简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Client Feedback: An Investor Strongly Accused Emporium Capital

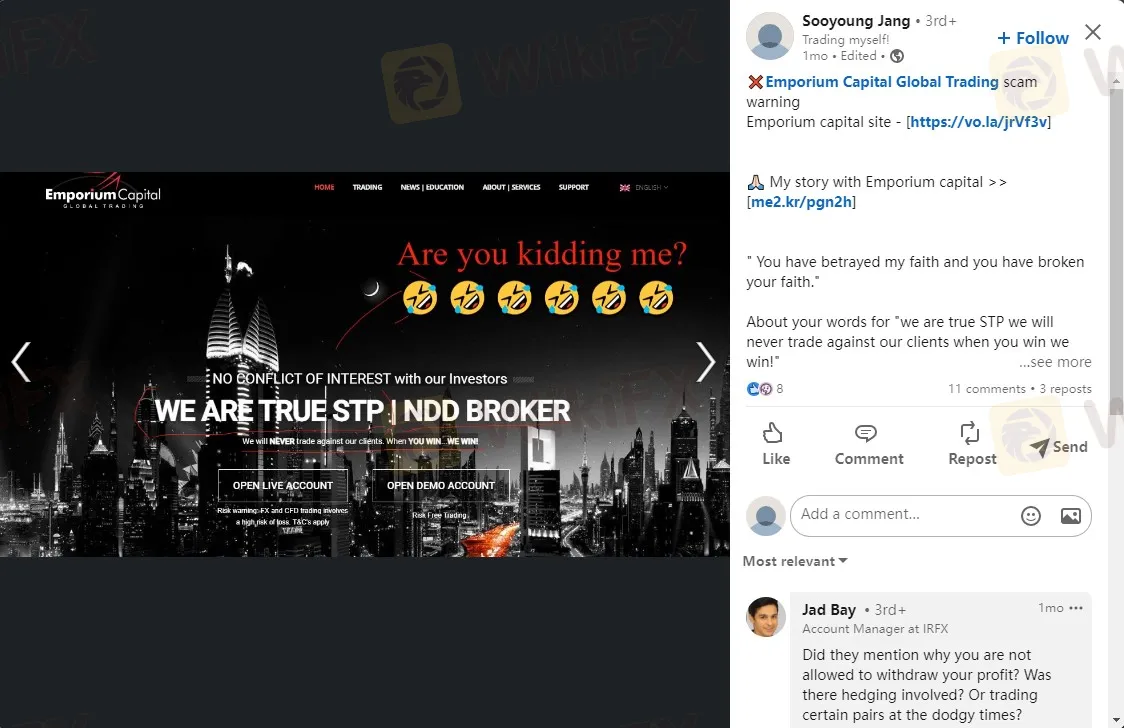

Abstract:"We are true STP broker. We will never trade against our clients when YOU WIN...WE WIN!"

This slogan was prominently displayed on Emporium Capital's website, demonstrating to investors that the broker was committed to making money for them.

However, one disappointed trader, named Sooyoung Jang, found the slogan ironic because of what happened between the broker and her. “You have betrayed my faith and you have broken your faith.” is what she said to this broker. What made the client so angry?

About Emporium Capital Regulation

Emporium Capital is a forex broker registered in Saint Vincent and the Grenadines (25845 IBC 2020) and regulated by Cyprus Securities and Exchange Commission (CySEC), license number 358/18.

In addition, the broker also claims to be “regulated” by Agency for Regulation and Development of the Financial Market of The Republic of Kazakhstan. However, the company name is not on the list of the registry. And the agency is not a forex regulatory body.

