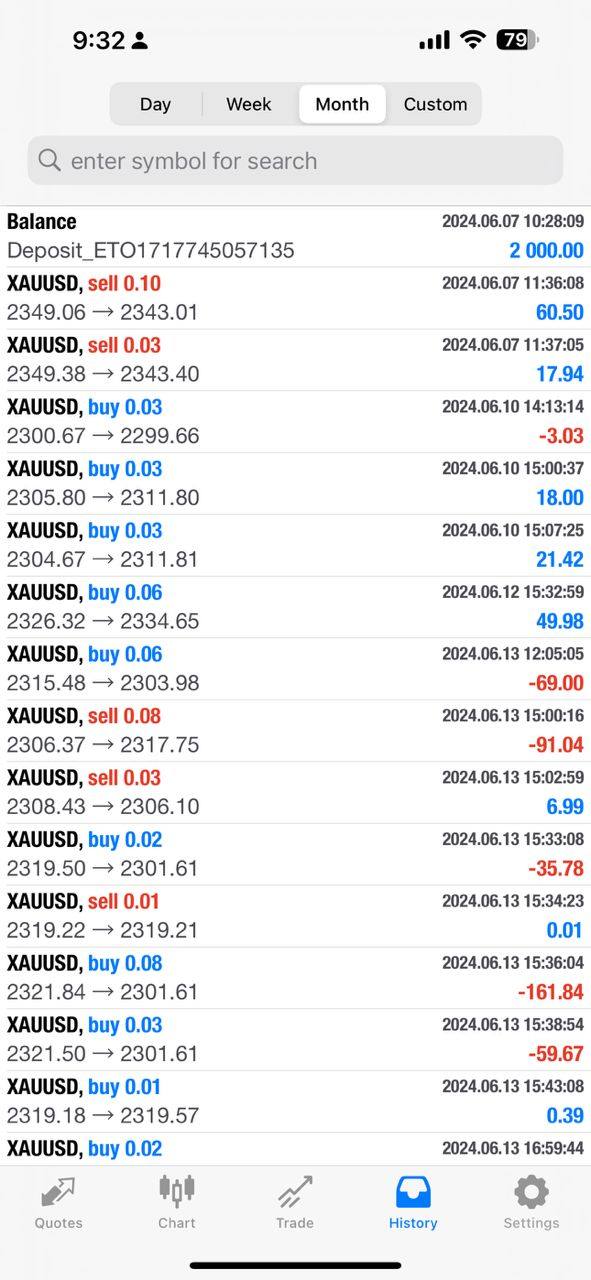

Malaysia

Everyone must be alert for this issue which I had voice out my problem to this platform company regarding my money why suddenly cant log in and my money inside all gone within no more than 10 minutes. I try call the manager who ask me to use this platform and put in money 2k USD. Everyone must be alert and becareful for this so called K teacher (+85268271986) he is the manager ask me using this platform.They not even settle my problem and ask me put in money again to this platform and help me trade and win back the money . Everyone must becareful to avoid same thing happen to you guys.

Exposure

2024-06-26

sjiajaks

Malaysia

An unscrupulous platform tries to induce consumers to continue depositing money.

