Overview of Teyler

Teyler is a newly established company in 2023, based in the United Kingdom, engaging in forex and CFD trading without formal regulation. Despite its unlicensed status by the NFA in the United States, it targets high net-worth individuals with a substantial minimum deposit requirement of $50,000. Offering trading across various platforms including mobile and MT4 web versions, it attends to traders looking for a wide range of tradable assets such as forex, futures, and indices. However, the lack of educational resources and transparency in deposit and withdrawal processes may pose challenges for potential clients.

Pros and Cons

Teyler provides a competitive array of market offerings with over 50 FX currency pairs and significant futures products such as gold, oil, and silver. This broker stands out for accommodating various trading strategies and offering leverage up to 1:100, along with rapid execution speeds, averaging 0.20 seconds, which could appeal to traders who value quick and efficient trade execution.

However, Teyler's services come with several notable drawbacks. The absence of regulation indicates doubts over the security of clients' funds and the integrity of trading practices. A high minimum deposit could deter smaller investors, while the lack of transparency in non-trading fees could result in unforeseen costs. The brokerage's educational resources are limited, potentially leaving less experienced traders without the necessary support. Furthermore, Teyler provides limited information on deposit and withdrawal processes and restricts customer support channels, which could impact the overall trading experience.

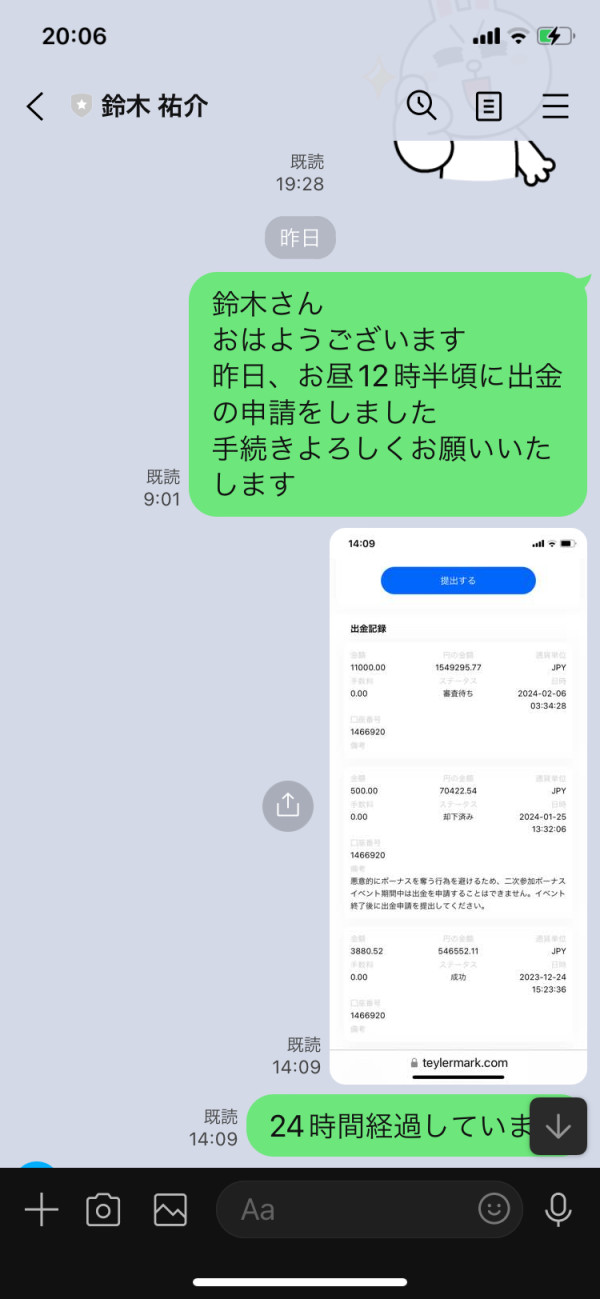

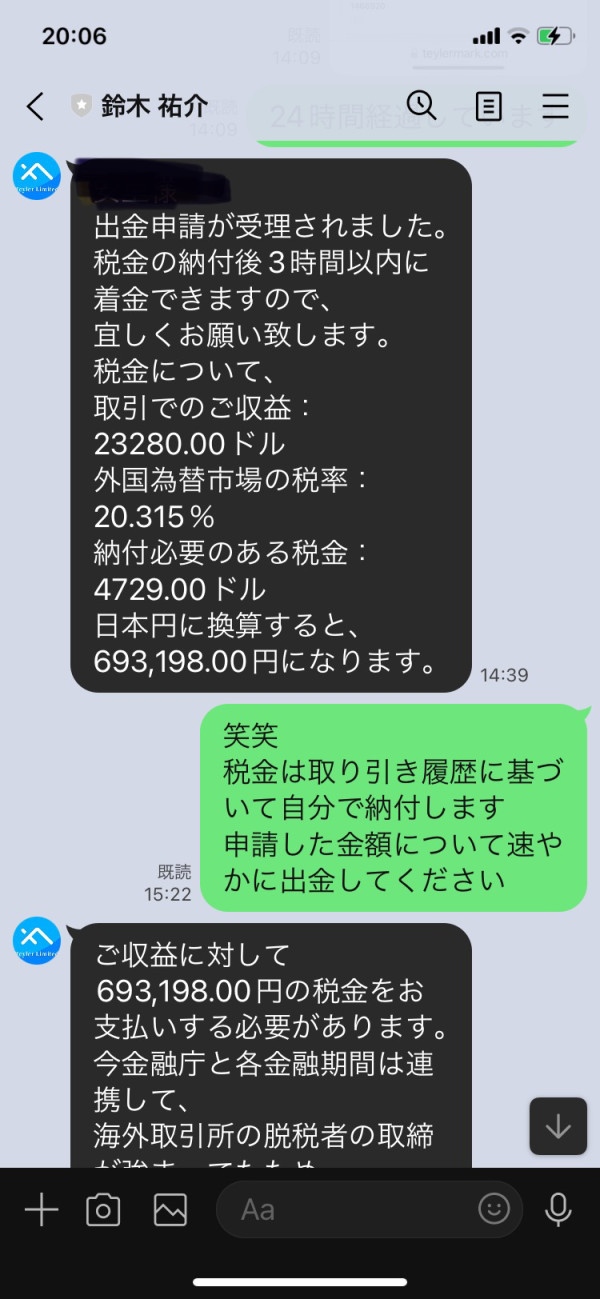

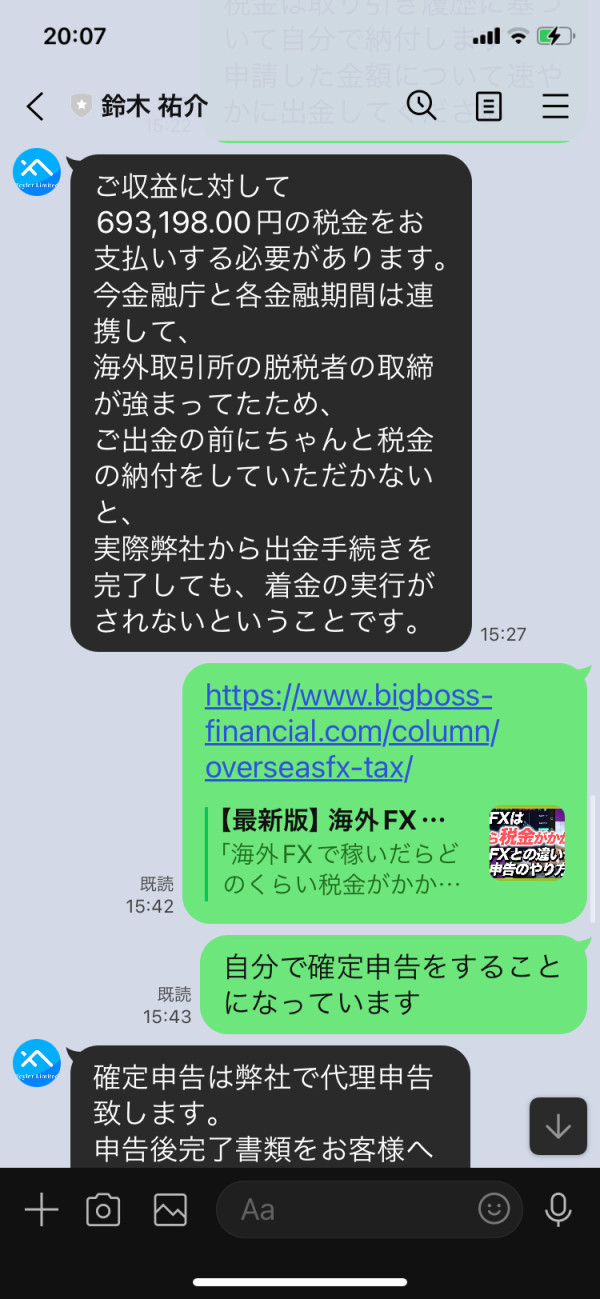

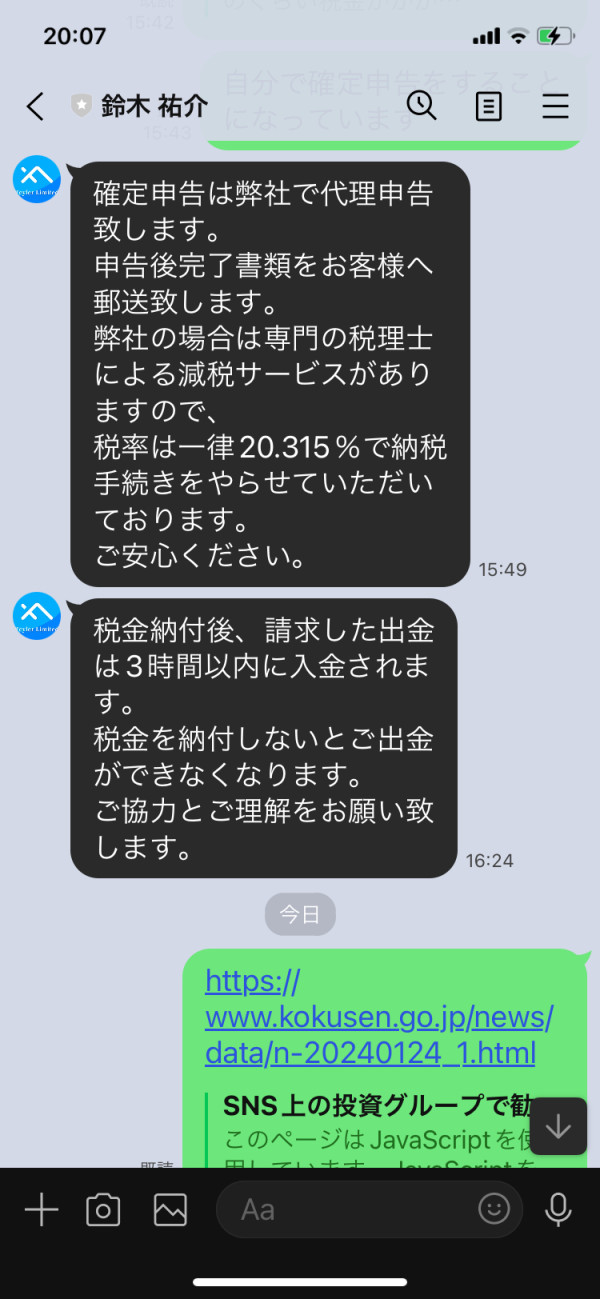

Is Teyler legit or a scam?

Teyler lacks regulatory credentials, notably from the NFA, with a license number (0560215) that is designated as unauthorized. This unregulated status poses substantial risks to traders, including increased susceptibility to fraudulent activities and limited protection for traders investments. Engage with unregulated brokers like Teyler entails significant risks.

Market Instruments

Teyler offers the following market instruments:

Forex CFDs: Traders have access to a broad spectrum of over 50 spot and forward FX currency pair CFDs, including prominent pairs such as EUR/USD and GBP/USD. The platform accommodates trades starting from 0.01 lots up to a maximum of 100 lots, allowing for both conservative and aggressive trading strategies.

