简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Digital Asset Platform Versus SEC | Who Will Win?!

Abstract:Cryptocurrency exchange Coinbase filed a lawsuit against the Securities and Exchange Commission (SEC), requesting the organisation to enact more precise cryptocurrency legislation.

Cryptocurrency exchange Coinbase filed a lawsuit against the Securities and Exchange Commission (SEC), requesting the organisation to enact more precise cryptocurrency legislation.

In a so-called “petition for rulemaking” made to the SEC in July 2022, Coinbase requested that the agency develop and adopt regulations for securities backed by digital assets. A total of 50 specific questions were also proposed for more clarity and certainty regarding the regulatory treatment of digital asset securities to create a more suitable market structure framework. While some concerns concentrate on subjects like asset custody and trading crypto asset securities on SEC-regulated exchanges, some of the queries centre on the SEC's process for designating some tokens as securities.

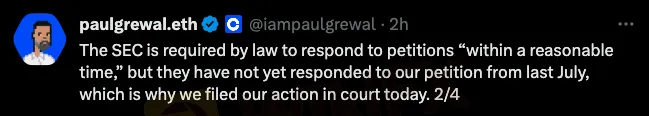

Coinbase Chief Legal Officer Paul Grewal also published a Twitter thread to explained why the company took this approach:

According to the Administrative Procedure Act, the SEC is required by law to respond to Coinbase's petition in a “reasonable” amount of time, which in this case is a total of 9 months, hence that led Coinbase to file a legal challenge.

The petition suggested that it would be advantageous with the enaction of a new legislation is required to regulate the crypto industry because it now falls under a regulatory grey area that is not covered by US securities regulations.

If the financial watchdog responds to the petition, it may reiterate remarks previously made by SEC Chairman Gary Gensler in which he stated that no new regulations are required. Gensler asserted that “regulations actually already exist” for the appropriate management of cryptocurrency under securities laws during a Senate hearing last month.

An insider revealed that Coinbase could stand a chance to sue the SEC if the regulator choose not to adopt new regulation. The insider also claims that Coinbases demand for regulatory clarity is effectively on hold until the company hears back from the SEC.

Grewal clarified that the company is not requesting that the court instruct the SEC on how to respond. He explained, We are just asking the Court to order the SEC to respond at all, which they are legally required to do.

“It‘s important for the SEC and any other agency petitioned for rulemaking to respond to the petition once the agency has made up its mind, especially if the answer is no,” Grewal continued. “Otherwise, the public can never exercise its right to ask a court if the agency’s decision was proper.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Google Bitcoin Integration: A Game-Changer or Risky Move?

Google Bitcoin integration blends wallets with Google accounts, stirring security fears and adoption hopes. ZKP encryption aims for privacy.

Pi Network Mainnet Launch: Game-Changer or Crypto Controversy?

Pi Network’s Mainnet launch sparks debate. With 100M users, KYC compliance, and Binance listing rumors, will it redefine crypto accessibility?

Coinbase Urges US Lawmakers to Establish Clear Crypto Regulations

Coinbase calls for clear US crypto regulations to foster innovation, protect consumers, and ensure transparency in the digital asset industry.

Binance.US Resumes USD Deposits and Withdrawals After 19 Months

Binance.US resumes USD deposits and withdrawals via ACH transfers, marking a major milestone for the crypto exchange after regulatory challenges.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

ED Exposed US Warned Crypto Scam ”Bit Connect”

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

Currency Calculator