简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

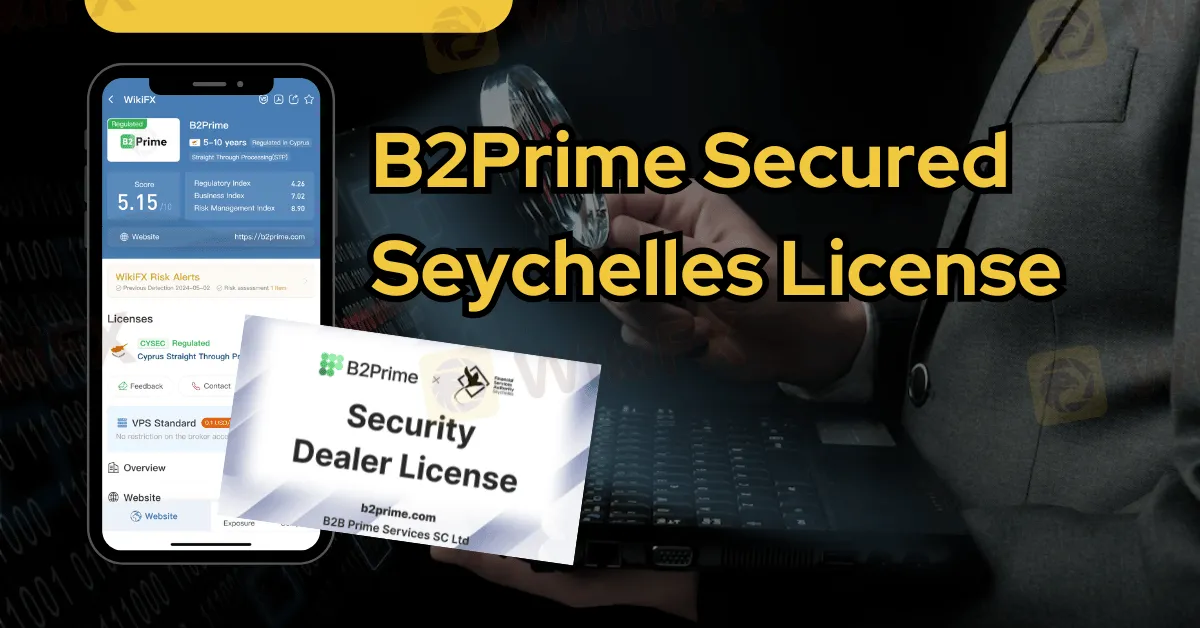

B2Prime Secured Seychelles License

Abstract:B2Prime, a liquidity provider offering services across multiple asset classes, has recently obtained a security dealer license in Seychelles, adding to its existing licenses in Cyprus and Mauritius.

B2Prime, a liquidity provider offering services across multiple asset classes, has recently obtained a security dealer license in Seychelles, adding to its existing licenses in Cyprus and Mauritius. This regulatory milestone signifies B2Prime's expansion into new jurisdictions and its commitment to providing compliant services to its global clientele. The company also received initial approval for a Dubai VARA crypto license.

Seychelles, recognized as an offshore hub for brokers, provides B2Prime with a strategic platform to distribute liquidity locally to regulated entities. With the newly acquired security dealer license, B2Prime is authorized to engage in essential financial activities, including securities negotiation, portfolio management, and transaction handling on behalf of clients.

B2Prime offers over 225 instruments across six asset classes, including Forex, Cryptos, Spot Indices, Precious Metals, Commodities, and NDFs, accessible through a single margin account. Clients benefit from deep liquidity pools sourced from Tier-1 providers, ensuring competitive spreads and efficient execution. The platform also provides seamless connectivity options through various integration channels like oneZero, PXM, Centroid, T4B, FIX API, and cTrader.

Eugenia Mykulyak, Founder & Executive Director of B2Prime, stated the company's aim to provide financial services to local brokers, hedge funds, money managers, institutional clients, and liquidity providers. This move aligns with B2Prime's global growth strategy and enhances its ability to capitalize on opportunities in the global financial markets.

B2Prime recently disclosed financial results for its parent company, demonstrating growth in the first quarter of 2024. Total assets in Cyprus increased significantly, reflecting a 40.32% rise from the previous year. Client assets held for trading also experienced substantial growth, rising by 47.6% to €26,840,460.11.

Shareholders' equity increased by 8%, indicating growth across various financial metrics. Regulatory capital adequacy showed improvement, with B2Prime's own funds increasing nearly 600% to €2,728,000, exceeding regulatory requirements.

These financial results highlight B2Prime's commitment to financial stability and growth, positioning the company as a player in the global financial landscape. With plans to disclose the fiscal report for B2Prime Mauritius soon, the company continues to strengthen its presence as a service provider for clients worldwide.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiEXPO Global Expert Interview: JinDao Tai ——The Future of Forex Trading

In the era of rapid changes in financial innovation and regulation, WikiGlobal, as the organizer of WikiEXPO, has always been at the forefront of the industry, capturing key topics with keen insight and presenting deep thinking and forward-looking perspectives to the industry through a series of unique interviews. This time, we are honored to invite Mr. JinDao Tai, the Managing Director of Jindaotai.com.

President of Liberland Vít Jedlička Confirms Attendance at WikiEXPO Hong Kong 2025

Vít Jedlička, President and Founder of the Free Republic of Liberland, has confirmed his participation in WikiEXPO Hong Kong 2025, one of the most influential Fintech summits in the industry. The event will bring together global leaders, innovators, and policymakers to delve into the future convergence of technology and society.

Is Billion Bucks Fx Scam?

Recent claims on YouTube and social media platforms allege that Billion Bucks Fx is a scam broker. Many traders have reportedly lost money after investing with this broker, and it has been given a notably low score of 1.06/10 by independent rating platforms. In this article, we break down the details of Billion Bucks Fx, assess the risks, and provide insight into whether investors should be wary of its services.

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

The worlds of social media and decentralized finance (DeFi) have converged under a new banner—SocialFi. Short for “Social Finance,” SocialFi leverages blockchain technology to reward user engagement, giving individuals direct control over their data and interactions. While SocialFi has primarily emerged in the context of content creation and crypto communities, its principles could soon revolutionize the forex market by reshaping how traders share insights and monetize social influence.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator