Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Institutions

The gold market approached 20-year highs in 2019 relative to other precious metals - Business Insider

Gold broke through the $1,400/troy oz. barrier in June, a level which had not been breached since the gold market correction in 2013.

China has piled up nearly 100 tons of gold reserves to help buffer against the blows of Trump's trade war

Gold's rise is a major sign that investors are worried about the state of the economy.

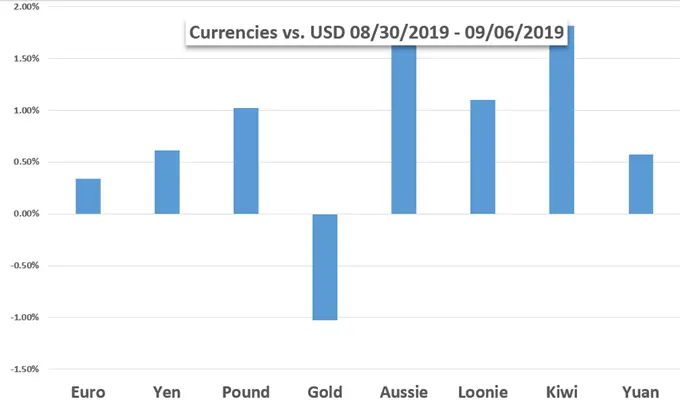

Dow Rises and Gold Falls on Trade War Enthusiasm, ECB Decision Top Event Ahead

Though tentative, market participants latched on to nascent signs that trade war conditions may improve and the threat of recession is not as imminent as many fear. This would be the perfect opportunity for monetary policy to further leverage the uneven swell in sentiment. The ECB will start a run

Trading Forecast: EURUSD and Dow Bearings Rest on Jackson Hole, Trump

Scheduled event risk is starting to give way to sentiment and systemic fundamental concerns a prospect that threatens volatility at a time of year when quiet is supposed to prevail. Trade wars are finding guidance from headlines that President Trump regularly tops, while recession fears are tied more closely to

Gold Price Targets: XAU/USD Breakout Halted at Trend Resistance

Gold prices ripped into multi-year trend resistance this week - the breakout is vulnerable while below. Here are the levels that matter on the XAU/USD weekly chart.

Gold Price Weekly Forecast: Bullish Breakout Remains In-Play

Gold is currently consolidating just under $1,500/oz. after hitting a six-and-a-half year high of $1,511/oz. earlier this week. Positive fundamentals remain but markets dont move in a straight line.

Gold Price Targets: XAU/USD Surges 4%- Can the Rally be Sustained?

Gold prices surged nearly 19% off the yearly lows with the rally targeting key long-term uptrend resistance. Here are the levels that matter on the XAU/USD weekly chart.

Gold Price Targets: Weekly Reversal Testing Resistance at Yearly High

Gold prices are poised to mark the largest advance in six-weeks with price now challenging the yearly highs. Here are the levels that matter on the XAU/USD weekly chart.

Gold Prices May Suffer if FOMC Undermines Dovish Expectations

Gold prices may look increasingly overpriced if the FOMC rate decision and commentary fall short of the markets comparatively more dovish expectations, opening the door to weakness.

Gold Price Targets: Breakout Stalls – XAU/USD Coils Below Resistance

Gold prices are softer this week after reversing off key uptrend resistance. Here are the breakout levels that matter on the XAU/USD weekly chart into the close of July.

Gold Price Targets: Breakout Stalls – XUA/USD Coils Below Resistance

Gold prices are softer this week after reversing off key uptrend resistance. Here are the breakout levels that matter on the XAU/USD weekly chart into the close of July.

Weekly Trading Forecasts: EURUSD Top Fundamental Candidate on Fed Speculation, ECB Decision Approaches

We may find the top scheduled event risk next week displaced for market moving potential by an increasingly volatile theme. Key event risk ahead includes Fridays US 2Q GDP update and the global PMIs for July which would seem to put the focus on growth and recession concerns. Yet, the

Gold Price Weekly Outlook: XAU/USD Rally Losing Steam into July Trade

Gold prices are poised for a sixth consecutive weekly advance with rally vulnerable int the start of July. Here are the levels that matter on the XAU/USD weekly chart.

Gold Price Weekly Outlook: Gold Rips to 5-Year Highs- Buyers Beware

Gold prices are poised to post the largest weekly advance in three years with price probing key resistance. These are the levels that matter on the XAU/USD weekly chart.

Gold Prices May Rise if USD Sinks, US Data Fuels Fed Rate Cut Bets

Gold prices spent most of last week in rather mute trade until a sudden surge of volatility on Thursday sent the precious metal rallying. Looking at the XAU/USD 4-hour chart below

Gold Price Weekly Outlook: XAU Breakdown Stalls at Technical Support

Gold plummeted nearly 2.6% from the May high with the sell-off now testing the yearly low-day close. These are the levels that matter on the XAU/USD weekly chart.

Gold Price Outlook: A Week Packed Full of Major Risk Events and Data

A deluge of high importance data releases and two major central bank interest rate decisions may buffet gold all next week, with the latest US non-farm payrolls to bring the week to a close, just for good measure. Add in low liquidity in Asia and traders will need to be

Weekly Trading Forecast: Risk Appetite Overcomes Growth Concerns

Speculative appetite – also called ‘animal spirits’ – is holding effective control over the capital markets. Despite regular warnings over the health of the global economy and infighting that suggests there is little capacity or will to fight future fires, the markets continue their advance in pursuit of capital gains.

Gold Q2 Forecast: Bets for Fed Rate-Cut Fosters Bullish Outlook

Gold may continue to catch a bid in the second quarter of 2019 as the Federal Reserve adjusts the forward guidance for monetary policy.

XAUUSD: Spot Gold Price Chart Suggests Further Pullback Risk

Spot gold is down roughly 4 percent since its recent peak in February, but the precious metal could see further downside.