General Information

EXANTE is the trading name of XNT Ltd or EXT Ltd, an investment services firm established in 2011, providing global multi-asset financial services, including direct access to various financial markets in the US, Europe, America, and the Asia Pacific. EXANTE provides its clients with access to various financial markets, including stocks, bonds, futures, options, funds, currencies, precious metals, and exchange-traded funds (ETFs). The company offers a proprietary trading platform, as well as support for the MT4 platform, API trading, and FIX connectivity.

To open an account with EXANTE, a minimum deposit of €10,000 is required for an individual account, and €50,000 for a corporate account. The company offers a demo account for traders to test the platform without risking any real money. However, EXANTE does not provide Islamic (swap-free) accounts.

EXANTE's maximum leverage level is 1:50, which is relatively low compared to other brokers in the industry. The spreads for the EUR/USD currency pair start at 0.3 pips, and the company charges a commission on transactions made on major European exchanges. Inactivity fees of €50 per month apply if no trades are made within six months or if the account balance is below €5,000.

EXANTE provides customer support via telephone, email, and live chat, and traders can access a knowledge base and frequently asked questions section on the website. The company accepts wire transfers for deposits and withdrawals, and the withdrawal fee is €30 or the corresponding currency equivalent.

Overall, EXANTE offers a wide range of financial instruments and a proprietary trading platform, making it a suitable choice for experienced traders with a significant amount of capital to invest. However, the high minimum deposit requirement and inactivity fees may be a deterrent for some traders, and the lack of Islamic accounts may not suit all investors. Here is the screenshot of EXANTES official website:

Regulation

When it comes to regulation, EXANTE is currently authorized and regulated by the Cyprus Securities and Exchange Commissions (CYSEC), with regulatory license number: 165/12. Additionally, EXANTE is also regulated by the Malta Financial Services Authority (MFSA).

The broker offers various financial services, including direct access to financial markets across the US, Europe, Asia-Pacific, and America. EXANTE provides its clients with a proprietary trading platform, as well as access to trading instruments such as forex, precious metals, futures, options, funds, bonds, stocks, and ETFs.

While EXANTE may require a minimum deposit of 10,000 euros to open an account, it is a common requirement for professional and institutional clients. The broker does not offer Islamic (swap-free) accounts but does offer a demo account with a balance of €1,000,000 in virtual currency.

Overall, based on its regulation and years of operation, EXANTE appears to be a legitimate and reputable broker. However, as with any investment, it is important to conduct your own due diligence and carefully consider the risks before investing.

Pros and Cons

Market Instruments

EXANTE offers a wide range of market instruments for traders and investors. The following are some of the key instruments available through their platform:

Stocks and ETFs: Trade over 24,000 stocks from around the world, as well as a range of ETFs for different investment strategies. The platform offers real-time prices and a single account for all your trades.

Currencies: Access over 50 currency pairs through EXANTE's online trading platform. The platform offers reliable trading with responsible leverages, as well as Forex forwards and swaps for added flexibility.

Metals: Trade gold, silver, copper, platinum, and palladium via Futures, Options, Spots, and ETFs. EXANTE provides real-time prices and fast execution, allowing traders to take advantage of opportunities in this valuable commodity.

Futures: Gain access to over 500 futures varieties from commodities to bonds on markets like CME, LIFFE, or EUREX. The platform offers real-time prices and a single-account trading model for added convenience.

Funds: Invest in hedge funds through EXANTE's online trading platform. The Hedge Fund Marketplace provides access to hundreds of funds from around the world, with real-time monitoring of positions and a single account for all trades.

Bonds: EXANTE offers a unique set of government and private bonds, with access to prime bonds with limited issue, both exchange-traded and OTC. Traders can diversify their portfolios with this low-risk instrument and enjoy timely interest payouts.

Options: Find, analyze, and trade options from markets around the world, with real-time data and powerful tools for risk management. EXANTE's platform provides access to over 270,000 options on versatile basis assets, with calculated Greeks and implied volatility for precision targeting.

Overall: EXANTE's market instruments provide traders and investors with a diverse range of options for building their portfolios and managing risk.

Account Types

To open an account with the broker, a deposit of 10,000 Euros is required for a basic account for individuals and 50,000 for a corporate account, with currency gains and losses borne by traders. Unfortunately, EXANTE does not provide Islamic (swap-free) trading accounts. EXANTE also offers a dedicated manager for each client, providing them with a personal guide and entry point for trading issues, OTC deals, customisation requests, and more. This ensures that investors receive personalized attention and support throughout their trading journey.

One of the advantages of EXANTE's account is its transparent pricing. There are no account maintenance fees, and commissions are only charged for trading and withdrawals. The account also offers cross-margin, which allows investors to use previously employed instruments as leverage to acquire new assets.

Additionally, EXANTE provides customization options for its clients. Investors can request more instruments, and EXANTE will add them within 24 hours. This ensures that investors have access to a diverse range of instruments to build their portfolios.

Finally, EXANTE offers 24-hour support, 7 days a week, ensuring that clients have access to help and assistance whenever they need it. Overall, EXANTE's account type provides investors with flexibility, convenience, and personalized support.

How to Open an Account?

To register and open a trading account with EXANTE, follow these simple steps:

Sign up on the EXANTE website to start the account opening process. Ensure that you provide accurate contact details, including a valid phone number and email address.

2. Access the EXANTE demo area through your Client's area and proceed to open a live account.

3. Complete a questionnaire to indicate your trading experience and interests, which will help EXANTE tailor your account to your needs.

4. Verify your identity by uploading the required documents for an individual or corporate account. This process usually takes one business day.

5. Add funds to your account according to your account type. The minimum funding requirement is €10,000 or £10,000 for individual clients and €50,000 or £50,000 for corporate clients.

6. Access the live trading platform from the EXANTE website or download it onto your desktop or mobile device.

By following these steps, you can easily open an account with EXANTE and start trading in various financial markets and instruments.

Demo Accounts Available

The EXANTE demo account is available on both individual and corporate account types. Traders use a demo account to access the broker's web platform without registration. These demo accounts and platforms access are available for an unlimited period of time while traders have access to a demo account balance of €1,000,000 in virtual currency.

EXANTE Leverage

The maximum leverage level offered by EXANTE is up to 1:50, which is considered a low ratio, however this broker obviously targets big investors with capital to spare, who supposedly dont need high leverage levels.

Spreads & Commissions, Swaps

Spreads for EUR/USD are 0.3 pips, GBPUSD spreads are 0.5 pips, and EURGBP spreads are 0.7 pips. The maximum rate on major US exchanges is $0.02 per share, and on European exchanges, the fees range from 0.02% to 0.18%. Transactions on major European exchanges (such as Euronext Brussels or Euronext Paris) are subject to a 0.05% commission. The company allows investors to access major Asian exchanges with fees ranging from 0.1% on the Tokyo exchange to 0.1927% on the Hong Kong exchange. The overnight fee applies to short positions and foreign exchange and is calculated as follows: (position value * interest rate / 360) * days = overnight fee amount.

Inactivity Fees

Please note an inactivity fee of 50 EUR/GBP per month is charged if one of the following cases occur:

The inactivity fee is charged for each user not each sub account held.

Trading Platform

The EXANTE platform offers several features and benefits for traders and investors. The platform provides access to over 600,000 financial instruments, including stocks, ETFs, bonds, options, futures, metals, and currencies, from a single multi-currency account. The platform is available on various devices, including web, desktop (Windows, macOS, or Linux), iOS and Android smartphones. EXANTE has created a network of 1,100 servers across the world to ensure the lowest latencies and safe data transfers.

In addition, EXANTE offers an HTTP API for traders and developers to design sleek, fast, and data-rich financial apps. The FIX API enables algorithmic traders to trade via a FIX 4.4-based API that allows for data transfer, quote retrieval, and full-scale trading automation. EXANTE has won several awards, including the Best Multi-Asset Financial Services Firm and Global Capital Market Access Experts of the Year.

