简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading Platform OctaFX Is Added By BNM To The Financial Consumer Alert List

Abstract:The foreign exchange (forex) trading platform OctaFX has been added to Bank Negara Malaysia's (BNM) list of Financial Consumer Alerts. By doing this, the central bank has made it clear that the platform is neither authorized nor permitted by BNM's regulations.

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert list to include foreign exchange (forex) trading platform OctaFX. With this, the central bank has clarified that the platform is neither authorised nor approved under the regulations administered by BNM.

In its statement, BNM noted that OctaFX‘s website, as well as official accounts on social media platforms have all been added into the Financial Consumer Alert list. These include the platform’s Facebook, Twitter, Instagram, YouTube, and LinkedIn accounts.

BNM also explained that the Financial Consumer Alert list acts as a guide for investors, so that they are aware of entities and schemes that “may have been wrongly perceived or represented as being licensed or regulated by BNM”. Additionally, the list is updated based on information that is shared by members of the public, with necessary assessments conducted on the reported entities and schemes.

Aside from BNM, the Securities Commission Malaysia (SC), too, had previously added OctaFX to its own Investor Alert List. It was listed based on the justification that the platform had been carrying out capital market activities of dealing in derivatives without a licence, and for operating a recognised market without authorisation from the SC.

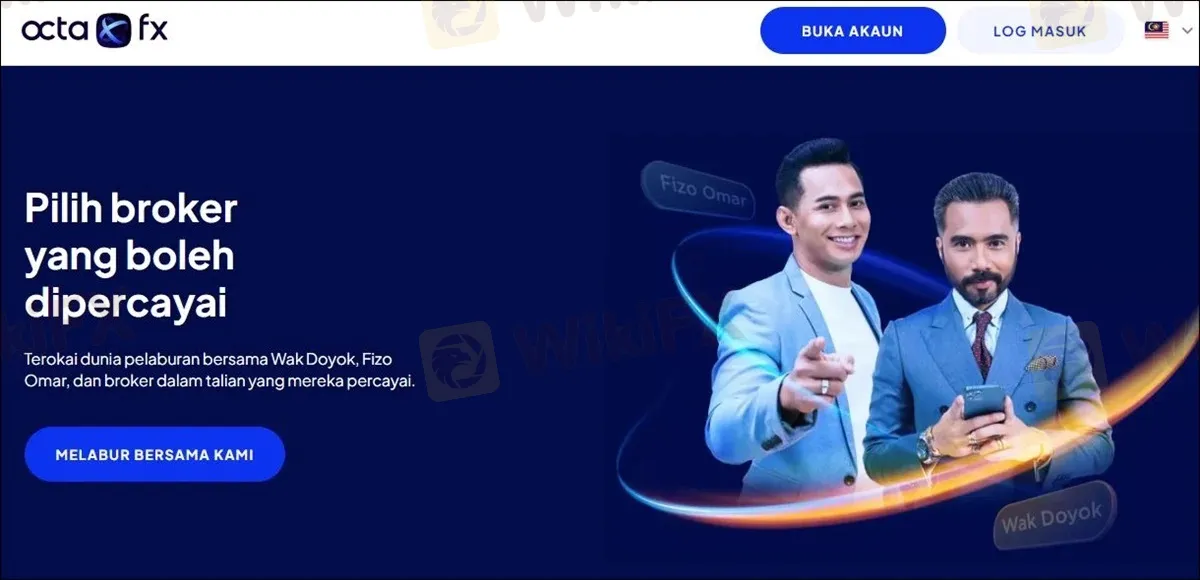

Meanwhile, OctaFX is an international forex broker with presence in over 100 countries globally. Within Malaysia, it has been gradually gaining interest and traction among investors due to its extensive advertisement campaigns, with celebrities such as Fizo Omar and Wak Doyok appearing as “ambassadors”. At the time of writing, the website for OctaFX is still live, along with its social media accounts (such as Facebook).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Hidden Tactics Brokers Use to Block Your Withdrawals

In the fast-paced world of online trading, liquidity is everything. Traders and investors must have unrestricted access to their funds at all times. Any broker that imposes unnecessary conditions or delays when it comes to withdrawals is raising a glaring red flag.

Forex Trading: Scam or Real Opportunity?

Meta: Explore forex trading: Is it a scam or real opportunity? Learn how it works, debunk myths, manage risks, and avoid scams with tools like WikiFX App. Start trading safely today!

Trade Nation 2025 Most Comprehensive Review

This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

FCA Warns of Trading212 Clone Scam Targeting Investors

FCA alerts investors about a Trading212 clone scam using fake details. Learn how to spot clones and protect your funds with the WikiFX app.

WikiFX Broker

Latest News

Is $CORONA Memecoin a Legit Crypto Investment?

Is Pi Network the Next Big Crypto Opportunity?

Donald Trump’s Pro-Crypto Push Boosts PH Markets

Japan’s Shift in Crypto Policy and What It Means for Investors

Is Linkbex a Scam? SFC Warns of Virtual Asset Fraud in Hong Kong

5 Best Copy Trading Brokers: You Can Trust in 2025

3 EXCLUSIVE Ramadan Offers That Won’t Last Long! ACT NOW

The Next Crypto Giants: 5 Altcoins to Watch

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Currency Calculator