General Information

Since its founding in 2010, Evotrade is a brokerage firm that offers trading services in a wide range of market instruments, including forex, cryptocurrencies, precious metals, energy carriers, and stocks. They provide multiple trading account types to cater to different traders' needs, along with leverage of up to 1:200. The broker offers access to the popular MetaTrader 5 platform, which offers advanced trading tools and features.

However, it's important to note that Evotrade is not regulated by any recognized financial regulatory authority. This lack of regulation raises concerns regarding the transparency, security, and fair treatment of clients' funds. Regulated brokers are subject to specific rules and guidelines designed to protect investors and maintain the integrity of the financial markets.

Additionally, Evotrade's withdrawal policy imposes fees for withdrawals and an extra charge if the trader has not completed a minimum number of trades. These factors, combined with the absence of valid regulation, should be carefully considered by potential traders.

It's crucial to conduct thorough research, evaluate the risks involved, and consider alternative brokers that are properly regulated and overseen by reputable authorities before deciding to engage in trading activities with Evotrade.

Pros and Cons

Evotrade is a brokerage firm that offers trading services in various market instruments, including forex, cryptocurrencies, precious metals, energy carriers, and stocks. While the broker provides multiple trading account types and leverage of up to 1:200, there are significant concerns regarding its legitimacy due to the lack of regulation by recognized financial authorities. The absence of valid regulation raises potential risks for traders, including the possibility of fraudulent activities and inadequate client protection. Additionally, Evotrade's withdrawal policy imposes fees on withdrawals and an extra charge if the trader has not completed a minimum number of trades. These factors, combined with the withdrawal fees and the requirement of a minimum deposit of $250, should be carefully considered before choosing to trade with Evotrade.

Pros and Cons

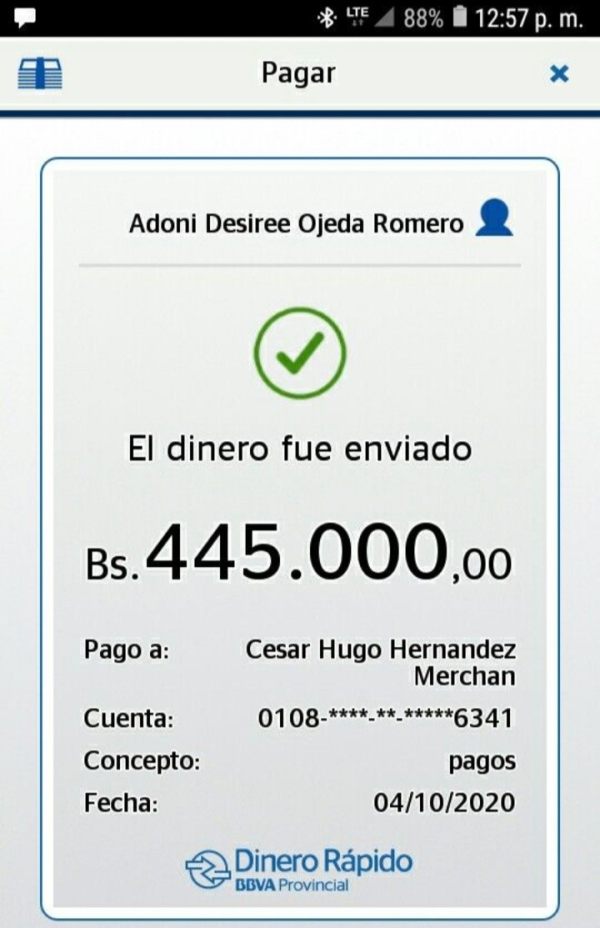

Is Evotrade Legit?

Evotrade is not regulated by any recognized financial regulatory authority. The broker claims to be regulated by FMRRC (Financial Market Relations Regulation Center) with the license number TSFRF RU 0395 AA V0172. However, it's important to note that FMRRC regulation may not hold the same level of credibility and oversight as regulatory bodies like the Financial Conduct Authority (FCA), the Securities and Exchange Commission (SEC), or similar reputable organizations.

The lack of valid regulation should be a significant concern for potential traders. Regulation plays a crucial role in ensuring the transparency, security, and fair treatment of clients' funds. Regulated brokers are subject to specific rules and guidelines designed to protect investors and maintain the integrity of the financial markets. Without proper regulation, there is a higher risk of fraudulent activities, mismanagement of funds, and inadequate client protection.

Given the warning and the absence of valid regulatory information, it is strongly advised to exercise caution and consider alternative brokers that are properly regulated and overseen by reputable authorities.

Market Instruments

Evotrade offers a range of market instruments for trading, including:

Forex: Evotrade provides access to the foreign exchange market, allowing traders to trade currency pairs and speculate on the exchange rate movements of major and minor currency pairs.

Cryptocurrencies: Traders can participate in the cryptocurrency market through Evotrade. Cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and others may be available for trading.

Precious Metals: Evotrade allows trading of precious metals like gold, silver, platinum, and palladium. Traders can take positions on the price movements of these valuable commodities.

Energy Carriers: The broker offers trading opportunities in energy carriers, which may include commodities such as oil, natural gas, and other energy-related products. Traders can speculate on the price fluctuations in these markets.

Stocks: Evotrade provides access to stocks, enabling traders to invest in shares of publicly listed companies. This allows traders to take positions on the price movements of individual stocks and potentially benefit from their performance.

Account Types

Evotrade offers multiple trading account types to cater to different traders' needs. Here is an overview of the account types and their features:

Micro Account: The Micro account requires a minimum initial deposit of $250. It offers spreads starting at 0.6 pips. Traders can also receive a trading bonus of up to 30%.

Bronze Account: The Bronze account requires a minimum initial deposit of $1,000. It offers spreads starting at 0.6 pips and a trading bonus of up to 30%.

Silver Account: The Silver account requires a minimum initial deposit of $5,000. It provides spreads starting at 0.6 pips and a trading bonus of up to 50%.

Gold Account: The Gold account requires a minimum initial deposit of $10,000. It offers spreads starting at 0.6 pips and a trading bonus of up to 80%.

Platinum Account: The Platinum account requires a minimum initial deposit of $25,000. It provides spreads starting at 0.6 pips. Traders can receive a trading bonus of up to 80% and a deferred bonus of up to 50% per month.

Diamond-VIP Account: The Diamond-VIP account is the highest-tier account, requiring a minimum initial deposit of $100,000. It offers spreads starting at 0.6 pips. Traders can receive a trading bonus of up to 100% and a deferred bonus of up to 50% per 3 months.

The specific details about maximum leverage, minimum position sizes, supported products, and commission are not provided in the information provided.

Leverage

Evotrade offers leverage of up to 1:200 according to their trading platform. Leverage allows traders to control larger positions in the market with a smaller amount of capital. With a leverage of 1:200, traders can potentially magnify their trading positions up to 200 times the amount of their initial investment. However, it's important to note that while leverage can amplify potential profits, it also increases the risk of losses. Traders should exercise caution and have a thorough understanding of leverage and its implications before utilizing it in their trading activities.

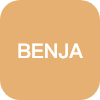

Deposit & Withdrawal

Evotrade's deposit and withdrawal process involves several considerations. To open an account, the minimum deposit requirement is $250. This amount serves as the initial funding for trading activities. It's important to note that Evotrade charges withdrawal fees for different methods. For wire transfers, there is a fee of $50, while credit or debit card withdrawals incur a $25 fee along with a $10 service charge. E-Payments are subject to a withdrawal fee of $25.

One aspect that traders need to be aware of is Evotrade's withdrawal policy. If a trader has not completed a minimum of 200 trades, an additional 10% charge will be imposed on their withdrawal amount. This means that if the trade volume requirement is not met, the trader will face a deduction of 10% from the requested withdrawal. These fees and charges associated with withdrawals can have an impact on the final amount received by the trader.

It's essential for potential clients to carefully consider the deposit and withdrawal terms before engaging with Evotrade. Evaluating these factors helps individuals make informed decisions about their trading activities and the associated costs.

Trading Platform

Evotrade offers multiple trading platforms for its clients:

MetaTrader 5 (MT5): Evotrade provides access to the widely used MetaTrader 5 platform. MT5 offers advanced trading tools, a user-friendly interface, and a wide range of features. It supports trading across various asset classes, including forex, cryptocurrencies, precious metals, energy carriers, and stocks.

Mobile Trading: Evotrade offers a mobile trading platform, allowing traders to access their accounts and trade on the go. The mobile platform is compatible with smartphones and tablets, providing convenience and flexibility for traders who prefer trading on mobile devices.

Webtrader: Evotrade also provides a web-based trading platform that allows traders to access their accounts and trade directly through a web browser. This platform eliminates the need for software downloads and provides access to the markets from any computer with an internet connection.

These trading platforms offer a range of tools, charts, and indicators to assist traders in conducting technical analysis and executing trades. Traders can monitor market prices, place orders, manage their positions, and access account information through these platforms.

Pros and Cons

Broker News

As Proof For The Evotrade Trading Robot Case, Luxurious Vehicles To Hundreds Of Billion Accounts

The police's Criminal Investigation Unit (Bareskrim) has started seizing the suspects' assets in the case involving fraudulent investments made using the Evotrade trading robot mode. So far, proof has ranged from a number of high-end autos to accounts holding hundreds of billions.

“One Lexus L 570 automobile, one BMW M5 car with Vehicle Ownership License (BPKB), one BMW Z4 car also with BPKB, one Mini Cooper, one Harley Davidson motorcycle, and one motorcycle are among the assets that have so far been seized in this case. flimavera vespa, ”Brigadier General Ahmad Ramadhan, Karo Penmas, Police Public Relations Division, spoke to media on March 24.

Investigators have also banned and seized the suspects' accounts in the case that has produced six suspects. These accounts have a notional value of 250 billion IDR.

Investigators also found cash in the form of rupiah and Singapore dollars. The quantity exceeds a thousand pieces.

According to Ramadhan, there were 1.150 pieces of 1000 Singapore dollar notes and 1.000 pieces of 100 000 rupiah denominations among the cash.

Not to mention, there are properties in the East Java region of Malang included in the list of confiscated assets. According to estimates, the nominal worth is in the billions.

Ramadhan said, One plot of land and a building at the Green Tombro Residence, Malang, East Java.

For information's sake, the Police Criminal Investigation Unit has identified six suspects in the Evotrade trading robot investment fraud case. The letters after their names are AD, AMA, AK, D, DES, and MS.

Conclusion:

In conclusion, Evotrade offers a range of trading instruments, multiple account types, and leverage options to cater to different traders' needs. However, there are notable disadvantages that must be considered. The lack of regulation by recognized financial authorities raises concerns about the legitimacy and security of the broker. Additionally, the withdrawal policy includes fees and an additional charge for insufficient trading volume, which can impact the amount received by traders. It is crucial for potential clients to carefully evaluate these disadvantages alongside the advantages before deciding to engage with Evotrade.

FAQs

Q: Is Evotrade regulated?

A: Evotrade is not regulated by any recognized financial regulatory authority. The broker claims to be regulated by FMRRC, but this regulation may not hold the same level of credibility as reputable regulatory bodies.

Q: What market instruments can I trade with Evotrade?

A: Evotrade offers trading opportunities in forex, cryptocurrencies, precious metals, energy carriers, and stocks.

Q: What are the account types offered by Evotrade?

A: Evotrade provides various trading account types, including Micro, Bronze, Silver, Gold, Platinum, and Diamond-VIP accounts. Each account type has different minimum deposit requirements and trading bonuses.

Q: What is the leverage offered by Evotrade?

A: Evotrade offers leverage of up to 1:200, allowing traders to control larger positions with a smaller amount of capital.

Q: What are the fees associated with deposits and withdrawals at Evotrade?

A: Evotrade charges withdrawal fees depending on the withdrawal method. Wire transfers have a $50 fee, credit or debit card withdrawals have a $25 fee plus a $10 service charge, and e-payment withdrawals have a $25 fee.

Q: What are the available trading platforms at Evotrade?

A: Evotrade offers the MetaTrader 5 (MT5) platform, a mobile trading platform, and a web-based platform (Webtrader) for traders to access the markets and execute trades.

Q: What payment methods does Evotrade accept?

A: Evotrade accepts debit and credit cards (Visa, Mastercard, Maestro, Visa Electron), bank wire transfers, and e-payment methods (Payeer, WebMoney, QIWI) for deposits and withdrawals.

Q: How can I contact Evotrade's customer support?

A: You can contact Evotrade's customer support via email at support@evotrade.com or by phone at +44 (204) 577-24-89.