However, one potential drawback is that the platform may be overwhelming for novice traders due to its many features and the large number of financial instruments available. Additionally, while the platform offers transparent pricing with no account maintenance fees, the commissions and spreads may be higher compared to other brokers.

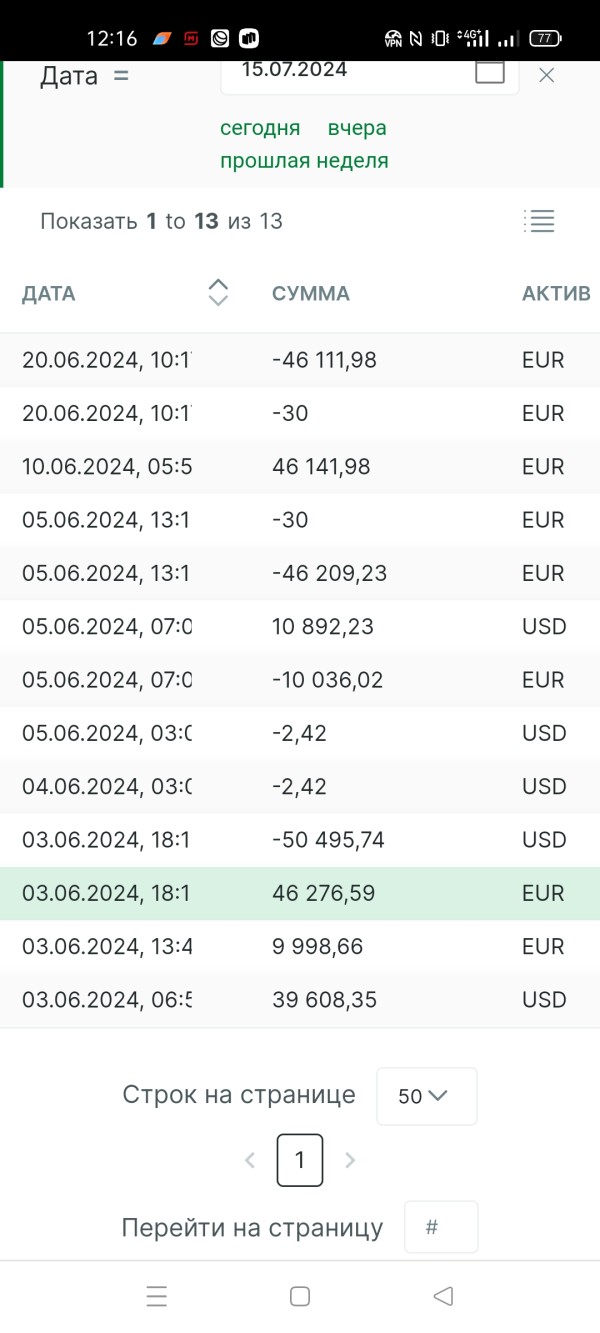

Deposit & Withdrawal

EXANTE accepts deposits and withdrawals only through bank transfers in a variety of currencies, including EUR, USD, GBP, CHF, CZK, JPY, AUD, CAD, HKD, MXN, NOK, SEK, PLN, and SGD. The minimum deposit amount is €10,000, and corporate clients are required to deposit a minimum of €50,000. Withdrawal requests are processed within one day, and funds are typically received within 3-5 banking days. A withdrawal fee of €30 or the equivalent in the currency being withdrawn applies to all withdrawals. Please note that the withdrawal fee may vary depending on the bank used and can sometimes be higher during the settlement period.

Customer Support

EXANTE provides customer support 24/7 to its clients, with dedicated account managers available to assist with any trading issues, customization requests, or OTC deals. The broker also offers an online help center with a knowledge base, FAQs, and guides to assist clients with their trading needs. In addition, EXANTE offers multilingual support through phone, email, and live chat to cater to the needs of clients worldwide. The broker also has a social media presence on platforms such as Twitter and LinkedIn, providing clients with an additional channel to reach out for support. Overall, EXANTE's customer support is comprehensive and easily accessible, providing clients with the assistance they need to navigate the markets.

