简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

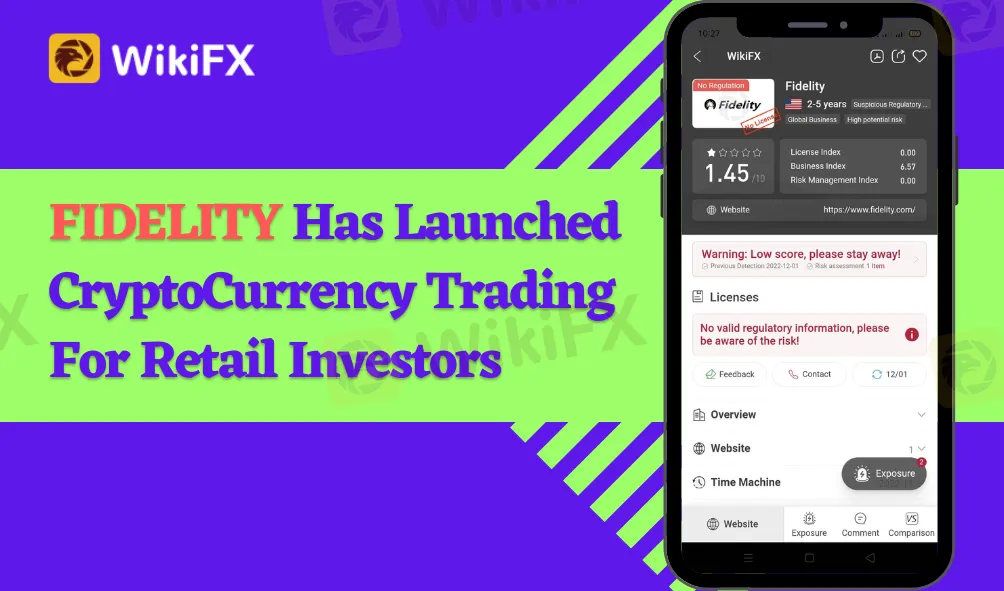

Fidelity Has Launched CryptoCurrency Trading For Retail Investors

Abstract:Fidelity, one of the world's major financial services companies, has begun to provide consumers with bitcoin trading accounts.

This follows their earlier disclosure of a wait list earlier this month. According to The Block, select users, presumably those on the queue, got an email outlining the release with the message “The wait is gone.”

Fidelity has been involved in the bitcoin sector for some time, beginning mining bitcoin in 2014, according to the company website. In addition, in December 2021, it will offer a spot bitcoin ETF in Canada.

The financial services behemoth's involvement in bitcoin has not gone unnoticed, with US lawmakers questioning its provision of a 401k plan that enables customers to allocate to bitcoin.

The same group of senators recently revived the same concern, stating in their newest letter, “Fidelity Investments has decided to go beyond conventional finance and plunge into the very unstable and more dangerous digital asset sector.”

Despite these cautions, Fidelity looks to be jumping into bitcoin wholeheartedly, as interest in bitcoin within the conventional banking industry grows. It should be emphasized that the move comes at a very intriguing moment, considering recent events surrounding the collapse of FTX and the increased focus on volatility in the sector.

With the industry image so shaky, the acts of behemoths like Fidelity will almost surely have repercussions for bitcoin legislation in the future.

Aside from FTX, senators claim that cryptocurrency investments have only developed as a dangerous and speculative bet, and they are afraid that Fidelity would assume similar risks with millions of Americans' retirement assets.

Fidelity is the biggest retirement plan provider in the United States, with more than $10 trillion in assets under management, and its move was considered a crucial driver for making cryptocurrency even more popular. The cryptocurrency option is now accessible to the 23,000 employers that use Fidelity to manage their 401(k) retirement funds.

You may check out more of Fidelity news here: https://www.wikifx.com/en/dealer/5871434190.html

Always remember to check the true identity of a broker before investing. Being regulated online trading broker must be known to public to be considered as trustworthy broker.

Stay tuned for more Online Trading news.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex BackTesting: Pros and Cons | Best Free Backtesting Software to Explore

Imagine you're driving from New York City to Philadelphia and want to know if your route is optimal, then you take two steps: Firstly, you gather the traffic records in the past five years, including traffic patterns, historic weather conditions, and holiday congestion records. Second, you run simulations of your proposed road to see if it is most efficient and fuel-saving before an actual trip.

Crypto Scam Advertised on Facebook Costs an E-Hailing Driver RM147,600

A 65-year-old e-hailing driver in Malaysia has lost RM147,604 to a fraudulent cryptocurrency stock scheme that was advertised on Facebook.

Shocking! Trump to Double Tariffs on Canada!

Trump announced a tariff hike on Canadian steel and aluminum to 50%, shaking the markets. The Canadian stock market took a hit, the Canadian dollar plummeted, and U.S. steel and aluminum stocks surged, triggering strong reactions from all sides.

Good News for Nigeria's Stock Market: Big Gains for Investors!

Nigeria’s stock market kicked off the trading week with strong momentum, boosting investor assets by ₦52 billion. Market confidence is high, creating a rare investment boom!

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Currency Calculator