Score

Billionext

The Virgin Islands|5-10 years|

The Virgin Islands|5-10 years| --

Website

Rating Index

Influence

Influence

D

Influence index NO.1

India 2.57

India 2.57Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- This broker has been verified to be illegal and all of its licences have expired, and it has been listed in WikiFX's Scam Brokers list. Please be aware of the risk!

Basic Information

The Virgin Islands

The Virgin IslandsUsers who viewed Billionext also viewed..

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM)

Website

billionextglobal.com

Server Location

United States

Website Domain Name

billionextglobal.com

Server IP

107.180.27.226

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

Note: Since Billionext s official site (http://www.billionextglobal.com/) is not accessible while writing this introduction, only a cursory understanding can be obtained from the Internet.

General Information

Billionext, a trading name of Billionext Global Limited, is allegedly a broker registered in the British Virgin Islands and established in 2015. However, actually, it is unregulated and was founded in 2019. Unluckily, we cant find other more detailed information about this broker on the Internet.

Customer Support

Billionext‘s registered address: Clarence Thomas Building, P.O. Box 4649, Road Town, Tortola, British Virgin Islands. However, this broker doesn’t disclose other more direct contact information like telephone numbers or email that most brokers offer.

Keywords

- Scam Brokers

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

News

News What is a forex scam really like, and will you be the next victim?

foreign exchange scams entice unscrupulous operators to make speedy money. While many once-popular scams have diminished away owing to the Commodity Futures Trading Commission's (CFTC) aggressive enforcement efforts and the founding of the self-regulatory National Futures Association (NFA) in 1982, some historic scams persist, and new ones maintain cropping up.

2022-06-11 11:30

News ACCORDING TO ANALYSTS, THE LINGERING FX CRISIS IS HARMING STOCK MARKET GROWTH

Experts have repeated demands for the Federal Government (FG) to implement a strategy to address the country's extended volatility in the foreign currency (forex) market in order to stimulate stock market, present uptrend, listed enterprises' profit

2022-06-09 16:05

News High Forex Scarcity forces Nigerians to keep their earnings abroad: Investors cry out loud.

Nigerian investors and business moguls have called on the Federal government to reconsider its policy on Forex Market which has created more scarcity for dollars in the exchange market and increased the exchange rate drastically in recent times. Speaking on this, the Founder of Stanbic IBTC Bank Plc - Atedo Peterside had called on the Nigerian government to create a level playing field to attract investment into the country.

2022-06-06 16:12

News ACCORDING TO THE REPORT, NIGERIA'S FOREX SITUATION WOULD IMPROVE

The monetary authority is well placed to relieve foreign currency (FX) pressures, as its coffers have been bolstered by a significant $7.3 billion liquidity - $4 billion Eurobond issue and $3.3 billion special drawing right (SDR) from the International Monetary Fund (IMF).

2022-06-05 12:00

News Is Forex trading gambling or an investment package?

Anyone who trades the forex market without a proper understanding of the fundamental factors that move the Forex Market is a gambler. The Forex Market is ontologically designed to be an investment package for individuals, companies, and government. However, the desire to make quick money by scalpers has dented the image of the forex industry. Forex is a tool for hedging against inflation and maximizing profits. And never a place for gambling.

2022-05-30 16:45

News South Africa is on the verge of a significant interest rate increase.

According to experts at the Bureau for Economic Research, South Africa is likely to witness another interest rate hike next week, albeit it may be greater than originally expected (BER).

2022-05-21 12:00

Comment 11

Content you want to comment

Please enter...

Comment 11

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

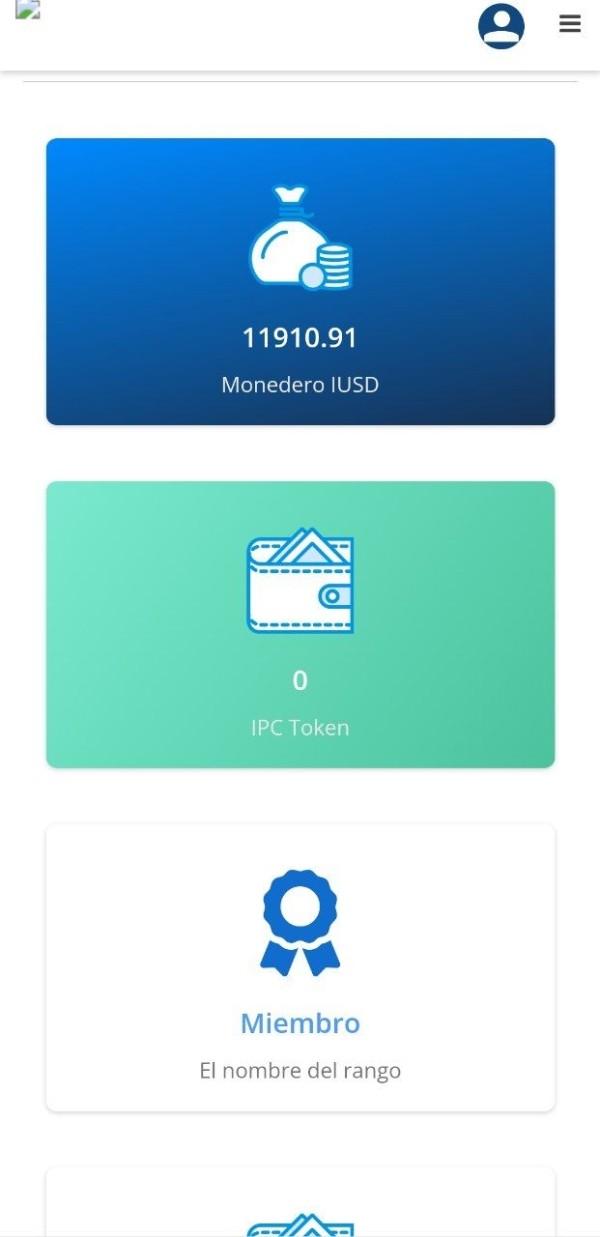

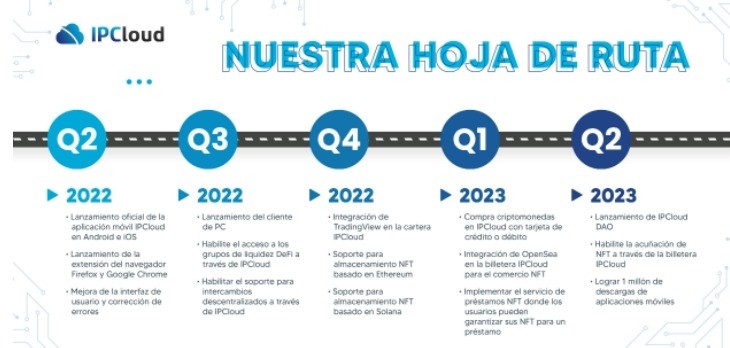

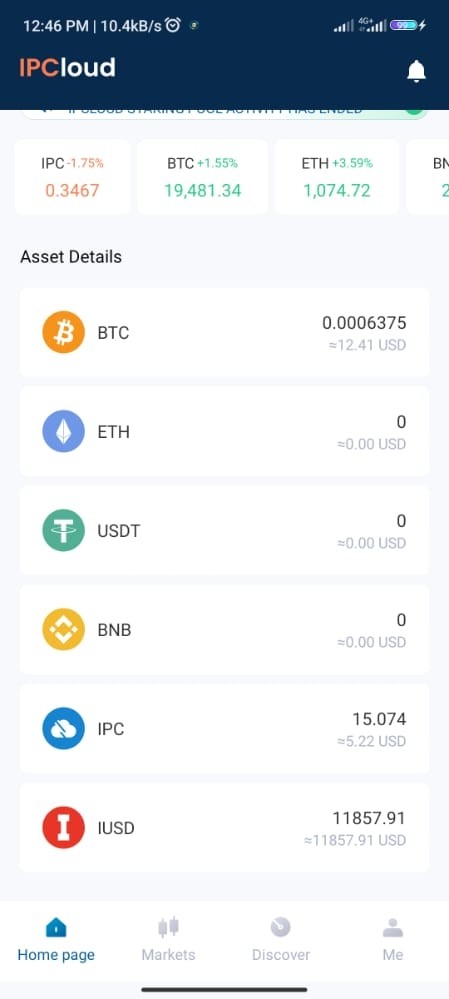

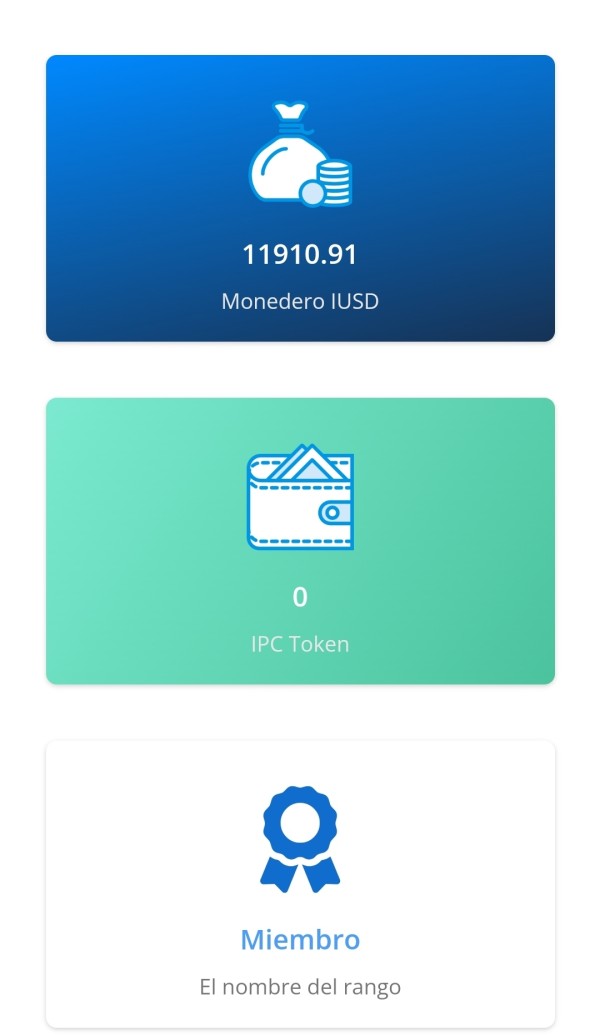

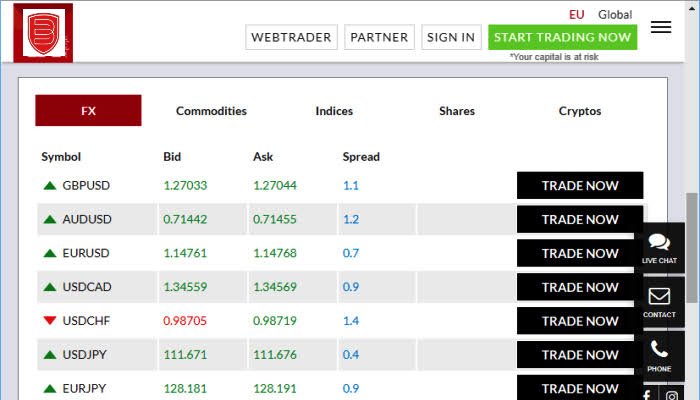

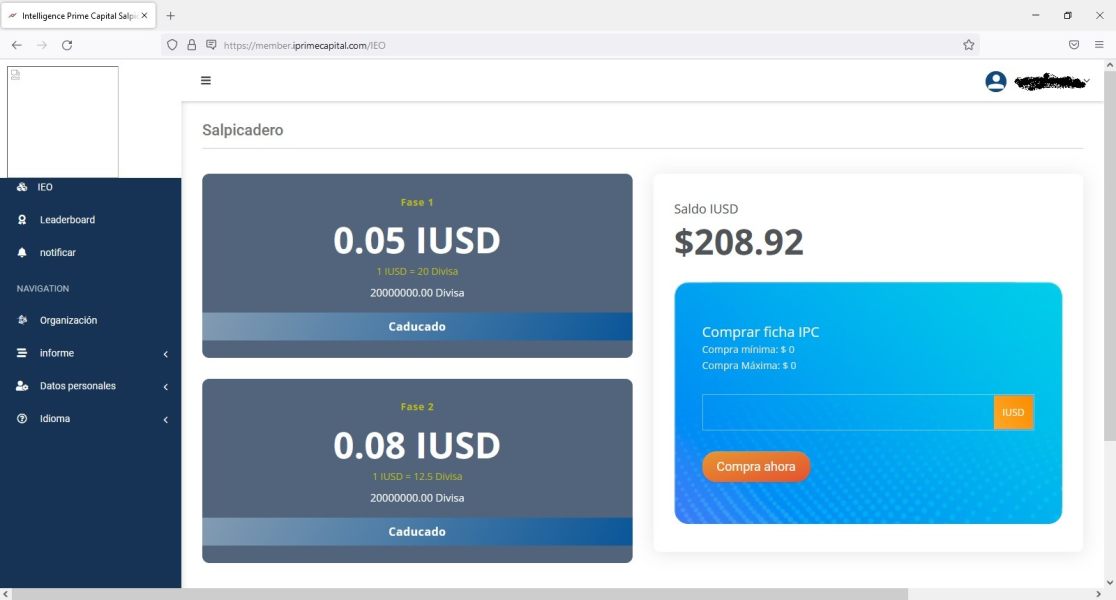

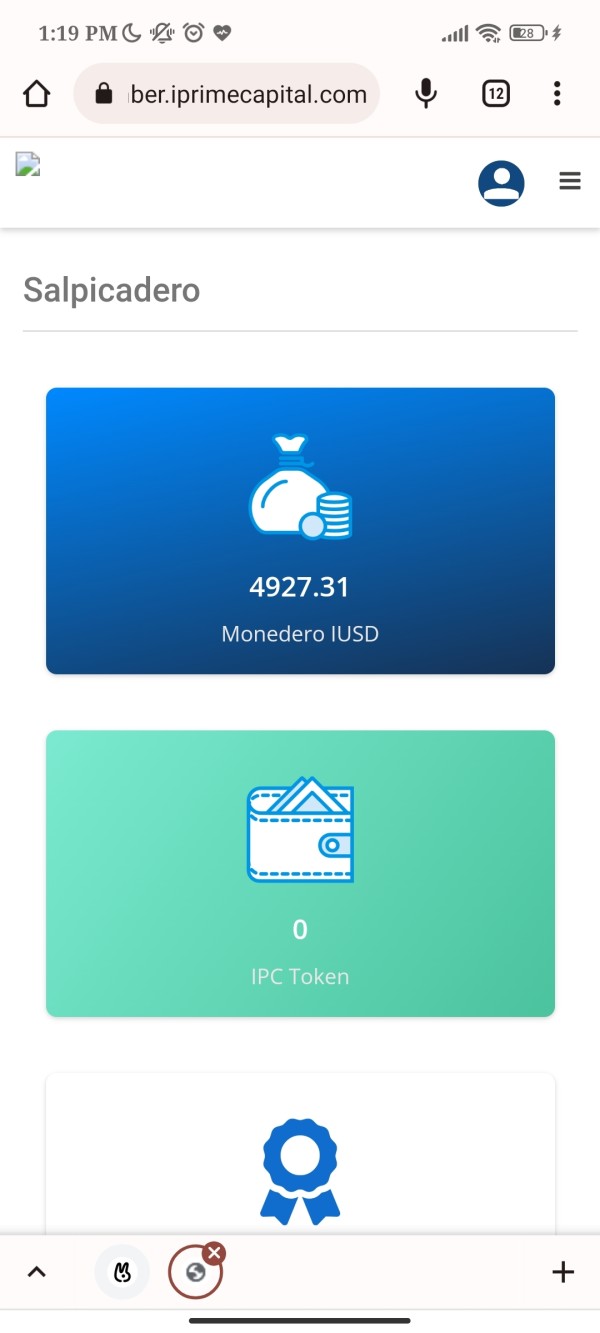

FX1779357697

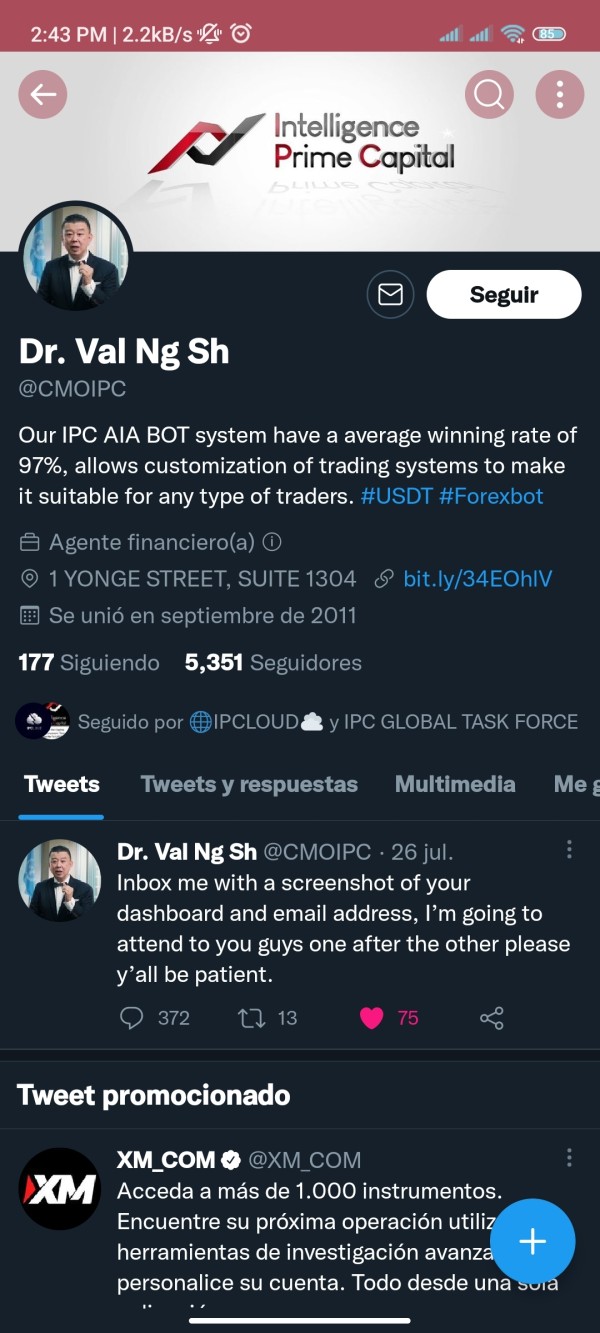

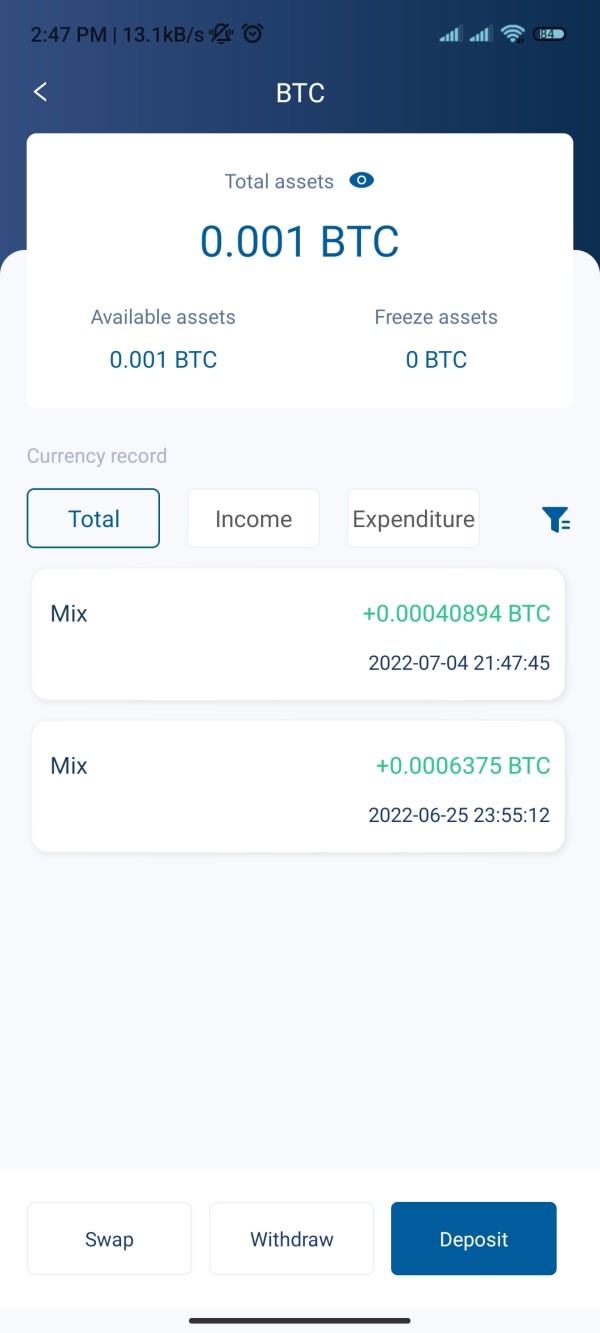

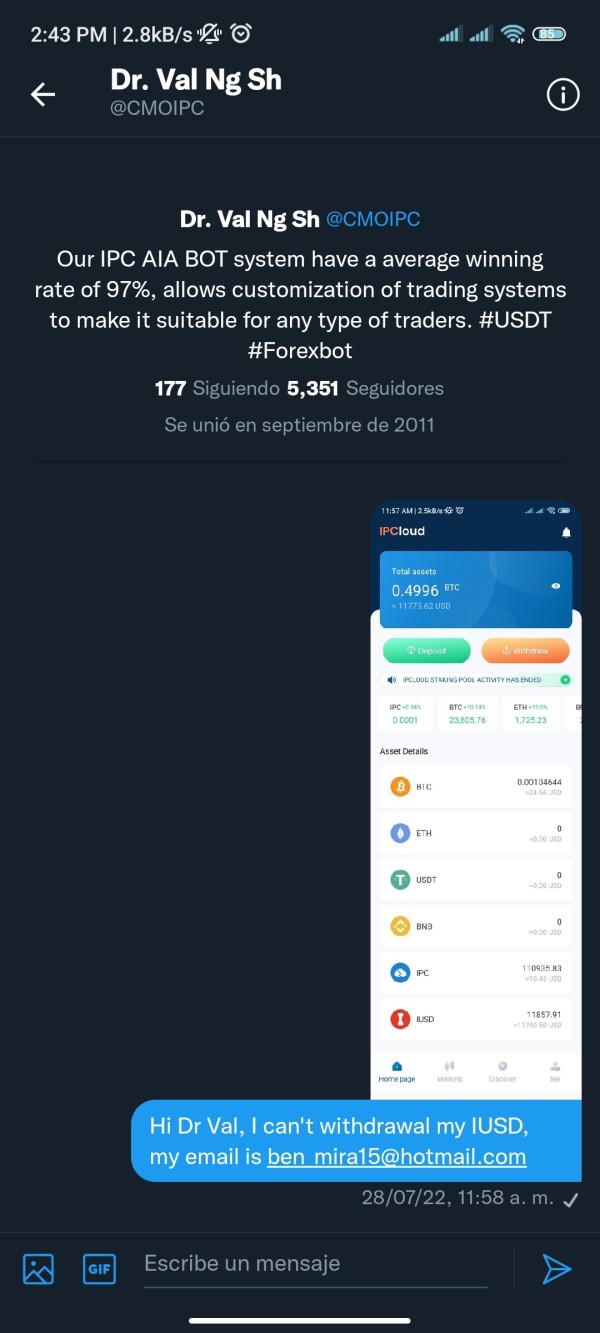

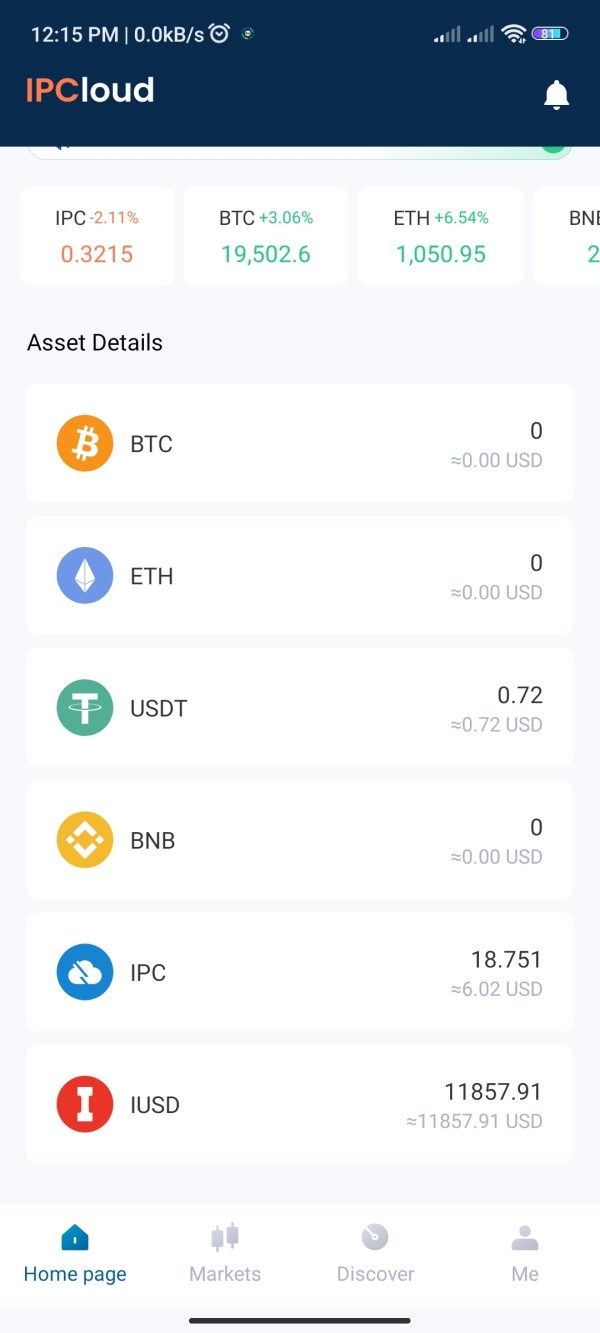

Mexico

Originally this platform started with the name of Intelligence Prime Capital, which was a FOREX broker that offered quite attractive returns through its bots and worked through MetaTrader4, in fact I had it audited with Myfxbook with the following link https://www.myfxbook .com/portfolio/benjas/9464704 , was accessed through the member.iprimecapital.com page, currently it is no longer possible to access it since such a page no longer exists, at first it worked quite well and could be removed without problem. As time passed in April, they told us that there was a hack on the platform that made user information vulnerable and that the bot would no longer work for a while and they would migrate us to a new bot that would work only with cryptocurrencies, by the end of that same month of April they tell us that we had to download an app in which it is a wallet and all the money from MetaTrader 4 was moved from there and migrated to a StableCoin called IUSD which to date cannot be withdrawn or moved anywhere , nor exchanged for any reason (the button is not enabled on the platform), also the alleged CMO of the company commented on twitter that those who had a problem with withdrawals should contact him and it is also the date that they have not contacted , as time passed, the MT4 account no longer allowed us to enter with the credentials and now it said that the name of the platform is billionext and no longer IPC, so I tell you about this experience to preview send to all the people who do not enter any of the 2 platforms since they withhold people's money

Exposure

2022-08-20

FX1779357697

Mexico

They have not allowed us to withdraw money for 3 months and they changed their platform by migrating to an app that does not allow withdrawals either

Exposure

2022-07-26

FX3071480497

United States

They keep pushing you to put more money but you can't withdraw money, you get a bonus when you deposit money. Besides having fintrack/ org file a class action that will see you get your money it is actually impossible to withdraw from the system if you accept the bonus from Billionext Global Limited.

Exposure

2022-05-21

FX1386604268

Mexico

This platform does not allow withdrawals since March 2022. They change the currency from usd to iusd without the consent. I change the server and name of the platform, at first it was called www.iprimecapital.com, now it has an application called ipcloud, and Billionext server.

Exposure

2022-05-17

FX1610219027

Colombia

This is my account and that is what i invested in this company it won't let me withdraw my money

Exposure

2022-05-17

Paula Andrea Beltran Patiño

Colombia

Intelligence primer capital does not allow the withdrawal of the sums of money invested. In January 2022 enter with a capital of 2000 dollars. I couldn't make withdrawals. change of broker to billionext without authorization. It does not allow withdrawals for any type of Crypto and I transform the money from our accounts from usdt to iusdt, a currency that the same company created. I need help to recover my capital. invested. . none of their customer service channels respond. [d83e][dd37]. I made an investment with Criptousdt. This is my wallet link.

Exposure

2022-05-16

Paula Andrea Beltran Patiño

Colombia

I invested 2000 dollars of capital in January 2022 to the IPCAPITAL broker. I was never able to withdraw my money and later the company suspended payments. transactions were rejected. in april 2022 switch all users to billontex without authorization. The broker disappeared and does not return my capital.

Exposure

2022-05-16

Chile

Hi, this platform won't let me withdraw my capital. I suddenly change the name. They disable my withdrawal option. I change its name to IPC Capital. My capital disappears from Meta Trade4.

Exposure

2022-04-30

low sw

Malaysia

Cannot withdraw, need pay 30% commission and cannot deduct from account. Commission told only when want to withdraw.

Exposure

2021-10-03

Alex Long

United States

Please be aware that if you try to withdraw profits they will tell you that you have to pay capital gains tax or pay further money to help them satisfy money laundering regulations before your money can be transferred to you. This is part of the scam!!!

Neutral

2022-12-16

Alex Long

United States

This is a good company as long as you don't ask for your money back. Because if you do, you're going to have a problem. They will keep coming up with all kinds of silly excuses for why you can't take your money out.

Neutral

2022-12-16