简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

THE EUR/USD seeks fresh clues around 1.0550 after the biggest daily gain in two months

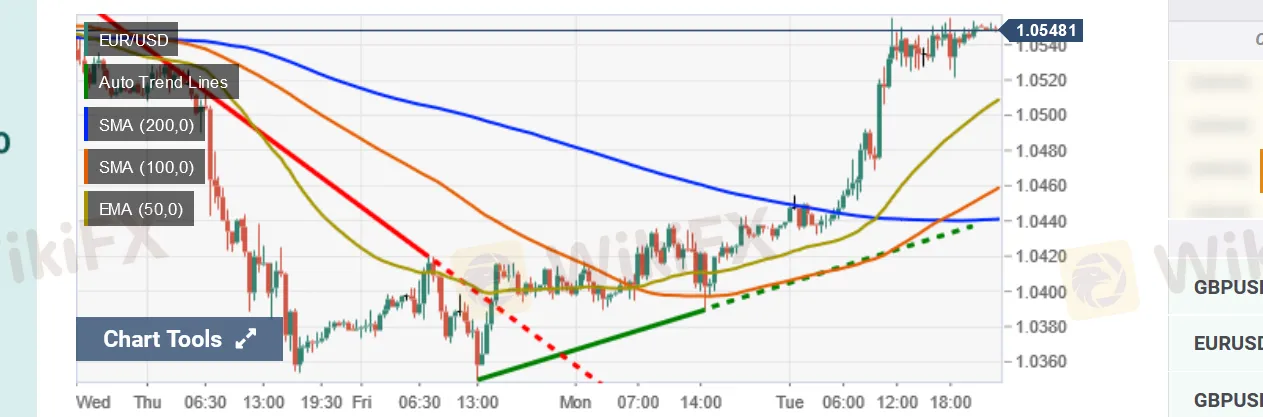

Abstract:The daily chart for EUR/USD shows that the bullish momentum is building up, although further gains are yet to be confirmed. Technical indicators continue to advance within negative levels, with the Momentum about to cross its midline into positive levels. At the same time, the pair is developing below bearish moving averages, with the 20 SMA currently providing dynamic resistance around 1.0575.

EUR/USD steadies around weekly top following the heavy run-up. Euro bulls take a breather around mid-1.0500s, the weekly high, after positing the heaviest daily jump since early March. Second-tier data may entertain traders, risk catalysts are more important for fresh impulses.

Technical Overview

The daily chart for EUR/USD shows that the bullish momentum is building up, although further gains are yet to be confirmed. Technical indicators continue to advance within negative levels, with the Momentum about to cross its midline into positive levels. At the same time, the pair is developing below bearish moving averages, with the 20 SMA currently providing dynamic resistance around 1.0575.

According to the 4-hour chart, the pair is bullish. It has extended its rally above a now flat 20 SMA while is currently battling to surpass a bearish 100 SMA. Technical indicators, in the meantime, head firmly higher near overbought readings. Further gains could be expected if the pair extends its advance beyond the aforementioned resistance in the 1.0570 region, while the case for bears will return if EUR/USD slides below 1.0470.

Support levels: 1.0510 1.0470 1.0430

Resistance levels: 1.0575 1.0620 1.0660

Fundamental Overview

The EUR/USD pair advanced to an intraday high of 1.0555 during the European morning, boosted by comments from European Central Bank Governing Council member Klaas Knot. Speaking on Dutch TV, Knot said that a 50 bps rate hike should not be excluded if data suggest inflation keeps broadening and accumulating. He also added that a 25 bps hike in July would be realistic.