Commodity Futures: The brokerage provides the ability to trade in major commodity futures, covering gold, oil, and silver, essential for traders focusing on commodities markets.

Indices: There is a selection of more than 14 indices available for trading, offering exposure to a diversified range of market sectors with the option of executing large orders.

Account Types

Teyler provides one type of trading account, the Master account. To initiate trading, clients must deposit a minimum of $50,000. This account is tailored for executing large volume orders in a managed fashion, requiring at least two investor accounts to amass a combined equity of no less than $50,000. The maximum leverage available is up to 1:100, and clients can benefit from spreads starting as low as 0.0 points.

How to Open an Account with Teyler

To commence trading with Teyler, the process involves three key steps:

Registration and Financial Commitment: The initial step necessitates registering and funding your live account with at least $50,000.

Account Configuration: Subsequent to funding, you must integrate live trading accounts into the master account, ensuring that at least two investor accounts amass a collective equity of no less than $50,000.

Operational Start: Once the master account is operational, you are equipped to manage and execute bulk orders efficiently.

Leverage

Teyler extends trading leverage up to a 1:100 maximum for stock indices, enabling traders to manage considerably larger positions through minimal capital investment. The provision of high leverage reflects Teyler's strategy to attract traders. Nonetheless, the absence of regulatory compliance, highlighted by its unlicensed status with the NFA in the United States, advises caution.

Spreads & Commissions

Teyler positions itself in the competitive trading landscape with its offering of minimal spreads, beginning at 0.0 pips. This approach targets a various range of traders, notably within the Forex and futures segments. The document hints at a cost-efficient trading setup, especially for holders of specific account types, indicating a strategy to leverage minimal spreads for enhanced trading efficiency, although it stops short of providing exhaustive details on commissions for every trading scenario.

Trading Platform

Teyler presents a versatile array of trading platforms, accommodating the various requirements of its clientele with support for Android and iOS devices, alongside the MT4 web version. This provision ensures trader flexibility, enabling mobile trading and web-based operations without the necessity for software installation. The inclusion of the MT4 web version underscores Teyler's dedication to delivering a platform known for its ease of use, comprehensive charting tools, and capacity for automated trading.

Furthermore, Teyler introduces the Multi Account Manager (MAM) within their ST5 platform, specifically tailored to facilitate efficient multiple account management by professional traders and investment firms, featuring various distribution methods, compatibility with Expert Advisors (EAs), and accommodating an unlimited count of sub-accounts.

Customer Support

Teyler facilitates customer support via:

Office Address: Lennon Studios, 57 Cambridge Court, London, L7 7AG, UK.

Telephone: +44 7001 9456.

Email: support@teylerltd.com.

Conclusion

Established in 2023 and headquartered in the UK, Teyler emerges as a novice in the trading arena, focusing on forex and indices. It boasts an extensive array of over 50 forex pairs and various indices, complemented by appealing features such as minimal spreads, leverage up to 1:100, and swift execution speeds. However, Teyler's lack of regulatory compliance, ambiguous fee structure, and the absence of educational resources significantly mar its appeal. Although its offerings, including an advanced multi-client manager, may seem attractive, the risks tied to trading with an unregulated entity necessitate cautious due diligence by prospective clients.

FAQs

Q: What is Teyler's trading emphasis?

A: Teyler emphasizes on forex and indices, providing an extensive range of trading options with over 50 forex pairs and various indices.

Q: Does Teyler have regulatory oversight?

A: No, Teyler operates without the oversight of any financial regulatory authority, highlighting a crucial factor for those considering its services.

Q: What standout features does Teyler provide?

A: It boasts low spreads, leverage up to 1:100, swift execution, and a multi-client manager for professionals and firms, marking its competitive edge.

Q: What are the potential drawbacks of trading with Teyler?

A: The lack of regulation and transparency about fees and educational resources are significant drawbacks, raising concerns about security and reliability.

Q: Before engaging with Teyler, what should be considered?

A: Prospective clients should thoroughly vet Teyler, weighing the benefits against the risks of engaging with an unregulated broker.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. Readers are strongly advised to verify updated details directly with the company before making any decisions, as the responsibility for utilizing the information herein rests solely with the reader.