Exposure

2024-04-16

FX2508073351

United States

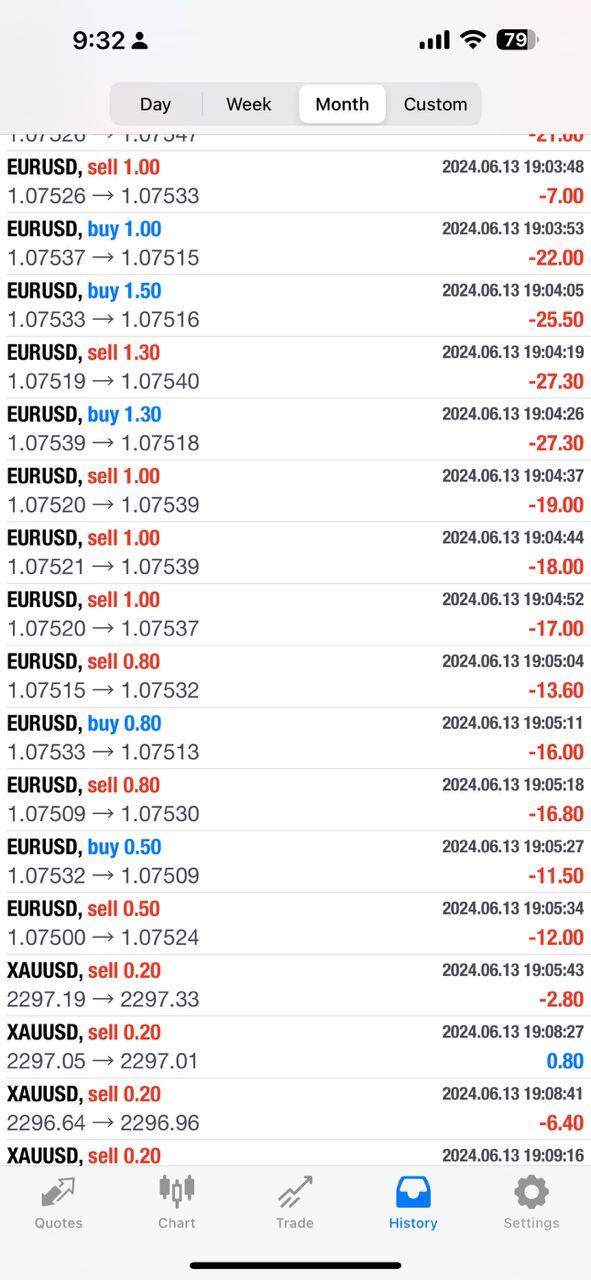

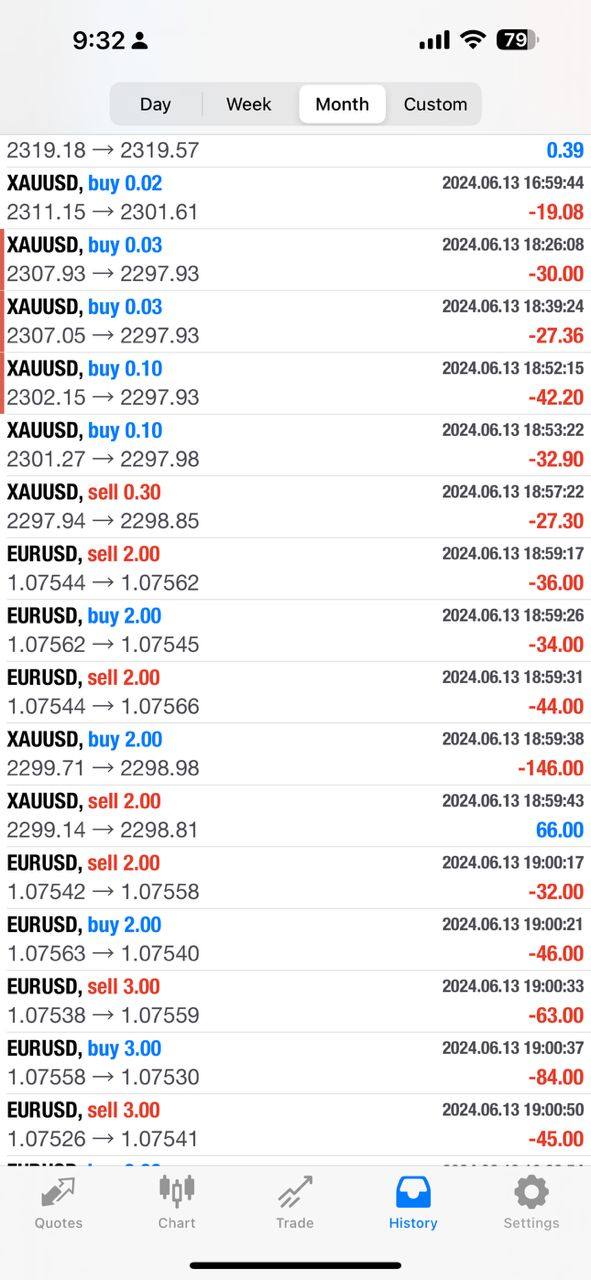

They maliciously liquidated my account and refused to compensate me. This is a black platform. The quotation that mt4 does not have, their platform manually pulled the K line to liquidate my account, and they did not compensate me.