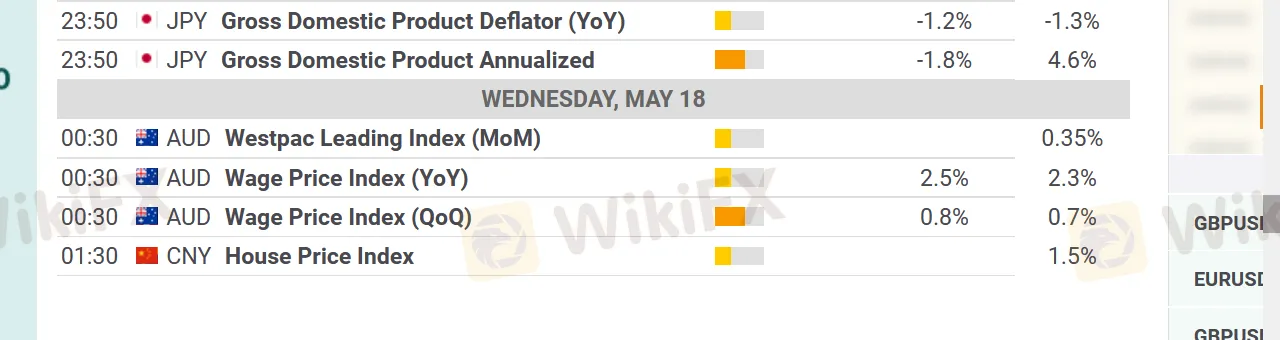

The shared currency was also aided by the positive tone of global stocks, which pointed to a better market mood, despite the underlying issues. Finally, the EU Q1 Gross Domestic Product was upwardly revised to 0.3% QoQ, while the annual comparison was lifted to 5.1% from 5% in the previous estimate.

The pair held on to gains above the 1.0500 ahead of the release of US Retail Sales. According to the official report, sales were up 0.9% in April, better than anticipated. The core reading also beat the markets forecast, as Retail Sales Control Group were up by 1%. The US will later release April Industrial Production and Capacity Utilization.

If you want to know more information about the reliability of certain

brokers, you can open our website (https://www.WikiFX.com/en). Or you

can download the WikiFX APP for free through this link

(https://www.wikifx.com/en/download.html). Running well in both the

Android system and the IOS system, the WikiFX APP offers you the easiest

and most convenient way to seek the brokers you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Acuity Trading Integrates Its Cutting-Edge Tools with cTrader to Revolutionize Trading Experiences

Acuity Trading, a leading provider of trading signals and research, has announced the integration of its comprehensive suite of tools with the cTrader platform. This partnership is set to enhance decision-making and revolutionize the trading experience by delivering powerful data and analytics directly to brokers and traders.

Japan May Face Significant Interest Rate Hikes

Japan's core CPI for December rose by 3% year-on-year. After the data was released, the Japanese yen briefly strengthened but then fell back to 156.05, with the market quickly shifting its focus to the Bank of Japan's future interest rate path.

Doo Prime Officially Launches Trading for OFFICIAL TRUMP (TRUMP/UST)

Trade OFFICIAL TRUMP (TRUMP/UST) now on Doo Prime! Discover exciting opportunities in cryptocurrency trading with low spreads, top platforms, and blockchain technology.

Teen Among 7 Busted in Shocking Online Investment Scam

A 17-year-old boy and six others face charges for allegedly running a fraudulent investment scheme in Taman Ekoflora. While the six adults pleaded guilty, the teen denied the charges. The group could face penalties under Section 120B(2) of the Penal Code. The court will reconvene on March 6 to decide on sentencing.

WikiFX Broker

Latest News

Plus500 Collaborates with Topstep, Prop firm

Robinhood Launches Crypto Trading Services in Spain

Archax Secures FCA Approval to Oversee Crypto Promotions in the UK

CLS Global Admits to Crypto Fraud

Philippine SEC Urges Caution Regarding Ecomamoni

Become Women Brand Ambassador of Yamarkets

Naira Falls Against Dollar as Nigeria Reshapes Economic Blueprint

How Often Do U.S. Recessions Impact Online Trading Trends?

Scam Impersonating U.S. Treasury Token Issuance Spreads on Social Media

Is eToro Leaving London to Focus on a $5B U.S. IPO in 2025?

Currency Calculator