Overview

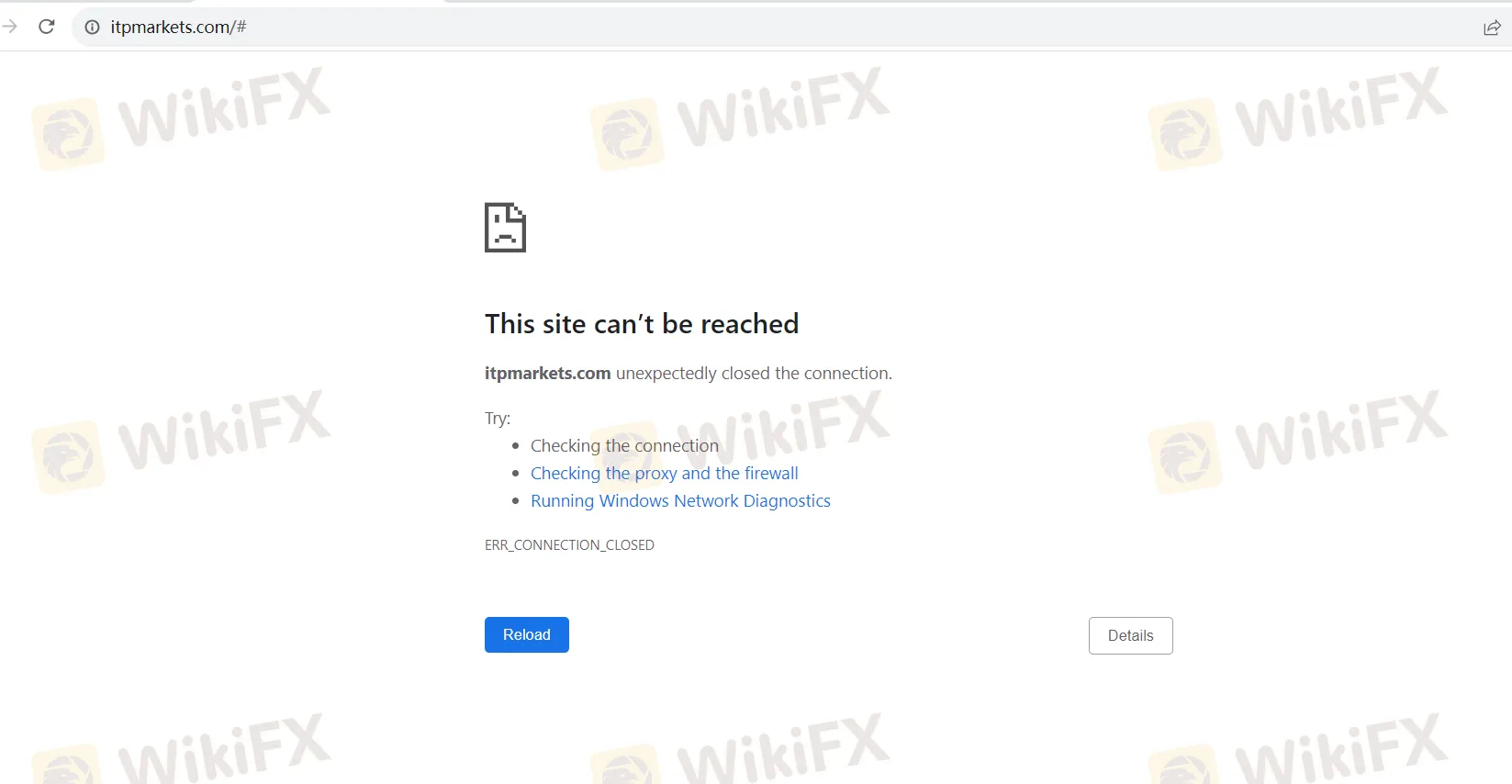

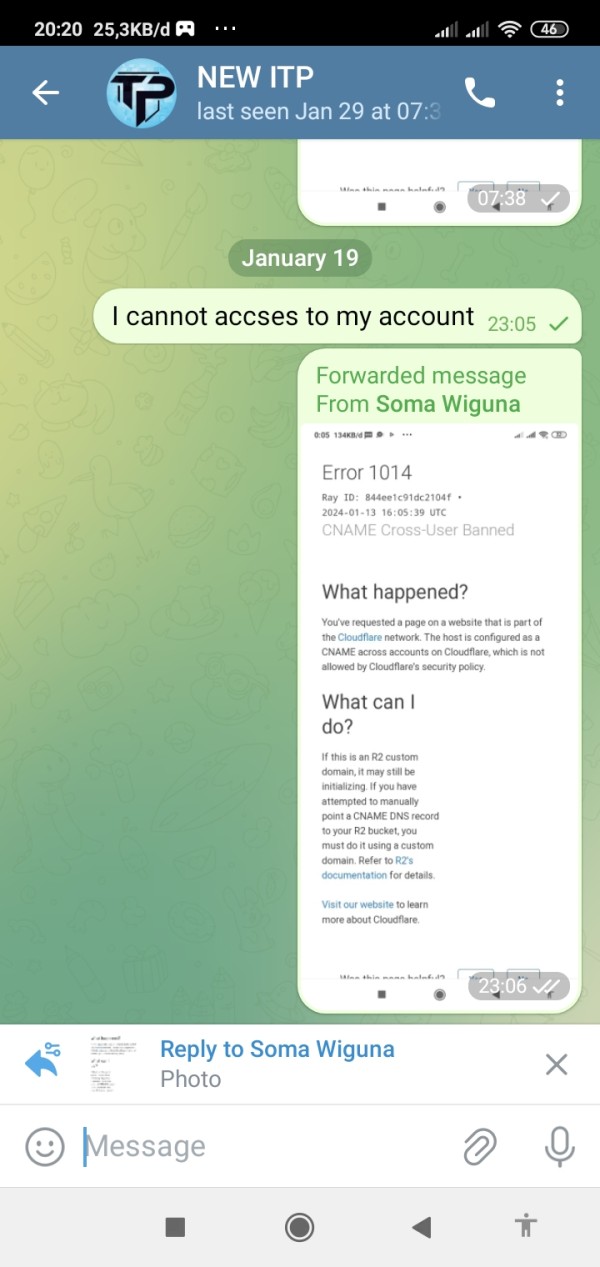

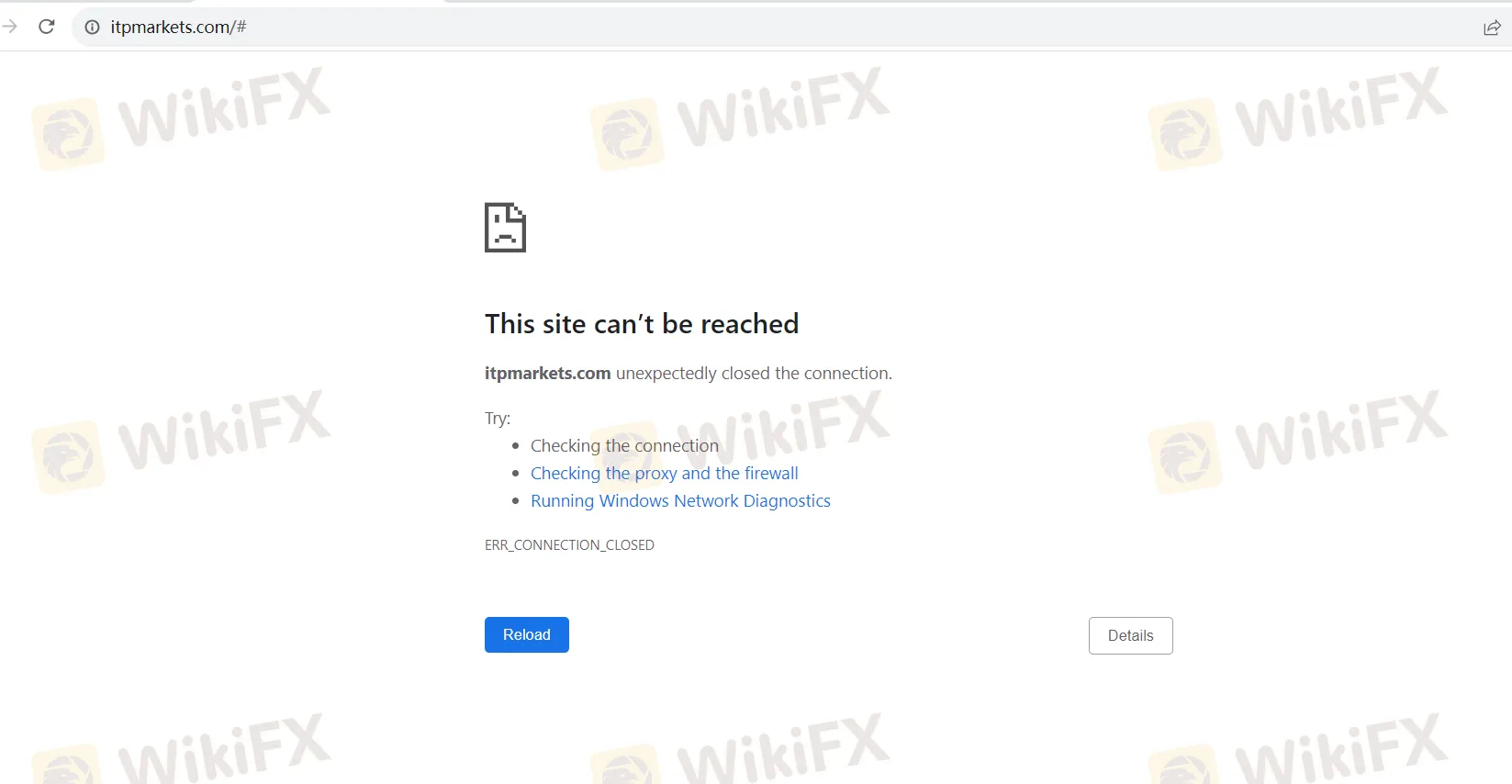

ITP Markets, based in Saint Vincent and the Grenadines, operates as an unregulated broker, which raises concerns about investor protection due to the lack of oversight from reputable financial authorities. While the broker offers a diverse range of account types with varying features and leverage levels, the absence of comprehensive educational resources and limited information about customer support may leave traders feeling uncertain. Additionally, the website's downtime further adds to the negative impression, suggesting potential reliability issues. Traders should exercise caution and carefully consider their options when dealing with ITP Markets.

Regulation

Unregulated. ITP Markets operates as an unregulated broker, meaning it lacks oversight from reputable financial authorities. Investors should exercise extreme caution when considering this broker, as the absence of regulation can pose significant risks to their investments and financial security. It is advisable to opt for regulated brokers that adhere to established industry standards and offer investor protection.

Pros and Cons

ITP Markets is a trading platform with both advantages and drawbacks. While it offers a diverse range of market instruments, focusing on forex and cryptocurrencies, traders should exercise caution due to its unregulated status. The availability of various account types with differing features and leverage levels provides flexibility but requires careful consideration. While the absence of educational resources is a limitation, the provision of risk management tools and likely trading resources is an advantage. Traders should also be aware of the potentially high leverage and its associated risks when using this platform.

Market Instruments

ITP Markets offers a diverse set of market instruments, primarily focusing on forex and cryptocurrencies:

Forex Trading:

Market: ITP Markets provides access to the foreign exchange (forex) market, enabling users to trade currencies from around the world.

Currency Pairs: Traders can engage in forex trading through currency pairs, like EUR/USD and USD/JPY, speculating on their relative values.

Liquidity and Volume: The forex market is exceptionally liquid, with a daily trading volume exceeding $6 trillion (as of January 2022).

Leverage: Forex trading on ITP Markets often includes leverage, amplifying both potential profits and risks.

Cryptocurrency Trading:

Market: ITP Markets allows users to trade popular cryptocurrencies such as Bitcoin, Ethereum, and Ripple.

Blockchain Technology: Cryptocurrencies operate on decentralized blockchain technology, offering transparency and security.

Volatility: Cryptocurrency markets are known for their volatility, making them attractive for traders seeking price fluctuations.

Risk Management: ITP Markets likely provides risk management tools to help traders navigate the crypto market's volatility.

Key Considerations:

Risk Awareness: Both forex and cryptocurrency trading carry inherent risks, emphasizing the importance of understanding market dynamics and risk management.

Regulatory Compliance: Users should ensure compliance with applicable financial regulations based on their location and ITP Markets' services.

Resources: ITP Markets likely offers various trading tools and resources to assist traders in making informed decisions.

In summary, ITP Markets caters to traders interested in forex and cryptocurrency markets, offering opportunities for profit but necessitating caution, risk management, and regulatory awareness.

Account Types

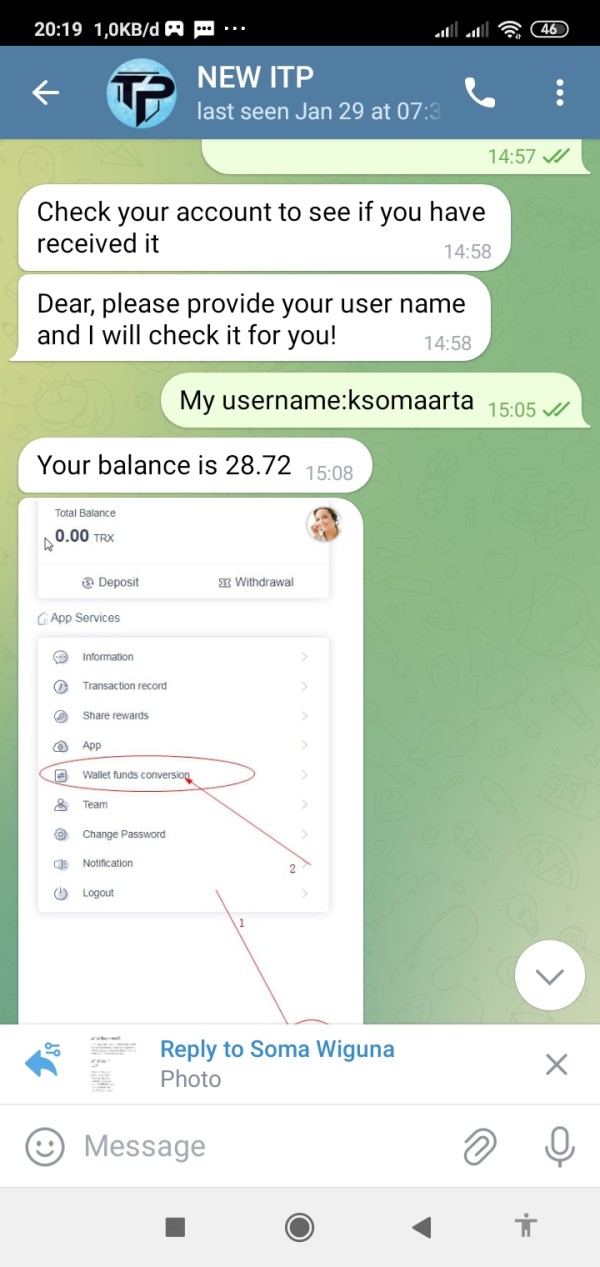

IT appears that ITP Markets offers a range of trading account types, each designed to cater to different trading preferences and needs. Among these, there are four account types, namely CRYPTO, MICRO/CENT, STANDARD, and PRO, which share certain similarities in their basic specifications. These similarities include a maximum leverage of 1:500, a minimum deposit requirement of USD 10, and minimum spread starting from 1.5. However, specific details about the products offered, available currency pairs, minimum position sizes, supported Expert Advisors (EAs), deposit and withdrawal methods, and commission rates are not provided in the information. To make an informed decision about which of these four account types is the most suitable, potential traders would need more comprehensive information about the trading conditions and features associated with each.

