简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Triple Candlestick Patterns

Abstract:To recognize quadruple Japanese candlestick patterns, look for specific formations that include three candlesticks in total. These candlestick formations assist traders in predicting how the price will behave in the future. 3 candlestick patterns are reversion patterns, that demonstrate the conclusion of a trend and the beginning of a new trend in the reverse.

What could be better than a pair of candlestick patterns?

TRIPLE candlestick designs!

To recognize quadruple Japanese candlestick patterns, look for specific formations that include three candlesticks in total.

These candlestick formations assist traders in predicting how the price will behave in the future.

3 candlestick patterns are reversion patterns, that demonstrate the conclusion of a trend and the beginning of a new trend in the reverse.

The last 3 candlestick patterns are continuance patterns, which show a pause followed by the continuation of the present trend.

Let's take a look at some of the most common triple Japanese candlestick designs.

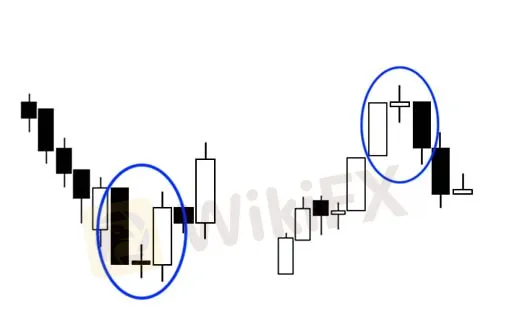

Evening and Morning Stars

The Morning Star and Evening Star are triple candlestick formations that show up close the end of a trend.

They are reversion patterns with three distinctive characteristics.

We'll use the Evening Structure on the right to demonstrate what you might see:

· The first candlestick is a bullish candle that represents a recent uptrend

· The second candle has an unassuming body, indicating that there may be some market hesitation. This candle has the potential to be either bullish or bearish

· As the candle closes past the halfway of the first candle, it fills in as evidence that a reversal has occurred.

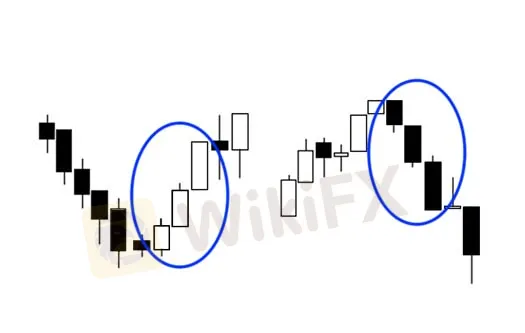

Three White Soldiers and Black Crows

The Three White Soldiers design shows up if three long bullish candles follows a Declining trend, indicating a reversal.

This kind of triple candlestick pattern is regarded as one of the most powerful in-your- face bullish signs, especially when it occurs following an extended decline and a brief period of consolidation.

The reversing candle is the first of the “three soldiers.” It either indicates the conclusion of the decline or that the phase of stabilization that followed the slump is finished.

The second candlestick should be larger than the prior candlestick's body for the Three White Soldiers pattern to be perceived certified.

Furthermore, the second candlestick should end at its high, with a small or quasi upper wick.

To complete the Three White Soldiers design, the last candlestick should have been at least the same size as the second candle and have little or no shadow.

The Three Black Crows candlestick design is the inverse of the Three White Soldiers motif.

It forms once three bearish candles follow a high Rising trend, indicating that a reversal is imminent.

The body of the second candle should be larger than the body of the first candle and it should close at or near its low.

Lastly, the third candle should be a similar size as or bigger than the body of the second candle, with a really short or no least from the perspective.

To complete the Three Black Crows design, the last candle should be at least the same size as the second candle and have little or no shadow.

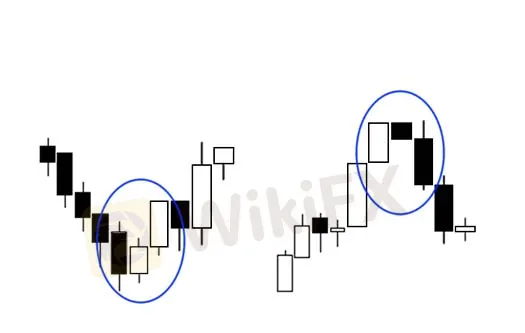

Three Inside Up and Down

The Three Inside Up candlestick pattern is a fad pattern that signals the end of a DOWNTREND.

This triple candlestick fact implies that the downturn may have ended and that a new upswing has begun.

Look for the following characteristics in a genuine three inside up candle arrangement:

The first candle, which is characterised by a strong bullish candlestick, should be placed at the bottom of a downtrend。

The second candle should at the very least reach the middle of the first candle. To prove that buyers have outweighed the intensity of the downturn, the third

The Three Inside Down candlestick formation, on the other hand, is found near the top of a UPTREND.

It indicates that the uptrend may have ended and that a major downturn has begun.

The following characteristics must be present in a three inside down candlestick formation:

The first candlestick should be placed at the top of an upswing and is distinguished by a strong bearish candlestick.

The second candle shall extend all the way down to the first candle's halfway. To prove that sellers have outweighed the intensity of the uptrend

The third candlestick must close below the low of the first candle.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator