简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is Fundamental Analysis?

Abstract:While technical analysis involves studying the charts to identify patterns or trends, examining economic data reports and news headlines is what Traders do for Fundamental Analysis. (And also irregularly and occasionally a random tweet from a specific world pioneer before he was restricted.)

While technical analysis involves studying the charts to identify patterns or trends, examining economic data reports and news headlines is what Traders do for Fundamental Analysis. (And also irregularly and occasionally a random tweet from a specific world pioneer before he was restricted.)

Looking at the forex market by analyzing the political, economic, and social factors, is the main strategy for Traders that uses Fundamental Analysis. Analyzing all of those factors can affect the price of the currency.

If you were remember back in time when youre in school, it is very much like in your Economics 101 class, it is based on market supply and demand that determines the price, or for our situation, the price exchange rate.

Involving market interest as a sign of where the price could be going is simple. The crucial step is breaking down each of the elements that influence the supply and demand.

All in all, you need to check out various elements to decide whose economy is rockin' like a BLACKPINK tune, and whose economy sucks.

You need to comprehend the reasons behind why and how certain occasions like an increment in the unemployment rate influence a nation's economy and financial arrangement which eventually, influences the degree of interest for its money.

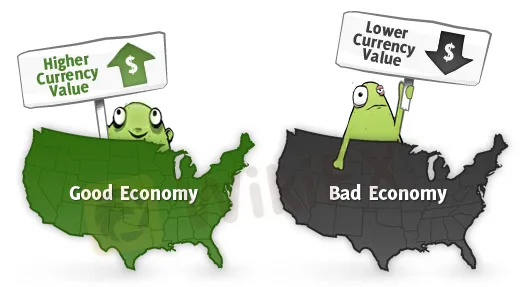

The thought behind this sort of analysis is that assuming a nation's current or future monetary standpoint is great, its money ought to reinforce.

The better shape a country's economy is, the more foreign organizations and financial backers will put invest into that country. This outcomes in the need to buy that country's currency to acquire those resources.

Basically, this is a simple explanation what fundamental analysis is:

For instance, suppose that the U.S. dollar has been acquiring strength in light of the fact that the U.S. economy is improving.

As the economy improves, raising interest rates might be expected to control development and inflation.

Higher interest rates make dollar-named monetary resources more appealing.

To get their hands on these exquisite resources, traders and invetors need to get some U.S. dollars first. This expands the demand for the currency.

Because of that, US dollars value will likely to increase against the other currencies with lesser demand.

As you dig further into this course, you will be able to understand which and why economic data points influences the currency prices.

You will learn who is the Fed Chairman and how retail sales reflects economic conditions. Your mouth will be spitting out global interest rates like song lyrics.

To have the option to use fundamental analysis, it is important to see how monetary, financial, and political news will affect currency rate.

You need to have a really good understanding regarding macroeconomics and geopolitics.

However, no should be scared by such extravagant sounding words. For the present, simply realize that fundamental analysis is an approach to analyze the possible direction of a currency through the strength or shortcoming of that country's financial viewpoint. You do not want to skip the lesson, it is awesome! Mark my words!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator