简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How To Calculate Currency Correlations With Excel

Abstract:Correlations will vary and alter over time, as you've read. As a result, keeping track of current coefficient strengths and directions becomes even more critical.

Correlations will vary and alter over time, as you've read. As a result, keeping track of current coefficient strengths and directions becomes even more critical.

Currency correlations may be estimated in the privacy of your own home, using only you and your chosen spreadsheet programme.

We'll use Microsoft Excel to demonstrate this, but any software that uses a correlation formula would suffice.

Step 1: We're thinking you won't be conjuring up daily pricing data out of thin air, but will instead obtain it from the internet. The Federal Reserve is one source.

Step 2: Open Excel

Step 3: Copy and paste your data into a blank spreadsheet or open the data file you exported in Step 1. Get the previous six months!

Step 4: Now, arrange your data so that it resembles the image below or something close. You get to choose the colours and fonts! Have some fun with it. However, yellow might not be the greatest choice!

Step 5: Now is the moment to set a deadline. Do you want to see the currency correlation from last week? What happened last month? What happened last year?

This will be determined by the quantity of pricing data you have, but you can always collect more. We'll use the previous month as an example.

Step 6: Type =correl(EUR/USD, USD/JPY) in the first empty cell below your first comparison pair (I'm correlating EUR/USD to the other pairs, so I'll start with EUR/USD and USD/JPY).

Step 7: Then, choose the EUR/USD price data range of cells, followed by a comma. This range will be surrounded by a box.

Step 8: Select the price data range for USD/JPY after the comma, just as you did for EUR/USD.

Step 9: To compute the correlation coefficient for EUR/USD and USD/JPY, press the Enter key on your keyboard.

Step 10: Steps 5–9 should be repeated for the remaining pairings and time periods.

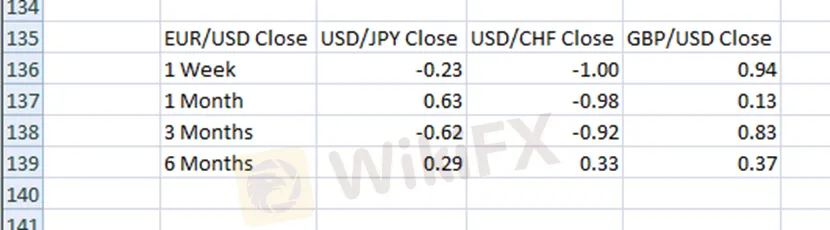

When you're finished, you can use your new data to make a table that looks like this. That's pro-status!

The trailing periods of one week, one month, three months, six months, and one year give the most comprehensive perspective of currency pair correlations.

However, you must choose which or how many time periods you want to examine.

While updating your data every day could be excessive, unless you're a currency correlation junkie, updating them at least every other week should enough.

You may need to get out more and pick up a hobby if you find yourself manually updating your currency correlation tables on Excel every hour.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator