简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Axi Review 2025: Live & Demo Accounts, Withdrawal to Explore

Abstract:Launched in 2008, Axi (formerly Axitrader), is an Australia-registered online forex broker that has gained solid development these years. Globally and heavily regulated, the Axi brand has several entities operating under different jurisdictions, including ASIC in Australia, FCA in the UK, CYSEC in Cyprus, FMA in New Zealand, and DFSA in the United Arab Emirates. Axi gives investors the opportunity to enter some popular markets with small budgets, including Forex, Metals, Indices, Commodities, Cryptocurrency, particularly IPOs, using its advanced software—the Axi Trading platform (newly launched), Copy Trading App, MT4, MT4 Webtrader . With no cost during account setup, traders can choose from 3 tailored live accounts in addition to a demo account. Among many forex brokers, Axi stands out due to its user-friendly interface, which allows for quick and simple account opening and withdrawals.

| Axi | ⭐⭐⭐⭐ |

| |

| Regulations | ASIC, FCA, CYSEC, FMA, DFSA |

| Tradable Assets | Forex, Metals, Indices, Commodities, Cryptocurrency, IPOs |

| Minimum Deposit | $0 |

| Live Accounts | Standard, Pro, Elite |

| Demo Account | Yes |

| Account Opening | 1-2 Working Days (Free Setup) |

| Max. Leverage | 500:1 |

| Trading Platform | Axi Trading Platform, Copy Trading App, MT4, MT4 WebTrader |

About Axi

Launched in 2008, Axi (formerly Axitrader), is an Australia-registered online forex broker which has gained solid development these years. Globally and heavily regulated, the Axi brand has several entities operating under different jurisdictions, including ASIC in Australia, FCA in the UK, CYSEC in Cyprus, FMA in New Zealand, DFSA in the United Arab Emirates. Axi gives investors the opportunity to enter some popular markets with small budgets, including Forex, Metals, Indices, Commodities, Cryptocurrency, particularly IPOs, using its advanced software - Axi Trading platform (newly lanuched), Copy Trading App, MT4, MT4 webtrader . With no cost during account setup, traders can choose from 3 tailored live accounts in addition to a demo account. Among many forex brokers, Axi stands out due to its user-friendly interface, which allows for quick and simple account opening and withdrawals.

✅Where Axi Shines:

- Extremely low enter barrier, $0 to start real trading on this platform

- IPOs Trading opportunity provided, not often by most brokers

- Free Autochartist and Trading Central

- Popular copy trading solution on offer - Copy trading app

- Fast account opening, manual review within 2 working days

- Demo accounts for risk-free trading

- 11 base account currencies available with the Standard and Pro account

- Localized Payment options, better serving clients from different countries

❌Where Axi Falls Short:

- Averagely slow trade execution

- Markets range could be widened

- Not supporting more trading platforms, like MetaTrader 5, cTrader, Tradingview

- High minimum deposit requirement for the Elite account

Is Axi Legit?

Axi has five regulated entities operating in different jurisdictions, including ASIC in Australia, FCA in the UK, CYSEC in Europe, FMA in New Zealand, and DFSA in the United Arab Emirates. It should be notable that trading accounts should be opened under these entities to get protection once Axi faces bankruptcy.

| Regulated Country | Regulated Entity | Regulatory Authority | License Type | License Number | Regulatory Status |

| AXICORP FINANCIAL SERVICES PTY LTD | ASIC | Market Maker(MM) | 000318232 |  |

| Axi Financial Services (UK) Limited | FCA | Market Maker(MM) | 466201 |  |

| Solaris EMEA Limited | CYSEC | Market Maker(MM) | 433/23 |  |

| AXICORP FINANCIAL SERVICES PTY LTD | FMA | Straight Through Processing(STP) | 518226 |  |

| AxiCorp Financial Services Pty Ltd | DFSA | Retail Forex License | F003742 |  |

Investor Protection Programs

Beyond regulatory compliance, Axi offers several investor protection mechanisms designed to enhance client security. These include participation in Investor Compensation Funds, implementation of Negative Balance Protection, and the availability of Stop-Loss Orders.

- Investor Financial Compensation Funds: In the event of an FCA-regulated firm's bankruptcy, a government-mandated compensation fund exists to protect client assets. This fund provides compensation to eligible clients, with a maximum payout of £85,000 per person.

- Negative Protection Balance: Axi maintains a comprehensive client money insurance policy, offering retail investors coverage up to $1,000,000.

- Stop-Loss Orders: It helps to control the maximum potential loss in a trade.

Axi Account Review

Axi Minimum Deposit

Axi stands out by offering a $0 minimum deposit, welcoming traders regardless of their starting capital. This open-door policy makes trading accessible to everyone, from novices with limited funds to seasoned investors.

For beginners, this means they can experience a professional trading platform without a significant initial investment. Experienced traders, however, might find this flexibility less relevant to their established strategies.

Axi benefits by attracting a broader audience, which translates to increased trading volume and, consequently, greater revenue.

| Broker Name | Axi | eToro | IC Markets Global | XM | FP Markets | Forex.com |

| Logo |  |  |  |  |  |  |

| Regulations | ASIC, FCA, CYSEC, FMA, DFSA | AISC, CYSEC, FCA | ASIC, CYSEC | ASIC, CYSEC, DFSA, SCB | ASIC, CYSEC | ASIC, FCA, CYSEC, FSA, NFA, MAS, CIRO |

| Minimum Deposit | $0 | $10 | $200 | $5 | $100 | $100 |

Axi offers three different active accounts: Standard, Pro, and Elite. Signing up for any of these accounts is completely free. You don't need to deposit any money to create a Standard or Pro account. Very few forex brokers are capable of doing this. The enormous minimum deposit required to start an Elite account is $25,000. Even though there isn't a ton of choice, opening an account with any of these three gives you access to around 290 tradable instruments. Trading flexibility can be greatly increased with generous leverage of up to 500:1. One can open a regular or pro account with one of 11 base currencies: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, PLN, SGD, EUR, USD. You can only utilize the following five base currencies with an Elite account: USD, EUR, GBP, AUD, and NZD. With these three accounts, you can access all of EA's features. As for VPS accounts, you may use the Elite account for free, while the other two require a subscription. Finally, all three account types are eligible for free Autochartist.

Axi Sign Up - How to register an account with Axi?

Axi Sign up

The account opening process at Axi has been simplified a lot, thus Axi Signup here typically takes within 2 bussiness days. Here is a brief rundown on how to sign up for a legitimate account here:

Step 1: To create an Axi account, go to the homepage and look for the “Open Account” button. After that, you'll see a form asking for your name, email address, country of residence, and phone number.

Step 2: The following page then appears, recommending either the Standard or Pro account tier. If you're an expert trader looking for incredibly cheap trading costs, the Pro account is what you need, but the Standard account is great for daily traders. You can trade with any amount you choose with either account, and there is no minimum deposit required to begin trading. Both accounts are exclusive to MT4.

Step 3: Next, go to the Set Your Preferences screen. There are eleven different base currencies to pick from, and you can also select your platform (MT4 is the default) and your preferred leverage (500:1-100:1).

Step 4: After that, provide further details about yourself, such as your full legal name, email, phone, date of birth, nationality, present domicile, job status, and financial situation. Please take the time to peruse the crucial documents before moving on.

Step 5: The Axi Team has promised to assess your account application within the next day, and it has arrived. After a few moments, you should be able to get a confirmation email informing you that your account has been successfully registered. Identification, Passwords, Serve (Desktop), and Serve (Mobile) are all part of your account details that you may view. You can see that AxiTrader Limited, an international entity of Axi, was regulated by the Financial Services Authority (FSA) in St. Vincent and the Grenadines when this account was opened.

With a 30-minute total time investment, creating an account on the Axi platform is simple, quick, and requires less rigorous verification than competing platforms. It's also great for beginners. But this does raise the possibility that the broker will have more leeway to mess with the consumers' trading accounts.

Axi Demo Account

Additionally, Axi highlights its 30-day demo account option that comes with $50,000 in virtual money. Traders can also customize the demo account with their desired base currency and leverage. By accessing real-time spreads on MT4, Axi claims their MT4 trial account simulates the genuine trading environment. Plus, once you've deposited funds into your genuine account, you can turn your demo account into a permanent one. A demo trading environment, however, is typically very different from a real trading environment. Yet, the good news is that newcomers can put Axi's trading environment through its paces with $50,000 in virtual money. The only possible base currencies are AUD, EUR, GBP, USD, CHF, and PLN, so please keep that in mind. Base currency cannot be changed once created.

Manage Your Axi Money-Axi Withdrawal

Most traders find the trading process on the Axi platform appears user-friendly at first, likely because they haven't experienced the withdrawal step. Everything can be changed when it comes to withdrawal, a common issue among many forex brokers. Simply put, the withdrawal process determines your ultamate trading on the certain platform. Thus, manage your axi money, from deposit to withdrawal, especially the withdrawal attaches great importance.

Axi Withdrawal Methods: Fees & Processing Time

Axi boasts that withdrawing money is simple and fast. Axi set localized payment channels targeting clients from Asia, Africa, Europe, Latin America (LATAM), Middle East & North Africa (MENA), North Africa (NA) to make the whole withdrawal process more convenient and more efficient.

Withdrawal in Africa

Axi provides 10 withdrawal methods for clients from Africa. Credit cards, e-wallets like Skrill and Neteller, and cryptocurrency withdrawals generally provide the fastest processing times, often being instant. Local bank transfers and mobile money services cater, specifically to domestic needs, offering convenient options for withdrawing funds within the country. International bank transfers support high withdrawal limits, making them suitable for large transactions. Options like Waave (PayPal) offer flexibility in terms of supported currencies. Withdrawals through these methods all occur with no fees.

Withdrawal in Asia

Cimpared to Africa, Asia offers a wider variety of withdrawal options than Africa does, with local bank transfers (in IDR, KRW, PHP, THB, VND, SGD, and fasapay) joining the 10 permitted methods in Africa.

Withdrawal in Europe

In Europe, Axi has reduced the number of withdrawal options to only five. The Przelewy 24 (which offers PLN) however, is also supported, in addition to the four withdrawal options already stated.

Withdrawal in Latin America

Withdrawal methods supported in Latin America include Credit/Debit Card, International Bank Transfer, Skrill, Neteller, Astropay, Crypto, and PIX (supporting BRL). All these withdrawal methods require no withdrawal fees.

Withdrawal in Middle East & North America

Withdrawal options for clients in the Middle East and North Africa include International Bank Transfers with a minimum of USD$50 and processing times of 1-3 business days. E-wallets like Skrill and Neteller are also available, offering instant withdrawals with lower minimums (EUR 5 and USD 5, respectively). All listed withdrawal methods are currently free of charge.

Withdrawal in North Africa

Various withdrawal methods, including credit/debit cards, e-wallets (Skrill, Neteller, PayPal), bank transfers, and cryptocurrencies. Credit/debit cards offer instant deposits with a low USD$5 minimum. E-wallets provide fast and convenient options, while bank transfers allow for larger deposits. Cryptocurrency deposits offer a modern alternative with varying minimums. Importantly, all listed deposit methods are currently free of charge.

How to Withdraw Money from Axi?

Making a withdrawal from the Axi platform is really easy, and the withdrawal request took only some time to process. Typically, clients can expect their withdrawal requests to be reviewed and approved by the Axi team within 2 days. Below is a brief instruction to show how to withdraw funds from the Axi platform:

Step 1: To withdraw funds, you need to first login into your trading account.

Step 2: Then click the “Withdraw funds” button to view your account (with clear account balance) together with withdrawal options, selecting the most practical one for you. To proceed, click the “I agree to the folllowing” again. Note: the minimum withdrawal amount for International Bank Wire is $50, and the amount below will be cancelled.

Step 3: After you've decided on a withdrawal method, you'll need to provide your bank details, the amount in your MT4 trading account, and the reason for the withdrawal. The next step is to submit your withdrawal request. The time it takes for the funds to reach your trading account is completely up to the bank and the withdrawal method you choose.

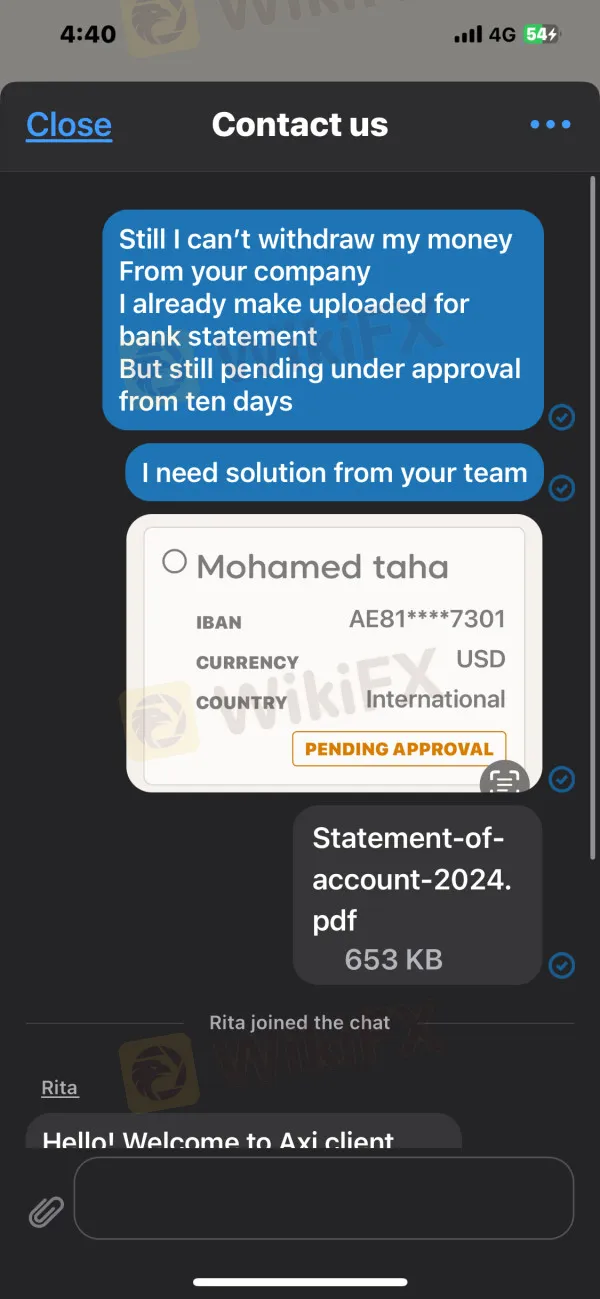

Some Negative User Reviews on Axi Withdrawal

Axi promotes its withdrawals as fast and convenient, while online feedback reveals instances where clients have encountered difficulties. Here we would pick two cases to make an analysis.

Case 1: Withdrawal is one of the most difficult things in the company

“ They do not give approval for the withdrawal and do not give me my money. Very bad customer service. They do not help the customer and do not solve the problem. For more than two months, I have been trying to withdraw and every time they ask for something else and there is no solution.”

A trader from the United Arab Emirates reported that Axi refused to approve his withdrawal request. The trader's post, supported by the transaction screenshot, all proving that this broker indeed exist withdrawal problems, and this negative review serves as a clear worrying sign for potential Axi trader: pay close attention to the withdrawal process. Maintain open communication with Axi team during the withdrawal process.

Case 2: This FX broker is a scam.They don't process your withdrawal request.

“They do not process your withdrawal requests, they do not answer to your mails ! A new kind of broker is on the Forex Market: The Zombie broker !!!”

Similarly, another trader posted that the Axi team didn't process his withdrawal requests, nor answered his email,as if they disappeared. And we contacted the Axi team about this situation, and got a reply from the Axi end that the trader did'n't provide clear requirement withdrawal documents. Though we cannot be sure whether it is true, the reality is that withdrawal, essentially, remains the true measure of successful trade. An unavoidable situation is that unresponsive brokers may arbitrarily deny withdrawal requests in an attempt to retain client funds.

How to trade with Axi?

Axi is often recommended for retail investors, particularly beginners, due to its robust regulatory framework and ability to accommodate small trading budgets. Then the question comes: How to trade with Axi to earn some profits? Specifically, how should investors manage their Axi money to trade and create their portfolios?

Small-budget investors are advised to focus on trading major forex pairs within an Axi Standard account. Major forex pairs like EUR/USD, USD/JPY, GPB/USD feature high liquidity, low volatility offering low spreads, which is advantageous for small-budget traders as it facilitates quick entry and exit positions.

Let's consider this example:

Account: Axi standard account

Currency Pair: EUR/USD

Trade Direction: Long (Buy)

Entry Signal: Price breaks above a key resistance level on the daily chart.

Stop-Loss: Placed below the recent swing low.

Take-Profit: Set to a level that provides a favorable risk-reward ratio (e.g., 2:1 or 3:1).

For more experienced traders, the pro account is their best choice, as this account features tightest spreads, enhanced excution. Experienced traders tend to choose major currency pairs, commodities, even cryptocurrencies to make possibly large profits. On top of that, experienced traders can also employ some trading styles, such as swing trading, scalping and day trading to enhance profitability.

The Bottom Line

Overall, Account registration on the Axi trading platform is super simple, and this feature does not share with many other forex brokers under the same strong regulation. Many investors, largely depening on whether they would leave a platform to trade, need a simple and straightforward account system when trading online. And this may be the reason why Axi keeps enticing investors, and receives mostly positive feedback. Axi withdrawals also impresses us by employing multiple and localized withdrawal services. In this way, most investors would be able to dedicate more time to trading without worrying. much.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

TopFX Launches New Website & Brand Identity for Enhanced Trading

TopFX unveils a redesigned website and brand identity, offering faster trading, advanced technology, and institutional-grade liquidity for serious traders.

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

In the age of digital finance, the promise of financial freedom through trading has never been more alluring. Social media is flooded with advertisements for trading academies claiming to turn beginners into expert traders in weeks, offering ‘guaranteed’ profits and ‘exclusive’ strategies. However, behind the glossy marketing lies a sinister reality as many of these so-called academies are nothing more than elaborate scams designed to exploit unsuspecting traders.

How Global Events Shape Currency and Gold Markets

In the fast-paced world of forex trading, timely and accurate information is paramount. Global events—whether political, economic, or social—can trigger rapid shifts in currency values and gold prices. This article examines how forex news drives market dynamics and offers insights on how traders can navigate this ever-changing landscape.

The Rise of Algorithmic Trading in Forex Markets: Opportunities and Risks

Over the past decade, the integration of technology into financial markets has revolutionized forex trading. Algorithmic trading, driven by complex mathematical models and real-time data, has become a cornerstone of modern trading strategies. This article explores the transformative impact of algorithmic trading on forex markets, as well as the opportunities and risks it presents.

WikiFX Broker

Latest News

How to Avoid Risks from Scam Brokers in Forex Investment

Beware: Forex Investment Fraud Targeting Low Income Earners

Central Bank Policies,Forex Markets and Gold Prices

These 24 Crypto Scams Are Accelerating the Theft of Your Assets

Beware of Fake 'Educational Foundations' Targeting Crypto Investors, Warns North Dakota Regulator

49 Foreigners Arrested in Illegal POGO Raid in Pasay City

We Asked Grok About Illegal FX Brokers—Here’s What It Revealed

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

Online Investment Scams on the Rise: How Two Victims Lost Over RM100K

Vanished Savings: How One Woman Lost RM412,443 to an Online Scam

Currency Calculator