简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading On Margin Should Be Done With Caution

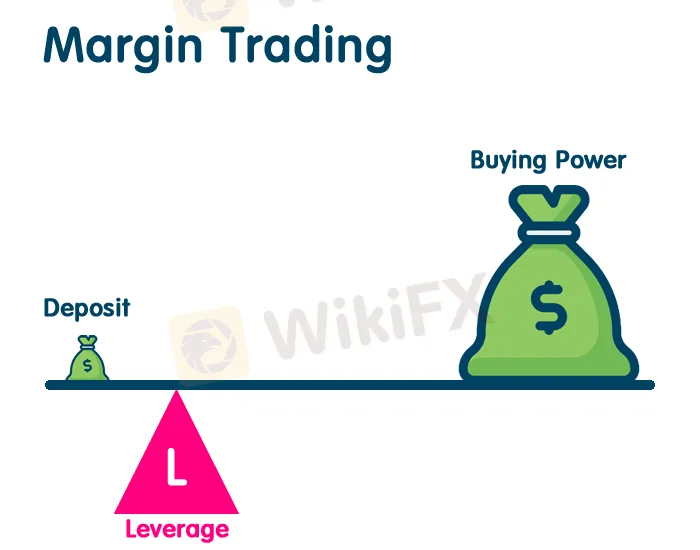

Abstract:Margin is a type of good faith deposit or collateral that is wanted to begin and maintain a trade. Margin trading allows you to take positions that are larger than your account balance.

Margin is a type of good faith deposit or collateral that is wanted to begin and maintain a trade.

Margin trading allows you to take positions that are larger than your account balance.

While buying and selling on margin does not present leverage in and of itself, it can be exploited as such.

This is because the size of the position you can open is usually determined by the amount of money you have in your account.

Margin trading allows you to improve your buying (and selling) power.

This means that if you have $5,000 in a margin account with a 100:1 leverage, you can trade up to $500,000 in currencies because just 1% of the purchase price is required as collateral.

You have $500,000 in purchasing power, to put it another way.

You can improve your total return on investment while spending less money if you have more purchasing power. However, keep in mind that trading on margin magnifies both your earnings and losses.

Call for a Margin

The dreaded margin call is something that every trader dreads.

It's not a pleasant sensation.

This happens when your broker informs you that your margin deposits have fallen below the required minimum amount due to a large move against you on an open account.

While trading on margin can be beneficial, it is critical to recognize the dangers involved.

Make sure you understand how your margin account works and that you read your margin agreement with your broker.

If there is anything in the agreement that you don't understand, always ask questions.

If the available margin in your account falls below a specified threshold, your positions may be partially or completely liquidated.

Before your investments are liquidated, you may not receive a margin call (the ultimate unexpected birthday gift).

Your broker will liquidate any or all open trades if the money in your account falls below the required margin (usable margin).

Even in a very volatile, fast-moving market, this can assist keep your account from going into negative territory.

Margin calls can be efficiently avoided by keeping a close eye on your account balance and using stop loss orders on any active positions to limit risk.

Keep in mind that if the market is moving quickly, your stop loss may face significant slippage.

Space is a difficult subject, and some claim that having too much margin might be detrimental. It all relies on the individual and his or her level of knowledge and training.

If you're going to trade on a margin account, you should be aware of your broker's margin account policies and be aware of and comfortable with the risks associated.

It's also worth noting that most brokers want a larger margin on weekends. This might be as little as a 1% margin during the week, but if you plan to maintain the position over the weekend, it could be as much as 2% or more.

Keep in mind that different currency pairs may have different margin requirements from brokers, so keep that in mind as well!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator