简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WTI eyes $110.00 on renewed supply worries as EU progresses toward Russian oil embargo

Abstract:WTI sees more upside as Germany surrendered its opposition to the embargo on Russian oil.

Finding a substitute for bulk exports of oil from Russia wont be easy for the EU.

The announcement of more stimulus from the PBOC has raised hopes of oil demand recovery.

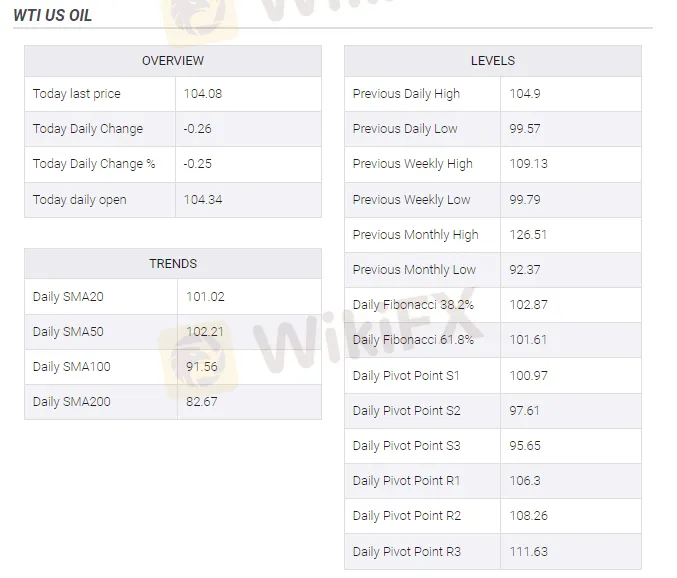

West Texas Intermediate (WTI), futures on NYMEX, are trading near Thursdays last traded price at $104.16. The oil prices have witnessed a strong rebound this week as supply worries overpowered the demand concerns. Supply concerns due to the prohibition of Russian oil by the Western leaders and demand worries due to the Covid-19 resurgence in China were resulting in a tug of war. Although bulls got underpinned and are likely to advance further as European Union (EU) progressed on the embargo on Russian oil.

The EU is aiming to prohibit the imports of oil from Russia sooner after Germany dropped its opposition. In earlier discussions, Germany was leading the criticism against the embargo on Russian oil overnight amid its higher dependency on fossil fuels and energy from Russia. Now, the major automobile exporter has surrendered its opposition, so the EU will do the required paperwork at the earliest. This may fuel the supply worries as a substitution of bulk Russian oil exports will not be a cakewalk. So probation of Russian oil by the eurozone in an already tight market will weigh pressure on the bulls.

Meanwhile, the announcement of prudent monetary policy guidance by the Peoples Bank of China (PBOC) will reduce the demand worries in the dragon economy due to the Covid-19 resurgence. More liquidity infusion by the PBOC in its economy will ram-up the aggregate demand and henceforth the demand for oil. It is worth noting that China is the largest importer of oil and demand recovery in China will have a positive impact on oil prices principally.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

How to Automate Forex and Crypto Trading for Better Profits

Find out how automating Forex and crypto trading is changing the game. Explore the tools, strategies, and steps traders use to save time and maximize profits.

Is Infinox a Safe Broker?

INFINOX, founded in 2009 in London, UK, is a regulated online broker under the UK FCA. It offers diverse trading instruments like forex, stocks, commodities, indices, and futures. Clients can choose between STP and ECN accounts and access educational resources. With 24/7 customer support, INFINOX aims to empower traders with reliable tools and guidance.

Is Your Zodiac Sign Fated for Stock Market Success in 2025?

The idea that astrology could influence success in the stock market may seem improbable, yet many traders find value in examining personality traits linked to their zodiac signs. While it may not replace market analysis, understanding these tendencies might offer insights into trading behaviour.

Good News Malaysia: Ready for 5% GDP Growth in 2025!

Malaysia's economy is on track to sustain its robust growth, with GDP expected to exceed 5% in 2025, according to key government officials. The nation's economic resilience is being driven by strong foreign investments and targeted government initiatives designed to mitigate global economic risks.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Currency Calculator