Exposure

2024-01-18

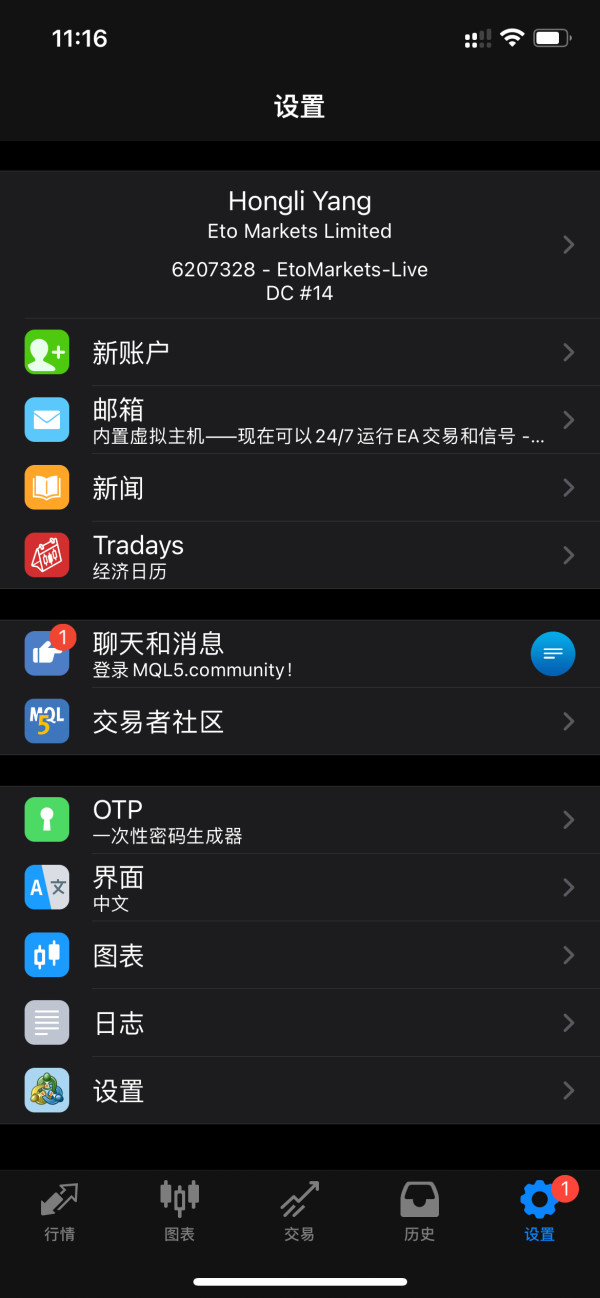

FX2508073351

United States

Nov 16, 2023 i traded on eto platform, the quote that mt4 doesn't have but eto platform does, black platform. The black platform liquidated my account and do not give me compensation. Don't use the black platform. I've suffered all this.

Exposure

2024-01-17

岁月1922

Taiwan

The ETO platform only allows customers to lose money and not make money. Making money is a violation of regulations. And the quotation is different from other platforms. It is completely Ponzi scheme, manually changing the candlestick line.

Exposure

2023-12-06

FX1062393618

United States

ETO is a fraudulent platform that won't let withdrawals, account is disabled, can't trade, says it is counterfeited and is a fraudulent platform.

Exposure

2022-09-02

Huikn

Argentina

They offer cTrader and a great selection of Forex trading pairs. It is one of my favorite brokers to date. The only issue I have is with their German entity. According to local laws they debit 26% of profits in withholding tax after each winning transaction but do NOT refund that amount when you have losing transactions. That results in way too much money being deducted at the end of each month. The only way to get those funds back is by filing a tax return.

Neutral

2024-04-19

Starye

United States

I traded forex on ETO Markets and it went super smoothly! The deposit and withdrawal methods are totally reasonable, and the speed is lightning fast!

Positive

2024-07-30

Kikoyo

New Zealand

I was intrigued by ETO Markets due to its variety of trading options and easy-to-use platforms. Starting with just $100 and the assurance of ASIC regulation felt reassuring.

Positive

2024-06-04

Yogesh9711

India

I have been trading on this platform since 3 months and it gives me satisfaction in return and I want to continue trade with this platform.

Positive

2023-06-28

Hugo Victor Garcia Andrade

Mexico

I hope so too, so let's see what happens, greetings from Mexico

Positive

2022-12-10

A039900

Peru

I have been trading with this company for 5 months now and I am satisfied so far and will continue to trade at least. I can trade the financial instruments I like! I like its leverage, up to 1:400, which allows me to trade more positions. Also, the various educational resources they provided helped me a lot as well.

Positive

2022-12-02