On the other hand, there is a distinct account type known as the ECN account. This account type stands out due to several key differences. It offers a maximum leverage of 1:300, which is slightly lower than the other account types, and requires a significantly higher minimum deposit of USD 1000. The ECN account also boasts potentially lower spreads, starting from 0.5. Again, detailed information about the products, currency pairs, minimum position sizes, EAs, deposit and withdrawal methods, and commissions for this account type is not provided.

In summary, while ITP Markets offers multiple account types, the information provided lacks crucial details about specific trading features and conditions. Traders interested in opening an account with ITP Markets would need to gather more information to make an informed decision about the most suitable account type based on their trading strategy, preferences, and risk tolerance. This additional information would help them better understand the unique advantages and disadvantages of each account type and align their choice with their individual trading goals.

Leverage

ITP Markets offers a maximum trading leverage of up to 1:500. This means that for every $1 in the trader's account, they can potentially control a trading position worth up to $500. High leverage allows traders to amplify their exposure to the market, potentially increasing both profits and losses. However, it's important to exercise caution when using high leverage, as it also increases the level of risk involved in trading. Traders should have a solid risk management strategy in place and be aware of the potential consequences of trading with such high leverage.

Spreads and Commissions

CRYPTO Account:

The CRYPTO account offered by ITP Markets is tailored for traders interested in cryptocurrency trading. It features competitive spreads, with the EUR/USD pair having a spread of 1.2 pips and the GBP/JPY pair having a spread of 2.0 pips. Notably, this account type does not charge any commissions on trades, making it appealing for traders who prefer a commission-free trading experience.

MICRO/CENT Account:

The MICRO/CENT account is designed for traders who are just starting or prefer smaller trade sizes. It offers spreads such as 1.5 pips for EUR/USD and 1.8 pips for USD/JPY. Similar to the CRYPTO account, this account type does not have commissions, which can be advantageous for traders with smaller capital looking to keep their trading costs low.

STANDARD Account:

The STANDARD account is a versatile choice for traders seeking a balance between competitive spreads and trade size flexibility. It features spreads of 1.0 pips for EUR/USD and 1.2 pips for GBP/USD. Like the previous account types, the STANDARD account does not charge any commissions.

PRO Account:

The PRO account is tailored for more experienced traders who prioritize tight spreads. It offers notably narrow spreads, with EUR/USD at 0.5 pips and USD/JPY at 0.8 pips. However, it does have a commission fee of $5 per lot traded on each side (buy and sell), which is a common practice for accounts with such tight spreads.

ECN Account:

The ECN account stands out with its extremely tight spreads, offering 0.2 pips for EUR/USD and 0.5 pips for GBP/JPY. To support these tight spreads, the ECN account charges a commission of $7 per lot traded on each side. This account type is ideal for traders who prioritize low spreads and are willing to pay a commission for access to competitive pricing.

In summary, ITP Markets offers a range of account types to cater to various trading preferences. Traders can choose between accounts with varying spreads and commission structures, allowing them to select the one that aligns best with their trading strategy and budget. It's important to note that these sample spreads and commissions are for illustrative purposes, and actual trading conditions may vary based on market fluctuations and the broker's policies. Traders should always refer to the broker's official website for the most accurate and up-to-date information on spreads and commissions.