The EXANTE customer support can be reached through several channels, including telephone, email, and live chat. Traders can also get some basic answers via the ' FAQ' section on the page.

Here are some contact details:

Telephone: +357 2534 2627

Email: info@exante.eu

Or you can also follow this broker on some social media platforms, such as Facebook, Instagram, Youtube, Linkedin and Twitter.

Conclusion:

EXANTE provides a comprehensive range of financial services to traders and investors globally. With a multi-currency account, direct market access, and low-latency trading technology, the company offers a seamless trading experience across multiple asset classes. Its dedicated account managers, transparent pricing, and cross-margining options are among the many benefits that make it an attractive choice for traders of all levels. EXANTE's commitment to providing cutting-edge technology and innovative trading solutions makes it a leading player in the global financial markets.

Frequently Asked Questions

Q: What is the difference between “Live” and “Demo” accounts?

A: The Demo account offers virtual €1,000,000 for practicing trading skills and strategies, while the Live trading account allows real-time trades and requires completing a questionnaire, verifying identity, and funding the account.

Q: What is EXANTE?

A: EXANTE is a multi-licensed investment company that provides direct market access to a wide range of financial instruments through a single multi-asset and multi-currency solution. They are licensed by the FCA, CySEC, and SFC.

Q: What are the benefits of trading with EXANTE?

A: EXANTE offers access to 50+ markets in the US, Europe, Asia, and Australia, state-of-the-art technology, manual service for trading OTC bonds and exotics, shorting, cross margining, and margin trading, 600,000+ instruments accessible from a single account, and a network of 1,100+ servers worldwide.

Q: Does EXANTE offer MT4/MT5 connection?

A: No, EXANTE does not offer MT4/MT5 connection. However, they provide a FIX connection setup for their clients.

Q: What is the FIX connection offered by EXANTE?

A: The FIX connection is a slightly adapted version of the FIX protocol, ver. 4.4. It is available for clients with an account value of 50,000 EUR/GBP or higher and is free to use. EXANTE's API is also based on FIX, and clients can find the integration guide, specification, and certificate required to set up the connection in the Client's area under FIX specification. EXANTE helps establish connections through their hubs in London, Frankfurt, Chicago, New York, or Moscow, and the setup takes up to one business day. However, they do not provide any assistance with the prior setup required to enable FIX convection on the client's computer and are not responsible for the quality of any third-party services.

FX4168730089

France

Exante stole all my money! I have been their client since 2019. In April 2024 there was an accident in my family my father has an Oncological disease and I tried to Withdraw my money for his treatment, At first I was informed that they do not withdraw money in my bank. I tried to transfer my srocks to another broker. l gave an order to transfer my stocks to another broker but after a long delay in the transfer procedure by Exante, they told me, that I can't allowed to do this, according their internal restricts. I asked them to show this internal restricts, but they couldn't do it. I wrote a letter to ceo Exante Aleksei Kirienko, complaint team, support team and personal manager and explained, that I need money for father's treatment and sent them all documents with diagnosis. They offered me to transfer my money to their account in Honk Kong. I opend the account in Honk Kong and they transfered money to this residence. Afrer it I tried to Withdraw my mone to my bank account, but money returned to my account in Exante Honk Kong. I asked them to show me swift document, but they amswered, that their bank can't provide Swift document, but it is the absurdity!!! I wrote the complience to complience department and CEO Dmitry Kirienko once again after it my money went missing from my account. My personal manager Sergei Krasikov told me, that they tried to transfer money to my bank account once again. After 3 weeks I don't have money in my bank account and I don't have money in my Exante account I wrote email to personal manager about actual status of my money, but there were no answer from him. Exante lies me every day!!! Three months I can't withdraw my money! They spoke with me only through the prrsonal manager, but he is not telling me the truth! I càn't receive any official answer from Exante team! Now I'm writing a claim to regulator!

Exposure

2024-07-15

FX3044180164

Hong Kong

Can not open their platform since October 2020. It has been half a year.