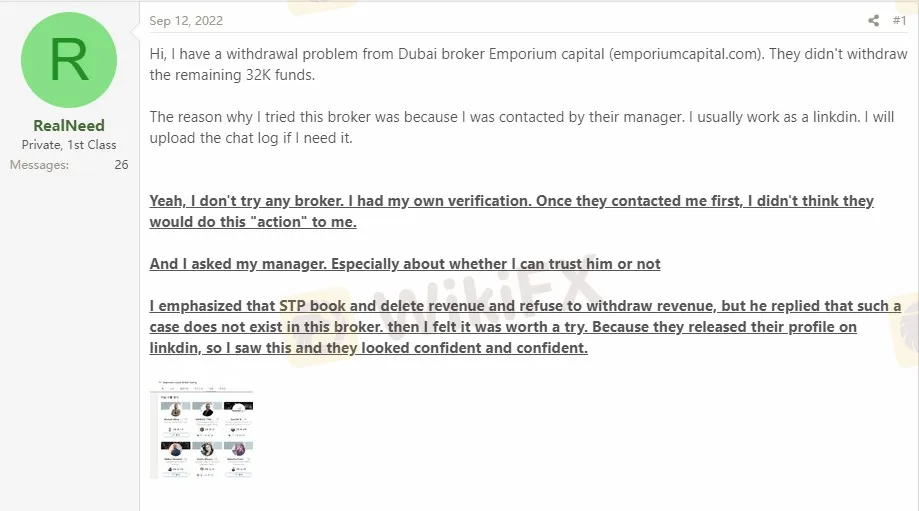

Why did Jang choose Emporium Capital?

According to Jang, a manager of Emporium Capital got in touch with Jang and talked to her on Linkedin. During the communication, Jang asked this manager if she could trust him. And the manager also said that when investing with this broker, there are no cases when the broker deducts the investor's earnings or refuses to withdraw funds.

In addition, another reason why Jang trusts Emporium Capital is that many of its employees' profiles are displayed on Linkedin.

At last, these reasons led Jang to trust this company and trade here for a month and a half.

What Made Jang's Accusation?

Jang said that she had withdrawl issue with Emporium Capital. According to her post, She has about $32,000 funds in her account. And the problem emerged when she submitted a $20,000 withdrawal request.

The broker sent her an email stating that her account engaged in prohibited high-risk trading activity, which led the firm to believe that she had abused the trading system and violated the Terms of Business, and that the account was under investigation. Additionally, the broker also suspects that Jang deliberately slowed down the update of market prices by using multiple simultaneous logged-in trading accounts. Due to the above, the company will close her account and remove $28,428 from the account.

Jang was dissatisfied with this reply and demanded that the entire balance be withdrawn from her account. However, the broker only agreed to refund the remainder of the $23,693 deposit, which is $3,693. Of course, Jang did not agree to this settlement, claiming that she had actually invested more than $30,000 and had lost $7,000 during her investment.

Regarding the company's statement that she violated the Term of Business, Jang responded that she had never received any documents regarding the trading and rules policy. In addition, she accused the company of hiding the fact that it was doing a B+Book deal while she had asked for an A+Book STP.

Although she tried to log into her account to gather evidence, she was unable to do so because the broker had closed her account. However, Jang decided to file a complaint with CySEC.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Best Binary Options Indicators: Enhance Your Trading Strategy

Binary options trading involves predicting whether an asset's price will rise or fall within a specific timeframe. Unlike traditional investing, more specifically, binary options demand rapid decisions due to fixed expiry times (e.g., 60 seconds to 1 hour). For instance, speculating if EUR/USD will be above 1.0800 in the next five minutes. Success yields a fixed payout, while failure results in the loss of invested capital. Binary indicators distill complex market data—price action, volume, volatility—into actionable signals tailored for short-term trades. Indicators act as a compass, guiding traders to trends, reversals, and optimal entry points, thus enabling traders to detect market shifts for higher-probability decisions.

Cybersecurity Alert: Lazarus Targets Developers with Malicious npm Packages

The notorious North Korean cybercrime group, Lazarus, has recently intensified its infiltration into the npm ecosystem by deploying six new malicious packages. These packages are designed to compromise developer environments, steal credentials, extract cryptocurrency data, and install backdoors.

SEC Charges Ronald A. Pallek in $1.54 Million Fraudulent Investment Scheme

SEC sues Ronald A. Pallek for a $1.54M fraudulent scheme, alleging false promises and Ponzi-like payments to investors.

Baazex Review: Is it safe to invest in it?

Baazex is a relatively new broker registered in the United Arab Emirates, with an operating history of between 2 to 5 years. Despite its claims of offering over 1500 trading instruments—from foreign exchange pairs like EUR/USD, GBP/USD, and AUD/JPY, to major stocks including Apple, Meta, Disney, LVMH, and Tesla; as well as commodities (oil, gold, silver, coffee), indices, cryptocurrencies, and futures—investors should be aware of some critical risks.

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

IIFL Capital Faces SEBI's Regulatory Warning

How Can Fintech Help You Make Money?

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Good News for Nigeria's Stock Market: Big Gains for Investors!

Currency Calculator