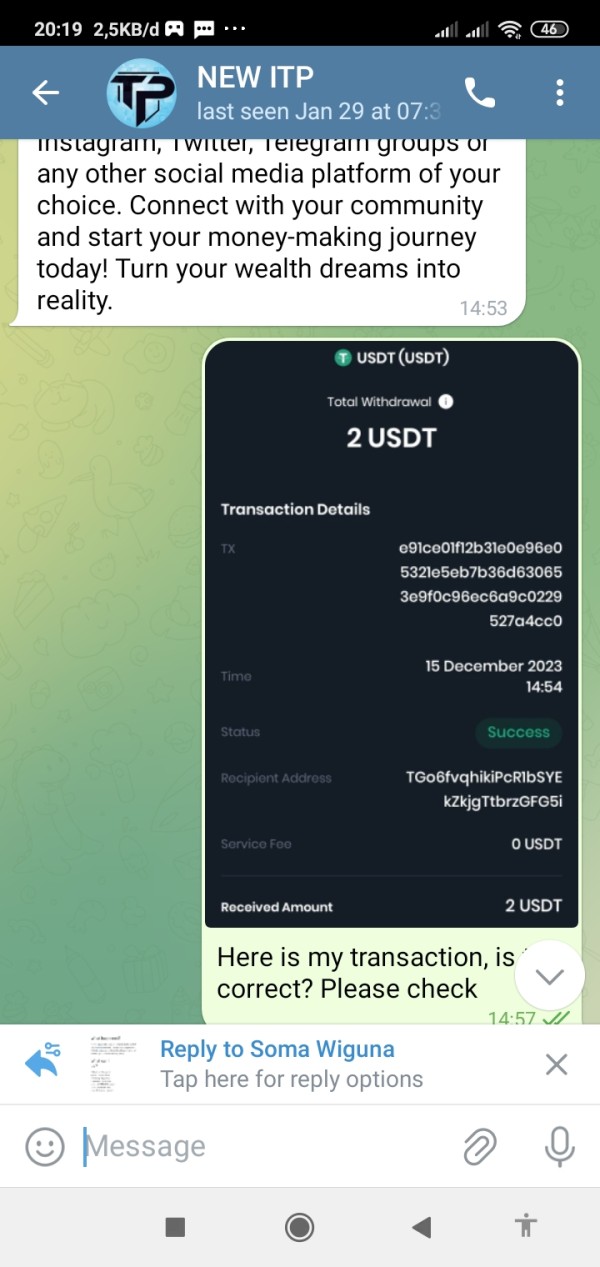

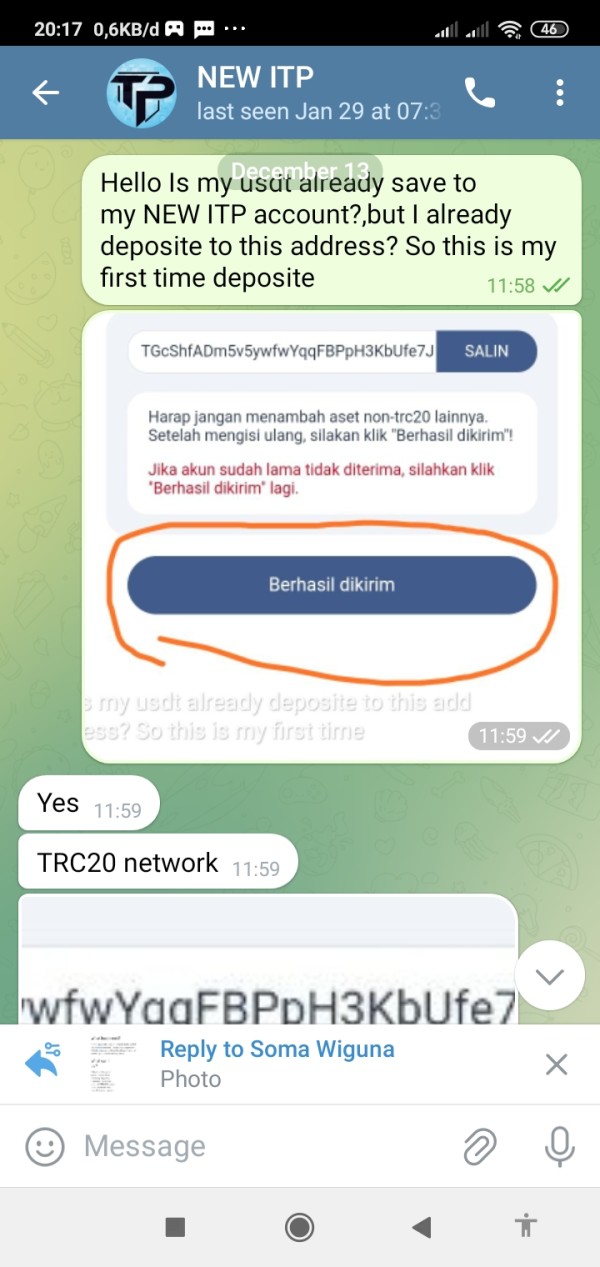

Deposit & Withdrawal

ITP Markets offers multiple deposit and withdrawal methods for its trading accounts:

Deposit Methods:

Credit Card: ITP Markets likely accepts deposits via credit cards. This is a common and convenient method for traders to fund their accounts. Traders can use their credit cards to transfer funds directly to their trading accounts, allowing for quick and easy access to the markets.

Wire Transfer: ITP Markets also offers wire transfer as a deposit method. Wire transfers are a secure way to transfer funds from a bank account to a trading account. Traders can initiate wire transfers to deposit larger sums of money into their accounts, and it's a widely accepted method in the financial industry.

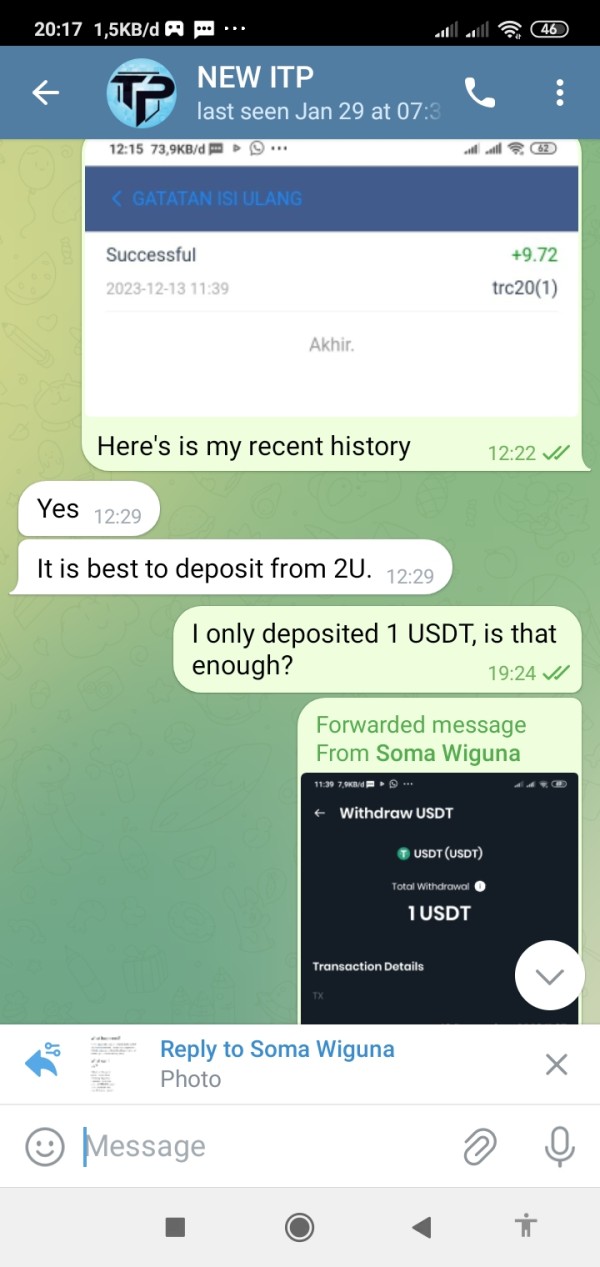

Crypto: ITP Markets appears to support cryptocurrency deposits. This means that traders can use cryptocurrencies such as Bitcoin or Ethereum to fund their trading accounts. Cryptocurrency deposits can offer additional privacy and security to traders who prefer using digital assets.

Withdrawal Methods:

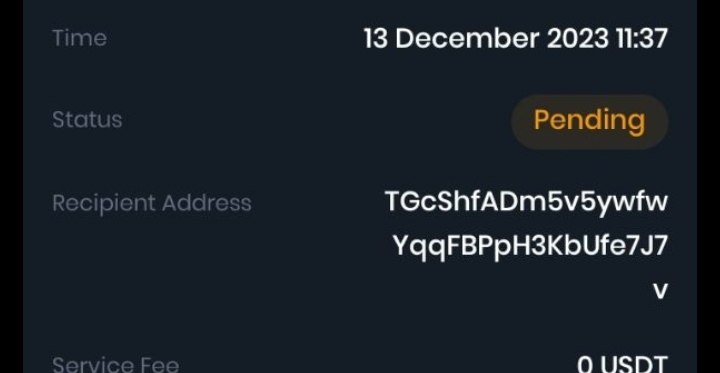

The available withdrawal methods are not specified in the provided information. However, it's common for brokers to offer similar methods for withdrawals as they do for deposits. Therefore, it's likely that traders can withdraw funds from their ITP Markets accounts using credit card withdrawals, wire transfers, and possibly cryptocurrency withdrawals if they initially deposited funds using this method.

Trading Platforms

ITP Markets offers the popular MetaTrader 4 (MT4) trading platform. MT4 is a widely recognized and widely used platform in the financial industry, known for its user-friendly interface, advanced charting tools, technical analysis capabilities, and support for automated trading through Expert Advisors (EAs). Traders who choose ITP Markets as their broker can access and trade on the MT4 platform, enabling them to execute trades efficiently, analyze market data, and implement their trading strategies seamlessly within a familiar and robust trading environment.

Customer Support & Educational Resources

ITP Markets may have limited customer support and educational resources available for its clients. The absence of specific details regarding customer support suggests that the broker may not offer extensive assistance or may have minimal customer support channels. Additionally, the indication of “no” regarding educational resources implies that traders using ITP Markets may not have access to a comprehensive range of materials to enhance their trading knowledge and skills. Traders considering this broker should be aware of these limitations and assess whether they require additional support and educational materials from external sources to meet their trading needs effectively.

Summary

ITP Markets operates as an unregulated broker, which raises concerns about investor protection due to the lack of oversight from reputable financial authorities. While they offer a variety of market instruments, primarily focusing on forex and cryptocurrencies, caution is advised. Their account types vary, with the ECN account offering tighter spreads but requiring a higher minimum deposit. The maximum leverage of up to 1:500 can amplify risks. Additionally, the absence of detailed information on deposit and withdrawal methods is a drawback. The website being down further adds to the negative impression, leaving potential traders with uncertainties about the reliability of ITP Markets as a trading platform.

FAQs

Q: Is ITP Markets a regulated broker?

A: No, ITP Markets operates as an unregulated broker, lacking oversight from reputable financial authorities.

Q: What is the maximum leverage offered by ITP Markets?

A: ITP Markets offers a maximum trading leverage of up to 1:500, which can significantly amplify both potential profits and risks.

Q: Are there educational resources available for traders on ITP Markets?

A: No, based on the information provided, ITP Markets does not seem to offer comprehensive educational resources for traders.

Q: What market instruments can I trade on ITP Markets?

A: ITP Markets primarily focuses on forex and cryptocurrency trading, offering a range of currency pairs and popular cryptocurrencies like Bitcoin and Ethereum.

Q: How can I deposit funds into my ITP Markets trading account?

A: ITP Markets supports various deposit methods, including credit cards, wire transfers, and cryptocurrency deposits. However, specific details about withdrawal methods are not provided in the available information.