Exposure

2021-03-30

FX3044180164

Hong Kong

Is it a fraud platform? It has been six months and I can’t open its website

Exposure

2020-12-30

FX3044180164

Hong Kong

EXANTE is out of contact now. I can't open it. My withdrawals have been delayed for three months. And I can't log in now. There is no one helping me

Exposure

2020-12-20

FX3044180164

Hong Kong

The custoomer service asked me to withdraw funds on September 1. But I can't contact the staff or log in.

Exposure

2020-11-30

FX3044180164

Hong Kong

I hope you can help me solve this problem.

Exposure

2020-11-11

FX3044180164

Hong Kong

The platform contact has been out of contact for two months. Can't witdhraw

Exposure

2020-11-08

Mr.Wang21942

Hong Kong

I checked the bank card number twice before I withdraw while the customer service said my card number was wrong and I have to pay 20% as the unfreezing fund!

Exposure

2020-10-28

FX3044180164

Hong Kong

In fact, I can’t withdraw. A series of tricks. During the operation, I deposited twice. And then the customer service said my password was wrong and I have to pay 20% of the margin. After that, the tax cost me 20%. But I didn’t have enough money, the operator said he can help me but he didn’t have enough money so I should borrow some. He said all the money can be withdrawn. When I paid all the money, I still can’t withdraw on September 1. When I think about it, these traps were tightly interlocked. I wanna die. Aren’t you these fraud afraid of the nemesis? Good will be rewarded with good, and evil with evil; if the reward is not forthcoming, it is because the time has not yet come

Exposure

2020-10-18

FX3044180164

Hong Kong

EXANTE is a fraud platform. Pay my hard-earned money back! You frauds, said my funds can be withdrawan on September 1. While the website can't be opened. Return my principal ¥194,470. Aren't you afraid of retribution?

Exposure

2020-10-17

FX3044180164

Hong Kong

EXANTE is a fraud platform. Py my hard-earned money back, you frauds. It's said that I can withdraw on September 1 but now the website can't be opened. Give my principal ¥19,4470 back. You'll pay for it

Exposure

2020-10-15

FX3044180164

Hong Kong

I scanned the QR code which I saw in the WeChat Moments this June. And I deposited twice. When I wanna withdraw, the customer service said my password was wrong and I have to pay20% margin. After I had paid the money, the customer service told me I can withdraw all my balance once on September 1. However, I can’t log in. Even the salesman and the operator blacklisted me. I was cheated of ¥194,470. I called the police and I hope you can help me.

Exposure

2020-10-13

FX3927531823

Hong Kong

I download this app and invest by scanning a QR code fron the WeChat moments. However, I can't withdraw now. I was swindled out of ¥225,000

Exposure

2020-10-11

FX3927531823

Hong Kong

When I wanna withdraw, the customer service said my bank card number was wrong and I have to pay 20% to unfreeze my fund. But I can’t withdraw after I paid the money.

Exposure

2020-10-09

你若安好便是晴天17816

Hong Kong

What a rip-off. Cheat investors. My ID information which was given to the customer service is right. Why can’t I withdraw?

Exposure

2020-09-28

FX7425233822

Indonesia

Unavailable to withdraw

Exposure

2020-09-22

FX7425233822

Indonesia

exposure to withdrawl process,, please accepte to confirm my email & re sort by phone... cause something wrong about the process please follow graud blich and sort to disclaim about it... thaks

Exposure

2020-09-14

Randem

Australia

Trading experience is smooth, but the platform's chat support is hit or miss. Sometimes I get a quick response, other times not.

Neutral

2024-08-06

Tutunana

Argentina

What I don't like is that if you go into the support chat it takes the whole screen and can't see where you were in the app to explain to customer support. Also their english could be better and inspire more trust.

Neutral

2024-04-25

HenryM

United Kingdom

One of the reasons I've chosen to trade with EXANTE is their tight spreads and lightning-fast execution. As an active trader, these factors are crucial for maximizing my profits. EXANTE consistently delivers on this front, providing a trading environment that allows me to capitalize on market opportunities efficiently. I'm confident in recommending EXANTE to anyone seeking a reliable and competitive broker.

Positive

2024-09-06